US index futures rose with for a second day alongside global markets as a continued drop in commodity prices helped ease fears about inflation risks. Treasuries advanced, cryptocurrencies rebounded from a Thursday rout while the dollar slumped. After a bruising week that saw the biggest one day drop for the S&P since February, higher S&P 500 and Nasdaq 100 contracts signaled a market recovery was gaining momentum.

The three main U.S. stock indexes snapped a three-day losing streak on Thursday after better-than-expected weekly jobless claims data. At 7:15a.m. ET, Dow e-minis were up 150 points, or 0.44%, S&P 500 e-minis were up 26 points, or 0.63%, and Nasdaq 100 e-minis were up 132 points, or 1.00%.

As Bloomberg notes, markets are regaining their equilibrium at the end of their biggest retreat in 11 weeks, with the focus of the benefits of an economic rebound overriding worry about the negative side-effect of inflation, for now. That may help to reinvigorate the reflation narrative of picking value shares tied to economic growth over pandemic stay-at-home favorites. Meanwhile, the Fed again reassured markets about the transitory nature of inflation. Among Fed speakers overnight, Governor Christopher Waller signalled that rates won’t rise until policymakers either see inflation above target for a long time or excessively high inflation. He also said he would only get worried if inflation rose above 4%, defining the Fed’s first real “red-line.”

Some notable pre-market moves:

- FAAMG mega-caps led gains in early trading rising about 1% each

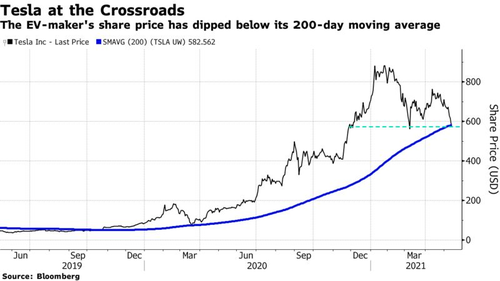

- Tesla rebounded from yesterday’s rout which saw its stock drop below the 200DMA briefly, adding about 3%.

- Disappointing Walt Disney subscriber additions overshadowed better-than-expected overall profits, driving down shares of the entertainment company by 3.8%.

Repeating what everyone knows by now, Louise Dudley, global equities portfolio manager at the international business of Federated Hermes said that “stocks with more attractive valuations and slower growth will do well in a higher-interest rate environment” Expensive growth stocks, by contrast, “are sensitive to higher interest rates,” she wrote in a note to clients. In signs that life was returning to normal, revised guidance from the CDC said fully vaccinated people do not need to wear masks outdoors and can avoid wearing them indoors in most places.

Gains in European stocks were led by banks, while miners fell amid a retreat in some raw-material prices. Eurostoxx 600 rose 0.6% bolstered by banks, tech and retail sectors with basic resources the sole sector in the red. Here are some of the biggest European movers today:

- Sanne shares rise as much as 28%, the most on record, to 770p after the private equity firm Cinven made a proposal to the asset management services provider regarding a possible cash offer of 830p a share, which was rejected earlier this week.

- Datalogic shares jump as much as 12% after the bar code reader maker reported 1Q results late yesterday, which Equita says are better than expected.

- Man Group shares jump as much as 4.6% as Credit Suisse raises its 2021 EPS estimate by 30% on higher revenue estimate.

- Banco BPM shares gain as much as 3.7% after Deutsche Bank upgraded their rating to buy from hold on expectations that its “speculative appeal” will significantly increase as merger talks among Italian lenders should intensify in the 2H following benign earnings.

- ERG shares fall as much as 9.1% in Milan trading, the steepest intraday decline since March 2020, and is the day’s worst-performer on the FTSE Italia All- Share Index; Banca Akros notes the 2025 Ebitda target is lower than its estimates and consensus.

- Geox shares drop as much as 6.9% in biggest intraday decline since October after the Italian shoe manufacturer said its 1Q sales were heavily affected by lockdowns.

- SICIT shares fall as much as 4.7% after Syngenta and Valagro decided against pursuing their interest in the Italian agriculture biostimulants maker.

