It should come as no surprise to most that the United States’ over 18-year long war in Afghanistan is a continual nightmare wrought with endless difficulties, earning America’s lengthy post 9/11 quagmire the moniker of “the forever war”.

But a new Pentagon inspector general report has confirmed the situation to be even worse than commonly perceived: the war to roll back the Taliban is not merely stalled, but there’s indicators suggesting jihadist insurgents are actually winning. The report finds Afghan national forces backed by the US have seen a 31% surge in casualties in recent months.

The Pentagon watchdog concluded the following, according to Bloomberg:

Casualties among Afghan National Defense and Security Forces rose 31 percent from December 2018 to February 2019 over the same period a year earlier, while troop levels fell short again of authorized strength for the first quarter of this year.

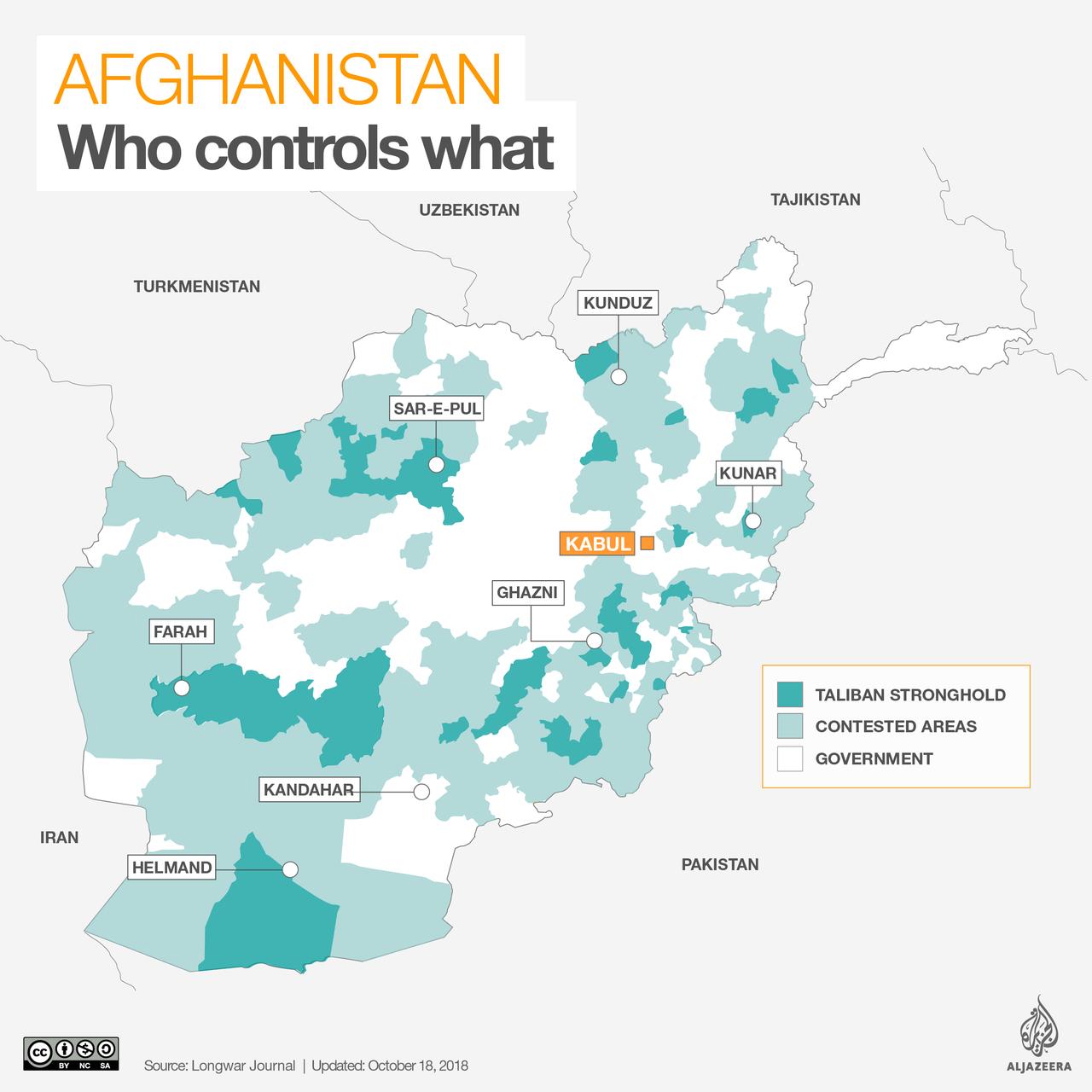

Further alarming is that after the US-led NATO and western coalition forces have spent nearly two decades attempting to stabilize the country under the government in Kabul, massive swathes of the country are still under Taliban rule, with about 35% of the nation’s population still not under the Afghan national government.

The assessment by the Special Inspector General for Afghanistan Reconstruction found further that from November 2016 through October 2018, “the Afghan government controlled or influenced between 64 percent and 66 percent of the population.”

The dour data points from the assessment come just as the Trump administration is engaged in uneasy negotiations with the Taliban, through special envoy on Afghan reconciliation, Zalmay Khalilzad, hosted in Qatar. Crucially, the report highlights that the US-supported side is not entering talks from a position of strength, but instead Afghan national forces are taking “more casualties as they seek greater leverage at the negotiating table.”

“If negotiators fail to secure a peace agreement, the ANDSF will be hard pressed to increase its control over Afghanistan’s population, districts, and territory,” the inspector general said, referring to the the Afghan National Security Forces.

All of this makes the prospect of Trump’s desired relatively quick US exit from the conflict highly unrealistic, especially in terms of getting his generals on board and the political expediency of the move.

Map of Taliban vs. national government control in Afghanistan as of Fall 2018.

Things have been so bad for US strategy there that the Pentagon has simply stopped tracking the amount of territory controlled by the Taliban. Inspector General for Afghanistan Reconstruction John F. Sopko put it as follows: “It’s like turning off the scoreboard at a football game and saying scoring a touchdown or field goal isn’t important.”

Secretary of State Michael Pompeo addressed the Afghanistan issue on on Monday, saying, “We are working to achieve a reconciliation so that this conflict, now coming on two decades, can be resolved.” He seemed to indirectly reference an increasingly negative Pentagon outlook concerning the war: “We can take down the violence level, we can get a political outcome,” he said, and added the near-term goal is to stabilize the country enough to prevent “an attack on the homeland from Afghanistan.”

Currently US military analysts put the total number of Taliban fighters at about 60,000 – which even after successful deconfliction negotiations would have to be reintegrated into Afghan society for the long-term.

via ZeroHedge News http://bit.ly/2V8Aiip Tyler Durden