Kroger-Albertsons Merger Blocked By Court In Latest Anti-M&A Farce By Biden Admin

The Biden administration, desperate to make an impact somewhere, anywhere, in its final, dying days, has struck again.

Just around the time we learned that Biden was set to finally kill the Nippon Steel of US steel, we learned that a federal judge had also blocked supermarket giant Kroger from acquiring Albertsons, siding with that anti-M&A puppet of various outgoing socialist interests, Lina Khan, who said the $20 billion supermarket merger would erode competition and raise prices for consumers, when in reality it will only lead to more supermarket failures, fewer jobs and even higher prices for consumers.

U.S. District Judge Adrienne Nelson agreed with the Federal Trade Commission’s argument that Kroger would become the dominant player in traditional supermarkets if allowed to add nearly 2,000 stores by taking over Albertsons, its smaller rival. Nelson rejected the companies’ counterargument that selling 579 stores to C&S Wholesale Grocers would replace the lost competition.

“Evidence shows that defendants engage in substantial head-to-head competition and the proposed merger would remove that competition,” Nelson wrote in the ruling, clearly unaware that grocers have a less than 1% profit margin, or that a similar ruling blocked the Jetblue-Spirit merger less than a year ago, culminating with Spirit’s bankruptcy, mass layoffs and even higher prices for those carriers who remained.

The decision is a significant milestone for the FTC under the Biden administration, whose chair Lina Khan has waged legal battles to stop megadeals rather than accept companies’ proposed fixes to address competition concerns.

For the companies, the decision is a major blow to a deal that executives have said is critical for competing against bigger retail powers like Walmart and Amazon. Attorneys for Kroger and Albertsons have previously said they would likely abandon the deal if the judge sided with the FTC.

An FTC spokesman said the ruling “protects competition in the grocery market, which will prevent prices from rising even more.”

As the WSJ reports, Kroger and Albertsons had both spent hundreds of millions of dollars on lawyers, bankers and other advisers since they announced the deal in October 2022, according to securities filings. If the deal is called off, Kroger has to pay Albertsons a $600 million breakup fee.

Kroger is the biggest traditional U.S. supermarket operator by sales, representing about 9% of the grocery market, while Albertsons is the second-largest supermarket with 5% of American grocery sales. Both companies have been surpassed by megaretailer Walmart, which for decades has been the country’s biggest seller of groceries, and Costco’s grocery sales have nearly caught up to Kroger’s.

The deal with Albertsons would have nearly doubled Kroger’s total store count, exceeding the scale of Walmart’s 3,500 supercenters. Rodney McMullen, Kroger’s longtime chief executive, had pledged to eventually invest $1 billion annually in lowering prices at the acquired Albertsons stores, where he said prices typically run 10% to 12% above a Kroger store.

But FTC attorneys argued the deal would only give Kroger a reason to increase prices by removing a competitor. The FTC said the merger would result in excessive concentration of supermarket ownership in over 1,900 local markets across the country, far more than what the companies acknowledged.

Kroger and Albertsons compete head to head for consumers in many markets, especially on the West Coast and in states such as Colorado and the city of Chicago.

Nelson’s order granting the FTC a preliminary injunction doesn’t immediately kill the deal. The FTC and the parties could continue to litigate a separate case testing the legality of the merger in the agency’s in-house court. A trial before an FTC administrative law judge is scheduled for no sooner than Dec. 18.

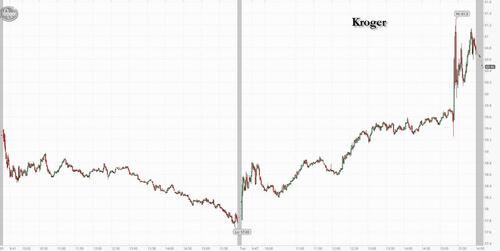

Kroger shares closed 5.1% higher, while Albertsons stock dropped 2.7%.

Tyler Durden

Tue, 12/10/2024 – 16:40

via ZeroHedge News https://ift.tt/YaFUNgp Tyler Durden