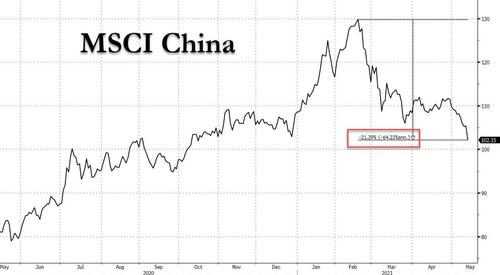

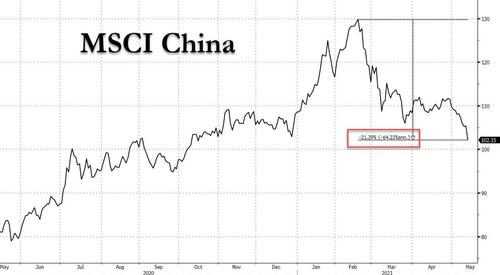

Earlier in the session, Asian stocks also stormed higher, with the regional benchmark snapping a three-day slump that plunged it into a technical correction. The MSCI Asia Pacific Index rose 1.2%, with equities in China and Japan leading the region. Technology stocks, which have been at the forefront of the recent rout, were the biggest boost to the gauge’s advance. The rebound comes after the Asian index lost 4.9% in a three-day slide that was its worst since June last year, owing to rising investor concern over inflation and a resurgence in virus infections in many countries. Sentiment worsened further after data showed U.S. consumer prices climbed in April by the most since 2009, with the Asian equities gauge extending its losses from a mid-February peak to more than 10% as of Thursday. “The U.S. CPI was higher than expected, but with that, the rise in inflation has been priced it for the time being and the market didn’t respond that much to the U.S. PPI data,” said Nobuhiko Kuramochi, a market strategist at Mizuho Securities Co. “With the latest data, people were able to grasp how high U.S. inflation could get and, while the numbers may remain high for the next few months, the extent of the surprise will likely be limited,” Kuramochi said. Chinese shares also rallied after the MSCI China Index tumbled into a bear market on Thursday as losses from its mid-February high extended to more than 20%.

Equities in Hong Kong and on the mainland have suffered as Beijing cracks down on heavyweight tech firms over monopolistic practices, adding to concerns of liquidity tightening in China. Chip-making giants Taiwan Semiconductor Manufacturing and Samsung Electronics were among the biggest contributors to the Asian benchmark’s gain Friday. Financials and industrials were other top-performing sectors. Yet even with Friday’s advance, the MSCI Asia Pacific Index dropped more than 3% this week, putting it on course for its worst weekly loss since February. Mark Matthews, head of Asia research at Bank Julius Baer & Co., expects “choppy” trading ahead for the region’s equities in the near term, as slow progress in vaccinations could lead to a divergence in economic fundamentals with places like the U.S. “You have to have a strong vaccination program in order to open up and rejoin the rest of the world and keep the virus at bay,” Matthews said, noting how some Asian countries are resorting to lockdowns again. “The longer that this persists I think it’s bad for Asia.”

Japanese shares led the rebound in Asian markets on Friday, building on the lead from investors on Wall Street snapping up stocks that would benefit most from an economic recovery. Japan’s Nikkei jumped 1.3%. The rally interrupted a three-day rout for stocks globally, as market jitters over accelerating U.S. inflation were calmed by Federal Reserve officials reiterating that price pressures from the reopening of the economy would prove transitory.

“U.S. equities were up, so there is a bit of relief in Asia,” said Frank Benzimra, head of Asia equity strategy at Societe Generale in Hong Kong. However, “we certainly are going to have some volatility near-term,” as markets react to CPI and other economic indicators for clues on the path for U.S. monetary policy. The Fed may open the discussion on tapering its asset purchases as soon as the policy meeting next month, he said.

In rates, the 10-year Treasury yield fell to 1.63% and Treasuries recovered from the prior session’s weakness, and outperformed Bunds. Treasuries rose with stock futures after regional bond buyers returned during Asia session. Treasury 10-year yields around 1.634% are ~2bp richer on the day; long-end-led gains flatten 5s30s and 2s10s by more than 1bp. Gains were sustained during European morning led by gilts with bunds lagging, as S&P 500 futures exceeded Thursday’s highs. A busy U.S. economic data slate includes retail sales and industrial production. U.S. swap spreads widen by up to 2bp across long-end following Thursday’s sharp tightening move.

