Authored by Mike Shedlock via MishTalk.com,

Let’s discuss what QE really does vs the psychology of QE.

John Hussman has an interesting take on “Quantitative Easing!” vs “Quantitative Easing” in his latest monthly missive Counting the Chickens Twice

After decades of successfully navigating complete market cycles, my greatest investment mistake (particularly between 2012 and 2017) was to underestimate the extent to which the idea of quantitative easing would infect the minds of investors and abolish their discernment.

As a policy, quantitative easing is very straightforward: the Federal Reserve buys interest-bearing Treasury securities, and pays for them with zero interest base money (currency and bank reserves) that someone has to hold at every moment in time until that base money is retired.

That’s it. That’s the entire mechanism by which QE has any hope of “supporting” the stock market. Investors become so uncomfortable holding a zero-interest asset that they feel compelled to get rid of it by purchasing some other asset that they imagine will provide them with a better return.

Quantitative easing does nothing more than replace interest-bearing government liabilities with zero-interest government liabilities. That certainly doesn’t seem to be enough to reliably hold $60 trillion of stock market capitalization at the most extreme valuations in history.

That’s exactly what I thought.

My epiphany came in late-2017. I had been so focused on the fact that there’s no reliable mechanism linking the Fed’s balance sheet to the stock market that I had missed one essential fact: investors don’t care. It became clear that there are actually two forms of “quantitative easing,” and the second type of quantitative easing is the powerful one. It’s what my Buddhist teacher Thich Nhat Hanh might describe as a “mental formation.”

Using the italic notation of my friend Ben Hunt at Epsilon Theory (a must-read), it’s what we might call Quantitative Easing!

Does anyone think investors care that the total amount of corporate bonds purchased by the Fed during the pandemic amounted to just $14 billion, in a $22 trillion economy, with $11 trillion of nonfinancial corporate debt and $60 trillion of equity securities? No, they do not. Do they care that Fed purchases of unbacked corporate securities were authorized only using CARES funding provided by the Treasury, and that such purchases are otherwise illegal under the Federal Reserve Act? No they do not.

Why? Because it isn’t the mechanism of quantitative easing that investors care about. What they care about is Quantitative Easing!

And because Quantitative Easing! is purely a mental formation, the only thing that alters its effectiveness is investor psychology itself.

The key to navigating Quantitative Easing! and Fed policy in general is to recognize that their effect on the stock market relies almost entirely on speculative investor psychology. See, as long as investors are inclined to speculate, they treat zero-interest money as an inferior asset, and they will chase any asset with a yield above zero (or a past record of positive returns). Valuation doesn’t matter because investors psychologically rule out the possibility of price declines in the first place.

But when investors become risk-averse, even briefly as in early-2018, late-2018, and early-2020, they do allow for the possibility of large negative price changes. At that point, a yield above zero isn’t enough. Moreover, if investors are inclined toward risk-aversion, safe liquidity is viewed as a desirable asset rather than an inferior one. As a result, creating more of the stuff may not support the market at all.

Strong Agreement

I have a couple of nitpicks but they are tiny compared to the overall idea expressed above.

-

First it is not necessarily true that the Fed buys interest bearing securities. The Fed could buy 0% interest rate bonds or even negative yielding bonds as happens in the EU.

-

Second, assuming the Fed wants to peg interest rates at zero, then it must perforce be a supplier of money at zero percent in whatever amount it takes to hold rates to zero.

Given the current psychology of the market, the Fed merely stating it will hold short-term interest rates at zero indefinitely is all it takes, for now. Any additional amount of short-term QE logically does nothing at all.

Forcing down longer term interest rates admittedly takes more effort.

What Would Happen to Inflation If the Fed Announced $40 Trillion a Month in QE?

On May 5, I wrote What Would Happen to Inflation If the Fed Announced $40 Trillion a Month in QE?

The ideas I expressed are similar in nature to the ideas of Hussman although at first glance we expressed things very differently.

QE Parameters

-

$40 trillion a month in QE for 24 months, no matter what, announced upfront.

-

3-month bills at 0% rolling everything over each month while adding a new $40 trillion each month.

-

Zero percent interest paid to banks on excess reserves.

What Would Happen?

-

Hyperinflationists and inflationists would come out of the woodwork on the announcement screaming inflation or worse.

