US equity futures fluctuated – first rising then sliding for a 4th session – in a volatile overnight session which saw global stocks fall to a six-week low as inflation fears continued to depress investor sentiment. One day after the S&P suffered its biggest one-day percentage drop since February it feels almost impossible how quickly sentiment has shifted and that the S&P hit an all time high just 4 days ago on Monday. It’s been non-stop selling since then.

Losses this week have pulled the S&P 500 4% off its record closing high on Friday, while the tech-heavy Nasdaq is about 8% below its April 29 all-time high. At 700 a.m. ET, Dow e-minis were down 144 points, or 0.43%, S&P 500 e-minis were unchanged and Nasdaq 100 e-minis were up 40.25 points, or 0.29%.The dollar rose to a one-week high and yields were stable, as investors awaited producer prices data, another inflation gauge, to see if a rise in prices would be strong enough to prompt a sooner-than-expected increase in interest rates.

Some notable premarket movers:

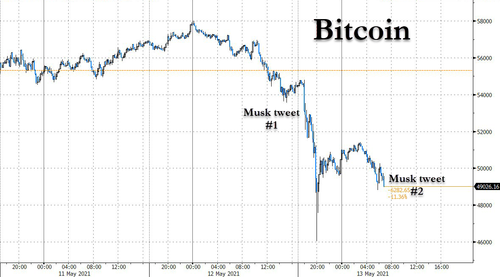

- Tesla rose to premarket highs after earlier falling as much as 3.1% earlier after CEO Elon Musk said the company is suspending purchases using Bitcoin, making a U-Turn from earlier this year, when the electric-vehicle maker said it planned to accept it as a payment.

- Cryptocurrency-exposed companies pared their losses in U.S. premarket as futures contracts on the Nasdaq 100 and S&P 500 erased their declines. Coinbase is now down only 2.2% after falling as much as 6% earlier, Marathon Digital -12% after dropping as much as 18% earlier, Riot Blockchain -8.8%, Bit Digital -5.3

- Shares in oil major Exxon Mobil and copper miner Freeport-McMoran dropped, tracking a fall in commodity prices, while lenders, including Bank of America and Goldman Sachs fell 0.8% and 1.7% in premarket trading.

- Dating app owner Bumble slipped 1% despite forecasting current-quarter revenue above estimates. The stock has shed about 19% of its value in the past three sessions.

- Walt Disney’s shares dropped 1.6% ahead of its second-quarter results due after the closing bell.

The MSCI World Index sank for a fourth day, losing 0.6% in the longest selloff since September. S&P 500 contracts dipped 0.4%, while Asian and European equities saw steeper losses. Asian stocks entered a technical correction after the MSCI Asia Pacific Index fell as much as 1.5%, extending losses from a Feb. 17 peak to 10%. Oil declined as the largest U.S. gasoline pipeline resumed service. Bitcoin dropped toward $50,000 as Tesla Inc. suspended purchases using the cryptocurrency.

European stocks slid on Thursday, tracking an overnight selloff on Wall Street, as a rapid rise in U.S. inflation spooked investors, while a drop in commodity prices weighed on heavyweight miners. The European STOXX 600 index fell 1.4%, drifting further away from an all-time high it hit earlier this month; it remains up almost 10% so far this year as economic recovery prospects and strong earnings drew buyers of equities. Basic resources and oil and gas sectors, among recent market leaders on the back of a surge in commodity prices, fell about 3%. Automakers also shed more then 3%, while defensive names like healthcare and telecoms posted small losses. The Stoxx Europe 600 Basic Resources Index (SXPP) drops as much as 2.7%, as iron ore futures sink amid growing inflation concerns and on Chinese moves to try to control the surge in commodities prices.

“The debate as to what the Fed will do will continue, and we’ve seen in terms of the market that after economic growth peaks, there tends to be a lull for six months or so,” said Frederique Carrier, head of investment strategy at RBC Wealth Management. “We think that returns are going to be modest at best over the next six months. Market could go sideways and there could be more volatility.”

Here are some of the biggest European movers today:

- Telefonica shares jump as much as 4.6% after 1Q results with Citi highlighting that the operator benefited from price rises in Spain. The market may view the earnings with relief, though will likely remain concerned by weak fundamentals, broker says.