In FX, the U.S. currency was steady against a basket of its major peers, with the dollar index consolidating around the 90.70 level for a second day on Friday, following Wednesday’s 0.6% jump. The Bloomberg Dollar Spot Index extended losses in the European session as the greenback fell versus all of its Group-of-10 peers and the euro climbed back above $1.21. Norway’s krone led G-10 gains, paring some of this week’s losses, after nearing the 55-DMA yesterday; the pound was the weakest G-10 performer on the day, but still headed for a second week of gains against a bruised dollar. The Aussie steadied but still headed for its biggest weekly decline in seven weeks, with losses driven by faster-than-expected U.S. inflation data and a slide in iron ore. Australia’s government said it’s ready to resume dialog with China. Japan’s bonds rose as the central bank’s purchases encouraged investors to take advantage of the recent increase in yields; the yen headed for a weekly loss. The yuan gained while most other emerging Asian currencies stayed in narrow ranges as investors assessed the impact of rising global inflation and coronavirus cases on the economic growth.

The market may still be finding its equilibrium after the post-CPI USD spike,” says Terence Wu, FX strategist at foreign- exchange strategist at Oversea-Chinese Banking Corp. “Expect major USD-Asia pairs to be implicitly heavy for now, save for the USD-SGD, which is higher on idiosyncratic COVID-19 developments”; he also said that the market is not yet in an outright risk-on mode, and sentiment could turn south again.

Some wondered if the bubble in commodities had popped as iron ore continued its fall from a record amid efforts by China to clamp down on surging prices, with the metal set for the biggest two-day plunge since 2019. Copper prices were on course for their first weekly decline since the start of April on Friday as rising inflation fears and a dip in demand from China dragged prices down. Oil prices remained subdued following a drop on Thursday as a recent rally paused as investors turned their attention to the coronavirus crisis in India, and as the top U.S. fuel pipeline network resumed operations. Brent crude was little changed at $67.02 a barrel, while U.S. West Texas Intermediate crude edged up 0.1% to $63.85 a barrel. Gold traded at around $1,824 an ounce at the end of the week, largely unchanged from the previous day, when it recovered some of Wednesday’s losses.

In cryptocurrencies, bitcoin recovered back over $50,000 on Friday, after plunging to a 2-1/2-month low of $45,700 in the previous session, while Ethereum was back over $4000, when a media report of a regulatory probe into crypto exchange Binance added to pressure from Tesla chief Elon Musk’s reversing his stance on accepting the digital currency. Much smaller rival dogecoin jumped as much as 20% to $0.52 after Musk said on Twitter that he was involved in work to improve the token’s transaction efficiency.

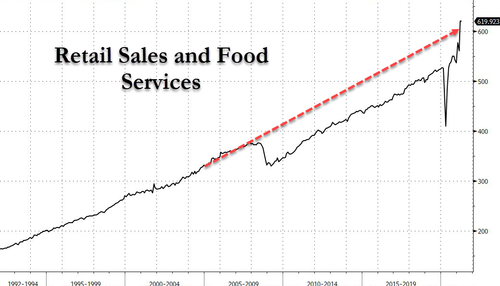

To the day ahead now, and the data highlights from the US include April’s retail sales, industrial production and capacity utilisation, along with the University of Michigan’s preliminary consumer sentiment index for May. From central banks, the ECB will be publishing the account of its April meeting, and Dallas Fed President Kaplan will be speaking.

Market Snapshot

- S&P 500 futures up 0.6% to 4,130.25

- STOXX Europe 600 up 0.3% to 438.83

- MXAP up 1.3% to 200.43

- MXAPJ up 0.8% to 670.04

- Nikkei up 2.3% to 28,084.47

- Topix up 1.9% to 1,883.42

- Hang Seng Index up 1.1% to 28,027.57

- Shanghai Composite up 1.8% to 3,490.38

- Sensex down 0.1% to 48,620.49

- Australia S&P/ASX 200 up 0.5% to 7,014.24

- Kospi up 1.0% to 3,153.32

- Brent Futures up 0.4% to $67.29/bbl

- Gold spot up 0.5% to $1,834.96

- U.S. Dollar Index down 0.32% to 90.46

- German 10Y yield down -0.9 bps at -0.130%

- Euro up 0.4% to $1.2124

Top Overnight News from Bloomberg

- U.K. ministers may bring forward second vaccine doses for millions of people and local restrictions could be imposed to curb the spread of a Covid-19 variant from India

