Key Events This Week: Payrolls, JOLTS, ISM And Fed Speakers Galore

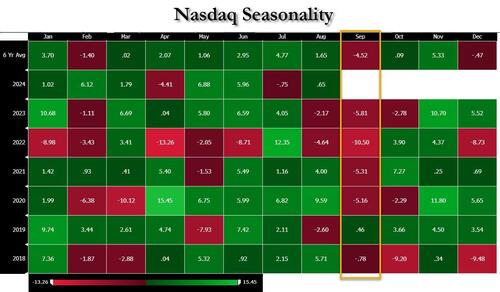

Welcome to September although as Jim Reid writes this morning, given the track record of recent years, perhaps we should say beware rather than welcome. For what it’s worth, the S&P 500 and the STOXX 600 have lost ground in each of the last 4 Septembers…

… while the Nasdaq is a veritable September horror show.

And for those hoping to find cover in fixed income, there hasn’t been any there either. In fact, Bloomberg’s global bond aggregate is down in each of the last 7 Septembers according to Reid. So if we do manage to get some positivity this month, that would fly in the face of a succession of negative performances.

That said, August was more than a solid month especially after the shocking plunge at the start, so even a red September will hardly be a shock after the staggering rebound achieved after August 5, in no small part thanks to the latest dovish pivot by the Fed.

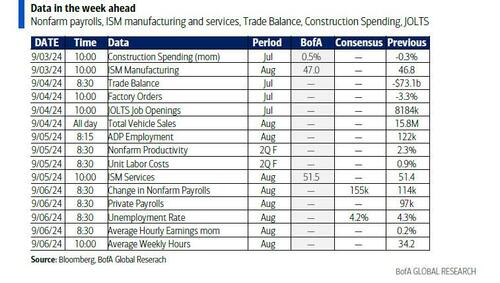

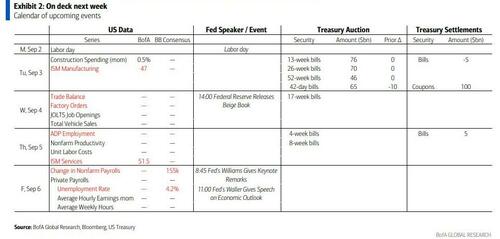

And speaking of the Fed, all roads this week lead to the US jobs report on Friday, which is going to be pivotal in terms of how much they cut rates by at their next meeting. As it stands, futures still see a 25bp move as more likely, but a 50bp move is being priced with a 31% probability this morning, so it’s in the balance as far as markets are concerned. And as we found out last month, an underwhelming jobs report can quickly shift expectations.

In terms of what to expect this time around, economists are forecasting that nonfarm payrolls will come in at +165k in August, a strong rebound from the shockingly bad 114K print in July. That assumes a rebound from potential weather-related disruptions in the July report, and they also see the unemployment rate ticking down a tenth to 4.2%. Of course, much of the focus will be on how Fed officials react, although they won’t have long to discuss the data, as the blackout period ahead of the September meeting begins the day after the jobs report. One final point: after the near record September negative payrolls revision, it wouldn’t be surprising to see a surge in payrolls now that we have had a kitchen sink reset of the fake numbers and the BLS can resume fabricating data from square one.

Although last month’s jobs report was underwhelming, it’s also worth noting that much of the data since then has looked more positive. The weekly initial jobless claims have fallen from their levels in late-July, the latest retail sales print was very strong as well, and the revisions to Q2 GDP growth saw it adjusted up to an annualized pace of +3.0%, which isn’t consistent with a recession (but it is consistent with pre-election propaganda meant to put lipstick on the economy). Moreover, Friday saw the Atlanta Fed’s GDPNow estimate for Q3 move up to +2.5%, so again pointing away from a recession.

This week we should get some more details on the August picture, as we’ll get the ISM manufacturing and services prints, which are coming out on Tuesday and Thursday respectively. The JOLTS report on Wednesday will also be worth looking at, although that’s a bit more backward-looking as it’s the July reading.

Aside from the US data, it’s a fairly subdued calendar this week, and US markets are closed today for the Labor Day holiday. One thing we will get though is the Bank of Canada’s latest policy decision on Wednesday, where they’re widely expected to cut rates by 25bps for a third consecutive meeting, which would take their policy rate down to 4.25%.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 2

- Data: China August Caixin manufacturing PMI, Japan Q2 capital spending, company sales, company profits, Italy August manufacturing PMI, new car registrations, budget balance, July PPI

Tuesday September 3

- Data: US August ISM index, July construction spending, Japan August monetary base, France July budget balance, Canada August manufacturing PMI, Switzerland August CPI, Q2 GDP

- Central banks: ECB’s Nagel speaks, BoE’s Breeden speaks

Wednesday September 4

- Data: US July JOLTS report, trade balance, factory orders, August total vehicle sales, China August Caixin services PMI, UK August official reserve changes, Italy August services PMI, Eurozone July PPI, Canada July international merchandise trade, Australia Q2 GDP

- Central banks: BoC decision, Fed’s Beige Book, ECB’s Villeroy speaks

- Earnings: Dollar Tree

Thursday September 5

- Data: US August ADP report, ISM services, initial jobless claims, UK August new car registrations, construction PMI, Japan July labor cash earnings, Germany August construction PMI, July factory orders, Eurozone July retail sales, Canada Q2 labor productivity, August services PMI

- Central banks: BoJ’s Takata speaks, ECB’s Holzmann speaks, BoE’s August DMP survey

- Earnings: Broadcom

Friday September 6

- Data: US August jobs report, Japan July household spending, leading index, coincident index, Germany July trade balance, industrial production, June retail sales, France July industrial production, current account balance, trade balance, Italy July retail sales, Canada August jobs report

- Central banks: Fed’s Williams and Waller speak

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Tuesday, the JOLTS job openings report on Wednesday, and the employment report on Friday. New York Fed President Williams and Fed Governor Waller will deliver speeches on Friday.

