Futures Jump Led By Megacap Tech As Trump Trades Reverse

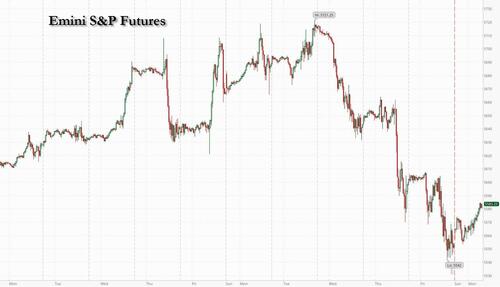

Global markets are relatively muted after a second consecutive historic weekend for US politics, one where Joe Biden ended his reelection campaign and (reluctantly) endorsed Vice President Kamala Harris. As of 7:45am, S&P futures are up 0.5%, led by tech with small caps also positive but lagging as the rotation takes a break; Nasdaq 100 futures gained 0.9%, reversing some of last week’s painful 4% slump. European stocks rose more than 1%, snapping a five-day losing streak and their worst week this year as the Trump Trade looks a bit shaky this morning (his odds on Predictit are down from 70% to 60% in the past week): the dollar is sliding slightly, havens like the Swiss franc and Treasuries edge higher as the yield curve twists flatter. Commodities are mixed with Ags higher and Energy/Metals lower. The biggest news this weekend is Biden dropping out of the Presidential race and VP Harris is now the presumptive nominee, though others may enter the race. As JPM’s Market Intel desk writes this morning, we have seen “some unwinds of the Trump Trade, it is possible that unwinds further as the market looks to Trump with a split Congress.” Elsewhere, it is a light macro day as we enter the second busiest week of earnings season with ~20% of the SPX reporting.

In premarket trading, Mag7 and Semis are leading with small caps lagging. Nvidia shares rise 1.6% premarket amid reports the company is working on a version of its new flagship AI chips for the China market that will be compatible with current US export controls. CrowdStrike falls 4% as Guggenheim cut its rating to neutral after a faulty software update from the cybersecurity firm affected 8.5 million devices that rely on Microsoft’s Windows operating system. Bank of America dropped 1.1% after Warren Buffett’s Berkshire Hathaway sold about 34 million shares in the lender for $1.48 billion, according to a public filing. Here are some other notable movers:

- 10X Genomics (TXG) climbs 4% after Jefferies raised its rating to buy on conviction of a recovery in the firm’s single-cell sequencing business.

- Globe Life (GL) gains 1% after saying its audit committee completed its review of allegations raised by short sellers Fuzzy Panda Research and Viceroy Research, and determined there is no merit to the short sellers’ various allegations regarding financial accounting, reporting and disclosure.

- Tellurian (TELL) soars 64% after Woodside Energy Group agreed to buy the US liquefied natural gas project developer for about $900 million.

- ON Semiconductor (ON) gains 2% after the company announced a multi-year pact with Volkswagen Group.

- Verizon Communications (VZ) slips 3% after posting 2Q results.

After this week’s shocking news of Biden’s unexpected reversal and decision to drop out of the race (following relentless pressure from the “Democratic” party, a full account of what happened can be found here), Democrats now face the task of uniting around a new nominee just weeks before their convention, and must rapidly make up ground against Donald Trump who remains an odds-on favorite to win the presidency. Investors have been wagering on Trump’s return to the White House for weeks, trimming holdings of long-term US bonds and buying Bitcoin, among other things. Now, they’re considering whether the “Trump Trade” is still on. The uncertainty may translate into volatility for markets, though for now, much attention is on earnings and the outlook for monetary policy.

“We are more focused on the cadence of the business cycle than on the outcome of the election,” said Morgan Stanley strategist Michael Wilson. “While markets have been digesting the rising odds of a Trump win, cyclical upside from here will likely be dependent on growth” the bearish MS strategist added, noting that the rotation into small caps is almost over (which likely means it is only just starting).