- Bitcoin was on course for a weekly slump of more than 10% after Tesla Inc.’s Chief Executive Officer Elon Musk doubled down on his attack on the token’s energy demands

- Iron ore’s slump from a record accelerated as China ramps up efforts to control a dizzying surge in prices. Tangshan city banned steelmakers from fabricating or spreading price-hike information, the latest in a list of measures targeting the hub, after Premier Li Keqiang earlier this week urged China to deal with surging prices

- The U.K. Debt Management Office (DMO) announces the appointment of a syndicate to sell by subscription the forthcoming launch of the new 0 1/8% Index-linked Treasury Gilt 22-March-2039. The transaction is planned to take place in the week commencing 24 May 2021, subject to demand and market conditions

- Israel’s ground forces fired artillery into the Hamas-run Gaza Strip early Friday after a blistering four-day air assault failed to quell militant rocket attacks, sweeping aside international appeals for de-escalation and possibly preparing for an assault by troops

Asia-Pac stocks were higher as the region took impetus from the firm performance in the US where the major indices recovered from the recent inflation-triggered sell-off and snapped a 3-day losing streak, with sentiment helped by data releases including pandemic-low jobless claimant numbers and although PPI printed firmer than expected, it remained within the range of analysts’ estimates unlike the recent blow out CPI. ASX 200 (+0.5%) was led higher by commodity-related stocks and with the energy sector atoning for the underperformance in US counterparts despite the continued retreat of oil prices from cyclical highs, while Treasury Wine Estates was among the biggest gainers as it plans to pivot to the US market and focus on its profitable Penfolds brand in an effort to spur profit growth amid the impact from Chinese tariffs. Nikkei 225 (+2.3%) benefitted from recent favourable currency moves and the global stock rebound, which has helped participants look past the ongoing COVID concerns and looming inclusion of 3 additional prefectures to the state of emergency list. Hang Seng (+1.1%) and Shanghai Comp. (+1.8%) were also firmer but with gains initially moderated as US-China tensions lingered following comments from US Secretary of State Blinken who reiterated support for Australia against economic coercion from China and USTR Tai suggested new trade laws are required to address the anti-competitive threats from China against key high-tech US industries. Earnings releases also provided a catalyst for price moves with Alibaba shares the biggest laggard in the Hang Seng. Finally, 10yr JGBs were positive as they tracked the rebound in T-notes and with the BoJ also present in the market for nearly JPY 1.4tln of JGBs with 1yr-10yr maturities, although gains in the 10yr benchmark were capped amid the outperformance in Japanese stocks.

Top Asian News

- JD Logistics $3.5 Billion IPO Said to Draw SoftBank, Temasek

- IPhone Maker Hon Hai Again Warns Components Crunch Worsening

- Japan Post Insurer Will Buy Back $3.3 Billion of Its Shares

- China Orders Didi, Meituan to Rectify Ride-Hailing Abuses

Bourses in Europe trade with broad-based gains across the board (Euro Stoxx 50 +0.6%) following the recovery seen on Wall Street yesterday which resulted in a positive vibe reverberating across APAC after a tumultuous week. US equity futures also see modest gains with participants awaiting fresh fundamental catalysts and further US data releases in what has, thus far, been a quiet morning. Sectors in Europe are mostly in the green except for Basic Resources amid a pullback in base metal prices (see commodities section), but it is difficult to discern a particular risk profile. Banks, Insurance, Retail, Household Goods, Oil & Gas, and Tech reside as the top performers while Healthcare and Travel & Leisure dwell among the laggards. Travel & Leisure has been underwhelmed by reports of uncertainty regarding UK tourism in Portugal after the Portuguese “state of calamity” was extended. In terms of individual movers, Adidas (+1.2%) are firmer amid source reports that Authentic Brands Group has teamed up with Wolverine World Wide to offer around USD 1bln for Reebok, albeit sources valued the unit at around EUR 1.2bln back in February. Meanwhile, French heavyweight Danone (-1.7%) is pressured after being downgraded at Goldman Sachs.

