US equity futures and European stocks dipped in a quiet overnight session to start the week amid renewed concerns about rising inflation and a spike in Covid-19 cases in parts of the world. Gold briefly reached a three-month high, while oil and the dollar were little changed; 10Y TSY yields rose after dropping earlier in the session.

At 715am ET, Dow e-minis were down 125 points, or 0.36%, S&P 500 e-minis were down 17 points, or 0.39%, and Nasdaq 100 e-minis were down 46 points, or 0.34%, reversing much of Friday’s rebound.

Wall Street’s main indexes rebounded on Thursday and Friday as investors picked up beaten-down stocks following a pullback earlier in the week on concerns around inflation and a possible tightening by the U.S. Federal Reserve. However, the mood reversed on Monday with travel, oil & gas and industrials the weakest sectors, while telecoms and autos were strong. Shares of Discovery jumped 12.5% in premarket trading after AT&T neared a deal to combine its media assets, including CNN and HBO, with the company. AT&T shares gained 3.1%.

The MSCI World Index was flat in European trade, albeit less than 2% from a recent record high. That followed its best day since February on Friday after an early week inflation-driven selloff. “What markets are doing is hoping for the best and preparing for the worst,” said Fahad Kamal, chief investment officer at Kleinwort Hambros, although adding he felt the inflationary pressures would dissipate.

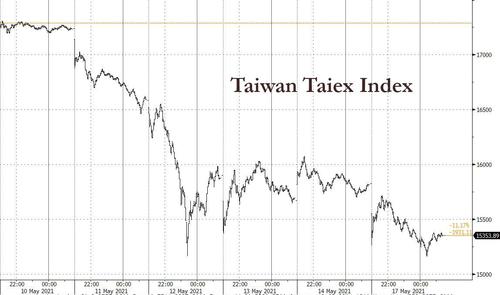

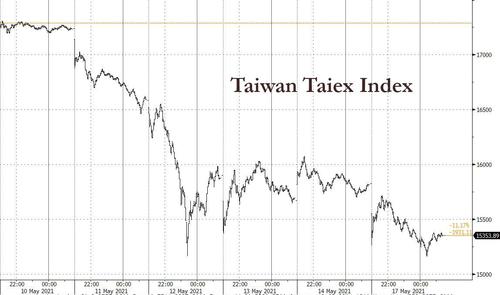

Europe’s Stoxx 600 Index fell 0.4% and stocks in Asia were mixed, with shares in Taiwan dropping as the country raced to contain its worst outbreak of the coronavirus. U.K. resumed international leisure travel Monday, but Portugal is only major destination on the “green list” with other destinations either prohibited or requiring travelers to quarantine on return. Most European airline stocks slid Monday, including EasyJet (-1.6%), Wizz Air (-1.4%), British Airways owner IAG (-1.4%) and Lufthansa (-1%). Ryanair gained 0.3% following an earnings update. Here are some of the biggest European movers today:

- Danone shares climb as much as 1.3% amid expectations Antoine de Saint-Affrique will become the French yogurt maker’s new CEO after a report saying an announcement is imminent.

- Diploma shares gain as much as 8.9%. Jefferies says FY consensus EPS estimates are expected to increase by double digits after the company reported 1H results.

- Ryanair gains as much as 2.6% in Dublin; Davy notes the low-cost carrier’s FY loss was helped by cost savings and ancillaries and FY22 guidance of “close to breakeven” is maintained.

- Bayer shares drop as much as 3.2% after the company lost its second appeal of three jury verdicts finding that the Roundup weed killer causes cancer. “Losing another appeal isn’t supportive,” says Commerzbank (hold).

- RCS MediaGroup shares fell as much as 13% in Milan (trades ex dividend); Banca Akros notes a Milan court rejected all claims advanced by RCS against Blackstone related to the sale of RCS’s headquarters in Milan in 2013, and cuts to neutral from accumulate.

Asian stocks were little changed on Monday following last week’s selloff on weak sentiment as worries over global inflation and the region’s ongoing struggle to contain the coronavirus continued to linger. The MSCI Asia Pacific Index fell as much as 0.4% before erasing its losses. The measure lost 3.2% last week in its worst weekly performance since February. Technology stocks continued to weigh the most heavily on the Asian benchmark, dragged lower by declines in chipmaking giants Taiwan Semiconductor Manufacturing and Samsung Electronics. Gains in consumer discretionary stocks like Meituan, however, cushioned the market’s drop. Taiwan’s benchmark was the region’s worst performer, extending its biggest weekly rout in more than a year after the government tightened restrictions on people and businesses to control its coronavirus outbreak. It closed down 3%.

