Submitted by F.F.Wiley of Cyniconomics blog,

Hunting season is off to a good start this week, and I’m not just talking about deer hunting. It seems that former Fed officials declared open season on their ex-colleagues.

First, Andrew Huszar, who once ran the Fed’s mortgage buying operation, let loose in yesterday’s Wall Street Journal. Huszar apologized to all Americans for his role in the toxic QE programs.

And then today, the WSJ struck again, this time with an op-ed by former FOMC Governor Kevin Warsh.

Instead of excerpting the Huszar essay, we’ll only share the apt words of commenter Ernest Moosa, who wrote:

Every reader needs to understand and grasp what is being said here. We have been on the wrong economic path for five years, and without the desired results, our leadership says “FULL SPEED AHEAD”. We have wasted so much time and money that future generations will point to us and say this is how a great country can be destroyed in less than a decade with no shots even being fired. Deplorable.

Moosa hit the nail on the head, and we recommend reading the op-ed in its entirety if you haven’t already done so.

As for Warsh’s editorial, it was tough to read without wondering what he’s thinking. Warsh is a former Morgan Stanley investment banker whose 2006 to 2011 stint on the FOMC spanned the end of the housing boom and the first few years of “unconventional” policy measures. After such a solid grounding in the ways of the Fed and Wall Street, he recently morphed into a critic of the status quo. His criticisms are welcome and we believe accurate, but they’re also oh so carefully expressed. They’re written with the polite wording and between-the-lines meanings that you might expect from such an establishment figure. He seems to be holding back.

So, what does he really want to say?

Here are our guesses, alongside excerpts from the editorial on each of nine topics that Warsh covered:

Quantitative easing

“The purchase of long-term assets from the U.S. Treasury to achieve negative real interest rates is extraordinary, an unprecedented change in practice since the Treasury-Fed Accord of 1951.

The Fed is directly influencing the price of long-term Treasurys—the most important asset in the world, the predicate from which virtually all investment decisions are judged. Earlier this year the notion that the Fed might modestly taper its purchases drove significant upheaval across financial markets. This episode should engender humility on all sides. It should also correct the misimpression that QE is anything other than an untested, incomplete experiment.”

What he really wants to say:

We’d all be better off if the central banking gods (myself included) hadn’t been so damn arrogant to think that we actually understood QE. We don’t, and it never should have been attempted.

The Fed’s focus on inflation

“Low measured inflation and anchored inflationary expectations should only begin the discussion about the wisdom of Fed policy, not least because of the long and variable lags between monetary interventions and their effects on the economy. The most pronounced risk of QE is not an outbreak of hyperinflation. Rather, long periods of free money and subsidized credit are associated with significant capital misallocation and malinvestment—which do not augur well for long-term growth or financial stability.”

What he really wants to say:

The inflation target is stupid. It’s not the CPI that’s killing us, it’s the credit booms and busts. The best way out of this mess is to lose the inflation target and go back to the old-fashioned approach of “taking the punch bowl away when the party gets going.”

Pulling off the exit from extraordinary measures

“[T]he foremost attributes needed by the Fed to end its extraordinary interventions and, ultimately, to raise interest rates, are courage and conviction. The Fed has been roundly criticized for providing candy to spur markets higher. Consider the challenge when a steady diet of spinach is on offer.”

What he really wants to say:

Pundits who praise the courage of our central bankers are clueless. The true story is that we consistently take the easy way out. If the current cast of characters wanted to show courage, they’d man up and replace the short-term sugar highs with long-term thinking.

The Fed’s relationship to the rest of Washington

“The administration and Congress are unwilling or unable to agree on tax and spending priorities, or long-term structural reforms. They avoid making tough choices, confident the Fed’s asset purchases will ride to the rescue. In short, the central bank has become the default provider of aggregate demand. But the more the Fed acts, the more it allows elected representatives to stay on the sidelines. The Fed’s weak tea crowds out stronger policy measures that can only be taken by elected officials. Nobel laureate economist Tom Sargent has it right: ‘Monetary policy cannot be coherent unless fiscal policy is.’”

What he really wants to say:

And if we don’t man up, you can count on Congress to continue with its egregious generational theft and destroy our nation’s finances, just as me, Stan and Geoff have been warning.

Who benefits from QE and who doesn’t?

“Most do not question the Fed’s good intentions, but its policies have winners and losers, which should be acknowledged forthrightly.

The Fed buys mortgage-backed securities, thereby providing a direct boost to balance sheet wealth of existing homeowners to the detriment of renters and prospective future homeowners. The Fed buys long-term Treasurys to suppress yields and push investors into riskier assets, thereby boosting U.S. stocks.

The immediate beneficiaries: well-to-do households and established firms with larger balance sheets, larger risk appetites, and access to low-cost credit. The benefits to workers and retirees with significant fixed obligations are far more attenuated. The plodding improvement in the labor markets offers little solace.”

