Like the other lagging European investment banks (Deutsche and SocGen immediately spring to mind), UBS is resorting to the last resort of the embattled megabank CEO when shareholders are demanding higher profits ‘or else’.

After a decade where UBS cut thousands of jobs in its investment bank unit, Sergio Ermotti is turning to one of the few business lines where fat can feasibly be cut: UBS’s once legendary asset-management business.

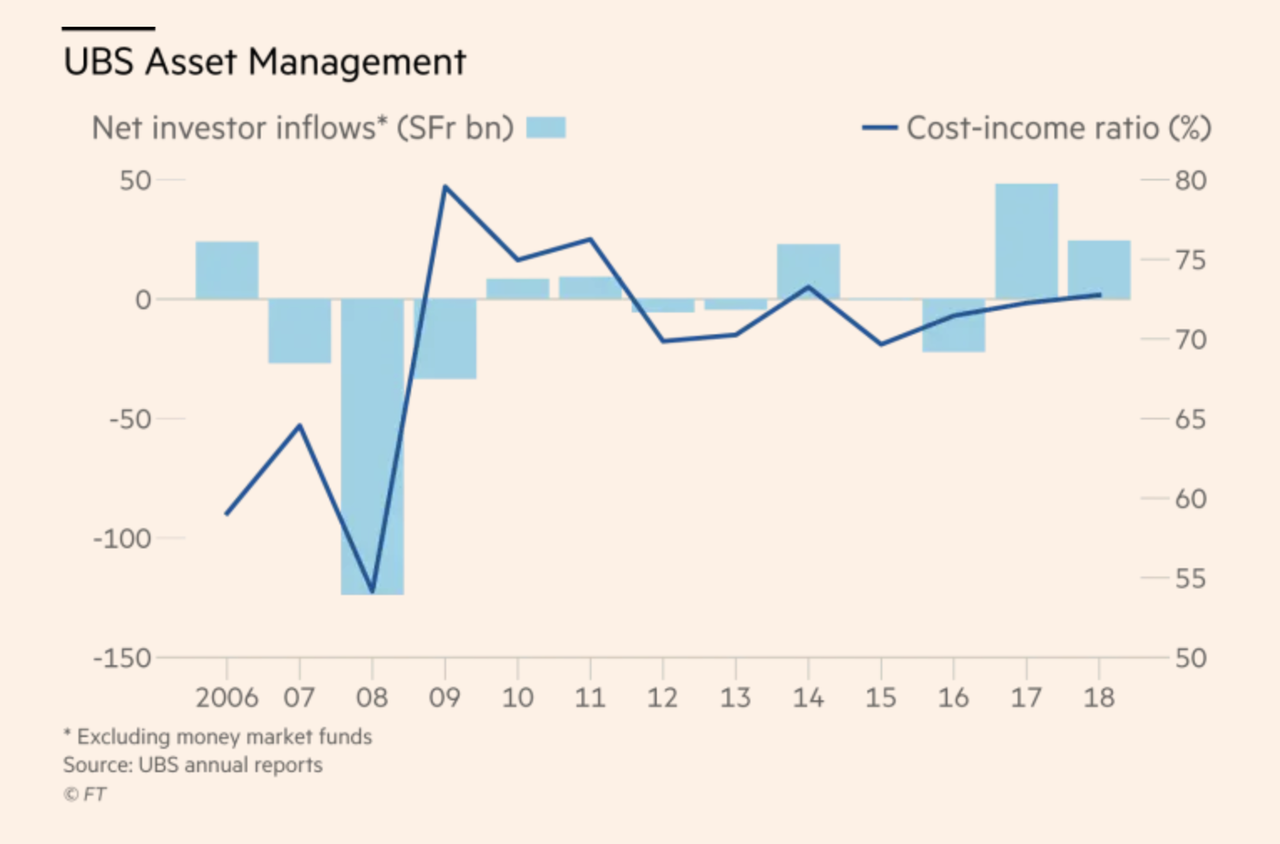

Before the crisis, the Swiss bank held the title of world’s largest asset manager. But it has seen its stature diminish during the intervening years, largely thanks to rise of passive managers like BlackRock (the current title-holder). Though the number of employees at UBS’s asset-management business have declined by one-third since 2006, the cost-to-income ratio has remained stuck at 72.7%, acccording to the FT.

According to Bloomberg, most of these cuts will focus on the unit’s back office, where managers are being told that for ever five employees who leave, they can only hire one to replace them. That’s now an informal rule at the bank, according to BBG’s sources.

For the client-facing employees, the rule is less strict: Managers can hire one employee for every two who leave.

UBS Group AG is telling executives in its large wealth management business to be more selective when hiring bankers as it seeks to cut costs following a challenging first quarter, according to people familiar with the matter.

The bank has introduced an informal rule to allow hiring of one back-office employee only if five are leaving, the people said, asking not to be identified because the matter is private. For client-facing staff, the rule is less strict: Managers can hire one banker for two departing ones, the people said.

Like other banks (for example, State Street), we imagine UBS will try and compensate for the back-office cuts by using automation to streamline workflow.

The bank said earlier this year that it would slow hiring and cut costs as Ermotti warned that this year saw one of the worst first quarter environments in history. When the bank reported earnings, its investment banking revenue took a hit from weak trading revenues, while its asset-management business outperformed thanks to a surprisingly strong pickup in its client business.

However, this hasn’t stopped Ermotti from seeking a tie-up with DWS, the Deutsche Bank-controlled asset manager, which would create, as the FT described it, a new “European champion” better equipped to compete with BlackRock and Vanguard.

via ZeroHedge News http://bit.ly/2GT2RHQ Tyler Durden