Tencent Revs Up Stock Buyback Program To Biggest In Decades After Pentagon Blacklist

Tencent, the Chinese social media and gaming giant, accelerated share buybacks in Hong Kong on Tuesday, marking its largest single-session repurchase in two decades. The move comes a day after the Pentagon designated the company as a Chinese military-linked business operating in the US.

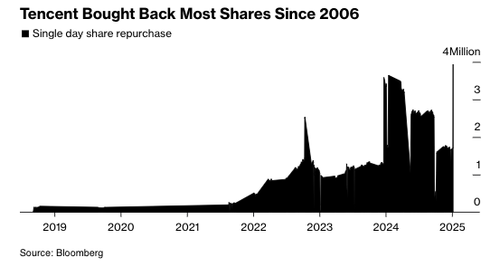

Bloomberg data shows Tencent bought 3.93 million Hong Kong-listed shares on Tuesday, the most since April 2006.

Hong Kong-listed shares of China’s most valuable company are down a little more than 10% since Pentagon blacklisted it and several companies, including Contemporary Amperex Technology Co., chipmaker Changxin Memory Technologies Inc., Quectel Wireless, and drone maker Autel Robotics, on Monday.

The update to the blacklist companies (1260H list) was published via a Federal Register filing on Monday and now features 134 companies.

Section 1260H refers to a provision in the National Defense Authorization Act for Fiscal Year 2021. This section is part of the US Gov’t aimed at addressing China’s economic and military activities in the US.

A Tencent spokesperson explained that the Pentagon made a “mistake” and will “work with the Department of Defense to address any misunderstanding.”

Providing more color into the situation, Wall Street analysts shared their views on the blacklisting:

Citigroup (Alicia Yap)

While we understand the market’s panic reaction, we also believe the inclusion in the list does not necessarily suggest that there is sufficient evidence to confirm the decision was the correct one”

Anticipates that Tencent is working with the Department of Defense to “address any misunderstanding,” adding that a couple of companies have been successfully removed from the list after providing valid explanations

Reiterates buy rating and top-pick status

Global X ETFs (Billy Leung)

“The event was definitely a surprise and should have an impact on the overall market, considering Tencent’s beta”

While the near-term reaction reflects geopolitical sensitivities, Tencent’s fundamentals remain robust, and this could be more of a temporary setback

With Tencent’s revenue predominantly from gaming and social platforms, there’s a good argument this designation could be a misclassification

Jefferies (Edison Lee)

The most serious consequence for Chinese military companies is a US investment ban, but it’s all up to Trump and his team

“Trump could ignore the Defense Department’s designations and do nothing”

Union Bancaire Privee (Vey-Sern Ling)

“From the statement Tencent put out yesterday you can see that the company thinks the US decision is wrong and the share price response is irrational, which probably warrants a higher share repurchase amount.”

“Still, geopolitical risks are heightened and brought to the forefront with this, and some investors will be put off.”

ZeroHedge (Tyler Durden)

- Whether US investors will be forced to divest their Chinese equity holdings in Trump 2.0 is undoubtedly on the minds of many desks.

In addition to the company repurchasing stock, Bloomberg noted that investors in mainland China purchased HK$14 billion of Tencent shares via exchange links with Hong Kong on Tuesday. It was the most purchased stock on that day.

Tyler Durden

Wed, 01/08/2025 – 09:40

via ZeroHedge News https://ift.tt/Pv5sAEU Tyler Durden