If somehow the scramble to open stores earlier and earlier on Thanksgiving day, until such time as the very Thanksgiving dinner had to be interrupted early for the annual rush out to the (un)friendly neighborhood Thug-Mart (Toys’R’Us opened at a ridiculous 5pm on Thanksgiving day) and punching people in the face just to get that 42 inch, 2010-model Plasma TV for $99, was supposed to boost overall sales instead of merely pulling them forward (see cash for clunkers), it didn’t work. According to ShopperTrak, total Black Friday traffic plunged 11% and total sales fell 13.2%, the second consecutive year of declines following last year’s 1.8%. The reason, as largely expected, is that a substantial portion of Friday shopping was pulled back to Thursday: as ShopperTrak founder Bill Martin said, “if retailers continue to promote Thanksgiving as the start of the holiday buying season, he thinks the holiday will eventually surpass Black Friday in sales. “We’re just taking Black Friday sales and spreading them across a larger number of days,” Martin said.”

Combining Thursday and Friday retail sales represented a 2.8% increase in traffic and a 2.3% increase in actual sales compared to the same period last year, which however took place against the backdrop of the most aggressively promotional environment ever, leading to even greater drops in retailer margins.

The bigger problem for retailers, and the economy, is that the National Retail Foundation expects sales to be up 3.9% to $602 billion for the season, which encompasses the last two months of the year. That’s higher than last year’s 3.5% growth, but below the % pace seen before the recession. Unfortunately, starting off the holiday shopping season at a selling pace that is 40% below the run-rated growth projection is hardly encouraging for the hoped for increase in sales, as well as US GDP, not to mention the disposable income state of the US consumer.

Sure enough, since reality once again intruded on economist “models” it was time to blame the weather. From the WSJ:

The ShopperTrak report showed strong traffic in the Western and Southern U.S. while visits in the Northeast slipped as a cold snap may have deterred some customers. Apparel and accessories stores saw more visits on both days, while gadget sellers suffered weaker traffic throughout the period, the firm said.

About 140 million people are expected to shop over this holiday weekend, a decline from the 147 million who planned to do so last year, according to the National Retail Federation. The trade group said that nearly a quarter of the people it surveyed planned to shop on Thanksgiving Day.

There is hope the weak start to the retail season will be salvaged by online sales, which have been progressively climbing as a percentage of total, accounting for 40% of the $59 billion in sales racked up over the four-day Black Friday weekend last year, up from 23% in 2006, according to the National Retail Federation. Store traffic this year has been sluggish amid slow growth in consumer spending. That transition is expected to persist according to the WSJ:

During the first 17 days of November this year, store traffic declined 4.8% from the same period the year before, according to Retail Next, which analyzes more than nine million shopping trips nationwide within 450 stores.

Meanwhile, online shopping is set to rise, with 51% of shoppers surveyed by Nielsen planning to buy something over the Internet on Friday, up from 38% last year. That compared with 48% of consumers who said they planned to visit a big-box store like Target or Wal-Mart.

Curiously, some shoppers were turned off by the Goliath in the online selling space, Amazon.

Andrea Bailey is one of those online shoppers, but she wasn’t on Amazon. Around 2 a.m. Thursday morning, she was sitting at a laptop in her living room in Lexington, Ky., refreshing Best Buy’s website. When she finally got through, she bought a $99 Kindle Fire, made by Amazon, for her 8-year-old son.

After a couple of hours of sleep, Ms. Bailey continued her shopping spree, buying sweaters and Christmas pajamas for her 5-year-old daughter and dress shirts for her husband from Macys.com, some Disney Infinity characters for her son from Toysrus.com and a new printer from the Sam’s Club website.

Altogether, Ms. Bailey spent nearly $400 before noon. She finds it easier to browse websites run by brick-and-mortar stores than to deal with Amazon’s overwhelming number of options, she said: “If I go on Amazon and look at videogames, holy moly, my brain hurts.”

Such big retailers as Wal-Mart and Target continue to struggle to keep up with Amazon on the Web. Despite years of effort, online sales still typically account for only around 2% of sales for the two chains.

And while online sales are a far easier way of getting shopper “feet in the door”, the margin erosion to vendors once the competition is unleashed, is far greater than even from brick and mortar venues which have at least some discipline in preserving margins.

To be sure, the full impact of the early start to selling season will not be known for a few more days, as Cyber Monday’s impact is becoming increasingly greater and will have to be taken into consideration to determine just how strong, or weak, the US consumer is.

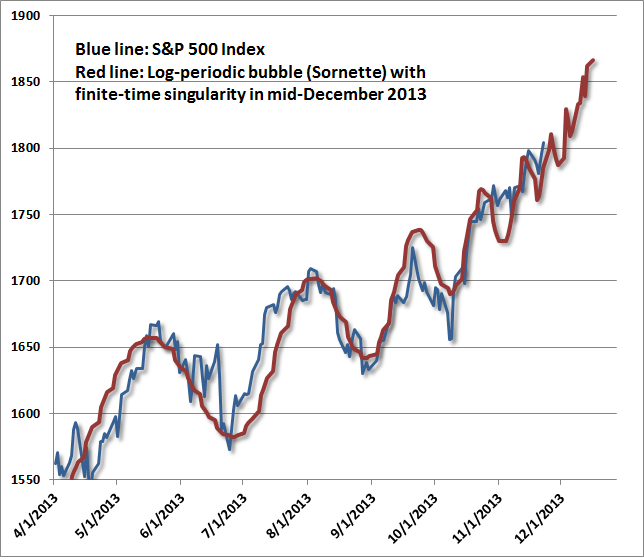

Finally, speaking of US consumers, recall that “strong” Thanksgiving sales were trumpeted every year between 2009 and 2012 only for the final holiday sales tally to disappoint without fail every single year. It remains to be seen if this time will finally be the opposite, as Bernanke’s “wealth effect” finally trickles down to the 99%. Or not.

![]()

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/aEZPV7i67Gk/story01.htm Tyler Durden