US Living Standards In Grave Danger

Authored by Jeffrey Tucker via The Epoch Times,

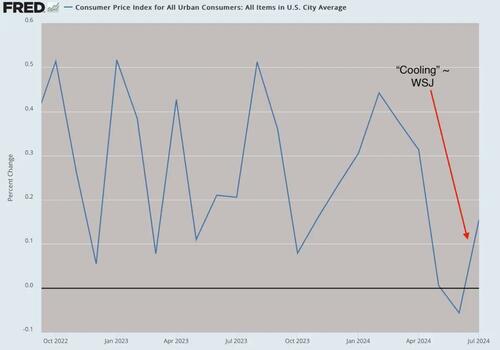

“Inflation cooled, lower than expected,” read the financial press on the release of the Consumer Price Index (CPI) for July. One only needs to look carefully: when month-to-month changes are down, those alone get the headline. When they are up, as they are in July, the headline focuses on the 12-month trend. Every time.

Based on the data release we have, the “cooling” is actually up from June to July, if you can believe it.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Most of the change is driven by housing but the CPI is far from capturing the whole. By using a black-box statistic called Owners Equivalent Rent, the CPI is able to completely bypass and not report data we actually have on housing prices. And that’s just the start of the problems we’ve discussed many times. Even so, the CPI still reveals something. Even then, we keep being told life is better than ever.

We know it is not true. Everyone to whom you speak knows the financial and economic strains of our time. They are grave and growing, and most data points are now underscoring the point. The jobs market even in hourly employment is freezing up, while inflation continues to take its toll. It is well known, finally, that we have lost far more than 20 percent of our purchasing power over four years. How much is still largely a guess based on spending patterns.

The distance between the official data—which still shows rising real output—and the consumer surveys is striking to behold. In some ways, the official economic data of our times is another iteration of the growing sense that we are not being told the whole truth in many sectors of life.

However, there are still times when the truth seeps out. CNN commissioned a well-constructed poll of about 2,000 random people to find out where they stand on personal finances. The headline number: nearly 40 percent of Americans are struggling to pay their bills. That is up from 28 percent from only three years ago, and a higher number than back in 2008–09, the period known as the Great Recession.

Two-thirds of people say that the number one issue they face is the cost of living and paying their bills. The typical American is spending nearly $1,000 more per month compared with three years ago just to pay living expenses. That is according to Moody’s, but it also fits with the intuition we all have. It suggests a dramatic decline in real household income, despite what the Bureau of Labor Statistics claims.

The survey further reports that a third of Americans say that they have to take an additional job to make ends meet. This has disproportionately affected Latinos and black Americans and those under the age of 45.

Nearly 70 percent report that they have cut back spending on entertainment, changed their grocery buying, and otherwise stopped with the extras like vacations and trips. Three in five say they have cut back on driving. Two-thirds are putting bills on revolving credit cards charging more than 20 percent. These trends show no change despite the seeming taming of inflation.

Inflation has been raging for years, but it is easy to slip into denial or believe that the price increases are going to reverse themselves. This was certainly the case from mid-2021 and following, as people were told that the price trend was transitory, a word that sounds a bit like temporary. Many people believed it and tried their best not to change their spending and lifestyle habits.

Three years in and the hard realities of accounting are hitting nearly everyone. The effect of this is cascading through every sector as spending on extras is culled across the board.

I was speaking to a journalist for a New England local paper that had always been supported by advertisers, including arts venues. But following lockdowns, arts institutions never really came back. Traffic at major museums is half what it was, and philanthropy is down as well. That leaves less in the budget for advertising.

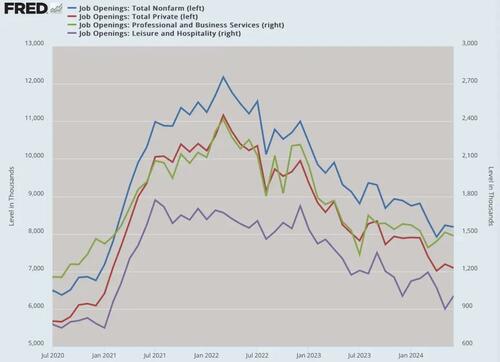

As a result, this newspaper has experienced a growing financial crisis, and everyone is now aware of how it ends. The paper will go out of business, eliminating many dozens of paid positions. These people will face a very hard job market with ever fewer numbers of open positions.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

Many large companies are posting dreary sales outlooks, including Starbucks, Home Depot, and McDonald’s, as consumers are increasingly tapped out. There is a great deal of fear and uncertainty extant among consumers and producers alike. It’s been a rude awakening.

Consumer sentiment has never recovered its January 2020 highs, and instead has fallen by a third.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

For the better part of 45 years in this country, we’ve mostly experienced what we can call good and prosperous times with some bumps along the way. The trouble traces to the way government policy has handled these bumps. They have been addressed by adding ever more liquidity to the system, rescuing the macroeconomic environment from too much damage by virtue of credit expansion.

Gone were the days of 1982 when recessions were tolerated as a means of cleansing the system and preparing for a robust recovery. Instead, monetary magic would be deployed to abolish the business cycle forever.

Prior to 2020’s inflationary bonanza, this was never more aggressive than in 2008 when the Federal Reserve decided to enter the markets and buy up failing mortgage securities, keeping them in the vaults of the Fed, while recapitalizing the banks. The Fed then slammed interest rates to zero while paying more than the free market for interest to hold bank deposits.

This seemed like a solution, but the decision caused the underlying conditions to worsen, extending the housing bubble to become a corporate and financial bubble too. This is the whole in which an entire generation came of age. Payrolls ballooned and so did salaries as cheap money seemed to be everywhere without a limit. Year after year went by with the underlying decay in capital structures taking place but without much public awareness.

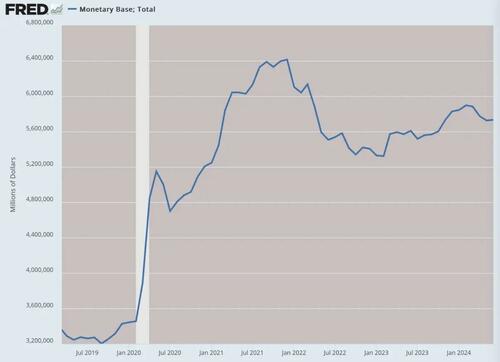

The Federal Reserve’s balance sheet now looks completely preposterous, and this is added to the broadest measure of money called the monetary base. This is not hot money on the street, but rather the valuation of all monetary instruments. It needs to be unraveled but no one knows how.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

The Fed’s options to deal with a cascading crisis are severely limited. Oddly, the United States finds itself in a position similar to Japan about a decade ago. Japan could not raise its rates for fear of unraveling the world’s most popular “carry trade” that encouraged borrowing low and earning high, but note that this was a source of the global financial instability in the first week of August. That problem was plugged once again with an assurance of more liquidity.

We just cannot continue to “solve” problems this way, as the inflation of the last three years has shown. It does seem relatively tame for now but the future could involve yet another wave as central banks once again come to the rescue of economies falling into recession.

At some point, we will need to recapture the old wisdom that economic downturns serve a function. They cleanse capital markets. They encourage consumers to cut back on debt and save more if possible. Unviable and bloated corporate projects are winnowed down to size. The entire nation and globe experience what used to be called austerity.

That is our future one way or another. People have long awaited a big crisis but we might be looking for the wrong thing. The real crisis will be slow and grinding, and unreported until it is too late.

Tyler Durden

Fri, 08/16/2024 – 18:25

via ZeroHedge News https://ift.tt/4KNgUi8 Tyler Durden