- Pirelli gains as much as 2% in Milan trading and is the day’s best performer on the FTSE MIB benchmark after 1Q revenue beat estimates. Mediobanca upgrades, noting limited downside risk.

- Burberry tumbles as much as 10% after FY22 margin guidance disappointed. The guidance suggests consensus estimates for operating margin will be cut by at least 50 bps, Morgan Stanley said.

- On The Beach slumps as much as 12% after the online seller of packaged vacations said it’s extending the off-sale period for holidays from June 30 to Aug. 31, following this week’s U.K. government announcement on the traffic-light system for leisure travel.

- BT drops as much as 5.9%, the worst day since last July, after the carrier’s results missed adjusted Ebitda estimates.

- Hargreaves Lansdown falls as much as 6% after a quarterly update that suggests normalizing trading volumes, according to Morgan Stanley.

The pain was even worse earlier in the session, when the MSCI Asia Pacific Index fell for a third day, wiping out this year’s gains; the index fell as much as 1.5%, extending losses from a Feb. 17 peak to 10%, and entering a technical correction. Technology, communication services were the biggest drags on the Asian benchmark.

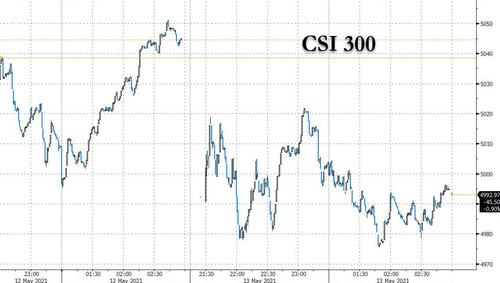

China stocks slid, tracking losses in U.S. shares on higher-than-expected inflation data there, as the materials sector tumbled after the government called for measures to deal with “overly fast” commodity price rises. The benchmark CSI 300 Index ended 1% lower, dragged by a 4.2% plunge in the materials subgauge that was its largest in seven weeks. The 10 biggest decliners in the main index were all from the sector, with Aluminum Corp of China sinking 9.2% to be the worst performer. Consumer discretionary shares were down 2.7%, with Gongniu Group among the biggest laggards after the company said it was under monopolistic probe by a local government. China needs to effectively deal with the commodity price surge and strengthen the coordination of monetary policies with other measures to ensure the stable operation of the economy, the state-run Xinhua news agency reported, citing a meeting of the State Council, the country’s cabinet, on Wednesday.

In Japan, the Nikkei 225 extended its drop to as much as 2.6%, briefly erasing its gains in 2021 as it faced the worst weekly loss since April 2020. SoftBank Group, Fast Retailing, Tokyo Electron lead losses; the Topix was down 1.5%.

In rates, treasuries were little changed trading near the low end of Wednesday’s range, with curve slightly flatter, after erasing gains. Treasury 10-year yields around 1.697% are less than 1bp higher on the day; bunds lag by 3bp, gilts by 4bp on Ascension Day holiday in some euro-area countries including Germany and France. Dip-buying emerged during an active Asia session in which cash and futures volumes were almost double recent average. The Treasury auction cycle concludes with $27b 30-year bond sale at 1pm ET; Wednesday’s 10-year stopped through by more than 1bp; the WI 30-year yield is around 2.395% is above auction stops since November 2019 and 7.5bp cheaper than last month’s, which stopped through by 1.6bp. Yield curves in Europe bear steepen. BTPs widen across the curve to bunds, trading around session lows after a soft reception at today’s auctions.

In FX, the Bloomberg Dollar index held steady around Wednesday’s best levels. A gauge of the dollar’s implied volatility climbed to a one- month high after a surprisingly strong U.S. inflation print prompted traders to recalibrate bets for an interest-rate hike. Still, options traders haven’t determined whether that makes for a stronger greenback. The Australian dollar fell to its lowest in over a week as iron ore futures dropped after Chinese Premier Li Keqiang urged the country to deal with the surge in commodity prices and its impact. The yen and Swiss franc led advances as global stocks fell to a six-week low and U.S. equity futures retreated. NOK and AUD are the worst performers in G-10, CHF outperforms. EUR/USD briefly tests 1.21 before paring gains. TRY lags in EMFX. Bitcoin remains ~8% lower after its overnight slump.