Investors have their hands full dealing with major earnings this week. Tesla and Alphabet will be the first of the “Magnificent Seven” to report on Tuesday. Analysts will likely press Elon Musk’s electric-vehicle giant on the progress of its plans for robotaxis. And investors will delve into the details of Google’s parent revenue boost from artificial intelligence.

“It’s a good reporting season so far, but you have to wonder what are the catalysts for the market to keep on rising further?” said Andrew Pease, global head of investment strategy at Russell Investments Ltd. “A lot of the hope is that we get this rotation away from the Mag Seven to the S&P 493 and the equal-weighted index starts to catch up with the cap-weighted. Asymmetry is still the watchword right now.”

European stocks surge as they look to snap a five-day losing streak. Technology, construction and consumer product shares are leading gains. Strategists at Morgan Stanley said companies in Europe have made a positive start to the second-quarter reporting season, with 29% beating profit expectations. Ryanair failed to boost that track record Monday, however, falling as much as 16% after the Irish budget carrier cut its outlook for ticket prices in the crucial summer travel period and predicting “materially lower” fares. Rivals EasyJet Plc and IAG SA also fell. Here are the top European movers:

- Nordea Bank shares rise as much as 1.9% after the Nordic lender was upgraded to buy from hold at Jefferies.

- Rentokil shares gain as much as 15% after the Sunday Times reported that Philip Jansen, the former chief executive officer of BT, is in talks with private equity firms about acquiring the pest controller.

- Finecobank shares jump as much as 7.4% following reported interest from Zurich Insurance Group, with likely support of PE funds.

- Barry Callebaut shares climb as much as 5.1% after Citi upgrades to buy and opens a 90-day positive catalyst watch, saying the Swiss chocolate producer offers a “potential valuation anomaly.”

- Belimo shares rise as much as 12% after the Swiss manufacturer of heating, ventilation and air conditioning equipment lifted its guidance for the year following a strong first half.

- Entain shares advance as much as 6.1% after the sports betting firm appointed industry veteran Gavin Isaacs as its news chief executive officer.

- Ocado shares rise as much as 7.6% after the online grocer said Kroger had placed an order for a wide range of new automated technologies to roll out in customer fulfillment centers across its network.

- Suess MicroTec shares gains as much as 8.1% after Oddo BHF lifts its rating on the German semiconductor equipment provider to outperform from neutral, saying the valuation now screens as attractive.

- Ceres Power shares jump as much as 18%, the most since January, after the UK fuel cell technology company struck a new manufacturing license deal and raised its guidance for 2024 in its trading update.

- Ryanair shares slide as much as 13%, the most since May 2020, after the low-cost carrier cut its outlook for ticket prices in the key summer travel period.

- Buzzi shares slip as much as 3.8% in Milan trading after JPMorgan downgraded the stock to underweight from neutral, seeing increased earnings risk.

- Invisio shares fall as much as 7.8% after SEB cut its recommendation on the Swedish tactical communications firm to hold from buy, seeing “an attractive case, but stretched valuation.”

In Asia, stocks suffered a third-straight day of losses as they were dragged lower by a weak tech sector amid valuation concerns ahead of key corporate earnings. Chinese bonds were a highlight, gaining after the central bank cut a policy interest rate. The country’s stocks fell, as investors continued to express disappointment at a lack of strong stimulus measures from a recent major Communist Party meeting. The MSCI Asia Pacific Index fell as much as 1.2% Monday, with TSMC and Samsung among the biggest contributors to the decline. Taiwan’s benchmark index ended 2.7% lower, taking its 4-day plunge to more than 7%, the most since October 2022. Key gauges in Japan and South Korea shed more than 1% each. Tech stocks have suffered sharp losses over the past couple of weeks as the upcoming US election and the Federal Reserve rate cuts injected new uncertainties to the once-mighty sector. Morgan Stanley recommended investors book profits on Asian and emerging-market tech and pivot to consumer staples. Traders were also game-planning the implications of President Joe Biden’s exit from the race.

