First Bond Auction Of 2025 Tails As Foreign Buyers Slide

The first bond auction of 2025 is in the books, and it was about as pretty as the selloff in bonds has been in recent weeks.

Moments ago the Treasury sold $58 billion in 3 year paper in a soggy auction which suggested that, today’s modest bounce notwithstanding, there is more pain in stock for the rates complex.

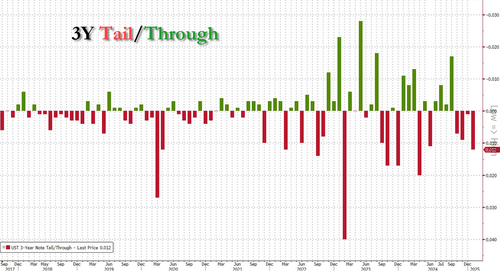

The auction priced at a high yield of 4.332%, tailing the When Issued 4.320% by 1.2bps. This was the fourth consecutive tail and the largest once since April.

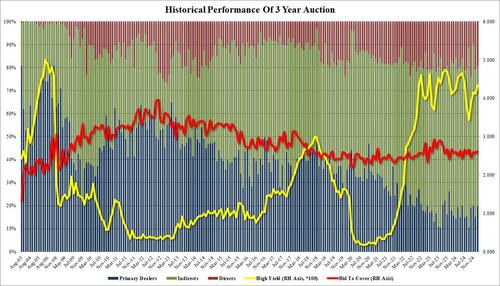

The bid to cover held up, rising to 2.616 from 2.577 in December, and above the six auction average of 2.585.

Internals, however, were nowhere near as solid with Indirects taking down 61.0%, down from 64.2% and the lowest since October (as well as below the recent average of 66.4%). And with Directs taking down 19.4%, down from 20.7% last month, Dealers were left with 19.7%, up from 15.11% and above the six-auction average of 15.8%.

Not surprisingly, the news of the ugly auction did not help already shaky sentiment, and yields on the benchmark 10Y rose 2bps to 4.63%, just shy of session highs at 4.64%, even as the dollar still remains soggy and down on the session after today’s fake news report by the WaPo which hammered the greenback just as the WaPo’s “anonymous sources”, who may or may not have been axed in various USD pairs, intended.

Tyler Durden

Mon, 01/06/2025 – 14:12

via ZeroHedge News https://ift.tt/3W5Y0na Tyler Durden