Top European News

- U.K. Fraud Prosecutor Opens Investigation Into GFG

- German Curbs Set to Ease as Covid Cases Drop Below Key Level

- Londoners Eye a Return to City Center as Rental Viewings Soar

- Sanne Rises 28% After Rejecting Proposal at 830p/Share

In FX, the Dollar continues to cool off after its midweek melt-up in response to significantly stronger than forecast US CPI data, awaiting the remaining releases of the week that comprise retail sales, ip and preliminary Michigan sentiment with updates to year ahead and 5 year inflation expectations, all before another speech from Fed hawk Kaplan. The Buck is also drifting back amidst renewed bull-flattening along the Treasury curve, albeit fairly mild and more in relief that the latest Quarterly Refunding has been completed rather than a positive reaction to the long bond finale that was far from well received. Moreover, broad risk sentiment has recovered somewhat following a positive Wall Street session to ‘end’ a 3-day run of consecutive losses to leave the DXY prone to further retracement from Wednesday’s peaks and a test of support around 90.500 having narrowly failed to scale technical resistance ahead of 91.000 when the headline and core inflation heat was full on.

- CHF/EUR/NZD – All taking advantage of the Greenback’s loss of impetus, with the Franc now considerably closer to 0.9000 compared to just shy of 0.9100 at the current w-t-d peak and Euro looking appreciably more comfortable on the 1.2100 handle than it has of late, while the Kiwi is probing 0.7200 again irrespective of a marked slowdown in NZ’s manufacturing PMI.

- AUD/CAD/GBP/JPY – The Aussie has overcome another pretty sharp reversal in copper and iron ore overnight to bounce firmly from the low 0.7700 area vs its US counterpart, but may find the half round number above tough to breach again given 1.3 bn option expiry interest rolling off at the NY cut. Conversely, a recovery in oil has helped the Loonie pare declines and regain 1.2150+ status even though BoC Governor Macklem expressed concerns about further Cad appreciation and the adverse impact this might have on Canadian exports plus policy settings if the Loonie rallies a lot further. On that note, and for reference Usd/Cad hit circa 1.2046 lows only 2 days ago to set yet another multi-year trough and was as high as 1.2654 before the BoC tapered QE and swivelled hawkishly on rates. Elsewhere, the Pound is still pivoting 1.4050, but looks increasingly bearish against the Euro as the cross rebounds a bit further above 0.8600, while the Yen is straddling 109.50 where 1.1 bn option expiries reside and not displaying too much dismay over Japan’s deteriorating COVID-19 situation at this stage against the backdrop of more favourable (softer) UST yields.

- SCANDI/EM – Some relief for the Nok after Thursday’s slide via the aforementioned revival in risk appetite and crude prices, while the Mxn has reclaimed 20.0000+ status in wake of Banxico maintaining rates as expected, but retaining a commitment to ensure that headline inflation converges to the 3% target within the policy horizon. However, the Czk has not gleaned much upward thrust from CNB minutes largely confirming a hike in June.

In commodities, WTI and Brent front month futures have trimmed overnight losses and some more, with traders citing yesterday’s weakness to an unwind in the Colonial pipeline premium alongside the worsening COVID situation in Asia – with India still in a critical condition whilst Taiwan and Singapore see rising cases which prompted the latter to tighten restrictions. Meanwhile, geopolitics remain in vogue as the Israeli/Palestinian conflict remains heated, as headlines also emerged regarding an Azeri/Armenian violation and Russia is reportedly involved as a mediator. Meanwhile, there is little to report on the JCPOA front. WTI Jun has reclaimed a USD 64/bbl handle (vs low 63.33/bbl) whilst Brent Jul extends gains above USD 67/bbl (vs low 66.50/bbl). Elsewhere, precious metals have been moving in tandem with yields and the Buck and thus have been grinding higher, with spot gold just under USD 1,850/oz (vs low 1,826/oz) whilst spot silver inches higher above USD 27/oz. Base metals meanwhile have been seeing losses with LME copper back below USD 10,250/t at the time of writing following the recent run, whilst iron ore and coke futures in Dalian hit limit down overnight as China top steel-making Tangshan said it requires firms to control price surges and will severely punish price manipulation.

