Into The Great Depression, Part 1: The Roaring ’20s & The Creation Of The Fed

Authored by Tumoas Malinen via substack,

Something that has been a particular interest of mine is the Great Depression of the 1930s. It continues to be the deepest global economic malaise of modern times, which preceded the most destructive war in human history. The extreme nature of the economic contraction has intrigued me, in addition to the path that led to it. The latter mostly because of the role of the newly created central bank, the Federal Reserve, in it.

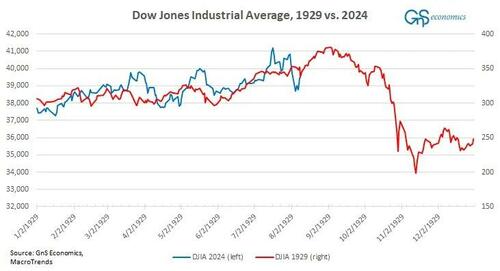

I’ve written extensively on the Great Depression in a book I am writing about forecasting financial crises. I think that the similarities between now and the era leading into the Depression are strikingly similar. This is why I decided to publish a series mapping the path of the U.S., and the world, into the deep global economic collapse. I start by mapping the route to the ‘Great Crash’, that is, to the collapse of the U.S. stock market at the end of October 1929.

In just four trading bays between 23 and 29 October 1929, the Dow Jones Industrial Average (DJIA) collapsed by 29% wiping out massive amounts of financial wealth. While the 1929 crash did not start the Great Depression, it laid the groundwork for it. Worryingly we seem to be on a similar road that led to the Great Crash, which I will map in this first entry to the series. I will also detail the creation of the Federal Reserve, which played a major role in the financial mania that led to the crash.

What is notable with the period, which preceded the Great Depression, is that many leading nations across the world experienced an economic decline at the same time, which manifested into a global banking crisis. We are seeing signs of the same kind of global slowdown now.

Before we dig deeper, let me inform that I decided to the make my piece on the Systemic Meltdown free to read. This is because, I think that everyone should understand what such an event would entail for the world, and how we could be able to manage it.

Now, let’s enter the ‘history lane’.

The Roaring Twenties

During the 1920’s, the United States became a dominant global power. She was the world’s leading exporter and second as an importer. Also, between 1924 and 1931, the US was responsible for around 60 percent of global international lending, making her the world’s banker.

High levels of imports and overseas investments from the US provided ample dollar liquidity to other countries, which were used to service international debts and to import goods and services. A high portion of this debt was short-term, but that did not bother the recipient countries.

The re-established global gold standard also acted in a pro-cyclical manner. Many countries were worried about their currencies appreciating due to capital inflows, and fixed their exchange rates to gold. This included, for example, Finland, France and Italy. But, because real appreciation through consumer price inflation was generally not allowed either, capital inflows were transformed into credit booms. Some countries, like the United Kingdom, fixed their exchange rate too high and were forced constantly to maintain restrictive credit conditions to support the overvalued currency. So, contrary to its original aim, the gold standard and fixed exchange rates actually fed the asset and credit booms or, alternatively, pushed countries to credit contraction.

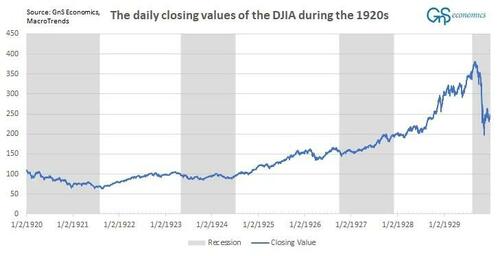

The ‘Roaring Twenties’ was thus not a continuous economic boom, with for example the U.S. experiencing three recessions: from January 1920 to July 1921, from May 1923 to July 1924 and from October 1926 to November 1927, according to the NBER. However, it was a relentless financial asset boom with, for example, the DJIA pushing through two recessions without even flinching.