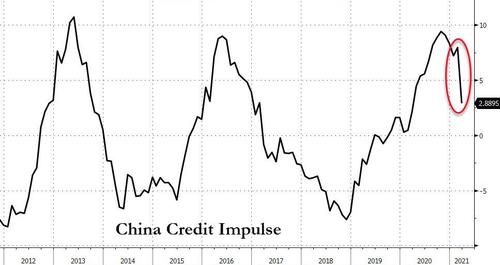

Japan’s small caps and Indonesian stocks also posted notable declines. “Inflation concerns continue to weigh, with the University of Michigan consumers’ inflation expectations showing a jump to amulti-year high,” Yeap Jun Rong, a market strategist at IG Asia wrote in a note. “Concerns on virus resurgences may continue to linger in the region, which have caused renewed restrictions in several countries, fueling concerns on the pushing back of the timeline on reopening and economic recovery.” U.S. consumer sentiment deteriorated unexpectedly in early May as Americans grew increasingly concerned about rising prices. The University of Michigan’s preliminary sentiment index fell to a three-month low of 82.8 in May. Consumers said they expect a 4.6% increase in inflation over the next year, in the highest reading in a decade. Chinese shares outperformed. The CSI 300 Index rose more than 1% despite a notable miss in retail sales growth, which slowed to 17.7% in April, below the projected 25% rise. Analysts saw the data as boosting hopes that Beijing will maintain policy support for an economic recovery that’s losing steam.

China stocks rose strongly even after retail sales data for April missed, gaining 17.7% y/y vs. est. 25%. Industrial Production of 20.3% Y/Y also missed expectations of 21.1% as China’s economic data is clearly slowing down.

The Shanghai Composite climbed 1% and the Chinext jumped 3%; the Hang Seng, India’s Sensex and Australia’s S&P/ASX 200 advanced. Index futures declined 0.3% for the S&P 500 and the Nasdaq 100; the Topix, Kospi and Thailand’s SET Index also retreated. Bitcoin slid under $43,000, down more than 10% since Friday after Elon Musk dueled over the weekend on Twitter with critics of his decision to suspend payments using the crypto currency. The Aussie dollar fell 0.3% and the New Zealand currency slid 0.5%. Treasuries were steady after rallying on Friday, with the 10-year yield sitting at 1.62%. WTI rose 0.1% to above $65 per barrel, gold advanced 0.5%.

Japanese stocks fell for the fourth day in five, extending losses after last week’s rout as concerns over rising inflation and China’s mixed economic data damped investor demand for equities while April wholesale prices in Japan, the world’s third-largest economy, rose at their fastest pace in six and a half years, as rising energy and commodities costs ate into corporate margins, although consumer price inflation remains subdued. Information companies and electronics makers were the heaviest drags on the Topix, which erased an earlier gain of as much as 0.8%. Tokyo Electron Ltd. and Fast Retailing Co. weighed down the Nikkei 225, which slid 4.3% last week in the gauge’s worst rout in almost 10 months. Sumitomo Mitsui Financial Group Inc. fell 1.1% after the bank forecast Friday that its profit will miss analyst estimates as provisions for soured loans remain elevated. Honda Motor Co. dropped 2.7% after the automaker issued a profit outlook that was short of analysts’ estimates. “Markets are still anxious about inflationary risks,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “Japanese stocks will fluctuate along with sways in U.S. rates.”

In rates, After reaching a six-week peak just above 1.70% last week, 10-year Treasury yields edged lower and were last around 1.63%, with corresponding U.K. and German yields higher by around 2bp each; across long-end of the curve 20-year sector continues to lag, cheaper by 1.3bp on the 10s20s30s fly. Volumes during the Asia session were heavy as yields declined, pointing to stop-driven action. Also during the Asia session there was heavy buying in Sep21 eurodollar futures after Morgan Stanley and JPMorgan strategists called for a continued drop in Libor; incidentally 3M dollar Libor dropped -0.55bp to 0.14963%, a new record low. Italy’s 10-year bond yield rose to its highest level in over eight months, rising above 1.10% as unease over the future of Italian economic reforms as well as a slowing down of central bank bond buying triggered fresh selling.