Monday, September 2

- Labor Day holiday. There are no major economic data releases scheduled. NYSE will be closed. SIFMA recommends that bond markets also close.

Tuesday, September 3

- 09:45 AM S&P Global US manufacturing PMI, August final (consensus 48.0, last 48.0)

- 10:00 AM Construction spending, July (GS +0.1%, consensus +0.1%, last -0.3%)

- 10:00 AM ISM manufacturing index, August (GS 47.3, consensus 47.5, last 46.8): We estimate the ISM manufacturing index edged higher in August (+0.5pt to 47.3), reflecting partial convergence toward the level of other manufacturing surveys (GS manufacturing survey tracker -0.1pt to 47.9) and neutral seasonality.

Wednesday, September 4

- 08:30 AM Trade balance, July (GS -$77.9bn, consensus -$78.9bn, last -$73.1bn)

- 10:00 AM JOLTS job openings, July (GS 8,100k, consensus 8,100k, last 8,184k): We estimate that JOLTS job openings edged slightly lower in July (-0.1mn to 8.1mn), reflecting stabilization in online job postings.

- 10:00 AM Factory orders, July (GS 5.0%, consensus 4.7%, last -3.3%); Durable goods orders, July final (consensus +9.9%, last +9.9%); Durable goods orders ex-transportation, July final (last -0.2%); Core capital goods orders, July final (last -0.1%); Core capital goods shipments, July final (last -0.4%)

- 02:00 PM Beige Book, September meeting period: The Fed’s Beige Book is a summary of regional economic anecdotes from the 12 Federal Reserve districts. The Beige Book for the July FOMC meeting period noted that five districts had reported flat or declining activity, three more than in the June Beige Book, and that districts expected slower growth in the coming six months because of uncertainty related to the election, domestic policy, geopolitics, and inflation. In this month’s Beige Book, we look for anecdotes related to the evolution of labor demand and firms’ expectations of activity growth for the remainder of the year.

- 05:00 PM Lightweight motor vehicle sales, July (GS 15.3mn, consensus 15.4mn, last 15.8mn): We estimate a 0.5mn decline in lightweight motor vehicle sales in August to 15.3mn (SAAR), reflecting moderation to a more normal level of sales after the prior month was boosted by the end of disruptions to dealer software systems from cyberattacks.

Thursday, September 5

- 08:15 AM ADP employment change, August (GS +155k, consensus +140k, last +122k)

- 08:30 AM Nonfarm productivity, Q2 final (GS +2.5%, consensus +2.5%, last +2.3%); Unit labor costs, Q2 final (GS +0.5%, consensus +0.8%, last +0.9%)

- 08:30 AM Initial jobless claims, week ended August 31 (GS 225k, consensus 230k, last 231k): Continuing jobless claims, week ended August 24 (consensus 1,865k, last 1,868k)

- 09:45 AM S&P Global US services PMI, August final (last 55.2)

- 10:00 AM ISM services index, August (GS 51.4, consensus 51.1, last 51.4): We estimate that the ISM services index was roughly unchanged at 51.4 in August, reflecting potential convergence toward our non-manufacturing survey tracker (which stands at 52.5 for August) but a potential headwind from seasonality.

Friday, September 6

- 08:30 AM Nonfarm payroll employment, August (GS +155k, consensus +165k, last +114k); Private payroll employment, August (GS +130k, consensus +140k, last +97k); Average hourly earnings (mom), August (GS +0.3%, consensus +0.3%, last +0.2%); Average hourly earnings (yoy), August (GS +3.7%, consensus +3.7%, last +3.6%); Unemployment rate, August (GS 4.2%, consensus 4.2%, last 4.3%); Labor force participation rate, August (GS 62.7%, consensus 62.7%, last 62.7%): We estimate nonfarm payrolls rose by 155k in August. Big Data indicators indicate a pace of job creation below the recent payrolls trend, and August payrolls have exhibited a consistent negative bias in initial prints over the last decade. We assume a modest rebound from severe weather in July and a still above-trend (albeit moderating) contribution from the recent surge in immigration. We estimate that the unemployment rate declined 0.1pp to 4.2% on a rounded basis (a low hurdle from an unrounded 4.25% in July), reflecting the reversal of some of the temporary layoffs that boosted the unemployment rate in July, especially those that appeared linked to summer auto plant retooling shutdowns or extreme heat. We estimate average hourly earnings rose 0.3% (mom sa), which would raise the year-on-year rate by 0.1pp to 3.7%, reflecting waning wage pressures but positive calendar effects.

- 08:45 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver a keynote speech at an event hosted by the Council on Foreign Relations. Text and Q&A are expected. Although President Williams voted in favor of keeping the fed funds rate unchanged at the FOMC’s July meeting, the minutes of the Fed Board’s July discount rate meetings showed that the New York Fed voted to lower the discount rate by 25bp. This suggests that President Williams was one of the “several” FOMC participants who said they could have supported a fed funds rate cut at the July meeting.

- 10:00 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will deliver a speech on the economic outlook followed by a Q&A session at the University of Notre Dame. Text and Q&A are expected. On July 17th, before the FOMC’s July meeting, Governor Waller noted that “current data are consistent with achieving a soft landing, and I will be looking for data over the next couple months to buttress this view,” noting that “while I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted.”

Source: DB, Goldman

Tyler Durden

Mon, 09/02/2024 – 10:42

via ZeroHedge News https://ift.tt/zUrF1ND Tyler Durden