In commodities, front-month crude futures drop over 2%: WTI trades back on a $64-handle, Brent back below $68. Spot gold trades near $1,814/oz, holding a narrow range close to Wednesday’s worst levels. Base metals are in the red with LME nickel slumping close to 3

After yesterday’s CPI shocker, the Labor Department’s data is likely to show U.S. producer prices rose 0.3% last month after a gain of 1% in March. A separate report is expected to indicate claims for U.S. unemployment benefits was below 500,000 in the latest week, for the third time in a row.

Looking at the day ahead, the data highlights will include the April PPI reading from the US, as well as the weekly initial jobless claims. Central bank speakers include BoE Governor Bailey and Deputy Governor Cunliffe, the Fed’s Barkin, Waller and Bullard, the ECB’s Centeno and BoC Governor Macklem. Finally, earnings releases include Disney, Airbnb and Alibaba.

Market Snapshot

- S&P 500 futures down 0.5% to 4,039.50

- MXAP down 1.5% to 198.62

- MXAPJ down 1.4% to 667.78

- STOXX Europe 600 down -1.36% to 431.97

- Nikkei down 2.5% to 27,448.01

- Topix down 1.5% to 1,849.04

- Hang Seng Index down 1.8% to 27,718.67

- Shanghai Composite down 1.0% to 3,429.54

- Sensex down 1.0% to 48,690.80

- Australia S&P/ASX 200 down 0.9% to 6,982.72

- Kospi down 1.3% to 3,122.11

- Brent Futures down 2.2% to $67.79/bbl

- Gold spot up 0.0% to $1,815.77

- U.S. Dollar Index little changed at 90.72

- German 10Y yield rose 1.9 bps to -0.105%

- Euro little changed at $1.2084

Top Overnight News from Bloomberg

- Fighting between Israel and Gaza Strip militants is spilling over into communal clashes inside Israel, where decades of pent- up grievances and nationalism have exploded into mob violence between Arabs and Jews

- Tesla Inc.’s Chief Executive Officer Elon Musk said the electric-vehicle manufacturer is suspending purchases using Bitcoin, triggering a slide in the digital currency

- South Korea unveiled plans to spend roughly $450 billion to build the world’s biggest chipmaking base over the next decade, joining China and the U.S. in a global race to dominate the key technology

- U.S. consumer prices are rising the most in decades, which, on its own, might suggest trouble for the world’s largest economy as it looks to recover from the Covid-19 pandemic. However, Americans are simultaneously freeing up space on their credit cards like never before, which could allow them to better withstand such increases in at least one sign that a sustained upward spiral in inflation can’t be dismissed so easily.

Asian equity markets were pressured following on from the losses in the US as US CPI printed its highest reading since 2009 which spurred a rise in yields and extension of the losses across the major indices with both the S&P 500 and DJIA posting their worst 3-day performance in over 6 months. ASX 200 (-0.9%) traded negatively with the index weighed on by underperformance in tech and weakness in property names although the downside for the local benchmark was stemmed by strength in healthcare after reports that Australia agreed to purchase a total 25mln doses of the Moderna (MRNA) COVID-19 vaccine through to next year and the Health Minister also noted they are in discussions with Moderna to locally manufacture its vaccine. Nikkei 225 (-2.5%) spearheaded the declines in the region once again as earnings releases failed to lift the mood with SoftBank investors disappointed by the lack of extension to the share buyback program and after the Co. announced it is to self-finance its Vision Fund to cut big investor pay-outs but would also expose the group to heavy losses in the event of a major downturn. Hang Seng (-1.8%) and Shanghai Comp. (-1.0%) conformed to the subdued picture across the region with risk appetite not helped after further criticism from the US regarding human rights abuses by China including in the annual International Religious Freedom Report, and after the latest Chinese lending and financing data also fell short of estimates, while the TAIEX (-1.4%) briefly recouped early losses after local reports stated that Taiwan sees a smaller chance of raising the COVID-19 alert although the recovery was only brief. Finally, 10yr JGBs were lower amid spillover selling from the vicious treasury sell-off that was triggered by the highest US inflation reading in more than a decade and after a decent US 10yr auction did little to help claw back losses. Nonetheless, Asia-Pac yields were relatively stable overnight following mixed results at the 30yr JGB auction and with Aussie yields unmoved by the RBA’s regular QE purchases.

