Hungary Is First Central Bank To Pause Rate Cuts As Inflation Suddenly Jumps

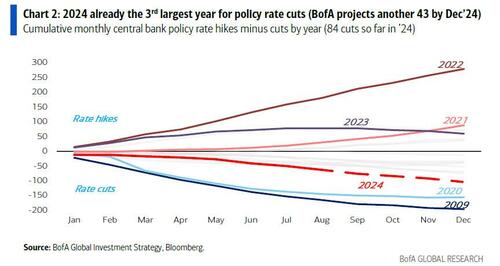

While the Fed has made it abundantly clear that it will officially end its hiking cycle in just over two weeks when it cuts rates for the first time since March 2020, the reality is that the US central bank is far behind the curve when it comes to easing monetary policy, with most other G7 central banks – including the ECB, BOE, BOC, SNB and so on – having already cut rates at least once. In fact, one may not realize it with inflation still at nosebleed levels for most people, but a few weeks ago, Bank of America calculated that 2024 is already the 3rd best year for rate cuts on record, with just the crisis 2009 and 2020 ahead!

Then again, cutting rates is easy: the problem is what happens when you have cut rates a few times and suddenly inflation is roaring back with a vengeance, and the central bank is facing a catastrophic credibility collapse similar to that experienced by the Arthur Burns Fed, when the US central bank hiked rates in the early 1970s as inflation soared, before cutting as inflation seemed to normalize, only to see a second, far more brutal surge in inflation over the next few years leading to the calamity that was the Volcker Fed’s 20% interest rates.

Impossible? Well, maybe reread what we wrote a week ago when we explained how Powell pivoted dovishly at Jackson Hole – and this for real – just as stocks, home prices, rents and food are at all time highs… and M2 once again positive and about to surge!

But while the Fed will have at least a few months to enjoy its “mission accomplished” before the next, far more crippling leg of inflation returns, for some central banks the day of reckoning has already arrived.

One such place is Hungary, whose central bank just paused rate cuts for the first time in more than a year as inflation jumped and the currency tumbled.

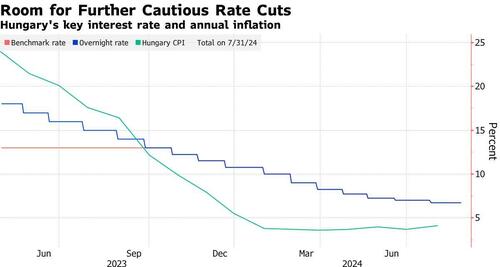

Last week, policymakers in Budapest left the benchmark rate at 6.75% on Tuesday following 15 consecutive cuts, a decision which was in line with the forecasts of most economists and left the country’s borrowing costs at the highest level in the European Union.

The National Bank of Hungary ended its easing cycle after inflation quickened more than its own forecast in July and breached the 4% upper bound of its tolerance range. Meanwhile, the forint, a key factor for monetary settings due to its impact on inflation, has slumped since last month’s (final) rate cut.

While Hungary’s rate setters signaled the pause was temporary and that they were looking for openings to ease monetary policy further, the reality is that absent a deflationary shock, the country’s easing cycle is most likely over and just like in the 1970s US, another, far more painful hiking cycle is on deck.

“There may be scope for cautiously lowering interest rates further in the coming period, depending on the expected interest rate policies of the world’s leading central banks, as well as developments in the domestic inflation outlook and changes in Hungary’s risk perception,” the rate-setting Monetary Council said in a statement.

The forint strengthened modestly after the decision, but remained down 2.5% versus the euro since the start of the year. The forint kept its gains after the guidance on further rate cuts, suggesting those were largely priced in.

Inflation may return to within the 1 percentage-point band around the 3% target in the coming months, Deputy Governor Barnabas Virag told reporters at a briefing, expressing his wishes more than some credible version of reality. At the same time, he said policymakers will closely monitor August data on potential stickiness in price growth, including in core inflation that strips out volatile food and energy items. Which is now rapidly rising once again…

The Monetary Council will weigh a 25 basis-point cut or no change to the key rate at each of its meetings this year, with room for one or two more quarter-point cuts by the end of 2024, Virag said, but don’t be surprised when the next move by the central bank is a hike instead of a cut.

Meanwhile, and as always when the central bank removes the Kool-Aid, Hungary’s politicians were immediately outraged that the money printers threaten to put their political career at risk over something as inconsequential as runaway inflation. Economy Minister Marton Nagy, a potential successor to Governor Gyorgy Matolcsy after his term expires early next year, last week lashed out at the central bank for its approach. He compared rate-setters to “cyclops” for a perceived singular focus on inflation at a time of lackluster economic growth. Nagy has in the past called for looser monetary policy, because that’s what politicians want: they want loose monetary policy (ideally QE) so they can bribe as many people as possible by literally printing money. That’s how the system works.

Meanwhile, the cental bank – while it still has independence – is focusing not just on preserving the careers of corrupt politicians who summarily embezzle about 20% of whatever money they hand out to buy votes, but on avoiding hyperinflation and currency collapse which would happen in an instant should politicians ever get their hands on the money print. The central bank has been clear that its priority is achieving price stability. Policymakers have progressively reduced the size of the cuts this year from a full percentage point to 25 basis points in the past two months. The key rate peaked at 18% last year.

And now that the easing cycle has hit its limits, deflation has dropped as low as it could go and inflation is once again rising, the next move will be a rate hike: first in Hungary, and then – when inflation comes roaring back across the world – everywhere else too…

Tyler Durden

Tue, 09/03/2024 – 04:15

via ZeroHedge News https://ift.tt/R407loD Tyler Durden