In FX, the Bloomberg Dollar Spot Index is off the lows but still down 0.2%, snapping a two-day advance, as investors weighed what US President Joe Biden’s exit from the presidential race would mean for markets. The yen was the strongest of the G-10 currencies, rising 0.5% against the greenback. The Australian dollar is the weakest, falling 0.3%.

In rates, treasuries are mixed as the short-end underperforms. The yield on 10-year US Treasuries was down as much as 4bps earlier. It’s now little changed 4.23%. Gilts lead a selloff in European bonds.

In commodities, oil prices are little changed, with WTI trading near $80 a barrel. Spot gold is steady around $2,402/oz.

On today’s econ calendar, the lone event is July’s Chicago Fed National Activity Index (8:30am). This week, traders will be focused on economic activity data in Europe, US second-quarter growth and a Bank of Canada rate decision. Fed members scheduled to speak before the next FOMC meeting begins July 30 — a period during which a self-imposed quiet period is customary — include only Governor Bowman and Dallas Fed President Logan on July 24, both at an event on Texas community partnerships

Market Snapshot

- S&P 500 futures up 0.4% to 5,573.75

- STOXX Europe 600 up 0.8% to 514.14

- MXAP down 0.7% to 182.05

- MXAPJ down 0.6% to 565.46

- Nikkei down 1.2% to 39,599.00

- Topix down 1.2% to 2,827.53

- Hang Seng Index up 1.3% to 17,635.88

- Shanghai Composite down 0.6% to 2,964.22

- Sensex little changed at 80,552.59

- Australia S&P/ASX 200 down 0.5% to 7,931.74

- Kospi down 1.1% to 2,763.51

- German 10Y yield little changed at 2.47%

- Euro little changed at $1.0892

- Brent Futures up 0.4% to $82.93/bbl

- Gold spot up 0.1% to $2,403.36

- US Dollar Index down 0.16% to 104.23

Top Overnight news

- Joe Biden announced in a tweet that he is stepping aside as a candidate and will focus on fulfilling his duties for the remainder of his term, while in a subsequent tweet he endorsed Vice President Harris and will speak to the nation later this week.

- Kamala Harris said she is honoured to have the President’s endorsement and she intends to earn and win the nomination, while she added that she will do everything in her power to unite the Democratic Party and unite the nation to defeat Donald Trump. Super PAC Priorities USA and liberal super PAC Unite the Country said they will support Kamala Harris as the 2024 Democratic presidential nominee, while Bill and Hillary Clinton announced their endorsement of Harris. It was separately reported by CBS News that California Governor Newsom and Michigan Governor Whitmer do not plan to challenge Harris and Newsom later endorsed Harris for the Democratic Presidential nomination.

- DNCChair Harrison said the American people will hear from the Democratic Party on the next steps and the path forward for the nomination process.

- Republican presidential candidate Donald Trump said he thinks that Kamala Harris will be easier to defeat than President Biden in the November election, according to a CNN reporter via X.

- China surprised markets by cutting major short and long-term interest rates on Monday, its first such broad move since August last year, signaling intent to boost growth in the world’s second-largest economy just days after a Communist Party leadership meeting. PBOC said it would cut the seven-day reverse repo rate to 1.7% from 1.8%, and would also improve the mechanism of open market operations. That is the first cut to the rate since August 2023. Minutes later, China cut benchmark lending rates by the same margin at the monthly fixing. The one-year loan prime rate (LPR) was lowered to 3.35% from 3.45% previously, while the five-year LPR was reduced to 3.85% from 3.95%. RTRS

- National Sec Advisor Sullivan warned to expect more sanctions over China’s aid to Russia (this is consistent with the stern warning contained in the recent NATO communique about Chinese assistance to Putin). SCMP

- Nvidia is working on a version of its new flagship AI chips for the China market that would be compatible with current U.S. export controls. RTRS