Top Asian News

- China Property Stock Sinks on Spinoff Plan, Spooking Bondholders

- Evergrande Raises $1.4 Billion Selling Shares in EV Unit (2)

- Senate Panel Advances Bill to Counter China in Bipartisan Vote

- Asian Stocks Set to Enter Correction on Inflation, Virus Woes

Bourses across Europe trade with losses, albeit off worst levels (Euro Stoxx 50 -1.5%) as the region plays catch-up to the stock rout on Wall Street which continued into APAC trade amid the US CPI-exacerbated inflation concerns, whilst the intensifying conflict in Israel/Gaza adds to the soured mood. Traders will be keeping a keen eye on the US Jobless Claims later today for any nuances that could pressure the Fed alongside the PPI print. US equity futures have re-joined the sell-off after some overnight consolidation, with the NQ, YM, RTY, and ES printing below yesterday’s respective lows as the US 10yr yield remains close to yesterday’s highs. Back to Europe, with Scandi and Swiss markets away in observance of Ascension Day, the remaining bourses largely see broad-based losses with the DAX cash and futures below 15k and FTSE 100 (-2.0%) the narrow laggard as losses in its mining giants weigh. The Basic Resources sector is the clear laggard as copper and iron ore prices see a sizeable pullback following their recent bull runs. Overall, sectors portray a more defensive tone and a “risk-off” mood, with Staples, Utilities, and Healthcare all faring slightly better than their counterparts, although the Healthcare sector also sees giants Roche and Novartis out of action due to the public holiday. In terms of individual movers, Burberry (-8.0%) resides at the foot of the Stoxx 600 despite reinstating its dividend and reporting a sales rebound as focus turns to the Chinese market in the months ahead amid the Burberry boycott in light of comments made over China’s human rights policy. Prudential (-5.5%) accelerated losses after announcing an intent to raise USD 2.5-3bln in equity. To the upside meanwhile, Telefonica (+2.7%) is one of the top large-cap performers following an earnings beat across the board.

Top European News

- U.K. 10-Year Yield Rises to 0.92%, Highest Since March 2020

- Italy Bonds Fall Ahead of Debt Sales; Large Screen Selling Seen

- Barclays Sees Value in Renewables, But Says Stay Selective

- Rolls-Royce Pins Hopes on Second Half With Big Jets Sidelined

In FX, choppy trade and some consolidation in the aftermath of Wednesday’s blow-out US CPI data, with the DXY also succumbing to a bit of resistance and offers into 91.000 as several key technical levels straddle the round number, including the 21 DMA (90.932), 100 DMA (91.062) and 21 WMA (91.087). However, this was relatively short-lived and after pause for breath in wake of its swift and sizeable rise from 90.153 to 90.798 yesterday, the index and Greenback in general are advancing again as Treasury and other debt yields remain elevated and the Buck retains a firm underlying bid on risk-off premium given the ongoing slump in global stock markets on ramped up reflation vibes. Moreover, several big option expiries could keep the Dollar underpinned vs major peers and the DXY aloft within a higher 90.909-587 range. Ahead, jobless claims, PPI, the final leg of Quarterly Refunding and yet more Fed commentary.

- CHF/JPY/NZD – The Franc, Yen and Kiwi are holding up a bit better than their G10 counterparts in the face of renewed Greenback strength and a fair degree of spread convergence between Swiss, Japanese and NZ bonds vs USTs is providing a buffer. Accordingly, Usd/Chf remains capped just under 0.9100, Usd/Jpy has faded around 109.79 and Nzd/Usd is back above 0.7150 following a brief dip below.

- EUR/AUD – Both looking susceptible to steeper depreciation vs their US rival, with the Euro only just recovering from a stop-chase through the 21 DMA (1.2064) in time to avoid more sell orders sitting at or beneath 1.2050. Nevertheless, Eur/Usd also faces heavy and layered option expiry interest from the round number above to 1.2150, including 1.3 bn at 1.2100, 1 bn from 1.2115-35 and the same size between 1.2140-50. Meanwhile, the Aussie is trying to keep tabs on the 0.7700 handle with the aid of 1 bn expiries starting from 0.7690 and ending at the strike after declining alongside copper and other base metals overnight, but will have to do very well to reclaim more lost ground given expiries beyond 0.7750 (at 0.7760-65 and 0.7790-95 in 1 bn apiece) and the fact that the half round number was not pierced earlier.

