The following Top Ten Market Themes, represent the broad list of macro themes from Goldman Sachs' economic outlook that they think will dominate markets in 2014.

- Showtime for the US/DM Recovery

- Forward guidance harder in an above-trend world

- Earn the DM equity risk premium, hedge the risk

- Good carry, bad carry

- The race to the exit kicks off

- Decision time for the ‘high-flyers’

- Still not your older brother’s EM…

- …but EM differentiation to continue

- Commodity downside risks grow

- Stable China may be good enough

They summarize their positive growth expectations: if and when the period of stability will give way to bigger directional moves largely depends on how re-accelerating growth forces the hands of central banks to move ahead of everybody else. And, in practice, that boils down to the question of whether the Fed will be able to prevent the short end from selling off; i.e. it's all about the Fed.

Top Ten Market Thesme For 2014

1. Showtime for the US/DM Recovery

- US growth to accelerate to 3%+

- Lower growth, but equivalent acceleration in Europe

- Fiscal drag eases outside Japan

- DM acceleration the main positive impulse

- Large output gap still in DM, keeping inflation at bay

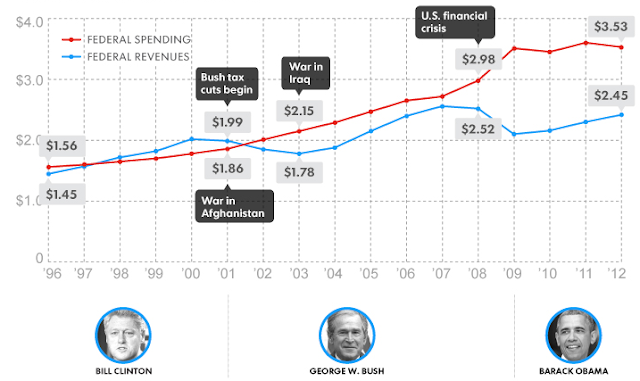

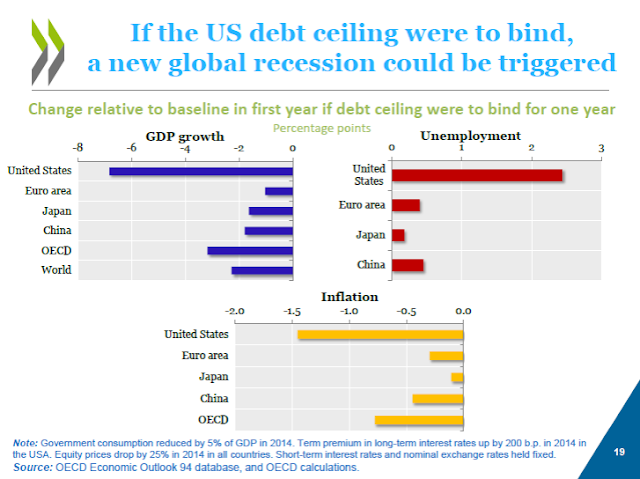

Market issues: Our 2013 outlook was dominated by the notion that underlying private sector healing in the US was being masked by significant fiscal drag. As we move into 2014 and that drag eases, we expect the long-awaited shift towards above-trend growth in the US finally to occur, spurred by an acceleration in private consumption and business investment. While the US (and the UK) represents the cleanest version of that story, we forecast a similar acceleration in GDP growth from lower levels in the Euro area. Although growth is likely to remain unbalanced across the Euro area, some fiscal relief and supportive financial conditions should push GDP growth to just above 1% for the year. Japan is the exception to this rule, where increased fiscal drag from the consumption tax hike in the spring is likely to offset other forces for acceleration, leaving growth stable. Nevertheless, our forecast of an improving domestic impulse is to a reasonable degree a DM-wide story. This improving DM impulse should also help EM growth. But with less slack, more inflation and ongoing imbalances, there is less scope for acceleration and the improvement in growth is more externally driven.

An improving global (and US) growth picture is widely forecast but, in our view, also still doubted in the investor community because of the stop-start nature of the recovery hitherto and the possibility of a renewed US fiscal logjam in early 2014. We therefore still see room for markets to price a better cyclical story or, perhaps more accurately, increased confidence that cyclical risk is diminishing. On balance, that should make 2014 another year in which equities and bond yields move higher together. On our forecasts, despite the outperformance of DM assets, our confidence is highest in the US and DM cyclical picture and we still favour assets exposed to that theme. While the growth picture is set to improve – and the ‘volatility’ of growth views may fall – the absolute growth trajectory is only clearly above trend in the US and still perhaps a shade below trend globally. So it is still an open question whether this kind of picture is enough to fuel real outperformance of global cyclical equities – although our bias is clearly to lean in that direction.