US Event Calendar

- 8:30am: April Import Price Index YoY, est. 10.2%, prior 6.9%; MoM, est. 0.6%, prior 1.2%

- 8:30am: April Export Price Index YoY, est. 14.0%, prior 9.1%; MoM, est. 0.8%, prior 2.1%

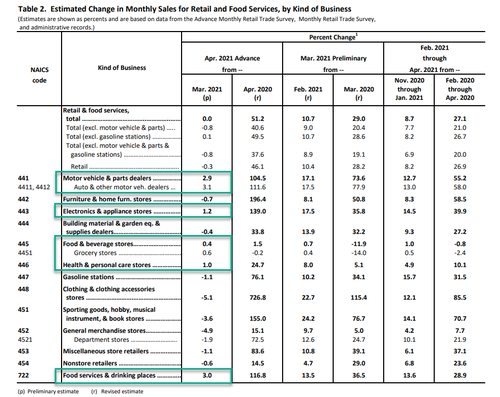

- 8:30am: April Retail Sales Advance MoM, est. 1.0%, prior 9.8%, revised 9.7%

- April Retail Sales Ex Auto MoM, est. 0.6%, prior 8.4%

- April Retail Sales Control Group, est. -0.4%, prior 6.9%;

- 9:15am: April Industrial Production MoM, est. 0.9%, prior 1.4%; Manufacturing Production, est. 0.3%, prior 2.7%

- 10am: March Business Inventories, est. 0.3%, prior 0.5%

- 10am: May U. of Mich. Sentiment, est. 90.0, prior 88.3; Expectations, est. 84.5, prior 82.7; Current Conditions, est. 99.8, prior 97.2

- 10am: May U. of Mich. 5-10 Yr Inflation, prior 2.7%; 1 Yr Inflation, est. 3.5%, prior 3.4%

DB’s Jim Reid concludes the overnight wrap

Following a torrid start to the week, markets finally showed signs of recovering their footing yesterday, something that’s extending overnight. The S&P 500 (+1.22%) and the MSCI World Index (+0.55%) both advanced after a run of 3 successive declines. The mood got better as the day went on, with Europe’s STOXX 600 pulling back from an intraday low of -1.75% to close just -0.14% lower, while S&P 500 futures were also pointing lower during the morning in Europe (-0.72% at the lows). Markets are hanging on the current dovish words from Fed officials to offset some of the inflation shock but relatively positive data on US jobless claims also helped to support the mood, which saw 444 companies in the S&P 500 move higher on the day, the broadest advance in over a month. Technology stocks continued to underperform, with the NASDAQ up “just” +0.72% and with the NYFANG+ index declining -0.73%, with the latter heavily-concentrated index now down -2.25% YTD.

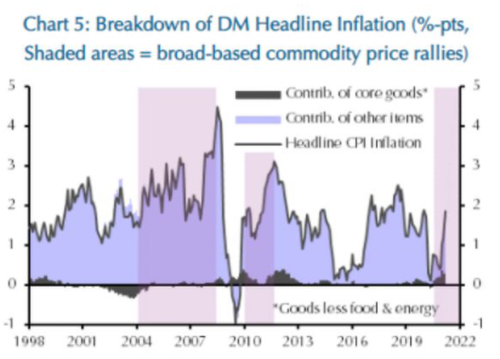

Indeed yesterday’s Fed speakers helped to reassure investors that the central bank was in no hurry to raise rates, and expectations for future rate hikes moved down marginally from where they were the previous day. Richmond Fed President Barkin said that he didn’t see persistent recurring inflation as likely, while later on Fed Reserve governor Waller joined the chorus saying that the rise in prices is “temporary”. This comes even as he forecasts inflation remaining above the 2% target through 2022, though he acknowledged that persistent 4% monthly increase would be “very concerning”. Waller wants to observe a few months of economic data before calling any point an outlier or adjusting any policy stances. Waller explained that, “despite the unexpectedly high CPI inflation report yesterday, the factors putting upward pressure on inflation are temporary, and an accommodative monetary policy continues to have an important role to play in supporting the recovery.” St. Louis Fed President Bullard, a non-voter this year, thinks that inflation “is likely to be meaningfully above 2% over the forecast horizon,” but that an inflation outcome modestly above the 2% inflation target in the short term “would be a welcome development for the FOMC, as inflation has generally been below target for many years.” So no real concern. Overall the Fed are seemingly doubling down on the transitory inflation message which will help the market in the short-term but creates more asset price risk if they are forced to admit that there is a permanence to some of the inflation further down the road.