-

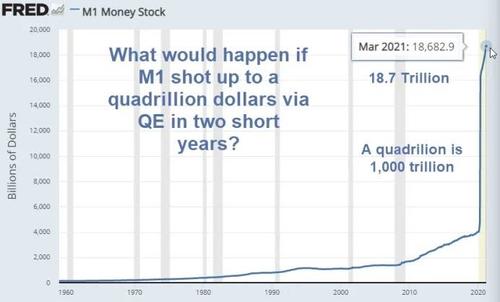

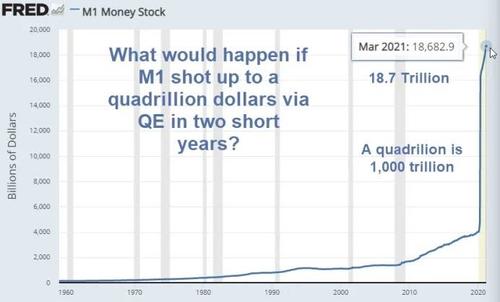

In two years, M1 would rise by $960 trillion dollars, nearly a quadrillion dollars.

-

Since M1 is currently about $18.7 trillion, M1 would thus rise by about 5,000 percent.

What About Inflation?

Q: What would a 5,000% increase in M1 over the course of two years under the parameters as outlined above do to inflation?

A: Not a thing

There is a stimulus impact of holding down short term rates, but the Fed was already committed to holding rates to zero indefinitely anyway.

Other than what is needed to hold the short-term interest rates to zero, any additional amount does nothing at all.

I suppose there could be a temporary knock on psychological effect over the size of the announcement but that would be short-lived.

In my example, the bonds had no interest rate nor was there any interest paid on excess reserves, which the Fed could easily do.

Hussman accurately noted that someone must hold every dollar.

In the case of QE, it is not really a matter of banks attempting to dump those dollars because banks don’t lend from reserves.

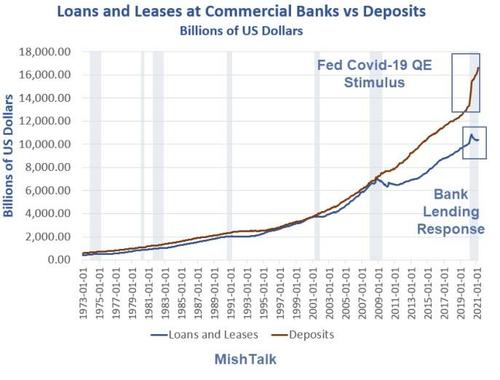

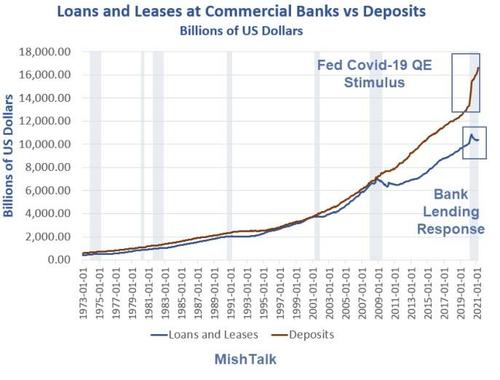

QE Did Not and Will Not Spur Bank Lending

Banks lend when they have creditworthy borrowers or believe they have creditworthy borrowers.

With nearly everyone looking for stronger inflation and higher bond yields please note The Fed Wants to Stimulate Bank Lending, Charts Show the Fed Failed

What About the Hot Potato?

There is a psychological hot potato on customer deposits but none on bank-held QE deposits.

There is also speculation impact due to interest rate suppression.

The Fed clearly goosed housing and speculation. Goosing housing did involve the Fed suppressing interest rates by buying interest bearing securities in Hussman’s example.

I made the claim “Other than what is needed to hold the short-term interest rates to zero, any additional amount does nothing at all.”

That is very similar to Hussman’s take “Quantitative Easing! is purely a mental formation, the only thing that alters its effectiveness is investor psychology itself.”

“Quantitative Easing!” vs “Quantitative Easing”

It’s the psychology, stupid.

As long as investors believe the Fed has their backs and will not let the markets go down, they will continue to speculate in anything and everything including dogecoin.

Greater Fool Mania

Recall Dogecoin, Created as a Joke, is the Epitome of Greater Fool Mania

Belief is enough until it changes.

There was a sudden psychological change at the peak of the housing bubble where psychology snapped. The same thing happened to the dotcom bubble in March of 2000.

No one knows when or why psychology might change.

Hussman commented “creating more of the stuff [QE] may not support the market at all.“

Contrast Hussman’s comment with my comment on Quantitative Easing: “Any additional amount of QE effectively does nothing at all.“

Ah Ha!

My comment was in regards to the logical mechanics of “Quantitative Easing” not doing anything.

In contrast, “Quantitative Easing!” psychology suggests we may also reach the point where any amount is sufficient not to support the market, but to collapse it.

Place your bets on how long the current status quo will last because belief that the Fed will hold up the market is all there is.