- GBP/CAD – Sterling is rotating around 1.4050 after finally losing sight of 1.4100 in the post-US inflation data fallout, awaiting independent impetus and direction via BoE speakers, while the Loonie has retraced from fresh 8 year or so midweek peaks in tandem with a retracement in crude prices between 1.2104-57 parameters and also looking for Central Bank inspiration via BoC Governor Macklem.

In commodities, WTI and Brent front month futures see hefty losses in early European trade with the complex subdued as the Colonial Pipeline premium unwinds, whilst the soured tone across markets exacerbate losses. WTI Jun sees itself on either side of USD 64.50/bbl (vs high 65.81/bbl) while Brent July dipped blow USD 68/bbl (vs high USD 69.04/bbl). That being said, the geopolitical landscape remains heated amid the intensifying Israeli/Gaza conflict whereby the US sided with the former and Russia with the latter, meanwhile, Israel is poised to ramp up its military offensive with a ground invasion of Gaza later today according to reports. Furthermore, separate reports suggested that Houthi-led rebels have carried out “a large joint offensive operation” against Saudi, with Aramco facilities among the targets. Elsewhere, the JCPOA has taken somewhat of a backseat at the moment given the market focus on the inflation narrative and geopolitics in the Middle East, although officials did note that negotiations will have to pick up the pace to reach a deal within weeks. Over to metals, spot gold and silver remain suppressed by post CPI yields and the Buck, with the former around USD 1,815/oz (vs high 1,822/oz) whilst spot silver dipped below USD 27/oz (vs high USD 27.24/oz). In terms of base metals, copper and iron ore futures eased following the recent bull run, with LME copper back below USD 10,500/t as the soured risk tone caps upside.

US Event Calendar

- 8:30am: May Initial Jobless Claims, est. 490,000, prior 498,000; Continuing Claims, est. 3.65m, prior 3.69m

- 8:30am: April PPI Final Demand MoM, est. 0.3%, prior 1.0%; PPI Final Demand YoY, est. 5.8%, prior 4.2%

- 8:30am: April PPI Ex Food, Energy, Trade MoM, est. 0.3%, prior 0.6%; 8:30am: PPI Ex Food, Energy, Trade YoY, est. 4.3%, prior 3.1%

- 8:30am: April PPI Ex Food and Energy MoM, est. 0.4%, prior 0.7%; PPI Ex Food and Energy YoY, est. 3.8%, prior 3.1%

DB’s Jim Reid concludes the overnight wrap

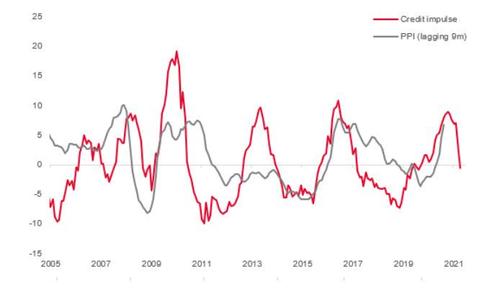

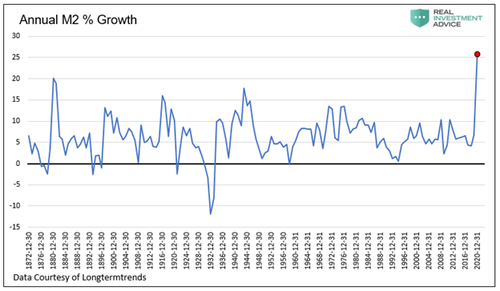

Well, well, well. That was an exciting day to be working in financial markets. Does that US CPI print get us closer to the inflation regime shift that we’ve been calling for this year? It’s dangerous to read too much into one number but the broad strength gives us confidence that this is not just a transitory story. Another buzz word for us has been how this year will be “complicated” for markets especially once reopening happens. This release personifies that thought process. You may get dull periods but this year is going to be a big battle between the bullishness of mass reopening/stimulus on one hand and the inflationary consequences on the other. Expect regular pockets of vol. I still lean heavily on the inflationary camp but the reality is that the battle is still in the early stages and non-inflationists will still be able to use the transitory argument for several more months yet.

To run through the headlines, the April CPI print came in at a much stronger-than-expected +0.8% on a month-on-month basis (vs. +0.2% expected), which in turn sent the year-on-year print to +4.2%, which was above every economists’ estimate on Bloomberg and the highest it’s been since September 2008. Core inflation didn’t provide any respite either, with the +0.9% monthly increase being the fastest pace of core price rises since September 1981, sending the annual number up to +3.0%, the highest since January 1996.