2. Forward guidance harder in an above-trend world

- G4 policy rates still at zero through 2014 as Fed firms up guidance

- Low and anchored inflation and expectations in the G4 as output gaps linger

- Above-trend growth will fuel bouts of doubt about easy policy

- Only a gradual normalisation of real rates

Market issues: Despite the improvement in growth, we expect G4 central banks to continue to signal that rates are set to remain on hold near the zero bound for a prolonged period, faced with low inflation and high unemployment. In the US, our forecast is still for no hikes until 2016 and we expect the commitment to low rates to be reinforced in the next few months. Against that, we expect a gradual tapering in bond purchases to begin, most likely in March. But the broad message from a Fed led by Janet Yellen is likely to be reassurance that financial conditions will remain easy and we expect a common desire among G4 central banks to lean against the kind of rapid tightening in financial conditions that we saw a few months ago. Our new 2017 forecasts reinforce the notion that when US tightening begins it may proceed more rapidly than the market is pricing. This is also consistent with recent Fed research into the optimal path for the Fed funds rate.

The combination of still-easy policy and improving growth should, on balance, be a friendly one for equities and other risky assets, while preventing sharp increases in longterm yields. But, as growth improves, the market is likely to experience bouts of doubt about the firmness of the commitment to forward guidance. The experience of the Bank of England in trying to keep expectations of rate hikes in 2015 at bay is a reminder of the fact that, confronted with above-trend growth, markets will reassess the odds of the macro thresholds being reached, and reprice the path for rate policy accordingly.

We therefore expect to see periods of pressure on rates markets, followed by reassurance from policymakers. As a result, the dance between improving growth and rising rates is likely to remain a key axis in 2014. This is particularly true during periods in which a dovish view is well reflected and the front-end risk premium is low (US 1y1y OIS is back at 27bp). It is the ‘belly’ of the curve – the point at which tightening is likely to occur – that looks most vulnerable to this kind of volatility. Without a shift in front-end rate views, it may be hard to push long-term yields rapidly higher. But even with anchored policy rates, the improving growth profile is likely to put moderate but steady upward pressure on longerdated US and European yields at a pace that is somewhat faster than the forwards. So, while we would look for assets with exposure to the growth recovery, our bias is to avoid areas with significant vulnerability to higher rates.

3. Earn the DM equity risk premium, hedge the risk

- Lower risk premia across assets than last year

- DM equity risk premium narrower but still historically high

- Multiple expansion possible from above-average levels if real rates stay low

- But earnings growth may need to pick up some of the burden

- Rising bond yields would close the equity-bond gap from the other side

Market issues: Over the past few years, we have seen very large risk premium compression across a wide range of areas. While not at 2007 levels, credit spreads have narrowed to below long-term averages and asset market volatility has fallen. Even in a friendly growth and policy environment such as the one we anticipate, this is likely to make for lower return prospects (although more appealing in a volatility-adjusted sense). In equities, in particular, the key question we confront is whether a rally can continue given above-average multiples. We think it can. In part, this is because moderate earnings growth should continue as top-lin

e growth does more of the running relative to margins. But the equity risk premium remains historically high. Put simply, if real 10-year US yields remain at or under 1% for the next couple of years, as the forwards are pricing, and if our forecast of above-trend growth is also correct, we think it would be hard to justify an unusually large spread for earnings yields to real bond yields. Multiples could then legitimately be higher – and higher-than-average – but in a context where the real risk-free rate was unusually low.

This broad story is also likely to play out in European equity markets, where arguably there is a greater risk premium embedded relative to the US, and the scope for margin expansion is also greater. While we worry about the lack of a resolution to the deeper institutional and debt sustainability issues, we doubt these will come more sharply into focus in an environment of improving growth. Given low inflation and a policy easing bias, this could help European equities – including banks – more than the currency.

