One Ring To Rule Us All: A Global Digital Fiat Currency

We’ve written extensively about the “war on cash.”

In a nutshell, governments would love to do away with cash in order to better track and control their citizens. There have been numerous moves closer to a cashless society in recent years, from capping ATM withdrawals to doing away with large-denomination bills. Last year, China launched a digital yuan pilot program and the US has floated moving toward a digital dollar.

We got a first-hand look at what happens when governments restrict access to cash when India plunged into a cash crisis after the country’s government enacted a policy of demonetization in November 2016.

It’s bad enough that various countries are exploring ways to move toward cashlessness, but there’s an even worse scenario – a global digital currency.

Economist Thorsten Polleit compares it to the “master ring” in J.R.R. Tolkien’s classic Lord of the Rings.

The following article was originally published by the Mises Wire.

1.

Human history can be viewed from many angles. One of them is to see it as a struggle for power and domination, as a struggle for freedom and against oppression, as a struggle of good against evil.

That is how Karl Marx (1818–83) saw it, and Ludwig von Mises (1881–1973) judged similarly. Mises wrote:

The history of the West, from the age of the Greek Polis down to the present-day resistance to socialism, is essentially the history of the fight for liberty against the encroachments of the officeholders.

But unlike Marx, Mises recognized that human history does not follow predetermined laws of societal development but ultimately depends on ideas that drive human action.

From Mises’s point of view, human history can be understood as a battle of good ideas against bad ideas.

Ideas are good if the actions they recommend bring results that are beneficial for everyone and lead the actors to their desired goals;

At the same time, good ideas are ethically justifiable, they apply to everyone, anytime and anywhere, and ensure that people who act upon them can survive.

On the other hand, bad ideas lead to actions that do not benefit everyone, that do not cause all actors to achieve their goals and/or are unethical.

Good ideas are, for example, people accepting “mine and yours”; or entering into exchange relationships with one another voluntarily. Bad ideas are coercion, deception, embezzlement, theft.

Evil ideas are very bad ideas, ideas through which whoever puts them into practice is consciously harming others. Evil ideas are, for example, physical attacks, murder, tyranny.

2.

With Lord of the Rings, J. J. R. Tolkien (1892–1973) wrote a literary monument about the epic battle between good and evil. His fantasy novel, published in 1954, was a worldwide success, not least because of the movie trilogy, released from 2001 to 2003.

What is Lord of the Rings about? In the First Age, the deeply evil Sauron—the demon, the hideous horror, the necromancer—had rings of power made by the elven forges.

Three Rings for the Elven-kings under the sky,

Seven for the Dwarf-lords in their halls of stone,

Nine for Mortal Men doomed to die,

One for the Dark Lord on his dark throne

In the Land of Mordor where the Shadows lie.

One Ring to rule them all, One Ring to find them,

One Ring to bring them all, and in the darkness bind them.

In the Land of Mordor where the Shadows lie.

But Sauron secretly forges an additional ring into which he pours all his darkness and cruelty, and this one ring, the master ring, rules all the other rings.

When Sauron puts the master ring on his finger, he can read and control the minds of everyone wearing one of the other rings.

The elves see through the dark plan and hide their three rings. The seven rings of the dwarves also fail to subjugate their bearers. But the nine rings of men proved to be effective: Sauron enslaved nine human kings, who were to serve him.

Then, however, in the Third Age, in the battle before Mount Doom, Isildur, the eldest son of King Elendils, severed Sauron’s ring finger with a sword blow. Sauron is defeated and loses his physical form, but he survives.

Now Isildur has the ring of power, and it takes possession of him. He does not destroy the master ring when he has the opportunity, and it costs him his life. When Isildur is killed, the ring sinks to the bottom of a river and remains there for twenty-five hundred years.

Then the ring is found by Smeagol, who is captivated by its power. The ring remains with its finder for nearly five hundred years, hidden from the world.

Over time, Sauron’s power grows again, and he wants the Ring of Power back. Then the ring is found, and for sixty years, it remains in the hands of the hobbit Bilbo Baggins, a friendly, well-meaning being who does not allow himself to be seduced by the power of the One Ring.

Years later, the wizard Gandalf the Gray learns that Sauron’s rise has begun, and that the Ring of Power is held by Bilbo Baggins.