The role of the newly formed central bank, the Federal Reserve, behind the credit boom of the 1920’s and subsequent crash is undeniable. The creation of the “Fed” was also mired with worries it would end up socializing the economy. As we now know, these fears were not unfounded.

The creation of the Federal Reserve

There had been several attempts to create a national or central bank in the U.S. during the 1800s, but those efforts had failed. The Panic of 1907, the first financial crisis of the twentieth century, was a game changer. The crisis started after several investors suffered crippling losses on their speculative bets. This started runs in the banks these investors were associated with. Runs spread to trust companies, which were unregulated financial intermediaries outside the banking system, providing liquidity (loans) to stockbrokers. They were the “shadow banks” of the time, loosely tied to commercial banks but a crucial part of the financial ecosystem. To stem the panic, banker J.P. Morgan personally guaranteed parts of the US banking system and solicited cash from large financial institution and industries to the exchange to support brokers. He also created a group of financiers to support ailing institutions and to buy plummeting stocks of sound companies. Yet, the Panic evolved into a deep economic contraction surpassed only by the Great Depression. Moreover, it gave more power to demands that the US banking system required a “liquidity backstopper”, i.e. a central bank.

In 1908, a Republican controlled Congress passed the Aldrich-Vreeland Act creating the National Monetary Commission, led by Senator Nelson Aldrich. The Commission introduced a public-private consortium entitled the National Reserve Association, to serve as a central bank. In the proposed institution, the decision-making leaned heavily towards the private sector. For example, out of the 46 proposed directors, 42 were to be appointed, indirectly and directly, by banks. The 1912 elections turned both the Congress and the White House to Democrats, which then made their own efforts for the monetary reform. In 1912, legislation known as the Glass-Willis proposal was introduced. The legislation aimed at creating a central bank through a compromise, which eventually led to the passing of the Federal Reserve Act on 23 December, 1913.

The “socialization” of the economy, by the Federal Reserve, was especially worrisome to the Republicans highlighted in the proposition for the National Reserve Association. A German-American banker, Paul Warburg, noted on the situation that “The view was generally held that centralization of banking would inevitably result in one of two alternatives: either complete governmental control, which meant politics in banking, or control by ‘Wall Street’, which meant banking in politics”. Efforts to establish a compromise between these two alternatives took many forms.

First of all, the power of the Fed to issue legal tender (currency) was restricted by both the ‘real bills doctrine’ and the gold standard. The regional privately-owned Reserve Banks, not the government-controlled Federal Reserve Board, were given the control for the creation of central bank credit, or money. That is, regional Reserve Banks lend to banks in accordance with their needs, and the Federal Reserve Board holds just a supervisory role. The Reserve Board did not conduct independent open-market operations, nor did it have any national interest rate policy. The “monetary policy” was conducted through Reserve Banks, who mostly responded to the needs of commercial banks.

The real bills doctrine stated that the Fed could only extend credit and thus increase the supply of money against collateral that already had established value through a “commercial transaction”. This meant that the value of the collateral could not be in the future and that it needed to have a price set in the markets. This, effectively, banned the monetization of the federal debt by the central bank, where the central bank buys debt directly from the Treasury. Yet, it was difficult to assess what constituted a “real bill”, which meant that different regional Reserve Banks had differing policies concerning the collateral they received from their loans.1

It was assumed that such a ‘two-tier system’ would ensure that neither the banks nor the government could take an upper hand in this newly created, “centralized” monetary system. This assumption failed.

The Fed started to takeover the economy, or to “socialize” it, effectively right after its inception. The real bills doctrine slowly faded away in the 1920s, and the Fed started its open-market operations, where it buys or sells securities of the US treasury to the banks to manipulate the short-term interest rate. Moreover, also in the 1920s, the Fed started to develop the federal funds market, where deposits or ‘reserves’, obliged and voluntary savings by commercial banks at the Reserve Banks, would be transferred nationally to banks in need, overnight. Yet, the Board did not control it, neither did the Fed have a target rate to manipulate banking lending in the economy through the interest rate set on the reserves. Now, the Fed Funds Rate, set by the Federal Open Market Committee (FOMC) used in the overnight lending activities between banks and the Fed, effectively dictates the price (interest) of bank credit in the economy. This was never the idea.