- President Biden exited the 2024 presidential race yesterday and endorsed VP Kamala Harris. Harris’ prediction market-implied odds of winning the Democratic nomination stood at 80% following the news. Democrats’ odds of winning the White House ticked up slightly, while House and Senate control odds were little changed. The implied odds of a Republican sweep edged down to around 41% but this remains the most likely outcome by a significant margin. The deadline for Democrats to nominate their candidate is at their convention August 19-22. However, the party has been considering a virtual nomination in August ahead of the convention and this remains a possibility. GIR

- Mysterious buyers with suspected links to Russia have begun amassing dozens of vessels capable of carrying liquefied natural gas, in moves that suggest Moscow is expanding its “dark fleet” of energy tankers. Shipping industry insiders say a clutch of previously unknown companies, largely registered in the United Arab Emirates, have rapidly acquired LNG vessels over the past year, driving up market prices, especially for the oldest ships. FT

- The number of UK companies in “significant financial distress” rose sharply in the second quarter, with leisure and tourism under particular pressure due to weak consumer demand. According to Begbies Traynor’s Red Flag report, which tracks the health of businesses, 601,950 companies are facing significant financial distress, up 8.5 per cent on the previous quarter and 37 per cent higher than the same period last year. FT

- The Secret Service denied requests for more security at Trump events in the two years leading up to his assassination attempt, the WaPo reported. Director Kimberly Cheatle faces hostile lawmakers at a House panel hearing today. BBG

- Luxury brands are starting to permanently trim prices in a bid to rejuvenate sales following a softening in demand from “aspirational shoppers”. WSJ

- Warner Bros faces a Monday deadline to submit a bid to the NBA as the company is at risk of being squeezed out of its only major foothold in sports. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly began the week on the back foot after last Friday’s selling pressure on Wall St and despite China’s surprise cuts, while markets also reflected on President Biden’s decision to bow out of the election race. ASX 200 was led lower by the commodity-related sectors with energy the worst hit after oil prices tumbled on Friday, while miners also suffered including South32 with its shares down by a double-digit percentage following its output update where it also flagged an impairment charge of USD 554mln for its Worsley Alumina operations. Nikkei 225 extended on its recent declines after gapping beneath the key 40,000 level. Hang Seng and Shanghai Comp. were mixed in which the former bucked the trend owing to the resilience in local tech-related stocks, while the mainland was pressured after President Xi noted China’s development entered a period of coexistence of strategic opportunities, risks and challenges, as well as increasing uncertainties and unpredictable factors. Furthermore, the PBoC’s surprise announcement to cut its 7-day reverse repo rate by 10bps, which Chinese banks followed through with similar cuts to the benchmark LPRs, failed to spur risk appetite as some viewed the cut to short-term funding rates as underwhelming and not the big measures needed to revive the economy and China’s slowing property industry.

Top Asian News

- China will change the release time of the monthly LPR fixing to 09:00 local time (02:00BST/21:00EDT) from 09:15 local time (02:15BST/21:15EDT) on the 20th of each month.

- PBoC announced a cut to the 7-day reverse repo rate to 1.70% from 1.80% and will strengthen counter-cyclical adjustment to better support the real economy, while it is to lower collateral requirements for the Medium-term Lending Facility Loans from July with the move meant to increase the size of tradable bonds in the market and to alleviate pressure on supply and demand of bonds in the market.

- Chinese President Xi said China’s development has entered a period of coexistence of strategic opportunities, risks and challenges, increasing uncertainties and unpredictable factors, while he added that various black swan and grey rhinoceros events may occur at any time, according to state media.

- China’s reform plan will push the collection stage of the consumption tax back and delegate it to local governments steadily, while it will study merging urban maintenance, construction tax, education surcharge and local education surcharge into a local surcharge and authorise local governments to determine specific applicable tax rates within a certain range. China will improve the coordination of investment and financing in the capital market, prevent risks, strengthen supervision and promote the market’s healthy and stable development. Furthermore, China will create a market-oriented, law-based and internationalised first-class business environment, while it will protect the rights and interests of foreign investment in accordance with the law.