Gandalf knows that there is only one way to defeat the ring and its evil: it must be destroyed where it was created, in Mordor.

Bilbo Baggins’s nephew, Frodo Baggins, agrees to take the task upon himself. He and his companions—a total of four hobbits, two humans, a dwarf, and an elf—embark on the dangerous journey.

They endure hardship, adversity, and battles against the dark forces, and in the end, they succeed at what seemed impossible: the destruction of the ring of power in the fires of Mount Doom. Good triumphs over evil.

3.

The ring in Tolkien’s Lord of the Rings is not just a piece of forged gold. It embodies Sauron’s evil, corrupting everyone who lays hands or eyes on it, poisons their soul, and makes them willing helpers of evil.

No one can wield the cruel power of the One Ring and use it for good; no human, no dwarf, no elf.

Can an equivalent for Tolkien’s literary portrait of the evil ring be found in the here and now? Yes, I believe so, and in the following, I would like to offer you what I hope is a startling, but in any case, entertaining, interpretation.

Tolkien’s Rings of Power embody evil ideas.

The nineteen rings represent the idea that the ring bearers should have power over others and rule over them.

And the One Ring, to which all other rings are subject, embodies an even darker idea, namely that the bearer of this master ring has power over all other ring bearers and those ruled by them; that he is the sole and absolute ruler of all.

The nineteen rings symbolize the idea of establishing and maintaining a state (as we know it today), namely a state understood as a territorial, coercive monopoly with the ultimate power of decision-making over all conflicts.

However, the One Ring of power stands for the particularly evil idea of creating a state of states, a world government, a world state; and the creation of a single world fiat currency controlled by the states would pave the way toward this outcome.

4.

To explain this, let us begin with the state as we know it today. The state is the idea of the rule of one over the other.

This is how the German economist, sociologist, and doctor Franz Oppenheimer (1864–1946) sees it:

The state … is a social institution, forced by a victorious group of men on a defeated group, with the sole purpose of regulating the dominion of the victorious group over the vanquished and securing itself against revolt from within and attacks from abroad…. This dominion had no other purpose than the economic exploitation of the vanquished by the victors.

Joseph Stalin (1878–1953) defined the state quite similarly:

The state is a machine in the hands of the ruling class to suppress the resistance of its class opponents.

The modern state in the Western world no longer uses coercion and violence as obviously as many of its predecessors.

But it, too, is, of course, built on coercion and violence, asserts itself through them, and most importantly, it divides society into a class of the rulers and a class of the ruled.

How does the state manage to create and maintain such a two-class society of rulers and ruled?

In Tolkien’s Lord of the Rings, nine men, all of them kings, wished to wield power, and so they became bearers of the rings, and because of that, they were inescapably bound to Sauron’s One Ring of power.

This is quite similar to the idea of the state. To seize, maintain, and expand power, the state seduces its followers to do what is necessary, to resort to all sorts of techniques: propaganda, carrot and stick, fear, and even terror.

The state lets the people know that it is good, indispensable, inevitable. Without it, the state whispers, a civilized coexistence of people would not be possible.

Most people succumb to this kind of propaganda, and the state gets carte blanche to effectively infiltrate all economic and societal matters—kindergarten, school, university, transport, media, health, pensions, law, security, money and credit, the environment—and thereby gains power.

The state rewards its followers with jobs, rewarding business contracts, and transfer payments. Those who resist will end up in prison or lose their livelihood or even their lives.

The state spreads fear and terror to make people compliant—as people who are afraid are easy to control, especially if they have been led to believe that the state will protect them against any evil.

Lately, the topics of climate change and coronavirus have been used for fear-mongering, primarily by the state, which is skillfully using them to increase its omnipotence: it destroys the economy and jobs, makes many people financially dependent on it, clamps down on civil and entrepreneurial freedoms.

However, it is of the utmost importance for the state to win the battle of ideas and be the authority to say what are good ideas and what are bad ideas.

Because it is ideas that determine people’s actions.

The task of winning over the general public for the state traditionally falls to the so-called intellectuals—the people whose opinions are widely heard, such as teachers, doctors, university professors, researchers, actors, comedians, musicians, writers, journalists, and others.

The state provides a critical number of them with income, influence, prestige, and status in a variety of ways—which most of them would not have been able to achieve without the state. In gratitude for this, the intellectuals spread the message that the state is good, indispensable, inevitable.

