China Panics: Cuts Multiple Rates And Reserve Ratio Requirements, Goes All-In To Prop Up Stocks

This morning, when we reported that a sudden – and extremely overdue – urgency appeared to grip Beijing’s top power echelons in fasttracking a bunch of new monetary stimulus measures, including a cut in the 14-day reverse repo tool, we said to expect much more during today’s impromptu briefing on the economy, attended by the country’s three top financial regulators, which had fueled speculation that China was about to unleash far more efforts to revive growth, among which further cuts to the country’s Reverse Repo rate, and LPR rate but also cuts to the RRR and various other monetary stimulus measures.

That’s precisely what happened moments ago when PBoC Governor Pan Gongsheng unleashed what Bloomberg called a “stimulus blitz”, and what we call “sheer panic”, when he announced a bevy of stimulus measures to prop up the sinking economy and crashing stock market. Among these:

- The PBOC will reduce the 7-day reverse repo rate by 20bps.

- The PBOC will cut the reserve requirement ratio by 0.5%, a move that will free up1 trillion yuan ($142 billion) in liquidity, Pan said.

- China may also cut the RRR further this year by another 0.25 to 0.5% at the appropriate time.

- The PBOC will cut the 1 Year MLF rate by 30bps

- The PBOC will also lower the rates for existing mortgages and cut the down payment ratio on second homes to 15% from 25%.

- The deposit rate will be lowered to “neutralize” the impact on bank margins.

“Monetary policy easing come bolder than expected, with both rate cuts and RRR cuts announcing at the same time,” said Becky Liu, head of China macro strategy at Standard Chartered Plc. “We see room for bolder easing ahead in the coming quarters, following the Fed’s outsized rate cuts.”

Or, to quote Mike Ehrmantraut, no more half measures, just as we predicted on Friday.

Time For China To Turn On The Printing Press https://t.co/IDBjhxAs90

— zerohedge (@zerohedge) September 21, 2024

But wait, there’s much more: at a time when not even the shoeshine boy wants to be within a ten foot pole of Chinese stocks, the PBOC governor also said that – in a last ditch attempt to bail out the country’s stock market – it will set up a swap facility allowing securities firms, funds and insurance companies to tap liquidity from PBOC to buy stocks. Brokers, funds and insurers will be allowed to pledge assets in exchange for liquidity for funds and buy stocks; the PBOC will also set up a separate specialized refinancing facility for listed companies and major shareholders to buy back shares, raise holdings. In other words, Beijing is greenlighting direct intervention in the stock market to prop up stocks.

According to Goldman, “this is very interesting new way of supporting stock market as so far it’s mainly national teams.”

While the devil will certainly be in the details, China is making it clear that it is not playing around, with Bloomberg reporting that China plans at least 500 billion yuan in liquidity support to stocks!

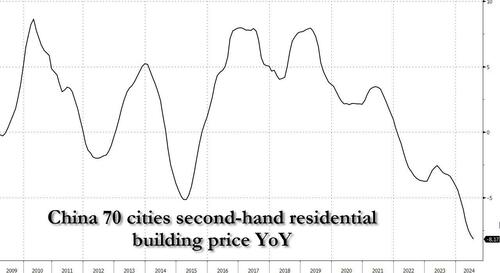

Over the past two years, Xi Jinping’s government has enacted piecemeal rate cuts that have completely failed to reverse a slowdown in the world’s No. 2 economy, with growth weakening further after grinding to its worst pace in five quarters and the housing market collapsing at an unprecedented pace.

That deterioration, which has translated into growing social unrest and surging labor strikes, has tested the Chinese leadership’s tolerance for missing its high-profile annual target for the second time in three years, at a moment when investor confidence is waning.

In May, China unveiled a laughable property rescue package which not only failed to turn around a years-long real estate slump that’s wiped out an estimated $18 trillion in wealth from households, but somehow made it even worse. Only 29 cities out of 200 urged to participate are heeding Beijing’s call to help absorb an excess of housing. New home prices clocked their biggest decline last month from July since 2014.

Not surprisingly, the central bank governor made the latest announcement at his first high-profile press conference since March, when he defended the government’s growth goal of about 5% alongside other top economic officials.

This year the PBOC chief has displayed a more transparent approach to policy in a bid to stabilize sentiment. Pan used a similar briefing in January to announce a cut to the amount of money banks must hold in reserve two weeks ahead of time, as authorities tried to halt a $6 trillion stock-market rout.