What he really wants to say:

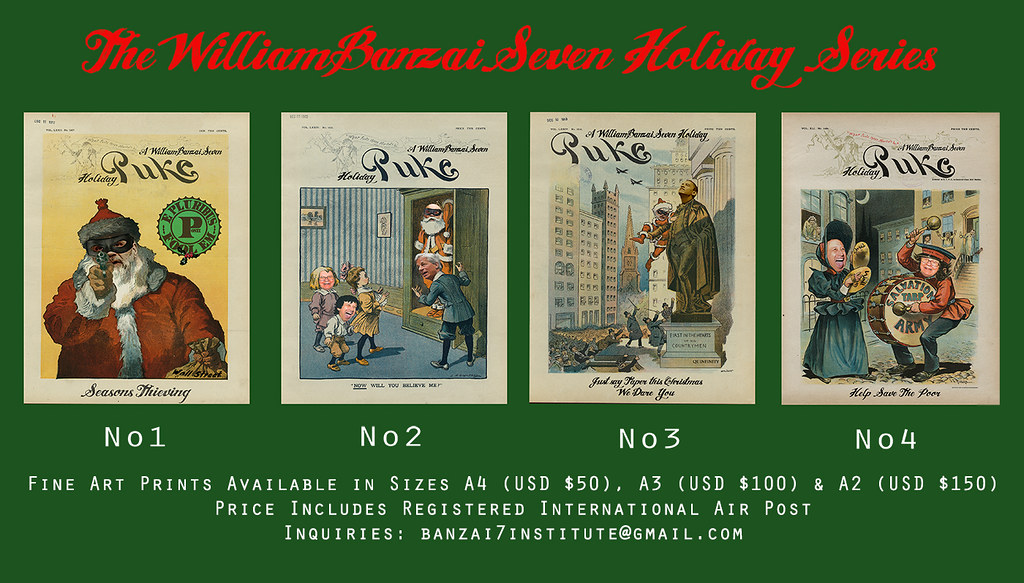

Unbelievably, my ex-colleagues still don’t acknowledge their policies are killing the middle class to the benefit of the plutocracy. Their silence on this is wholly unacceptable and has to

stop (and so do the policies).

Domestic versus global policy considerations

“[T]he U.S. is the linchpin of an integrated global economy. Fed-induced liquidity spreads to the rest of the world through trade and banking channels, capital and investment flows, and financial-market arbitrage. Aggressive easing by the Fed can be contagious, inclining other central banks to ease as well to stay competitive. The privilege of having the dollar as the world’s reserve currency demands a broad view of global economic and financial-market developments. Otherwise, this privilege could be squandered.”

What he really wants to say:

We really need to climb out of our shell and look at things from a global perspective. The rest of the world knows that we’re selling a bill of goods and won’t continue buying it forever. If we don’t change, you can say goodbye to the dollar.

Forward guidance

“Since QE began, Fed policy makers have tried to explain that asset purchases and interest rates are different. Hence their refrain that tapering is not tightening, and that very low interest rates will continue after QE. Investors do not agree. Once the Fed begins to wind down its asset purchases, these market participants are likely to reassert their views with considerable force.

Recently, the Fed has elevated forward guidance as a means of persuading investors that it will indeed keep interest rates exceptionally low even after QE. Forward guidance is intended to explain how the central bank will react to incoming data. Fed projections for example, may show below-target inflation and a residual output gap justifying very low interest rates several years from now. But words are not equal to concrete policy action. And the Fed hasn’t received many awards for prescience in recent years.”

What he really wants to say:

Forward guidance is a load of crap. First, you won’t convince the market of any of your dumb ideas. Investors can and will think for themselves. Second, talk is cheap. And talk that’s based on the Fed’s ability to foresee the future? C’mon now, that’s ridiculous.

Transparency

“[T]ransparency in communications about future policy is not a virtue unto itself. The highest virtue is getting policy right. Given manifest uncertainties about the state of the economy, oversharing policy deliberations is not useful if markets are led astray, or if public commitments reduce policy makers’ flexibility to call things the way they see them.”

What he really wants to say:

Transparency, shmansparency. I’ve had it up to here with taper, untaper, maybe taper, maybe not taper. I’ll trade a transparent central bank for one that knows what it’s doing any day.

Obama’s nomination of Janet Yellen as the next FOMC chair

“The president has nominated a person with a well-deserved reputation for probity and good judgment. The period ahead will demand these qualities in no small measure.”

What he really wants to say:

The president made a bad choice.

Disclaimer

These are only our guesses, not actual thoughts from Kevin Warsh, who hasn’t told us what he really wants to say. We don’t even know if he hunts. (We’re guessing no.)

via Zero Hedge http://feedproxy.google.com/~r/zerohedge/feed/~3/gGR3bWnhCd4/story01.htm Tyler Durden

![]()