Among the intellectuals, there tend to be quite a few who willingly submit to the rings of power, helping—consciously or unconsciously—to bring their fellow men and women under the spell of the rings or simply to walk over, subjugate, dominate them.

Anyone who thinks that the state (as we know it today) is acceptable, a justifiable solution, as long as it does not exceed certain power limits, is seriously mistaken.

Just as the One Ring of power tries to find its way back to its lord and master, an initially limited state inevitably strives towards its logical endpoint: absolute power.

The state (as we know it today) is pushing for expansion both internally and externally. This is a well-known fact derived from the logic of human action.

George Orwell put it succinctly: “The object of power is power.” Or, as Hans-Hermann Hoppe nails it, “[E]very minimal government has the inherent tendency to become a maximal government.”

Inwardly, the state is expanding through all sorts of interventions in economic and social life, through regulations, ordinances, laws, and taxes.

Outwardly, the economically and militarily strongest state will seek to expand its sphere of influence. In the most primitive form, this happens through aggressive campaigns of conquest and war, in a more sophisticated form, by pursuing political ideological supremacy.

In recent decades the latter has taken the form of democratic socialism. To put it casually, democratic socialism means allowing and doing what the majority wants.

Under democratic socialism, private property is formally upheld, but it is declared that no one is the rightful owner of 100 percent of the income from their property.

People no longer strive for freedom from being ruled but rather to participate in the rule. The result is not people pushing back the state, but rather coming to terms and cooperating with it.

The practical consequence of democratic socialism is interventionism: the state intervenes in the economy and society on a case-by-case basis to gradually make socialist ideals a reality.

All societies of the Western world have embraced democratic socialism, some with more authority than others, and all of them use interventionism. Seen in this light, all Western states are now acting in concert.

What they also have in common is their disdain for competition, because competition sets undesirable limits to the state’s expansive nature.

Therefore, larger states often form a cartel. Smaller, less powerful states are compelled to join—and if they refuse, they will suffer political and economic disadvantages.

But the cartel of states is only an intermediate step. The logical endpoint that democratic socialism is striving for is the creation of a central authority, something like a world government, a world state.

5.

In Tolkien’s Lord of the Rings, the One Ring, the ring of power, embodies this very dark idea: to rule them all, to create a world state.

To get closer to this goal, democracy (as we understand it today) is proving to be an ideal trailblazer, and that’s most likely the reason why it is praised to the skies by socialists.

Sooner or later, a democracy will mutate into an oligarchy, as the German-Italian sociologist Robert Michels pointed out in 1911.

According to Michels, parties emerge in democracies. These parties are organizations that need strict leadership, which is handed to the most power-hungry, ruthless people. They will represent the party elite.

The party elite can break away from the will of the party members and pursue their own goals and agendas. For example, they can form coalitions or cartels with elites of other parties.

As a result, there will be an oligarchization of democracy, in which the elected party elites or the cartel of the party elites will be the kings of the castle. It is not the voters who will call the tune but oligarchic elites that will rule over the voters.

The oligarchization of democracy will not only afflict individual states but will also affect the international relations of democracies.

Oligarchical elites from different countries will join together and strengthen each other, primarily by creating supranational institutions.

Democratic socialism evolves into “political globalism”: the idea that people should not be allowed to shape their own destiny in a system of free markets but that it should be assigned and directed by a global central authority.

The One Ring of power drives those who have already been seduced by the common rings to long for absolute power, to elevate themselves above the rest of humanity. Who comes to mind?

Well, various politicians, high-level bureaucrats, court intellectuals, representatives of big banking, big business, Big Pharma and Big Tech and, of course, big media—together they are often called the “Davos elite” or the “establishment.”

Whether it is about combating financial and economic crises, climate change, or viral diseases—the one ring of power ensures that supranational, state-orchestrated solutions are propagated; that centralization is placed above decentralization; that the state, not the free market, is empowered.

Calls for the “new world order,” the “Great Transformation,” the “Great Reset” are the results of this poisonous mindset inspired by the one ring of power.

National borders are called into question, property is relativized or declared dispensable, and even a merging of people’s physical, digital, and biological identities—transhumanism—is declared the goal of the self-empowered globalist establishment.

But how can political globalism be promoted at a time when there are (still) social democratic nation-states that insist on their independence? And where people are separated by different languages, values, and religions?