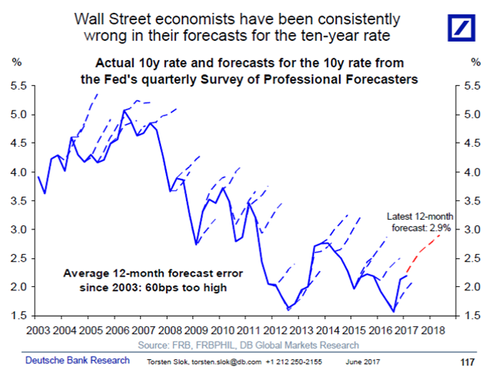

Sovereign bond yields shot up in response to the print on both sides of the Atlantic, with yields on 10yr US Treasuries up +7.0bps to 1.692%. The move was driven by higher real yields (+4.9bps) rather than inflation expectations (+2.2bps), but with 10yr breakeven closing at 2.56%, a level not seen in more than 8 years. This rise in inflation expectations was evident across the curve, with the 5yr breakeven climbing +3.5bps to 2.75%, a level not seen since 2005. However inflation expectations were even higher intraday with the 5yr breakeven rising +11bps intraday, which would have been the largest daily rise since back in November when we got the first efficacy news from the Pfizer trials.

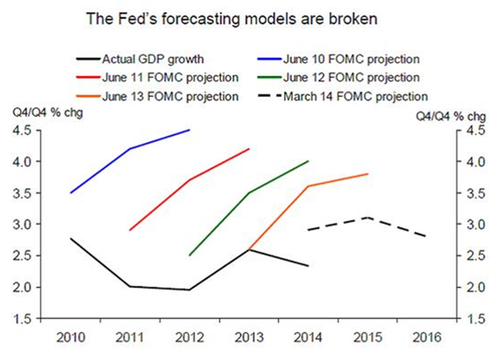

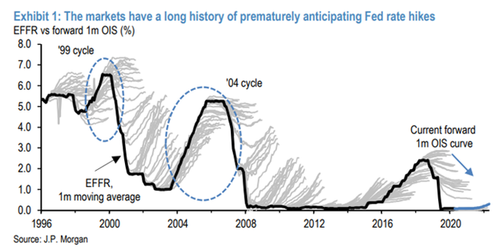

Of course, markets are now on edge as to what this might mean for monetary policy, but the Federal Reserve officials we heard from yesterday predictably downplayed the report and continued their mantra that any rises in inflation would prove temporary. Vice Chair Clarida said that he was surprised by the reading, but his speech still said that he expected “inflation to return to – or perhaps run somewhat above – our 2 percent longer-run goal in 2022 and 2023”, with this outcome being “entirely consistent” with the Fed’s new framework. Governor Bostic added later in the day that he was “expecting a lot of volatility at least through September” on inflation readings as transitory and base effects work through the data. He went on to say that “then we will have to see what is happening with the supply chain disruptions and the commodities prices and those sorts of issues.” The Fed is going to have a real communication and policy problem if this inflation isn’t transitory. This number is a huge headache for them regardless of the public pronouncements.

The strong inflation number meant that US equities continued their slump for a 3rd day running, with the S&P 500 down another -2.14%, as the VIX index of volatility rose a further +5.8pts to a fresh 2-month high of 27.6pts. The S&P has pulled back every day this week after hitting a new high on Friday after the historic miss in the US jobs report. The index has now fallen -4.01% this week, the worst three-day stretch since the last week of October. Tech stocks led the declines with the NASDAQ down -2.67%, which means the index has now lost -7.8% since its all-time high in late April. The selling was very broad, with 94% of the S&P 500 trading lower and 23 of the 24 industry groups negative yesterday with 15 of these seeing losses over 2.0%.Energy stocks (+0.06%) were the lone exception, buoyed by both Brent crude (+1.12%) and WTI (+1.23%) oil prices closing at their highest level since the pandemic began. For Europe it was a brighter picture however, with the STOXX 600 recovering +0.30% following its worst day so far this year on Tuesday and closing before the last leg of the US sell-off. The STOXX Banks index advanced +1.17% to a post-pandemic high as sovereign bond yields in Europe hit fresh highs.