- Chinese Finance Ministry said will extend tariff exemptions for imports of some US products until Feb 28th 2025

- Indian FY25 GDP growth seen between 6.5-7%, according to Reuters sources citing Indian Economic survey.

European equities, Stoxx 600 (+0.4%) are entirely in the green, shrugging off a mostly weaker APAC session overnight. European sectors hold a strong positive bias; Tech takes the top spot, whilst Travel & Leisure lags, following poor Ryanair (-12%) earnings. US equity futures (ES +0.3%, NQ +0.5%, RTY +0.2) are modestly firmer to various degrees, with slight outperformance in the NQ, as traders digest news that US President Biden is dropping out of the election race.

Top European News

- UK Chancellor Reeves said she will consider inflation-busting pay rises for almost 2mln public sector workers this month to avert crippling strikes, according to Reuters.

- UK Treasury ministers are reportedly softening up public opinion for a tough autumn Budget and potential tax increases, while Chancellor Reeves said she wanted to “level” with the public about the fiscal “mess”, according to FT.

- ECB’s Makhlouf said there is no need to rush to make decisions and that rapid interest-rate action from the central bank is not required, according to an interview with the Irish Examiner.

- ECB’s Kazimir said doors remain open to additional easing should the environment warrant it; market bet on two more cuts by year-end is not entirely misplaced but a given; no need to rush decisions, data will set stage for Sept decision.

FX

- USD is steady vs. peers with DXY tucked within Friday’s 104.13-42 range. Little follow-through in FX markets from US President Biden’s decision to drop out of the election race as it remains unclear if Harris (yet to be officially nominated) would be able to change the electoral calculus.

- EUR is a touch firmer vs. the USD but EUR/USD is unable to gain a footing above 1.09. EZ newsflow remains light with ECB officials continuing to echo caution on the rate-cutting cycle.

- GBP is flat vs. peers as speculation over potential tax hikes/additional borrowing has little follow-through. For now, Cable remains tucked within Friday’s 1.2901-1.2951 range.

- JPY strengthened in early European trade after the pair tripped through 157.00 and Friday’s low @ 156.96 in quiet newsflow before basing out at 156.29.

- Yuan is a touch softer vs. the USD following stimulus efforts by Chinese officials. Desks remain of the view that measures are too piecemeal to have a materially stimulative impact. USD/CNH now eyeing 7.30; last breached 4th July.

- PBoC set USD/CNY mid-point at 7.1335 vs exp. 7.2624 (prev. 7.1315)

Fixed Income

- USTs are flat and saw a muted reaction seen in fixed income markets to Biden dropping out of the Presidential race. It is unclear if Harris is any more likely to beat Trump than Biden was. Plus, desks still fancy Republicans to control both houses. Sep’24 UST contract sits within Friday’s 110.25-111.07 range.

- Contained price action within European fixed income markets as the ECB heads for its summer break. Sep’24 Bund has breached 132.00 and Friday’s low (131.93) to the downside.

- Gilts are lower by only a handful of ticks ahead of this week’s PMI before the BoE next week. UK 10yr is now below Friday’s trough after slipping below the 98.00 level. Next target is the 12th July low at 97.81.

Commodities

- Modestly firmer intraday but more-so a consolidation following the slump on Friday. Overnight, China conducted surprise rate cuts overnight to the RRR, LPR, and SLF in a bid to inject stimulus, although markets are seemingly overlooking these efforts. Brent Sept sits in the middle of a USD 82.75-83.22/bbl parameter.

- Mixed trade arcross precious metals with the complex awaiting the next catalyst. Spot gold resides in a narrow range on either side of USD 2,400/oz.

