Authored by Greg Orman via RealClearPolitics.com,

President Biden spoke at the White House earlier this week to address an unsettling national trend – millions of jobs going unfilled in an economy still struggling to right itself. The president couldn’t deny the existence of the paradox: His own administration’s numbers show that millions of Americans are drawing unemployment while millions of jobs are going unfilled.

But he and his top economic officials dismissed the most obvious explanation for April’s dismal job numbers – generous unemployment benefits eroding the incentive to work.

“We don’t see much evidence of that,” Biden said.

It was a line dutifully echoed by his designee to run the Commerce Department, the Cabinet department tasked with compiling employment numbers. But it’s a disingenuous argument. The Commerce Department, through the Bureau of Labor Statistics, derives employment numbers by compiling two surveys of employment – one completed by roughly 144,000 employers and another completed by approximately 54,000 American citizens. Neither of these surveys actually ask if an employee has been offered a job and turned it down. And it’s awfully hard to find evidence of something when you’re not actually looking for it.

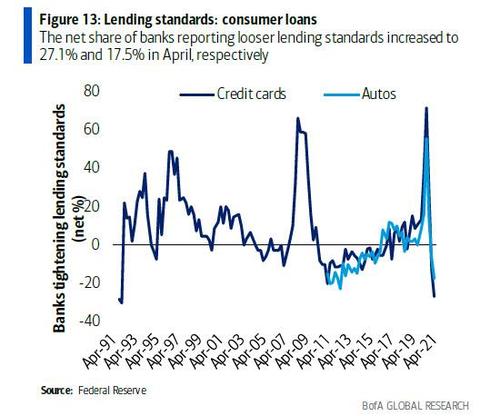

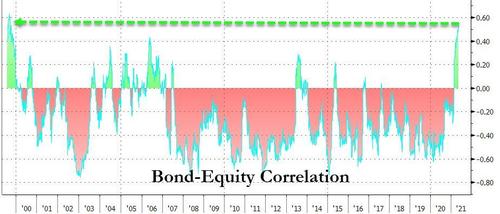

The president’s remarks Monday were in response to an April jobs report showing that only 266,000 Americans rejoined the workforce at a time when employers coast to coast are reporting that they have job openings but can’t find willing workers. As if to underscore the sheer perverseness of the situation, the following day the government released data showing that job openings in March are up by 597,000 – to a staggering 8.1 million. This is the highest number of job openings since the government started tracking them at the turn of the century. It could be the highest ever.

You don’t need evidence to know that incentives matter. Common sense will suffice. But there is evidence, which I’ve witnessed first-hand.

In April 2020, as businesses were grappling with how to navigate the pandemic and associated shutdowns, I was involved in helping half a dozen businesses plan for the unknown. Their stories are instructive. In one instance, the CEO of an Idaho firm had to lay off a significant number of manufacturing staffers as orders declined precipitously. As he gathered everyone in the plant and shared the sobering news that all but three employees were going to be furloughed, one of those being kept on audibly groaned when his name was called. Roughly eight weeks later he persuaded the CEO to lay him off — saying that he, too, deserved an extended “paid vacation” — and call back one of the other employees.

As the pandemic progressed into the summer and fall, a Kansas City manufacturer that prints invitations and promotional items (neither big sellers in an age of Zoom meetings and social distancing) was finally able to call back furloughed workers. All his employees were offered their job back, but 20% declined (three out of four of those were still receiving unemployment compensation). The company, which pays its press operators starting pay of $22 an hour and provides benefits including health insurance, disability, and a 401(k) match, is now relying on temp agencies to fill vacancies.

Anyone with light industrial jobs, such as another Kansas City employer I aided, is likely also struggling to fill roles. In the near term, they’re hoping college students on their summer breaks will fill vacancies. A recent discussion with a local light industrial placement company revealed that it has over 200 job openings and no prospects for filling them.

This isn’t to say that there aren’t many Americans who are legitimately claiming benefits as they search for work and try to stay afloat from the significant economic pain incurred during the pandemic. But the stories articulated above, and thousands of similar ones, paint a compelling and ominous picture. The purposeful constriction of the labor market by the federal government constitutes a state-sponsored labor strike. And we don’t need signs and picket lines to see the evidence – Democrats are happy to read their party’s stage directions out loud.

“Let’s get one thing straight: there is no labor shortage,” tweeted Robert Reich, who headed the Department of Labor in Bill Clinton’s administration.

“There is a shortage of employers willing to pay their workers a living wage.”

On Monday, the president regurgitated Reich’s talking point: “People will come back to work if they’re paid a decent wage.”

Spoken like a true union boss.

So that’s the endgame here? Using government money, all of it borrowed, to jack up wages? The problem with this state-sponsored labor shortage is that the pain is one-sided. Strikes work precisely because both sides have something obvious to lose if they don’t work out an agreement. With generous unemployment benefits (largely tax-free), paid health care (employers are now required to provide, free of charge, six months of COBRA coverage to laid off employees, which the government theoretically will reimburse), and no enforceable requirement to look for a job, there’s no real monetary incentive to go back to work. In some cases, it may not even be a rational act: A married woman with two kids, who is her family’s only breadwinner and making the average national wage of $30 an hour will have an after-tax income that’s within a dollar an hour of her old wage if she remains unemployed. She’ll also have paid health insurance, likely a huge benefit. And she won’t have to worry about day care, either, which is an issue in the many places where teacher unions (and school districts controlled by them) are refusing to return to the classroom.

Those people on the front lines of providing social welfare services to poorer Americans often decry the “benefits cliff” that greets Americans trying to improve their lives. The argument is that if we take away a dollar of benefits for every dollar someone earns, we leave them with no incentive to improve their lot in life. It’s an argument I fully embrace and have used to argue for a more gradual reduction in benefits as Americans pull themselves out of poverty. Biden has created an enormous benefits cliff and is now arguing the other side of the coin.

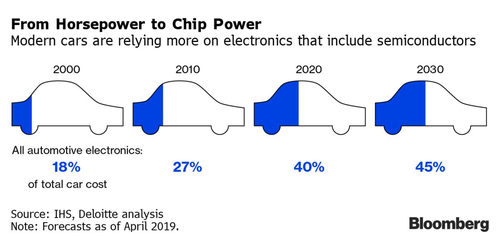

Biden’s hope that this labor force constriction will permanently raise wages is a dangerous gamble. All three of the companies mentioned above are now implementing automation and other strategies to improve their operations without adding workers. While they are all growing and will have roles for each of their current workers long into the future, other employees at different companies may not be so lucky. Not everyone can work for the government, but if we continue with these policies, millions more will be dependent on a government check.

The real answer to lifting up American workers lies not in more unemployment benefits but in helping them obtain the skills they need to perform higher value work. This will require a whole host of changes to our educational system. A good place to start would be re-examining our guaranteed student loan programs to ensure kids getting welding and machining certificates qualify on the same basis as university students. It will require public/private partnerships between employers and professional colleges to train workers in relevant skills. Importantly, it will require evaluating K-12 education to ensure kids are prepared for the world they are entering. Those changes and many other similar ones should be the focus of the Biden administration’s efforts to lift people up. Short-term strategies that artificially distort markets will only work so long before they come crashing down on the people they’re intended to help.