In FX, the Bloomberg Dollar Spot Index fluctuated in a tight range between losses and gains even as the greenback was higher against most of its Group-of-10 peers as risk-sensitive Antipodean and Scandinavian currencies lead declines; most of the other crosses traded in tight ranges. The euro was steady against the dollar while bunds were flat, underperforming Treasuries, which inched higher. The pound was steady after swinging between small gains and losses as most of the U.K. relaxes coronavirus restrictions further; Prime Minister Boris Johnson said the next step out of lockdown must be taken “with a heavy dose of caution” amid concern over the highly transmissible virus strain that originated in India. Japan’s new inflation- linked bonds were were met with stellar demand, helped by the global reflationary theme; the yen inched up versus the dollar while the Bloomberg Correlation-Weighted Currency Index, which measures relative strength in the yen against other G-10 currencies, touched the lowest level since February 2018 before rebounding. The Hungarian forint neared the strongest level this year against the dollar after central bank Deputy Governor Barnabas Virag said the nation will respond to surging inflation by tightening monetary policy as soon as next month following the release of new economic forecasts.

Bitcoin fell 8.5% to its lowest since February after tweets from Elon Musk hinted that Tesla may have sold, or will sell, its holdings, the drop reversed around 2am when Musk tweeted that Tesla had not in fact sold its Tesla holdings.

In commodities, the dip in U.S. yields combined with inflation concerns helped gold to a three-month peak of $1,855 an ounce before pulling back to trade up 0.4% at $1,849 an ounce. Oil traded around flat, with Brent and U.S. crude last down 0.1% at $68.62 a barrel and $65.29 a barrel, respectively.

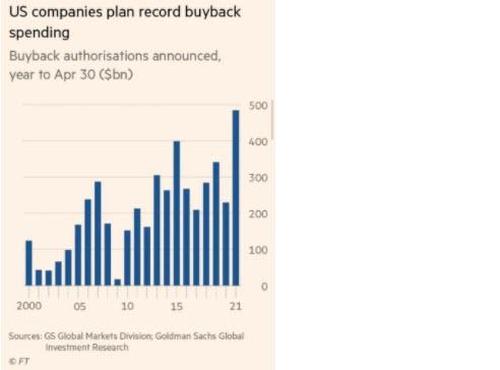

With the earnings season nearing its end, overall earnings for S&P 500 companies are expected to have climbed 50.6% from a year ago, the strongest pace of growth in 11 years. Walmart, Home Depot and department store operator Macy’s are set to report on Tuesday, with Target, Ralph Lauren and TJX Cos on tap later in the week.

Amid a light U.S. data calendar this week, all eyes will be on Wednesday’s minutes of the Federal Reserve’s last policy meeting for clues about any tightening in monetary policy. So far, the Fed has argued the inflation spike is transitory, yet last week’s University of Michigan consumer survey showed the highest long-term inflation in the past decade

“We believe inflation has reached an important inflection point, and we expect it to be structurally higher than during the last cycle, but not so high as to create major disruptions in markets,” said Joseph Amato, chief investment officer for equities at Neuberger Berman. “This drives our positive view on risk assets and equities.”

U.S. economic data slate includes May Empire manufacturing (8:30am), NAHB housing market index (10am) and March TIC flows (4pm); building permits/housing starts, FOMC meeting minutes and Markit manufacturing PMI are ahead this week.

Market Snapshot

- S&P 500 futures down 0.4% to 4,149.75

- MXAP little changed at 200.80

- MXAPJ little changed at 672.66

- Nikkei down 0.9% to 27,824.83

- Topix down 0.2% to 1,878.86

- Hang Seng Index up 0.6% to 28,194.09

- Shanghai Composite up 0.8% to 3,517.62

- Sensex up 1.4% to 49,404.91

- Australia S&P/ASX 200 up 0.1% to 7,023.56

- Kospi down 0.6% to 3,134.52

- STOXX Europe 600 down 0.23% to 442.3

- German 10Y yield up 0.2 bps at -0.127%

- Euro little changed at $1.2140

- Brent Futures little changed at $68.72/bbl

- Gold spot up 0.5% to $1,853.07

- U.S. Dollar Index little changed at 90.35

Top Overnight News from Bloomberg

- China’s recovery remained unbalanced in April, with industrial output and investment buoyed by strong exports and a hot property market, while retail sales missed forecasts. Industrial output rose 9.8% in April from a year earlier versus the median estimate for a 10% increase. Retail sales expanded 17.7% in the period, far slower than a projected 25% rise