- Mixed trade across base metals with little follow-through seen on the surprise Chinese rate cuts, with some participants suggesting the announcements were ultimately underwhelming.

- Dubai set official crude differential to DME Oman for October at USD 0.10/bbl premium.

Geopolitics

- Israeli military called on Gazans to clear out of eastern parts of the Khan Younis ahead of a ‘forceful’ operation which comes after ‘significant terrorist activity and rocket fire’.

- Israel conducted a strike on Yemen’s Hodeidah on Saturday which killed six people and injured 80, while it was separately reported that Yemen’s Houthis said they fired missiles at Israel’s Eilat.

- Israeli PM Netanyahu will meet with US President Biden on Tuesday, while Netanyahu said the port that Israel conducted a strike on was an entry port for weapons from Iran and the port attack reminds enemies that there is no place that Israel cannot reach. Israeli PM Netanyahu also said Israel will send a delegation to hostage deal talks on Thursday.

- Ukrainian President Zelensky called for long-range weapons after drone attacks on Kyiv. In relevant news, Russia’s Defence Ministry announced their forces captured two settlements in Ukraine.

- Philippine Foreign Ministry said China and the Philippines reached an understanding on a provisional arrangement for resupply missions in the disputed South China Sea shoal.

DB’s Jim Reid concludes the overnight wrap

Planes couldn’t take off, trains struggled to run, TV shows got pulled off the air, traders couldn’t trade, payments got delayed, hospitals had to cancel operations… oh and the EMR couldn’t get published on time. Friday was a fascinating day of learning how reliant we all are on tech companies. Although the DB IT infrastructure survived the outage exceptionally well, DB Research use a third-party provider to send out research and this was completely down for much of Friday. We ended up using a manual back up to send the EMR out late, but we couldn’t include links. Apologies for the late running. As we couldn’t include links, we’ll keep our global markets survey open until 8am (London time) this morning. So all last responses very welcome. It includes questions on the US election, US tech versus the rest of the US equity market, and a few other relevant questions that include several we now have a long-term series for. It should only take a couple of minutes and feel free to skip any questions you want.

One question that we don’t need to ask anymore is whether you think Joe Biden will be the Democratic Party nominee for President in November. On Friday speculation was rife that he would stand down as early as the weekend but bullish remarks by Biden in the early part of the weekend put some doubts to that speculation. However by Sunday afternoon US time Mr Biden had withdrawn and endorsed VC Kamala Harris. It seems difficult to see a path for someone to pip her to the nomination but we are in uncharted territory so you couldn’t completely rule it out. The Democratic convention starts on August 19th so if someone was going to challenge they’d need to be building up momentum well ahead of that. Unless there was a groundswell of support for that candidate it seems a very high hurdle to supplant Harris. The Clintons have endorsed Harris even if Obama hasn’t, although his practise is not to do so until a nomination has been secured. Overnight, potential rivals Newsom and Buttigieg have also thrown their support behind Harris. In terms of the polls, the match-up between Trump and Harris has been slightly narrower than with Biden in recent times with Trump 1.9pp ahead at the national level instead of 3pp according to Real Clear Politics poll aggregates. However with the attention now likely to be firmly on Harris this could move notably in either direction over the next few days and weeks. Perhaps for now it slightly reduces the impetus for Trump trades but there’s a long way to go.

It’s hard to say markets have reacted much to the news so far. 10yr US Treasury yields are -1.7bps lower which may reflect a little less risk of even more fiscal spending. The dollar is around a tenth of a percent lower but the Peso was initially +0.6% higher against the dollar but has pared that back to around a tenth of a percent gain. S&P 500 (+0.21%) and NASDAQ 100 (+0.32%) futures are higher but well within normal trading ranges.

The rest of Asia is marching to its own beat with a China rate cut doing as much to unsettle as improve sentiment. Across the region, the KOSPI (-1.35%) is the biggest underperformer closely followed by the Nikkei (-1.17%) with the CSI (- 0.65%) and the Shanghai Composite (-0.69%) also lower. The Hang Seng (+0.67%) is bucking the regional trend though.