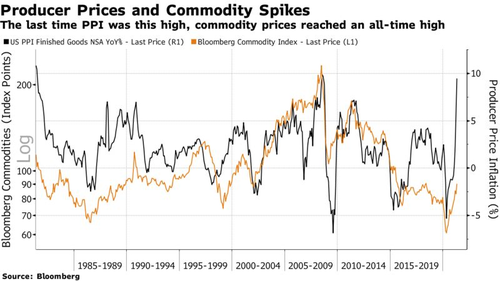

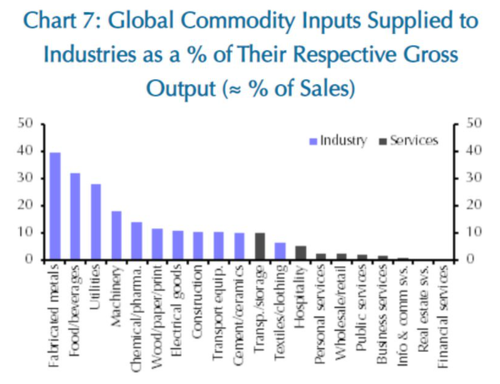

Another small respite on the inflationary front yesterday came from declines in a number of key commodities, with Bloomberg’s commodity spot index down -2.31% yesterday in its worst day for nearly two months. Obviously this is just one day lower in what’s generally been a strong march upwards over the last year, but the rise in a number of key inputs has been a contributing factor to the strong price pressures we’ve seen lately. In terms of the specific moves, both WTI (-3.42%) and Brent crude (-3.27%) oil prices lost ground, copper (-0.99%) fell for a 2nd day running, and corn futures were down -5.08% as they remained on track to end a run of 6 successive weekly advances.

Nevertheless, while commodity prices were falling, the latest data on US producer prices added to the theme of building inflationary pressures, with the month-on-month reading coming in at a stronger-than-expected +0.6% in April (vs. +0.3% expected), which in turn sent the year-on-year number up to +6.2%. All eyes will be on today’s retail sales reading to see where that comes out for April, with our economists expecting a +2.0% monthly gain on the headline number. The CoTD yesterday (link here) showed that we’ve already pulled forward around 5yrs of retail sales growth since the pandemic started. Remarkable.

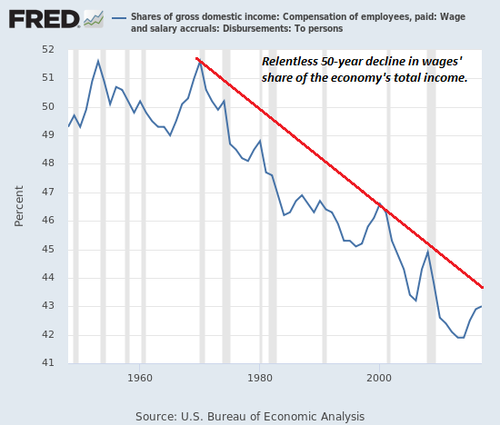

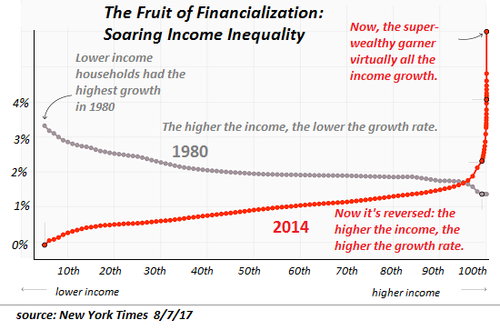

Ahead of this report, we also got some positive signs on recent labour market progress following the disappointing April jobs report, as the initial jobless claims for the week through May 8 fell to 473k (vs. 490k expected), their lowest level since the pandemic began. Interestingly, in yet another sign that firms were struggling to hire in the current labour market, McDonald’s announced that they’d be raising hourly wages in company-owned restaurants by 10% on average. Amazon joined in yesterday announcing that its hiring 75k employees across the US and Canada with a focus on positions in its warehouses. In order to entice potential employees, the retailer is offering a $100 bonus if workers are already vaccinated and signing on bonuses of as much as $1000 in some locations. Wages also reportedly have increased to $17/hr, a marked increase from the $15/hr starting wage typically offered by the firm. Is the “Amazonification” impact becoming more balanced rather than just disinflationary?