How do the political globalists get closer to their badly desired end of world domination, their world state?

6.

Sauron is the undisputed tyrant and dictator in his realm of darkness. He operates something like a command economy, forcing his subjects to clear forests, build military equipment, and breed Orcs.

There are neither markets nor money in Sauron’s sinister kingdom. Sauron takes whatever he wants; he has overcome exchange and money, so to speak.

Today’s state is not quite that powerful, and it finds itself in economies characterized by property, division of labor, and monetary exchange.

The state wants to control money—because this is one of the most effective ways to gain ultimate power.

To this end, the modern state has already acquired the monopoly of money production; and it has replaced gold with its own fiat money.

Over time, fiat money destroys the free market system and thus the free society. Ludwig von Mises saw this as early 1912. He wrote:

It would be a mistake to assume that the modern organization of exchange is bound to continue to exist. It carries within itself the germ of its own destruction; the development of the fiduciary medium must necessarily lead to its breakdown. (6)

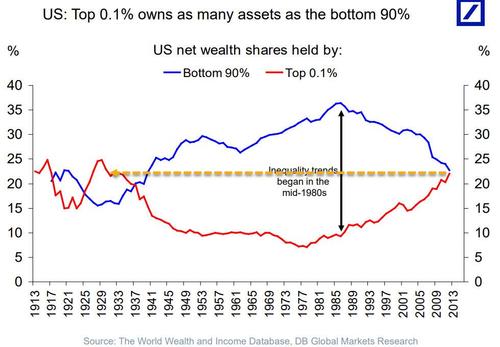

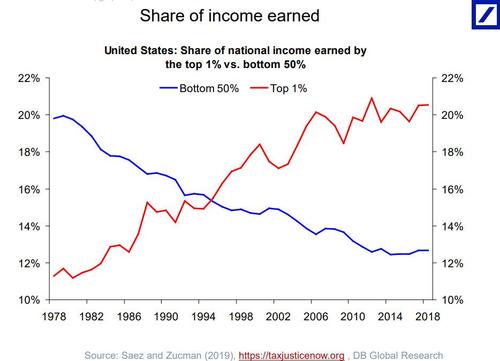

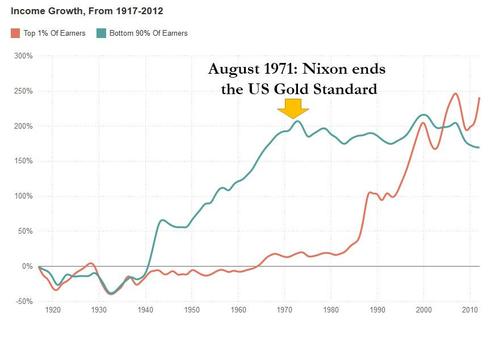

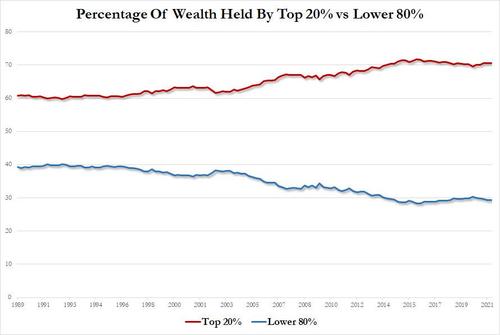

Indeed, fiat money not only causes inflation, economic crises, and an unsocial redistribution of income and wealth. Above all, it is a growth elixir for the state, making it ever larger and more powerful at the expense of the freedom of its citizens and entrepreneurs.

Against this backdrop, it should be quite understandable why the political globalists see creating a single world currency as an important step toward seizing absolute power.

In Europe, what the political globalists want “on a large scale” has already been achieved “on a small scale”: merging many national currencies into one.

In 1999, eleven European nation-states gave up their currencies and merged them into a single currency, the euro, which is produced by a supranational authority, the European Central Bank.

The creation of the euro provides the blueprint by which the world’s major currencies can be converted into a single world currency.

This is what the 1999 Canadian Nobel laureate in economics, Robert Mundell, recommends:

Fixing the exchange rates between the US dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound against each other and also fixing them against a new unit of account, the INTOR. And hocus pocus: here is the world fiat currency, controlled by a cartel of central banks or a world central bank.

7.