- President Joe Biden’s prospects for passing a major infrastructure bill through Congress with bipartisan support — seen unlikely in the wake of his Democrat-only pandemic-relief package in March — are now rising, though disagreements over funding could still scupper a deal

- Interbank borrowing rates are already at record lows and set to remain under pressure, prompting strategists to ask how low dollar Libor may go

- Iran is preparing to ramp up global oil sales as talks to lift U.S. sanctions show signs of progress. But even if a deal is struck, the flow of additional crude into the market may be gradual. State-controlled National Iranian Oil Co. has been priming oil fields — and customer relationships — so it can increase exports if an accord is clinched, officials said

Quick look at global markets courtesy of Newsquawk

Asian equities traded somewhat mixed and only partially benefitted from last Friday’s rebound on Wall St. where the major indices gained as weaker than expected US Industrial Production and Retail Sales data supported the narrative for prolonged Fed accommodation, although further pandemic-related concerns and fresh restrictions have left some regional markets in the lurch. ASX 200 (+0.1%) was kept afloat by outperformance in gold miners after the recent advances in the precious metal and with energy also underpinned following the government announcement of a AUD 2.3bln support package to keep Australia’s two remaining refineries open which are being run separately by Ampol and Viva Energy. Nikkei 225 (-0.9%) failed to hold on to opening gains with sentiment subdued by the recent widening of the state of emergency to three additional prefectures lasting through to month-end and with some of the biggest movers driven by earnings releases, while the TAIEX (-3.0%) slumped 3% at the open due to a record increase of domestic cases and tightened COVID-19 measures. Hang Seng (+0.6%) and Shanghai Comp. (+0.8%) were positive after the PBoC injected funds through a CNY 100bln MLF operation but with gains capped as participants digested mixed Chinese activity data in which Industrial Production printed inline with estimates and Retail Sales disappointed but still showed respectable growth. Finally, 10yr JGBs were supported by the weakness in Japanese stocks and following similar upside in T-notes, while the results of the 10yr inflation-indexed auction from Japan were inconclusive with a higher b/c than previous but lower accepted prices.

Top Asian News

- Hong Kong, Singapore Delay Anticipated Air Travel Bubble Again

- MUFG Sees Profit Topping Estimates on Lower Bad-Loan Costs

- Vaccine Costs to Strain India’s Already Frail State Budgets

- Shimao Dollar Bonds Slide in Latest Developer to See Price Drop

Major European bourses kick the week off relatively contained and with little conviction (Euro Stoxx 50 -0.2%), following on from a mixed APAC handover with news-flow also on the lighter side once again. US equity futures are similarly caged but with a mild downside bias following Friday’s rally, with no significant outliers in terms of performance as participants await this week’s risk events, including the FOMC minutes and flash PMIs. Back to Europe, the FTSE 100 (-0.3%) narrowly underperforms as the GBP remains elevated while base metal miners unwind some recent gains, oil & gas names also remain pressured. Sectors see a mixed picture after a primarily positive open with defensives now faring better than cyclicals. The Telecoms sector outpaces peers, led by Telefonica (+3.3%), BT (+2.4%) and Deutsche Telekom (+2.5%) – with the latter also underpinned by a broker upgrade at Barclays. Travel & Leisure has made its way to the bottom of the pile despite the UK kick-starting travel to designated countries, with COVID developments in Asia potentially providing some sectorial headwinds as the Hong Kong-Singapore travel bubble has been deferred again. However, Ryanair (+1.2%) bucks the overall trend in the sector after earnings topped forecasts whilst providing a rosy outlook contingent on vaccination efforts. In terms of commentary, analysts at JPM have revisited their equity strategy for the Euro Stoxx 50. They maintained their overall bullish view and reaffirmed the medium-term positive growth-policy trade-off. The bank reiterated their tactical call favouring defensives vs manufacturing cyclicals during this current consolidative phase which is expected to last 1-3 months before the next run higher, according to the analysts. “We think that better tactical showing of lower beta will ultimately end up a good staging post for the renewed Value and Cyclicals rally in 2H.” Contrary to a widespread view, JPM disagrees that UK will be the most profitable exposure this year and suggests that overweight EZ vs the UK makes more sense and is backed by current performance.