The Banking Act of 1935 ended the autonomy of the Reserve Banks, and the Board received the authority over open-market operations. The government-side of the Fed started to take over, which meant that the fears regarding the socialization of the economy started to materialize. Yet, there was one factor standing in between the socialization of the economy by the Fed, and the still-somewhat-free monetary system: The gold standard.

The Gold Standard

In a gold standard, which had been returned somewhat forcefully after the First World War, the stock of gold of a nation and its demand affects the availability of money and inflation. This meant that the Federal Reserve had only a limited control over money in circulation in the economy. It could not print it at will.

In a gold standard, the flow of gold into a country through, e.g., international trade increases the gold reserves and thus the supply of money (credit) in the economy. To sterilize, the central bank can let the ratio of gold reserves to notes in circulation to increase or it can rise the interest rate to tighten the supply of short-term credit. Outflows of gold naturally has an opposite effect diminishing the amount of money in circulation, unless interest rates are lowered or ratio of gold reserves to notes lowered.

In the 1920’s, the Fed let the share of gold reserves to notes rise effectively sterilizing all gold inflows from abroad. This was seen as the main factor keeping the consumer price inflation at bay. However, the flow of gold to the US and its sterilization also “exported” deflation to other countries, who were forced to cut back the supply of domestic credit due to falling gold reserves. So, while the money stock of the US was kept at bay by letting the share of gold reserves to rise this also meant that the interest rates were kept relatively low from around 1922 till 1928, which fed the speculation in the asset and real estate markets. The credit boom intensified peaking in 1925 and again in 1927. In the absence of signs of inflation, the Fed had little motives to rise short term interest rates even there were rather clear signs of a real estate and consumer booms. The 1920’s kept on “roaring”.

Regardless of its flaws, the gold standard was a crucial element in the playbook of those, who tried stop the socialization of the economy by the Federal Reserve, because it restricted the creation of money by the central bank. This was removed in early 1970s by the dissolution of Bretton-Woods, unleashing the money printing and economy-manipulation ability of the Fed in its totality. We can also argue that, at that point, the government-side of the Fed totally took over.

During the Spring of 2020, at the wake of the Corona-shock, we wittnessed the full socialization of the financial market of the U.S. Durign that Spring, the Fed backstopped U.S. Treasury markets, intervened in corporate commercial-paper and municipal bond markets and short-term money-markets. Alas, the socialization of the U.S. economy, feared by those who objected the creation of the Federal Reserve over 100 years ago was complete, and I fear that the Fed will not stop there. More on that later. Now, back to the 1920s.

Feeding the speculation

A change in the mindset of the Federal Reserve arrived in January 1928, when a consensus was reached that the era of easy money (cheap credit) should end. The Reserve Banks began to sell their government securities, diminishing the supply of money, and gradually raised the discount rate, which determines the interest rate banks are charged on their loans from the Fed, to five percent from 3.5 percent. The Fed was afraid that a sudden change in monetary policy and tighter credit conditions might be destabilizing for business and the asset markets and tried to gently deflate the bubble on Wall Street by making the bank borrowing for speculation gradually more expensive. However, the policy had unintended and major domestic and international consequences.

A noticeable industry of non-bank lenders developed during the 1920’s, and higher rates made more funds available for stock market speculation from these non-bank sources. Stockbrokers’ loans were usually funded by the large balance sheets of corporations, which made them a viable option for investors as rates at money markets rose. For example, during 1929, Standard Oil of New Jersey contributed $69 million to call market per day, on average. As investors had looked overseas for funds, their sudden turn to domestic funds drew dollar liquidity from international markets. Although other foreign lenders stepped up to cover at least some of these flows, the withdrawal of dollar liquidity, e.g., drove Germany into a recession and the UK to the brink of a recession already before the crash in Wall Street. Moreover, as call rates for margin loans rose in the US, it became profitable for banks to borrow cheaply from the Fed and lend the money to speculators with a very good margin. During the last weeks of 1928, the call market rate rose to 12%, while the Fed funds rate was 5%. A window for a great arbitrage trading opened to all banks feeding the stock market frenzy. The prices of stocks increased three-fold between 1927 and August 1929.

