Trump Victory Sparks Renewed Optimism In Manufacturing Surveys

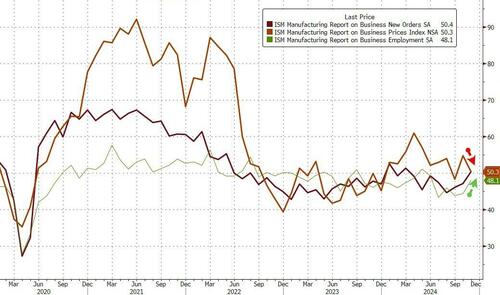

While Services surveys are soaring, Manufacturing continues to stagnate (below 50) despite a serial improvement in US Macro ‘hard’ data.

However, November saw a post-Trump resurgence in confidence with S&P Global’s Manufacturing PMI rising to 49.7 (highest since June) and ISM’s Manufacturing PMI jumped from 46.5 to 48.4…

Source: Bloomberg

While both of the surveys rose notably, they do both remain in contraction (sub-50).

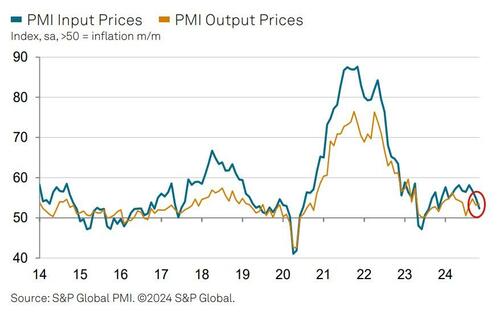

One more silver lining is that while new orders rose, prices actually fell (for now)…

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence noted optimism is on the rise:

“The mood among US manufacturers brightened in November, though any feel-good factor has yet to feed through to higher output on the factory floor.

“Optimism about the year ahead has improved to a level not beaten in two and a half years, buoyed by the lifting of uncertainty seen in the lead up to the election, as well as the prospect of stronger economic growth and greater protectionism against foreign competition under the new Trump administration in 2025.

But, it’s not all coming up roses:

“In contrast, current production levels fell for a fourth straight month in November, dropping at a rate not exceeded for nearly one and a half years. The gap between expected future output and actual current output is now the widest seen for a decade if the pandemic is excluded, underscoring the marked divergence between tough current conditions and the mounting expectation of better times to come.

“Demand conditions need to improve alongside the improvement in confidence to encourage producers to raise production. However, although export sales continue to fall sharply, we note that November’s fall in overall new orders was the smallest seen over the past five months, hinting that the downturn in domestic demand for goods is easing and could help revive the manufacturing sector as we head into 2025.

But, Manufacturers recorded a slower rise in input costs in November, and one that was only modest.

The pace of input price inflation eased for the third month running to the weakest for a year.

On the other hand, the pace of output price inflation quickened slightly and remained slightly above the pre-pandemic average.

“The promise of protectionism has meanwhile led to an increase in input buying by some US producers, as they seek to front-run price hikes on imports from threatened tariffs. One in four companies reporting higher input purchases in November attributed the rise to tariff threats, underlying US manufacturers’ concerns over the inflationary impact of tariffs.”

We shall see if that wave of inflation fears shows its ugly head…

Tyler Durden

Mon, 12/02/2024 – 10:05

via ZeroHedge News https://ift.tt/fJPknpx Tyler Durden