Top European News

- IPhone Maker Foxconn Finalizes Auto Partnership With Stellantis

- Merkel Rejects Calls to Bring Coal Exit Forward: FAZ

- Bayer Falls on Appeal; Decision ‘Isn’t Supportive’: Commerzbank

- Hungary Central Bank Readies June Rate Hike After Inflation Jump

In FX, the Dollar is somewhat mixed against G10 counterparts, but lagging vs precious and base metals, like Gold and Copper, albeit the latter partly due to heightened prospects of strike action at BHP’s Spence and Escondida mines in Chile following the rejection of a contract offer. Conversely, spot bullion has taken advantage of softer US Treasury yields and a flatter curve that are keeping the Greenback capped in wake of last Friday’s disappointing retail sales data to breach a key technical level that was protecting Usd 1850/oz (200 DMA at Usd 1845.98), with bulls (or bugs) now eyeing another upside objective in the form of a declining trend-line that crosses the y axis around Usd 1858.40. Back to the Buck, 90.500 in the index has not been reclaimed and 90.153 may offer some support ahead of 90.000 on any further pull-back through the prior session low (90.278) as this represents the midweek base outside of the 90.429-220 range thus far. Ahead, NY Fed manufacturing, NAHB and 3 Fed speakers including hawk and current FOMC voter Bostic twice.

- JPY/GBP – Both holding up better than other majors, though only marginally firmer against the Dollar as the Yen meanders between 109.15-50 in the absence of anything Japanese specific ahead of Q1 GDP tomorrow, while the Pound is pivoting 1.4100 in the run up to several BoE speeches and a packed UK data agenda this week, also kicking off from Tuesday. However, Sterling is losing a bit more traction vs the Euro below 0.8600 amidst the ongoing post-Brexit rift over NI Protocol and some concerns that Britain may want to rewrite the agreement that PM Johnson’s advisor Frost has already said is dead in the water.

- EUR/CHF/CAD – The Euro is sitting comfortably enough above 1.2100, but could struggle to clear 1.2150 convincingly ahead of the NY cut given the fact that 1.9 bn option expiries reside at the half round number, while the Franc is rangebound just under 0.9000 and straddling 1.0950 vs the single currency following firmer Swiss producer and import prices compared to previously and a decline in weekly domestic bank sight deposits and the Loonie is also hovering shy of a big figure at 1.2100 amidst flattish crude prices before Canadian housing starts.

- NZD/AUD – Having run into offers bang on 0.7250 against its US rival, the Kiwi has waned to test bids ahead of 0.7200 and derived little lasting traction via a rise in NZ’s services PMI, but the Aussie is showing more resilience around 0.7750 after mixed Chinese ip and retail sales releases and a foray above 1.4 bn option expiry interest from 0.7755-60 that may yet tether Aud/Usd in advance of RBA minutes.

In commodities, WTI and Brent front-month futures remain within tight ranges in early European trade, in-fitting with the indecisive mood across the markets and as participants weigh the global recovery with the worsening COVID situation in Asia – which has seen a considerable slower inoculation drive vs the UK, US and now the EZ. COVID remains the overarching theme, but geopolitics has also been increasingly in vogue amid the tensions between Israel/Gaza, prompting the US, EU, Russia and China to take opposing sides, with these developments worth keeping on the radar against the backdrop of JCPOA talks and a potential US-Sino meeting by month-end. Further on Iran, reports over the weekend suggested that state-controlled National Oil Co. has begun priming oil fields and customers in a bid to swiftly increase exports if a JCPOA deal is clinched, according to officials – with the most optimistic scenario pointing to pre-sanction production levels of almost 4mln BPD in as little as three months. COVID and geopolitics aside, the Colonial Pipeline has restarted operations after last week’s ransomware attack. Still, last week’s shuttering is expected to be reflected in this week’s EIA release, which is seen printing a significant draw in PADD1 (East Coast) product stocks alongside builds in crude and products from PADD3 (US Gulf Coast) alongside a decline in refining activity. WTI Jun meanders around USD 65.50/bbl (vs USD 65.12-74/bbl range) while Brent July trades just under USD 69/bbl (vs USD 68.34-69.07/bbl range). Russian Deputy PM Novak meanwhile suggested that prices around USD 62-66/bbl reflects the current market conditions. Elsewhere, spot gold and silver trade firmer in tandem with the softer Buck and yields, with the yellow metal hovering around USD 1,850/oz (vs low 1,822/oz) and the latter marginally above USD 27.50/oz (vs low USD 27.35/oz). In terms of base metals, LME copper prices have been edging higher amid Chilean strike action at two BHP mines after contract offers were rejected. Iron ore futures overnight nursed some of Friday’s losses after Chinese steel producers were warned about price manipulation. However, the recent surge in prices has not convinced Vale’s CEO of a supercycle as he expects demand to flatten out after a couple of years of tightness.