The key risk to that story – beyond the failure of the growth recovery to materialise – is that real bond yields do not stay low and that the equity risk premium closes through pressure on bond markets. Our own forecasts see the risk premium closing from both sides. So we continue to like strategies that involve earning the DM equity risk premium through long equity positions, while trying to protect against the risk that US yields increase more rapidly than we or the markets expect, or that the market worries again about Fed exit. While short bond positions are the most direct form of that exposure (including towards the front end), we have highlighted the advantage of finding assets that are likely to reward investors even without a sharp move in rates, but that may move more rapidly with such a move. Long USD positions against gold, and some EM and commodity currencies fall into that camp.

4. Good carry, bad carry

- Higher growth, anchored inflation supportive of low volatility on average

- Risk premium more obvious lower down the capital structure

- But spikes in rate volatility are the primary risk to carry strategies

- Variations in carry not perfectly aligned with fundamental risk

Market issues: Our 2014 forecast of improving but still slightly below-trend global growth and anchored inflation describes an environment in which overall volatility may justifiably be lower. Markets have already moved a long way in this direction, but equity volatility has certainly been lower in prior cycles and forward pricing of volatility is still firmly higher than spot levels. In an environment of subdued macro volatility, the desire to earn carry is likely to remain strong, particularly if it remains hard to envisage significant upside to the growth picture. As always, the primary challenge is to identify places where the reward clearly exceeds these – and other – risks. Given how far spreads have compressed, that may require moving down the capital structure and more deeply into illiquid areas than before. Parts of high yield (HY) credit and subordinated debt for banks offer some of that profile.

We warned last year that termites were eating at the ‘search for yield’, particularly given the risk that longer-dated real risk-free rates could move higher. Even more than with long equity positions, this remains the primary risk to many carry strategies. But after a substantial shift already, the vulnerability to shocks here may ironically be lower than a year ago. We have made that argument in FX, where carry has more clearly increased in places and the underperformance of high-carry areas has increased. And we have shown in the EM context that some countries that offer similar carry in FX (or roll-down in rates) have very different fundamental risks.

We remain wary of owning assets for carry purposes where we do not think the underlying asset also has scope to appreciate (or a low risk of depreciation). But there may be scope to fund ‘good carry’ out of ‘bad carry’ areas within asset classes: high-yield credits versus investment grade (IG), and the more vulnerable EM credits and currencies against other comparable carry equivalents (more on this below).

5. The race to the exit kicks off

- 2014 should see some DM and EM countries begin tightening

- Market may begin to move away from pricing a ‘synchronised’ exit

- Separation may become a driver of relative currency moves

- Non-G4, EM likely to lead

Market issues: 2013 has already seen some EM central banks move to policy tightening. As the US growth picture improves – and the pressure on global rates builds – the focus on who may tighten monetary policy is likely to increase. As we described recently (Global Economics Weekly 13/33), the market is pricing a relatively synchronised exit among the major developed markets, even though their recovery profiles look different. Given that the timing of the first hike has commonly been judged to be some way off, this lack of differentiation is not particularly unusual. But the separation of those who are likely to move early and those who may move later is likely to begin in earnest in 2014.

We currently expect New Zealand, Norway and Sweden to hike first within the G10 in the second half of 2014. We still expect Australia to go against the grain with one more cut in early 2014. Within the G4, we see conditions for exit in the UK arriving earlier (but still in late 2015) than the others, and we expect more easing from the Bank of Japan – most likely in April. There is also the prospect of a further shift towards easing in the Euro area through LTROs and perhaps a deposit rate cut, especially if deflationary forces are stronger than forecast. These patterns are partly reflected by the market, but market pricing of the change in policy rates between now and the end of 2016 in the US, UK, Euro area, Sweden, Canada and Australia is still quite tightly clustered.

In general, our G4 forecasts are more dovish than the market, while our non-G4 views are not. We also expect Israel, Korea, Malaysia, Thailand and the Philippines within the EM universe to begin a tightening cycle in the second half of 2014. Our views on Israel and Korea in particular are more hawkish than the forwards in the next year or two. The growing separation of monetary policy profiles will likely be an increasingly important driver of relative currency moves. For instance, the logical upshot of our view of fresh easing by the BoJ (including purchases of equity ETFs) versus Fed tapering is support for another leg of $/Yen downside and Nikkei (and Topix) upside. A more positive view of the NZD versus the AUD is likely to be reinforced, and we may even see some of the weakness in the NOK and SEK from this year begin to reverse.

