US Retail Sales “Beat” Thanks To Yet Another Massive Downward Revision

For once, consensus is in line with BofA’s omnipotent forecast for retails today (July data) with an expectation of a 0.4% MoM rise in nominal spending. They were both wrong… as retail sales shot up 1.0% MoM – well above the highest forecast.

That is the biggest MoM rise since Jan 2023 – so to hell with your soft landing narrative, right…

Source: Bloomberg

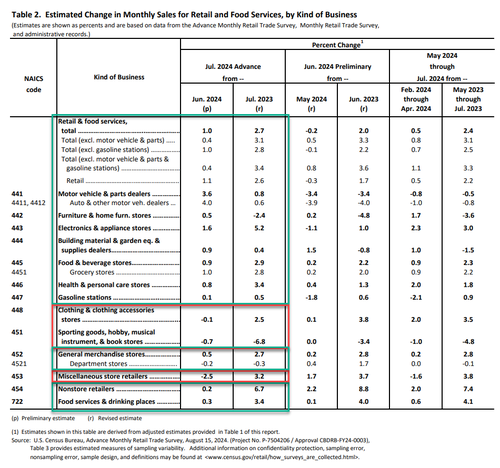

Under the hood, almost everything saw spending surge (except Sporting goods and book stores)

…with a giant swing in Auto sales…

Source: Bloomberg

According to the report, two-thirds of the increase in retail sales was due to autos; meanwhile dealers are slashing prices…

Source: Bloomberg

… (see CPI report) because nobody is buying cars…

Source: Bloomberg

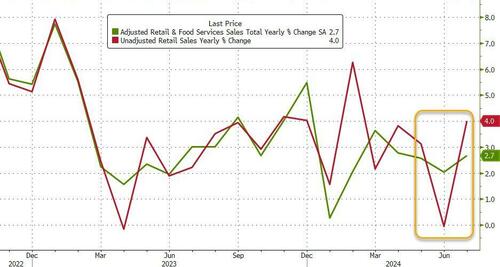

The non-seasonally-adjusted sales bounced massively…

Source: Bloomberg

Back to the big picture, this is the biggest MoM rise since Jan 2023 – so to hell with your soft landing narrative, right…

BUT… and it’s another big but…

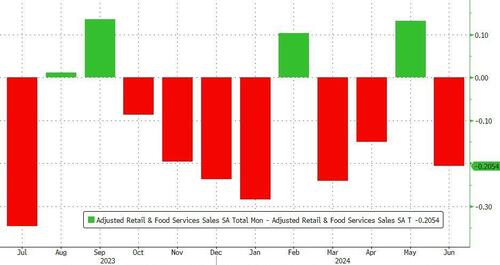

…for the eighth month in the last year, the previous month’s data was revised lower..

Source: Bloomberg

…thus making the current month ‘beat’ more impressive.

Who could have seen that coming?

So in addition to the July print, significant revisions in either direction could alter the trajectory of retail sales, and if past is prologue, last month’s retail sales print will be revised lower in keeping with the original forecast. But since algos only react to the here and now, a big jump from a sharply downward revised previous number will be viewed much more favorably than a modest drop from an unrevised prior month, even if they both end up at the same place.

You just can’t make this shit up – Kamalanomics is simply govt-manipulated data of historic data to make the current data look more favorable.

Will this manipulation ever end? (We suspect it will in November if the ‘right’ person doesn’t save democracy).

Tyler Durden

Thu, 08/15/2024 – 08:39

via ZeroHedge News https://ift.tt/NXEbIT3 Tyler Durden