Back to markets and Sovereign bond yields hit fresh highs in Europe yesterday, although they came off these heady heights towards the close. Yields on 10yr bunds were up a further +0.5bps to their highest level in nearly 2 years, as were 10yr gilts with their own +1.2bps increase. Treasuries had a much stronger performance however, with 10yr yields coming down -3.4bps to 1.657%, which included a decline in inflation breakevens (-2.6bps) to 2.54%, coming off their 8-year high the previous day.

Overnight in Asia, markets have taken Wall Street’s lead with the Nikkei (+2.27%), Hang Seng (+0.95%), Shanghai Comp (+1.21%) and Kospi (+0.81%) all up. Futures on the S&P 500 are also up +0.47%. Elsewhere, in a further sign of easing commodity prices, iron ore prices are down -8.87% this morning while SHF steel rebar prices are also down -6%. In other news, the Federal Reserve in its new schedule, which runs from May 14 to June 11, has tweaked the US treasury purchases to buy more securities maturing in seven years or longer while keeping the monthly pace at about $80bn. The Fed will now buy $20.25bn in those longer terms tenors (vs. $17.75bn previously).

Elsewhere, bitcoin (-9.5%) saw a significant slump yesterday as the cryptocurrency fell back beneath the $50,000 mark again, closing beneath that level for the first time since April 25. It’s fairly flat overnight. As we touched on in yesterday’s edition, this followed Elon Musk tweeting that Tesla was suspending vehicle purchases using bitcoin, saying that they were concerned about its use of fossil fuels. Later in the day, he went on to put out another tweet highlighting its electricity consumption, which is something that we previously highlighted in a CoTD back in February (link here). Nevertheless, even before Musk’s tweets there were already signs that the astonishing rally we saw in bitcoin around the turn of the year has begun to peter out, with April seeing its first monthly decline since September, and its performance so far in May leaving it on track for a second one.

On the pandemic, the news continued to brighten somewhat at the global level, with the rate of new cases continuing to decline since their peak 2 weeks ago. However, a number of countries in Asia are continuing to impose fresh restrictions to deal with the pandemic. Overnight, the Japanese government has said that it will be expanding the state of emergency to three more prefectures to include the northern island of Hokkaido as well as the Hiroshima and Okayama prefectures, effective from May 16 through to the end of the month. Japan’s current emergency measures covers Tokyo, Osaka, Hyogo, Kyoto, Aichi and Fukuoka prefectures, which make up about 40% of the country’s economy and the imposition of emergency rules in the additional prefectures increases the risk that the economy might slip back into recession. Singapore’s local cases have now also risen to the highest since July and this is leading to concerns that a travel bubble with Hong Kong may get delayed again.

Meanwhile, here in the UK, the government might bring forward second vaccine doses for millions of people, according to a Bloomberg report. This comes as the spread of a Covid-19 variant from India has risen to 1,313 new cases from 520 over the past week and Public Health England has assessed the strain to be “at least as transmissible” as the so-called Kent variant that took hold in December. Elsewhere the US announced passing another marker on the path-to-normal, as the CDC said fully vaccinated Americans no longer need to physically distance or wear masks indoors or outside. However the mask guidance remains in place for airports, trains and other forms of public transportation. 59% of American adults have now received at least one shot, though vaccination raters have slowed somewhat over the last few weeks. In a move that could have follow-through to employment numbers, the president of the largest teacher union in the US (American Federation of Teachers) called on a full reopening of schools in the Fall, a critical shift from an important voice in the effort.

To the day ahead now, and the data highlights from the US include April’s retail sales, industrial production and capacity utilisation, along with the University of Michigan’s preliminary consumer sentiment index for May. From central banks, the ECB will be publishing the account of its April meeting, and Dallas Fed President Kaplan will be speaking.