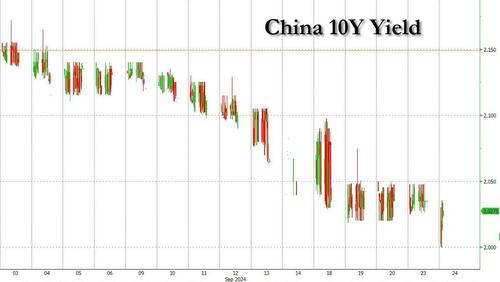

In response to the larger than expected – if not yet bazooka stimulus – the offshore yuan weakened 0.1% as PBOC announced the various rate cuts while China’s 10-year government bond yields declined to 2%, a fresh record low.

The plunge in yields confirms that the market was certainly taken aback with the size of the monetary stimulus, although for the real kick, Beijing will also have to unleash the fiscal firehose, which is also what Standard Chartered’s Becky LIu said when she predicted that the PBOC could take more aggressive action in the future, after a series of surprise rate cuts on Tuesday.

“The possibility for USD-CNY to dip below 7.0 is rising. China rates also have more downside.”

Echoing this view, Lynn Song, chief economist for Greater China at ING, said that China’s 10-year yield could decline to 1.8% should PBOC ease monetary policy further.

“It will be interesting to see if the PBOC steps in again to try and protect the 2% level, but I am personally expecting it to move below 2% at some point,” said Song. “If we are seeing more easing later in the year, it would not surprise me to see it move down to 1.8% or so.”

Tuesday’s RRR cut is “in line with expectations as it has been signaled for some time, but will not have too much of an impact as the issue currently is not banks lacking the funds to lend out but rather limited quality borrowing demand.”

What does today’s barrage of rate cuts mean for the economy? According to Jing Liu HSBC Global Research Greater China Chief Economist, China’s policy rate cuts are to support its 5% growth target goals, and there may be further reductions in the reserve requirement ratio: “This is basically to ensure that China can deliver the 5% growth target. With stronger support now I think we are going to see some kind of lifting effect… Don’t forget we could still have further fiscal stimulus. We still have more than one trillion yuan of quota left to be used up this year.” And with rates at all time lows, China can certainly afford to see yields tick up amid a flood of new debt.

“I personally think they are likely to use ultra long-term bonds because that doesn’t change the longer-term deficit and at the beginning of the year they left room for more operation on that” Liu said adding that “the next move to watch is whether the central government can put money directly into stabilizing the housing market. And whether China can have PPI inflation turn positive relatively soon.”

Xiaojia Zhi, head of research at Credit Agricole CIB, said that a big driver for the Chinese move was the Fed’s 50bp rate cut and the rebound in the yuan, which gave China room to ease monetary policy: “While PBOC rate cut and increase in liquidity would weigh on CNY and CNH, an partial offsetting factor could arrive if there is a boost to sentiment,” she says

While it remains to be seen how long this latest stimmy will last, at least the kneejerk reaction among risk assets was favorable, and the Chinese stock market rose with Chinese property stocks jumping after the PBOC’s announcement. “Good to see policy makers’ proactive moves to help overall economy and to support property market. The 15% down payment for second home is one of the lowest levels in history, which coupled with lower mortgage rate, could help reduce financial burden of homebuyers,” says Raymond Cheng, head of China property research at CGS International Securities Hong Kong.

Meanwhile, Pan’s mentioning of support to buy unsold homes could suggest more implementation of the policy. Overall, the stimulus was positive for the sector near term although yet to see impact on property sales.

Despite all that, the skeptics remain. According to Oversea-Chinese Banking Corp, China’s policymakers are clearly attempting to repair market confidence though more information is needed on the measures themselves. “The cuts were more or less within expectations but what is slightly different this time is a tool to support equity markets,” says Singapore strategist Christopher Wong. “This clearly shows that policymakers are making attempts to repair confidence — but it still remains to be seen if this sees sustained gains or just another one to two days of gains. Equity markets should cheer the move but devil is still in the details.”

Worse, according to ANZ bank head of Asia research Khoon Goh, the easing package – while the most comprehensive to date, “is far from being a bazooka.”

“If the new measures to support the equity market is successful, it could see a return of foreign inflows, supporting the yuan”

“Whether any rally in the equity market can be sustained ultimately lies in the ability for these measures to turn confidence around. Still, markets will welcome this announcement” if only for a few days at which point the selling will resume, as traders do everything in their power to force the PBOC panic to hit boss level.

Which it will: now that China has finally tipped its hand with what appears to be a barrage of monetary easing, it may pretend it won’t do a fiscal bazooka but when this “panicked” stimmy fizzles as it will, as have all previous ones, Beijing will have no choice but to flood the economy with debt, which will then send commodities soaring, and restart China’s export of its favorite commodity – inflation… and just in time for the Fed’s aggressive rate cuts.

In short, 2025 is shaping up like a very exciting year, if only for the second coming of the Arthur Burns Fed.

Tyler Durden

Mon, 09/23/2024 – 22:33

via ZeroHedge News https://ift.tt/EzLNXTO Tyler Durden