Admittedly, creating a single world fiat currency seems to have little chance of being realized at first glance. But maybe at second glance.

First of all, there is a good economic reason for having a single world currency: if all people do business with the same money, the productive power of money is optimized. From an economic standpoint, the optimal number of monies in the world is one.

What is more, nation-states have the monopoly of money within their respective territory, and since they all adhere to democratic socialism, they also have an interest in ensuring that there is no currency competition—not even between different state fiat currencies. This makes them susceptible to the idea of reducing the pluralism of currencies.

Furthermore, one should not misinterpret the so-called rivalry between the big states such as the US and China and between China and Europe, which is being discussed in the mainstream media on a regular basis.

No doubt that there is a rivalry between the national rulers: they do not want to give up the power they have gained in their respective countries; they want to become even more powerful.

But the rivalry between the oligarchic democracies of the West has already weakened significantly, and there are great incentives for the oligarchic party elites to work together across borders.

In fact, it is the oligarchization of democracy in the Western world that allowed for the rapprochement with a socialist-communist regime: the state increasingly taking control of the economic and societal system.

This development could be called “the Chinacization of the West.”

The way the Western world has dealt with the coronavirus—the suspension, perhaps the termination of constitutional rights and freedoms—undoubtedly shows where the journey is headed: to the authoritarian state that is beyond the control of the people—as is the case in Communist China. The proper slogan for this might be “One System, Many Countries.”

Is it too farfetched to assume that the Western world will make common cause with Communist China not only on health issues but also on the world currency issue? The democratic socialists in the West and the Chinese Communist Party have a great deal of common ground and common interest, I would think.

It is certainly no coincidence that China has pushed hard for the Chinese renminbi to be included in the International Monetary Fund’s special drawing rights, and that the IMF already agreed in November 2015.

8.

The issue of digital central bank money, something the world’s major central banks are working on, could be a catalyst in the creation of a single world currency.

The issue of digital central bank money not only heralds the end of cash—the anonymous payment option for citizens and entrepreneurs.

Once people start using digital central bank money, it will be easy for the central bank and the state to spy on people’s transactions.

The state will not only know who pays what, when, where, and what for. It will also be in a position to determine who gets access to the deposits: who gets them and who doesn’t.

China is blazing the trail with its “social credit system”: behavior conforming to the Communist regime is rewarded, behavior that does not is punished.

Against this backdrop, digital central bank money would be particularly effective at stifling unwanted political opposition.

Digital central bank money will not only replace cash, but it will also increasingly compete with money from commercial banks.

Why should you keep your money with banks that are exposed to the risk of default when you can keep it safe with the central bank that never goes bankrupt?

Once commercial bank deposits can be exchanged one to one for digital central bank money—and this is to be expected—the credit and monetary system is de facto fully nationalized.

Because under these conditions, the central bank transfers its unlimited solvency to the commercial banking sector.

This completely deprives the financial markets of their function of determining the cost of capital—and the state-planned economy becomes a reality.

In fact, this is the type of command and control economy that emerged in National Socialist Germany in the 1930s. The state formally retained ownership of the means of production.

But with commands, prohibitions, laws, taxes, and control, the state determines who is allowed to produce what, when, and under what conditions, and who is allowed to consume what, when, and how much.

In such a command and control economy, it is quite conceivable that the form of money production will change—away from money creation through lending toward the issue of helicopter money.

The central bank determines who gets how much new money and when. The amount of money in people’s bank accounts no longer reflects their economic success. From now on, it is the result of arbitrary political decisions by the central banks, i.e., the rulers.

The prospect of being supplied with new money by the state and its central bank—that is, receiving an unconditional basic income—will presumably drive hosts of people into the arms of the state and bring any resistance to its machinations to a shrieking halt.

9.

Will the people, the general public, really subscribe to all of this?

Well, government-sponsored economists, in particular, will do their very best to inform us about the benefits of having a globally coordinated monetary policy; that stabilizing the exchange rates between national currencies is beneficial; that if a supranational controlled currency—with the name INTOR or GLOBAL—is created, we will achieve the best of all worlds. And as the issuance of digital central bank money has shut down the last remnants of a free capital market, the merging of different national currencies into one will be relatively easy.

The single world currency creature that the political globalists want to create will be a fiat money, certainly not a commodity money.

Such a single world fiat currency will not only suffer from all the economic and ethical defects which weigh on national fiat currencies.

