Bonds, Bitcoin, & Bullion Bid As Markets Mull Moscow, Mullahs, Musk, & Macro

Geopolitics, macroeconomics, and domestic politics all combined for a wile ride in stocks today…

Geopolitics was a major headwind overnight as Putin signed a decree allowing Russia to use nuclear weapons in the event of a massive conventional attack on its soil. But, then that reversed as headlines suggested Iran is looking to de-escalate (IRAN AGREES TO STOP PRODUCING NEAR BOMB-GRADE URANIUM: IAEA).

All of that prompted a roller-coaster in stocks with Nasdaq ending the best (and Small Caps recovering dramatically from overnight weakness). The Dow desperately tried to get green but failed (even with help from WMT)…

Then Musk sparked some chaos in media stocks as he tweeted: “No advertising for pharma”…

Source: Bloomberg

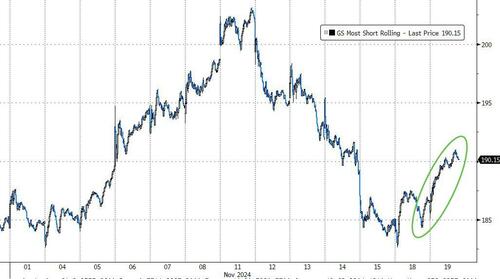

Shorts were squeezed today from the cash open…

Source: Bloomberg

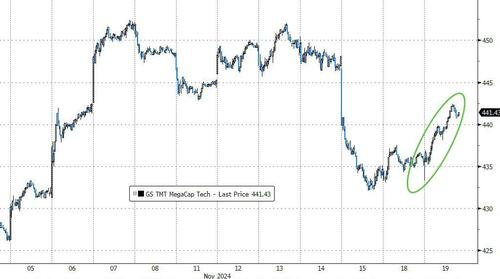

Mega-Cap Tech rallied significantly on the day, bouncing off pre-election levels ahead of tomorrow’s NVDA earnings…

Source: Bloomberg

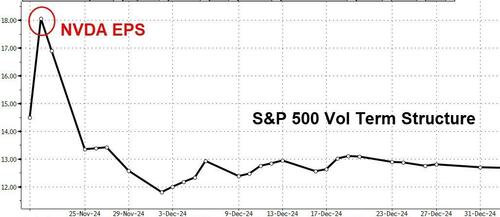

VIX was higher on the day with tomorrow’s risk event priced in (though less than typical for an NVDA earnings day)…

Source: Bloomberg

US Macro data disappointed – housing starts and permits were ugly – which helped pull bond yields lower (along with chatter about potential ‘safe’ picks for Treasury Secretary)…

Source: Bloomberg

Bitcoin continued its charge higher, topping $94,000 – a new record high in USD terms…

Source: Bloomberg

…and coming within a few points of an all-time record high against gold…

Source: Bloomberg

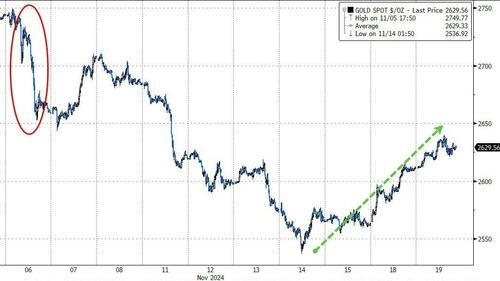

…even as gold started to rally back from its post-election doldrums too…

Source: Bloomberg

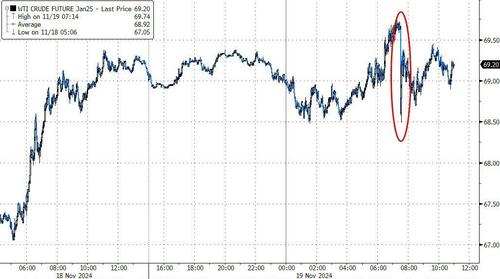

Oil prices dipped on the Iran headlines but overall it appears geopolitical uncertainty is adding some premium back into the energy complex…

Source: Bloomberg

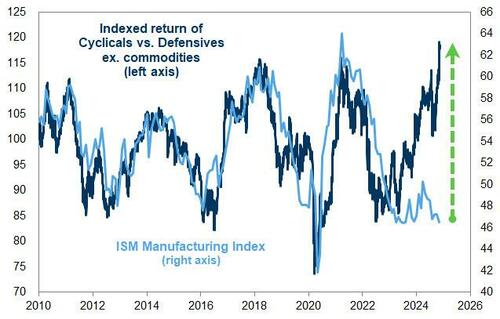

Finally, US equities are currently pricing a very optimistic growth environment…

Source: Goldman Sachs

Goldman’s sector model leads them to recommend overweight positions in Materials, Software & Services, and Utilities. From an investment strategy perspective, they invoke the dictum of Donald Trump to “protect the downside and the upside will take care of itself.”

Tyler Durden

Tue, 11/19/2024 – 16:00

via ZeroHedge News https://ift.tt/6iDbnjt Tyler Durden