There was a one major innovation in the stock markets during the 1920’s that fed the speculation. Trading at the margin enabled the buyer of the stock to greatly increase his/her leverage. The idea of buying a security at the margin is that the security is left with the broker as a collateral for the loan used to buy the asset, while the investor pays only a small cash deposit (the margin). The invention of margin trading thus greatly amplified the speculation in the stock market. In the 1920’s, earnings were also generally much less than the interest of the margin lending. Therefore, the buyer on margin was betting mostly on the rise of the stock price in question. Notably, broker’s loans, which define the collateral used to buy assets at the margin, started to rise strongly in 1928. In the same year, credit growth accelerated clearly above its long-term trend. A convincing case can therefore be made that the speculative bubble in the stock market started only as late as 1928.

Troubles emerge

On December 4, 1928, President Coolidge noted in his state of the union address that:

No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospects than that which appears at present time. In the domestic field there is tranquility and contentment […] and the highest record of years of prosperity.

There definitely were reasons for joy. The US economy had grown by close to 40 percent from the dismal year of 1921. The Federal Reserve index of industrial production had almost doubled (it did double when reaching its peak in June 1929). Wages had not risen so much, but prices were stable. Business earnings rose rapidly. There, of course, were also some problems. Most notably, the rich were getting richer much faster than the poor were able to escape from their impoverished state. Income inequality grew rapidly basically all though the 1920’s.

The first half of 1929 was marked with increasing market volatility and some close calls. The stock market kept on rising and the economic boom continued, but the Fed was becoming ever more nervous about the speculation and the flow of funds from corporations and individuals to feed it. The Board of the Fed did not want to address the issue directly, but it also kept on pondering how to respond. In early February 1929, the Federal Reserve Board issued two statements, from which the first was aimed to individual Federal Reserve banks and the latter for the general public, with one clear message: the Federal Reserve facilities were not to be used to aid the growth in speculation. At almost exactly the same time, the Bank of England raised its bank rate from 4.5 to 5.5%. Stock markets dropped, but soon recovered.

In March 1929, the Federal Reserve Board was meeting constantly in Washington. Because no statements were given from the meetings, it started to make investors nervous. On March 25, the selling in the highly over-valued stock market began. Banks also began to curb their loans to the call market and the rate of brokers’ loans rose strongly. On March 26, it looked like a selling panic could form, but one banker, Charles E. Mitchell, acted to stem the flow. He stated that his bank, the National City, would loan money as necessary to prevent a market liquidation. His bank also borrowed from the New York Fed and thus did what the Board of the Fed had explicitly warned against. Money rates eased and markets rallied. Charles E. Mitchell had single-handedly saved the stock market, and while he faced some grilling from the Senate there were no legal or other actions against him. There was a sense of relief, which was short-lived.

During the latter stages of the boom, it was a common belief that earning and dividends would continue to grow rapidly because of systematic application of science to industry, development of modern management technologies and business mergers. These were, in practice, the same ones that historians have used to explain the ‘Roaring Twenties’, and which have been used many times after the 1920’s to explain booms. As always, during the boom, they seem totally valid arguments. Like many times after the 1920’s, high stock prices and high price-earnings ratios were also a consequence of expected rapid growth in earnings.

So, while dark clouds gathered, the twenties kept on roaring, until suddenly they did not.

Tyler Durden

Mon, 08/19/2024 – 20:05

via ZeroHedge News https://ift.tt/1vJx3QT Tyler Durden