It will also exacerbate and exponentiate the damages a national fiat currency causes. The door to a high inflation policy would be pushed wide open—as nobody could escape the inflationary single world fiat currency.

The states are the main beneficiaries: they can get money from the world central bank at any time, provided they adhere to the rules set out by the world central bank and the special interest groups that govern it.

This creates the incentive for national states to relinquish sovereignty rights and to submit to supranational rules—for example, in taxation and financial market regulation.

It is therefore the incentive resulting from a single world currency that paves the way toward a world government and a world state.

In this context, please note what happened in the euro area: the starting point was not the creation of the EU superstate, which was to be followed by the introduction of the euro. It was exactly the opposite: the euro was introduced to overcome national sovereignty and ultimately establish the United Nations of Europe.

One has good reason to fear that the idea of issuing a world fiat currency—which the master ring relentlessly pushes for—would bring totalitarianism—that would most likely dwarf the regimes established by Joseph Stalin, Adolf Hitler, Mao Zedong, Pol Pot, and other criminals.

10.

In Tolkien’s Lord of the Rings, evil is eventually defeated. The story has a happy ending. Will it be that easy in our world?

The ideas of having a state (as we know it today), of tolerating it, of cooperating with it, of giving the state total control over our money, of accepting fiat money, are deeply rooted in people’s minds as good ideas.

Where are the forces supposed to come from that will enlighten people about the evil that the state (as we know it today) brings to humanity?

Particularly when in kindergartens, schools, and universities—which are all in the hands of the state—the teachings of collectivism-socialism-Marxism are systematically drummed into people’s (especially impressionable children’s) heads, when the teachings of freedom, free market and free society, and capitalism are hardly or not at all imparted to the younger generation?

Who will explain to people the uncomfortable truth that even a minimal state will become a maximal state? That states’ monopolies over money will lead to a single world currency and thus world tyranny?

It does not take much to become bleak when it comes to the future of the free economic and social order.

However, it would be rather shortsighted to get pessimistic.

Those who believe in Jesus Christ can trust that God will not fail them. If we cannot think of a solution to the problems at hand, the believers can trust God. Because “[e]ven in the darkest night, there is a bright light shining somewhere.”

Or: please remember the Enlightenment movement in the eighteenth century. At that time, the Prussian philosopher Immanuel Kant explained the “unheard of” to the people, namely that there is such a thing as “autonomy of reason.”

It means that you and I have the indisputable right to lead our lives independently; that we should handle it according to self-imposed rules, rules that we determine ourselves based on good reason.

People back then understood Kant’s message. Why should such an intellectual revolution—triggered by the writings and words of a free thinker—not be able to repeat itself in the future?

Or: the fact that people have not yet learned from bad experience does not mean that they won’t eventually learn from it.

When it comes to thinking about changes for the better, it is important to note that it is not the mass of people that matters, but the individual.

Applied to the conditions in today’s world, among those thinkers who can defeat evil and help the good make a breakthrough are Ludwig von Mises, Murray Rothbard, and Hans-Hermann Hoppe—and all those following their teachings and fearlessly disseminating them—as scholars or as fans.

They are—in terms of Tolkien’s Lord of the Rings—the companions. They give us the intellectual firepower and the courage to fight and defeat evil.

I don’t know if Ludwig von Mises knew Tolkien’s Lord of the Rings. But he was certainly well aware of the struggle between good and evil that continues throughout human history.

In fact, the knowledge of this struggle shaped Mises’s maxim of life, which he took from the verse of the Roman poet Virgil (70 to 19 BC):

“Tu ne cede malis, sed contra audentior ito,” which means “Do not give in to evil but proceed ever more boldly against it.”

I want to close my interpretation with a quote from Samwise Gamgee, the loyal friend and companion of Frodo Baggins.

In a really hopeless situation, Sam says to Frodo: “There is something good in this world, Mr. Frodo. And it’s worth fighting for.”

So if we want to fight for the good in this world, we know what we have to do: we have to fight for property and freedom and against the darkness that the state (as we know it today) wishes to bring upon us, especially with its fiat money.

In fact, we must fight steadfastly for a society of property and freedom!

Tyler Durden

Sat, 10/09/2021 – 22:00

via ZeroHedge News https://ift.tt/2YCwJni Tyler Durden