6. Decision time for the ‘high-flyers’

- Stronger US, global recovery may highlight domestic imbalances elsewhere

- Smaller economies with housing/credit booms may face them more actively

- Fear of FX strength a constraint, but one that may be softening

Market issues: A number of smaller open economies have imported easy monetary policy from the US and Europe in recent years, in part to offset currency strength and in part to compensate for a weaker external environment. In a number of these places (Norway, Switzerland, Israel, Canada and, to a lesser extent, New Zealand and Sweden), house prices have appreciated and/or credit growth has pick

ed up. Central banks have generally tolerated those signs of emerging pressure given the external growth risks and the desire to avoid currency strength through a tighter policy stance. As the developed market growth picture improves, some of these ‘high flyers’ may reassess the balance of risks on this front.

Macro-prudential tightening has been the instrument of choice so far, but these dynamics could lead to a faster switch towards earlier interest rate tightening than in other places, consistent with the previous theme. The currency has played an important role in the assessments of central banks in most of these places. For several of them, the ideal combination would be for rates to be higher and currencies weaker. Israel and Canada arguably fall into this camp, as perhaps do Switzerland and New Zealand. The question in these economies is whether improving growth in the US and Europe is sufficient to alleviate the upward pressure on their currencies, thereby increasing the room for domestic policy rate hikes. For Sweden and Norway, the need for currency weakness is less clear, so the issue may be a more straightforward one of whether a tighter policy stance overall is needed. Of course, paying rates in some of these areas where our views are hawkish is complicated by negative carry and the downward drag of the G4 zero-rate environment. Short positions relative to receiving in places where we have a dovish view are one way to offset the carry cost, although this introduces other risks.

7. Still not your older brother’s EM…

- Despite asset shifts, further need to address imbalances in several countries

- Bouts of pressure on EM FX and rates likely

- China and rate risks are better known, so pressure may be less acute

- But EM unlikely to gain as much from global growth/low rates as they used to

Market issues: 2013 has proved to be a tough year for EM assets. 2014 is unlikely to see the same level of broad-based pressure. The combination of a sharp downgrade to expectations of China growth and risk alongside the worries about a hawkish Fed during the summer ‘taper tantrum’ are unlikely to be repeated with the same level of intensity. Moreover, after the initial shock and deleveraging and a significant repricing of assets, the fundamental vulnerabilities are lower. We still do not believe, however, that the adjustments in many places are complete.

EM FX is the asset class where we are most cautious, and the bouts of pressure in US rate markets are likely to be reflected here most directly. Although forward FX carry is now generally higher – and hence shorts are more costly – in several countries, we think it does not offer enough protection relative to the fundamental depreciation risks. And the need for depreciation comes not just from US rate adjustment but from the need to improve current account deficits.

Long-term yields in EM should continue to head north as curves steepen in the DM world. EM front ends are also likely to be at risk given the sensitivity to FX depreciation and US long rates in EM central bank reaction functions. But markets are pricing more tightening than we think central banks will deliver in many places – such as Turkey, South Africa and Brazil – and there may be periods in the year when the risk-reward for receiving rates in specific places improves. There may also be scope to combine receivers with long USD positions against EM currencies to offset some of the risks.

EM equities are better placed relative to other EM assets. The acceleration in DM growth should continue to help EM activity and, in an equity-friendly environment globally, EM equities (in local currency) should move higher in 2014 outside of the bouts of pressure on EM FX and rates. But given the continuing need to address domestic and external imbalances, it is harder to make the case for EM equity outperformance relative to DM, which has tended to characterise environments of accelerating global growth over the past decade. At the aggregate level, EM credit is likely to continue to perform broadly in line with equities – as it has this year – but differentiation across credits is likely to increase (see the next theme).

8. …but EM differentiation to continue

- Penalties continue for CA deficits, low DM exposure, low GES, overheating

- Not only the obvious candidates that need weaker currencies

- Differentiation even among the most vulnerable as policy response varies

Market issues: 2013 saw countries with high current account deficits, high inflation, weak institutions and limited DM exposure punished much more heavily than the ‘DMs of EMs’, which had stronger current accounts and institutions, underheated economies and greater DM exposure. This is still likely to be the primary axis of differentiation in coming months, but in 2014 we would also expect to see greater differentiation within both these categories.