US Event Calendar

- 8:30am: May Empire Manufacturing, est. 24.0, prior 26.3

- 10am: May NAHB Housing Market Index, est. 83, prior 83

- 4pm: March Net Foreign Security Purchases, prior $4.2b

- 4pm: March Total Net TIC Flows, prior $72.6b

DB’s Jim Reid concludes the overnight wrap

I didn’t have the greatest weekend. I found out late on Friday that I need another knee operation and six weeks on crutches with no weight bearing at some point this year, I got soaked most of Saturday running the kids around, and then finished a poor 75th out of 110th in a golf tournament on Sunday and got soaked again on the way round for good measure. However it was salvaged by a sensational (and absolutely crucial) Liverpool winner after injury time was up via a flying header from a corner from our goalkeeper. I have never seen anything like it. I ran round the TV room shouting and scaring all my family. One of the twins said “Daddy, why you do funny dance?” More on the knee later in the week as there is a very cautionary tale about how I injured it. Hopefully my celebrations didn’t make it worse.

The inflationists were the ones celebrating last week and you would have had to have just got back from an uninhabited desert island without Wi-fi to not know that inflation is the number one theme at the moment. However the market reactions wouldn’t have been that easy to predict had you known the US CPI data in advance last week. The S&P closed the week above it’s pre CPI levels and 10yr US yields ended up within a basis point of where they were prior to the release.

Although CPI stole the show, perhaps Friday’s UoM survey that showed 5-10 year consumer expectations for inflation had climbed to 3.1% (a 10 year high) will ultimately prove more important. The 1-yr view at 4.6% was also at the highest since 2011. Note that neither index slumped during the pandemic so this is not a bounce back or a make up for undershooting. The DB rates view in 2021 is that there’s a decent chance we go back into the 1998-2014 inflation expectations regime after 6-7yrs of very low expectations that never recovered after the oil slump of 2014. If correct we could say ultimately say goodbye to a 1% handle on 10yr treasuries for an extended period of time. We would probably need a few more readings to confirm this but it’s looking increasingly likely.

Overnight we have just seen China’s April economic data dump which included a large retail sales miss with a print of +17.7% yoy (vs. +25% yoy expected). There were also marginal misses for industrial output (at +9.8% yoy vs. +10% yoy expected) and YtD fixed investment (+19.9% yoy vs. +20% yoy expected). The surveyed jobless rate printed at 5.1% (vs. 5.2% expected). Asian markets are mixed this morning with the Shanghai Comp (+1.02%) and Hang Seng (+0.39%) up while the Nikkei (-1.47%) and Kospi (-0.91%) are down. The Nikkei seems to be weighed down by the planned extension of the state of emergency to three more regions over the weekend while the Shanghai Comp seems to be gaining as the weaker retail sales print might lead to a slower wind down of stimulus by the authorities. Futures on the S&P 500 are -0.23%. Elsewhere, Bitcoin is down around -11.5% from Friday’s close to c.$43,500 as Elon Musk implied in a tweet that Tesla might sell its holdings of the cryptocurrency or may have already sold. It is now down more than $20,000 from its peak in April. Other cryptocurrencies such as Ether and Dogecoin are also under pressure.

Turning to the latest on the pandemic, the global 7-day average growth in new cases has continued to decline and is now at the lowest level since March this year. Nonetheless, many countries in Asia are moving ahead with imposing fresh restrictions. Taiwan’s Taipei City has decided to close high schools, elementary schools and kindergartens for two weeks until May 28. Meanwhile, Singapore’s ministry of education said yesterday that all primary, secondary, junior college and Millennia Institute students will shift to full home-based learning from May 19 until the end of the school term on May 28. However, pre-schools and student care centers will remain open to support parents who have to work.

