Here We Go Again: China Vows More Massive Stimulus, Embraces “Moderately Loose” Monetary Policy

It’s desperation time in China again.

Two months after Beijing vowed it would unleash a fiscal bazooka, sending Chinese stocks soaring, only to see the entire move reverse as the market was promptly disappointed by yet another empty promise by the world’s second largest economy, on Monday China’s top leaders signaled another round of bold economic support next year using their most direct language on stimulus in years, as Beijing braces for a trade war when Donald Trump takes office.

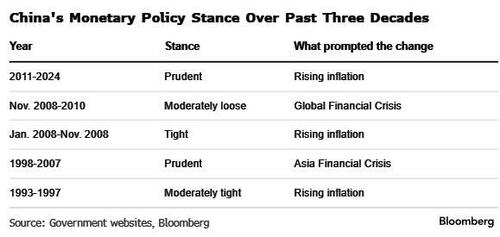

President Xi Jinping’s decision-making Politburo vowed to embrace a “moderately loose” monetary policy in 2025, signaling more rate cuts ahead and shifting from a “prudent” strategy that’s held for 14 years, and reverting to the policy stance that defined the post-GFC world until 2010.

As Bloomberg reports, the 24-man body also vowed “more proactive” fiscal policy at its monthly huddle, according to the official Xinhua News Agency, raising expectations for Beijing to widen the fiscal deficit from 3% at the annual parliamentary session in March. That would open the door to more central government borrowing to shore up the faltering economy.

Still, China’s leaders ticked off nearly every major problem plaguing the economy, with direct pledges to “stabilize” the stock market as well as the property sector fighting a years long slump. In a first, cadres touted “extraordinary” measures for counter-cyclical policy adjustment, language analysts said could hint at greater bond issuance or a stabilization fund to support the stock market. Among the various (laughable) promises were the following”

- China’s monetary policy to be moderately loose next year

- Fiscal policy to be more proactive

- To enrich and improve policy toolbox

- To boost consumption and investment efficiency

- To step up extraordinary counter-cyclical adjustments

- To deepen high-level opening up

- To effectively prevent, resolve risks in key areas

- To stabilize foreign trade and investments

- To implement more proactive macro policies

- To expand domestic demands in all aspects

- To enhance party’s leadership on economic work

- To lift investment returns

- To firmly prevent systemic risks

- To promote urban-rural integrated developments

Policymakers also elevated the importance of boosting consumption, making that the top goal of the meeting — potentially a sign the work conference will make domestic demand the priority for 2025. Xi’s push for manufacturing to propel the economy has seen the US and European Union complain China is flooding their markets with cheap goods and prompted calls for Beijing to get its own consumers spending.

Of course, getting all these tasks completed would cost trillions (in dollars) in new debt, which is why gold has resumed its surge higher. And just like in September when Beijing unleashed its latest promise to start a new Golden Age for China, the gusher of superlatives flooded in: the Politburo’s December meeting “sent the most aggressive stimulus tone in a decade,” Morgan Stanley economists including Robin Xing wrote in a research note, adding that “while the tone is very positive, implementation remains uncertain.”

“The wording in this politburo meeting statement is unprecedented,” said Zhaopeng Xing, senior China strategist at ANZ Bank China Co Ltd. “We think the commentary points to strong fiscal expansion, big rate cut and asset buying. The policy tone shows strong confidence.”

Of course, this won’t be the first time China has vowed to stimulate… or the second, or the third. And, sure enough, after an initial burst higher, the euphoria quickly fizzled and China-linked stocks in the US dipped after bursting higher. Meanwhile, the offshore yuan erased losses to trade modestly stronger on bets China’s economy will recover due to monetary and fiscal stimulus. Regional currencies also got a boost from the Monday readout, with Australian dollar rising 0.3% and New Zealand’s currency trimming losses. That said the moves were far more muted than the eruption observed in late September when the world was convinced a true bazooka was coming only to be left with a big bag of nothing.

While Politburo readouts never reveal new numerical economic targets, the vaguely worded statements give important clues on future policy. The December conclave sets the agenda for the larger Central Economic Work Conference that crafts priorities, such as the annual growth goal. That meeting is set to begin Wednesday.

Other highlights of the Politburo meeting included:

- Signaled 2024 growth target of “around 5%” will be hit by saying full-year goals will be met “smoothly”

- Reaffirmed the overall principle of “using progress to promote stability”

- Pledged to continue push for technology innovation and the construction of a modern supply chain

- Vowed to implement economic reforms, including some “iconic” measures

- Repeated a pledge to open up the economy, stabilize foreign investors and trade

- Vowed to strengthen political supervision as part of Xi’s signature anti-corruption drive, suggesting party cadres will face more close scrutiny of their loyalty to China’s top leader.

“The wording in this Politburo meeting statement is unprecedented,” said Zhaopeng Xing, senior strategist at Australia & New Zealand Banking Group. “The policy tone shows strong confidence against Trump’s threats,” he noted, referencing the US president-elect’s vow to impose a 60% tariff on Chinese exports that would decimate bilateral trade.