Within the most vulnerable countries, we could potentially see a greater separation between countries with credible tightening policies (Brazil, India) and those where imbalances are allowed to grow (Turkey). Places with hitherto sound, but deteriorating current account balances (Thailand and Malaysia) may be more affected, although they should be helped by the DM recovery; and the downside risks on commodities (which we discuss next) may exacerbate pressure on the commodity producers (South Africa and Chile). The EMs most likely to benefit from stronger DM demand (without being hurt by the higher rates that come in its train) are the underheated economies of Central and Eastern Europe (Poland, Czech Republic and Hungary), where we expect to see inflation-less accelerations, and Korea and Taiwan in North Asia.

There is also likely to be increased focus on the small number of countries showing more classic EM-style problems. The macro environment in Venezuela is deteriorating rapidly and we expect a large devaluation and further credit pressure. Argentina’s macro backdrop is also unfriendly. And we continue to think that Ukraine will choose to devalue and seek external support in the coming months. Given the idiosyncrasies in each case, our central case is that these issues will not create much contagion. But they may make the market less patient than in the past with any signs that others are flirting with more heterodox policy paths. And we do think there is insufficient credit risk premium priced into some higher-debt EM countries, both absolutely and compared with lower-debt EM and perhaps also the peripheral European economies.

9. Commodity downside risks grow

- Lower prices in metals, beans, gold – at least later in 2014

- Oil more stable but with downside risk

- Shale still supporting demand pick-up from global recovery

- Commodity producers still adjusting to the ‘new reality’

Market issues: Last year we pointed to the ongoing shift in our commodity views, ultimately towards downside price risk. The impact of supply responses to the period of extraordinary price pressure continues to flow through the system. And we are forecasting significant declines (15%+) through 2014 in gold, copper, iron ore and soybeans. Energy prices clearly matter most for the global outlook. Here ou

r views are more stable, although downside risk is growing over time and production losses out of Libya/Iran and other geopolitical risk is now playing a large role in keeping prices high. Relative to the past, shifting oil dynamics – especially increased shale production in the US – remain a key positive, in the sense that energy price constraints are unlikely to short-circuit an acceleration towards trend global growth. That continues to be an advantage for the recovery relative to the previous cycle.

Translating these downside pressures in commodities into market views is complicated by two factors. First, we expect these pressures mostly to become visible later in 2014. On that basis, it may be difficult to position early given the natural volatility going into an improving growth picture. Second, for iron ore in particular – where our downside view is strongest – direct trading is difficult. However, we do think the shifts in these markets add to the downside pressures on several of the commodity currencies, including the AUD (iron ore, copper), ZAR (gold), CLP (copper) and perhaps BRL (soybeans, iron ore).

These pressures are also likely to reinforce some of the other core themes discussed here – loosening what has been a key constraint on DM and global growth in recent years, keeping inflation subdued and preventing long rates from rising much above forwards. On the flipside, meaningful downside moves in oil and gold prices would alleviate some of the concerns around inflation and current account deficits in EMs such as India and Turkey.

10. Stable China may be good enough

- China growth expectations have reset lower

- Stable but unimpressive growth may be enough to reassure for now

- Improving external backdrop may see market overlook medium-term risks

- More support for Asian economies and markets, especially equities

Market issues: Expectations of Chinese growth have reset meaningfully lower as some of the medium-term problems around credit growth, shadow financing and local governance have been widely recognised over the past year. Some of these issues continue to linger: the risks from the credit overhang remain and policymakers are unlikely to be comfortable allowing growth to accelerate much. But the deep deceleration of mid-2013 has reversed and even our forecast of essentially flat growth (of about 7.5%) may be enough to comfort investors relative to their worst fears. The details from the recent Third Party Plenum were also more encouraging about the prospects for further market liberalisation and rural/land reform, and have boosted market sentiment.

At this juncture, the market pricing of China’s growth prospects is negative enough that this stability, alongside an improving external impulse, may be enough to be reassuring. Our China ‘risk factor’ has substantially underperformed market perceptions of US and Euro-related risks this year. If the market were to relax about China growth risk, this would help improve the case for EM equities and credit, and make long USD positions more risky. Our views on each of these areas remain a balancing act, as previous themes have elaborated, but this is one of the reasons why we are less negative across the board on EM assets, and why there is more need to discriminate across asset classes and countries. And so we are more open to China-sensitive exposures than last year, especially when they have other desirable features. We also think the continued strength of inflows will keep the CNY and CNH under upward pressure.

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/UBb8JhyxV3I/story01.htm Tyler Durden

![]()