10yr bunds (+3.8bps) and gilts (+5.3bps) hit levels not seen in nearly 2 years, at -0.12% and 0.89% respectively. Breakevens moved higher across the continent, with 10yr German ones at a 7-year high of 1.48%, while the 5y5y forward inflation swap for the Euro Area was up +3.0bps to 1.63%, a level not seen in over 2 years.

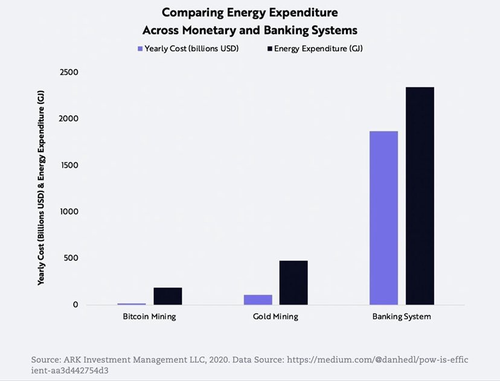

There are some signs of markets stabilising overnight with futures on the S&P 500 up +0.33%. Asian markets are catching down still though with the Nikkei (-1.60%), Hang Seng (-0.92%), Shanghai Comp (-0.74%) and Kospi (-0.73%) all trading in the red. European equity futures are also pointing to a weaker open as the markets here catch up with last leg of the US sell-off last night. Elsewhere, Bitcoin is down -6.83% overnight to $50,759 after Elon Musk tweeted that Tesla has suspended vehicle purchases using the digital currency over environmental concerns in its mining process. As a reminder from a CoTD we did earlier this year, if Bitcoin was a country it would use around the same amount of electricity a year to mine as Switzerland does in total. There are always those that say that a lot of it is renewable but an awful lot is not as well! See here for that CoTD. Musk added that Tesla will not be selling any Bitcoin. The tweet had sent the crypto currency down as much as -15% at one point in time.

Another big event yesterday was the meeting between President Biden and congressional leaders from both parties over the administration’s economic proposals. President Biden sought to offer optimism, while citing the partisan divide, saying he would see if he could “reach some consensus on a compromise.” While both Republican leaders, McConnell and McCarthy, said that there were places where they could find bipartisanship they also reiterated they were committed to a plan far smaller than President Biden’s proposed $ 4 trillion. One line that has been drawn is a corporate tax raise to 21% that undoes the 2017 tax cuts, with McConnell saying that would be “our red line.” Politically speaking, the higher inflation numbers aided Republican talking points, who have been calling for restraint on the economic proposals, in part because of the risk of higher prices.

There wasn’t a great deal of news on the pandemic yesterday. The EU’s executive branch has asked the 27 member states to enact a non-essential travel ban on India only allowing EU citizens and long-term residents to travel. With all the talk of breakdowns in supply chains, the news out of Brazil that they are likely to run out of ingredients for Astazeneca’s vaccine by the end of the week is a concern. Elsewhere, in the US, the CDC has approved the Pfizer/BioNTech shot for those 12-15yrs old with just the FDA’s sign-off needed before the shots can be distributed. Sticking with vaccines, researchers from University of Oxford reported in The Lancet medical journal that people who got one dose of AstraZeneca’s shot and another of Pfizer’s vaccine reported more short-lived side effects such as fatigue and headaches with most of them being mild. The results are early findings from a study that has yet to show how well such a cocktail defends against the virus.

Looking at yesterday’s other data, the main highlight was the Q1 GDP reading from the UK, which showed a slightly smaller-than-expected-1.5% contraction (v.s -1.6% expected), with the monthly GDP reading for March of +2.1% (vs. +1.5% expected) outperforming expectations. Our UK economist has revised up his 2021 forecast in response (link here) and now sees GDP growth this year at +6.7%. Separately in the Euro Area, industrial production rose by just +0.1% in March (vs. +0.8% expected), though the European Commission upgraded their projections in their latest forecast, which now sees the Euro Area growing by +4.3% this year and 4.4% next (vs. +3.8% for both years in February).

To the day ahead now, and the data highlights will include the April PPI reading from the US, as well as the weekly initial jobless claims. Central bank speakers include BoE Governor Bailey and Deputy Governor Cunliffe, the Fed’s Barkin, Waller and Bullard, the ECB’s Centeno and BoC Governor Macklem. Finally, earnings releases include Disney, Airbnb and Alibaba.