Looking forward to this week, the flash PMIs for May (Friday) will likely be the data highlight but it’s tough to know what they’ll tell us that we don’t already know. Having said that, our equity strategist Binky Chadha has previously said that they’ll likely be an equity correction once the ISM rolls over from its current lofty peaks even as growth stays strong. The ISM has fallen for one month from its peak so it’ll be interesting to see what the flash PMI shows as a guide. April’s composite number was the highest on record at 63.5. The Euro Area composite PMI was at 53.8, the highest since July.

Otherwise, there’ll be some further April data from the US, including on housing starts, building permits (both tomorrow) and existing home sales (Thursday), while the weekly initial jobless claims will also be in focus, after they fell to a post-pandemic low last week of 473k. In the all important inflation watch, keep an eye out for U.K. inflation on Wednesday. Everything I seem to be buying is going up in price here!!

It’s a fairly quiet week ahead on the central bank front, with the next big round of meetings not taking place until mid-June. However, there’ll be a lot of focus on Federal Reserve speakers in particular as they react to the much stronger-than expected CPI reading for April, which as we know came in at +4.2% year-on-year, the highest since 2008 last week. So far Fed speakers have largely kept to their dovish “transitory” script so it feels unlikely that anyone will go rogue. We’ll also get the minutes from the FOMC’s last meeting (Wednesday), which will be a little out of date but will be examined for tapering clues amongst other things.

Earnings season will continue to wind down over the week ahead, with more than 90% of the companies in the S&P 500 having now reported. There are still a few companies left however next week, including 20 from the S&P 500 and a further 27 from the STOXX 600.

Now to quickly recap last week. In the end a Thursday/Friday rally helped limit the S&P 500’s losses to -1.39% on the week and from their record highs at the end of the previous week. The loss was the largest weekly decline since since late February, despite a strong rally on Thursday (+1.22%) and Friday (+1.49%). It was also just the second weekly loss for the index in the last 8 weeks. Inflation worries weighed on technology shares in particular as the NASDAQ fell -2.34% (+2.32% Friday) while the FANG+ index was down a greater -3.98%, and the latter is now just above flat (+0.37%) on an YTD basis. Cyclicals sectors outperformed their growth counterparts as banks (+1.07%) gained with the uptick in yields. The VIX volatility index rose +2.1pts to 18.8, which is largest weekly rise in the implied volatility index since the end of February. It peaked at 28.86 intra-day early on Thursday morning European time and at its highest level in 2 months. European stocks reached a record high last Monday before the STOXX 600 finished the week down -0.54% over the week, with the FTSE MIB (+0.63%) and IBEX (+0.95%) outperforming other bourses.

US 10yr yields finished the week +5.1bps higher (-2.9bps Friday) at 1.628% – just the second weekly rise in the last six weeks. However we were at 1.620% just before CPI was released so not much follow through. The week’s move was driven by the rise in inflation expectations (+3.3bps) which came in addition to the smaller rise in real yields (+1.2ps). The US 10yr breakeven rate is now at 8 year highs and US 5yr breakevens are at their highest since 2008. European rates rose further with 10yr bund yields gaining +8.6bps last week and UK gilt yields gained a similar +8.2bps, while yields on OATs rose +9.2bps. The rise in commodities took a breather this week, with the Bloomberg commodity spot index falling back -1.82% – the biggest pullback for the index since late January. The index is still up +19.1% on an YTD basis and up +62.5% over the last year.

In terms of economic data from Friday, US retail sales were the main highlight and came in weaker than expected, though there was some expectations of a softer print after last month’s stimulus-fueled increase, which was actually revised up 0.9pp to +10.7% MoM. In the end retail sales in April were flat (+0.0%), with the median survey response expecting a +1.0% increase. US industrial production came in under expectations as well, increasing just +0.7% last month (+0.9% expected) after the +2.4% rise in March. The initial May reading of the University of Michigan survey fell to 82.8 from 88.3, the biggest drop since last July as year-ahead inflation expectations rose to 4.6% – the highest since 2011. As discussed at the top, and more importantly, 5-10 year expectations hit 3.1% – the highest since 2011.