Coming back to China, the PBOC unexpectedly trimmed the seven-day reverse repo rate for the first time in almost a year, lowering it by 10 bps to 1.7% to reinvigorate the economy. Chinese banks have lowered one and five-year loan prime rates by 10bps each to 3.35% and 3.85%, bringing the rates further into record-low territory. Following the decision, yields on 10yr Chinese government bonds fell around -2.0bps.

As for this week, most roads point to Friday’s US core PCE deflator. En route to this, the main other highlights are US Q2 GDP on Thursday, the global flash PMIs and the Bank of Canada rate decision on Wednesday, alongside a big week for earnings that includes Alphabet, Tesla and LVMH (all tomorrow). Don’t expect to hear from Fed officials as they are on their blackout period ahead of next week’s FOMC.

With the core PCE deflator, our economists expect a 0.14% MoM reading given the CPI and PPI components that feed into it. There could be some downward revisions to prior months that could edge this month up nearer to 0.2% so one to watch as a whole rather than the June number alone. The base case at DB is that the YoY rate will dip to 2.5% which is below the Fed’s YE ’24 prediction of 2.8% at their June FOMC. However our econ team point out that base effects from low H2 prints last year will make further progress much more challenging. Nevertheless the recent run, especially in rents, suggest that the Fed will be having increasing confidence that inflation is moving back closer to 2%. For Q2 US GDP, our economists expect 2.1% annualised growth (consensus 1.9%) although with durable goods out at the same time there might be a bit more uncertainty than usual.

Recapping last week, it was an incredibly eventful time for markets, with various ups and downs through the week. It began fairly positively, with the S&P 500 hitting new records on both Monday and Tuesday. But on Wednesday, the rally came to an abrupt halt, mainly driven by chipmakers at first, but spreading among equities more broadly. That meant the S&P 500 fell -1.97% last week (-0.71% Friday) in its worst weekly performance since April. But under the surface there was also a rotation taking place away from mega-caps towards small-cap stocks, as the Magnificent 7 was down -4.78% last week (-1.24% Friday), even as the Russell 2000 was up +1.68% (-0.63% Friday).

That volatility was clear in several ways. For instance, the VIX index was up +4.06pts to 16.52pts, marking its biggest weekly increase since March 2023 during the week of SVB’s collapse. In other regions the losses were even bigger, and Europe’s STOXX 600 fell every day last week to close -2.68% lower (-0.77% Friday), in its worst weekly performance since October. And with the massive IT outage on Friday, Crowdstrike ended the week down -17.87% (-11.10% Friday), marking its worst daily and weekly performance since November 2022.

For sovereign bonds however, there was a bit more divergence on either side of the Atlantic. In the US, 10yr yields ended the week up +5.6bps (+3.7bps Friday) at 4.24%. But yields fell back in Europe after the ECB’s decision, which had several dovish elements and maintained an implicit direction towards further easing, even as they left rates unchanged and hawkish sources emerged in the aftermath of the meeting. Overall, that helped yields on 10yr bunds fall by -2.8bps (+3.6bps Friday) to 2.47%.

Finally, the risk-off tone coupled with concerns over Chinese growth meant that it was a very bad week for commodities across the board. For instance, Brent crude oil fell -2.82% (-2.91% Friday) to close at $82.63/bbl, its lowest in over a month. Copper prices were also down every day last week to a 3-month low, posting their worst weekly performance since July 2022 with a -8.25% decline (-1.10% Friday). Similarly, it was a bad week for precious metals, and even though gold closed at an all-time nominal record earlier in the week of $2469/oz, it ended the week as a whole down -0.44% (-2.26% Friday) at $2401/oz.

Tyler Durden

Mon, 07/22/2024 – 08:14

via ZeroHedge News https://ift.tt/LksCAMS Tyler Durden