Perhaps the most notable change was Beijing’s decision to adopt a “moderately loose” monetary policy; the last time China did that was in the Global Financial Crisis as part of a bazooka stimulus package to prop up the economy. That’s something Beijing has vowed to avoid repeating, with officials providing just enough support to hit this year’s growth goal of around 5% without loading up debt.

The Politburo readout, however, sent markets a message Xi is feeling a new urgency. It’s a reminder “top leaders’ view on economic conditions has shifted substantially compared to last quarter,” said Martin Rasmussen, senior strategist at macro research firm Exante Data. And yet, for all the talk, Beijing has yet to follow through with any tangible action which is why the market continues to ignore every and all such promise from Beijing.

After second quarter growth fell short, policymakers started rolling out stimulus in late September. Economists widely expect another cut to the amount of cash banks have to keep in reserve before the year is out, while a rate adjustment is more likely to fall in the first quarter of 2025. According to ANZ Bank’s Xing, the message points to a big rate cuts: “We think it points to strong fiscal expansion, big rate cut and asset buying,” Xing said adding that “special LGBs will be used to buy homes and stock stability funds may be introduced. The policy tone shows strong confidence against Trump threats.”

“The statement looks to manage market expectation. Any disappointing number at the late March NPC will hit the market.”

As well as rising trade tensions, China is battling its longest streak of deflation this century. That problem was on display earlier Monday in data showing producer prices falling in November for a 26th straight month. Consumer prices also rose at their slowest pace in five months, hovering around zero. Falling prices have undercut the economy’s 4.8% growth so far this year, eating into corporate profits and pushing companies to cut investment as well as wages. While the People’s Bank of China has slashed interest rates and offered more cash for banks several times, authorities have found it hard to spur greater borrowing.

The Politburo promised to “forcefully lift consumption” and drive domestic demand “in all aspects,” without directly mentioning the problem of deflation. That could indicate more rounds of the cash-for-clunkers program that’s operated as a consumption voucher, encouraging people to buy new electronics at a discount in exchange for their old products.

China’s Premier Li Qiang vowed to deploy “every means possible” to boost consumption at a meeting on Monday with heads of major international economic organizations in Beijing, including the International Monetary Fund, which has long called on China to expand domestic demand.

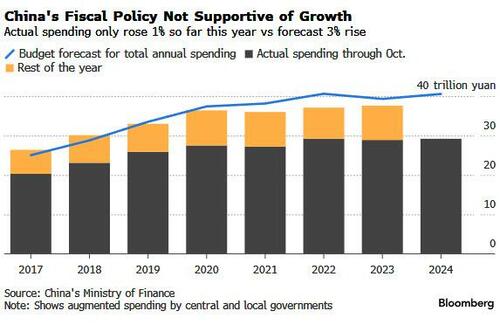

While the latest language on fiscal policy doesn’t mark a fundamental shift from the “pro-active” adopted in 2008, the addition of the word “more” signals government spending will be dialed up. A state media commentary Friday said Beijing had ample room to raise its budget deficit next year.

Fiscal spending is widely regarded as the most important element in any stimulus package, since private demand from households and companies has dwindled. While government spending has been weak this year, in November the Finance Ministry launched a $1.4 trillion rescue program for indebted local governments to free up regional officials to boost growth.

The specifics of the government’s budget, including the fiscal deficit and the amount of bonds it plans to issue, will likely only be revealed in March during the annual legislative session. But the Politburo readout will likely raise expectations for those targets.

“The Politburo statement is very positive,” He Wei, China economist at Gavekal Dragonomics. “It has everything that people wanted.”

Looking ahead, following the December Politburo meeting, the annual CEWC will be held mid-week, during which top policymakers will communicate the government’s growth target and budget for 2025 to local governments. Local governments in turn will announce their own 2025 growth and investment targets in their local “Two Sessions” (in January-February), although no national targets will be officially announced until next March’s “Two Sessions”.

Today’s meeting adds conviction to Goldman’s view that fiscal easing will do the heavy lifting to stabilize growth, “but the composition of this easing will likely differ substantially from past cycles, with more focus on consumption, high-tech manufacturing, and risk containment rather than traditional infrastructure and property investment” according to Goldman China anlyst Lisheng Wang. He adds that during his recent marketing trips in China, onshore investors broadly expect the growth target for 2025 to remain unchanged from this year at “around 5%” to rebuild confidence, and the official fiscal deficit to be much higher than in 2024. For policy stimulus next year, the bank expects policymakers to expand the augmented fiscal deficit meaningfully (by 1.8pp of GDP in our estimation), cut policy rates considerably (by 40bp), and step up easing measures for the property sector (see our expectations for 2025 budget numbers from our 2025 outlook).

More in the full Goldman note available to pro subs.

Tyler Durden

Mon, 12/09/2024 – 09:40

via ZeroHedge News https://ift.tt/NUEzXj1 Tyler Durden