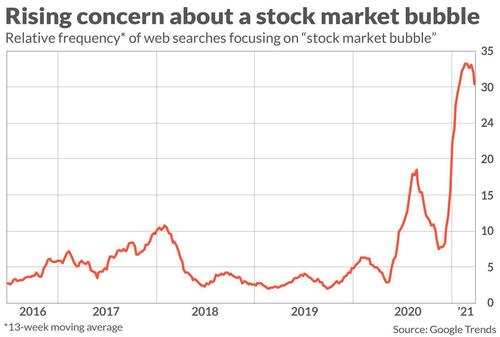

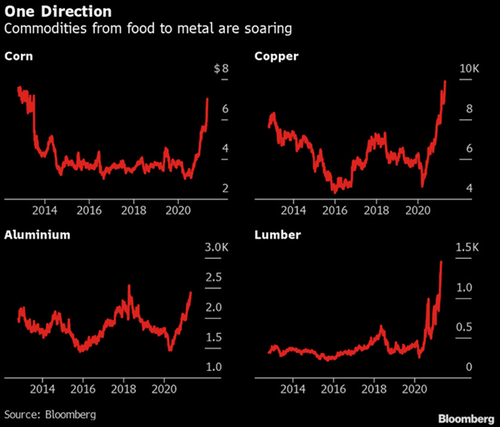

Yesterday was bad, but not too bad, and we titled our morning market wrap “Futures Flat As Soaring Commodities Depress Tech Stocks.” 24 hours later it’s much worse, as the rout that hammered US tech stocks on surging inflation fears (see “This Is Not Transitory”: Hyperinflation Fears Are Soaring Across America“) has now gone global, with markets in Asia and Europe hammered and S&P futures sliding 0.8%, while Nasdaq futures tumbled by another 1.3% after Monday’s 2.6% rout. Treasuries were steady ahead of today’s 3Y auction while the dollar erased its gains and dropped to session lows.

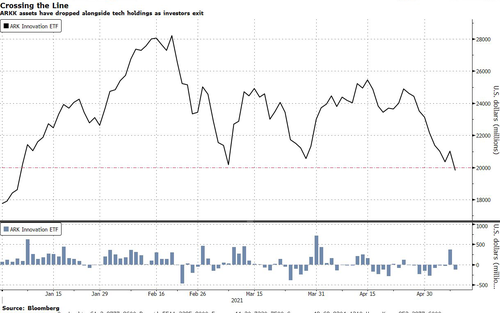

Here are some of the notable bloodbath highlights: the Hang Seng Tech Index sank as much as 4.5%, extending its tumble from a February high to about 30%. In Europe, the Stoxx 600 Index fell the most since January as tech sector losses drove the gauge lower. One of the biggest winners over the past year, Cathie Wood’s Ark Innovation ETF, was down more than 3% in pre-market trading after plunging 5.2% yesterday.

“It seems to be a combination of inflation fears making a comeback and some market participants moving higher along the value spectrum, cutting their exposure to anything with a stretched valuation,” said Marios Hadjikyriacos, investment analyst at online broker XM in Cyprus.

In a late session reversal on Monday, inflation jitters drove investors away from growth stocks to cyclicals, which benefit the most as the economy reopens, resulting in the S&P 500 logging its worst day in nearly eight weeks. At 700 am ET, Dow e-minis were down 159 points, or 0.46%, S&P 500 e-minis were down 31.5 points, or 0.75%, and Nasdaq 100 e-minis were down 169.25 points, or 1.27%.

Some of the bigger pre-market movers:

- Tesla dropped 7% in U.S. premarket trading after reports that the company halted a plan to buy land in Shanghai and sales in China fell.

- Cathie Wood’s Ark Innovation ETF dropped down more than 3% in pre-market trading after plunging5.2% yesterday.

- Shares of the FAAMG complex dropped between 1% and 2% in premarket trading, while Tesla Inc fell nearly 4%, one day after a rare downgrade of GOOGL and FB by Citi sparked a widespread selloff.

- Simon Property Group Inc fell 3.6% after the U.S. mall operator said it does not expect a return to 2019 occupancy levels until next year or 2023, as it looks to play hardball in rent negotiations with tenants.

“The underlying driver is that there is still a rotation out of duration (higher interest rate) sensitive parts of the market and this is why tech stocks are coming under pressure now,” said Mizuho’s Head of multi-asset strategy Peter Chatwell. “Given the rise in the earnings power of these firms different governments will also seek to raise more tax revenue from them in the coming years.”

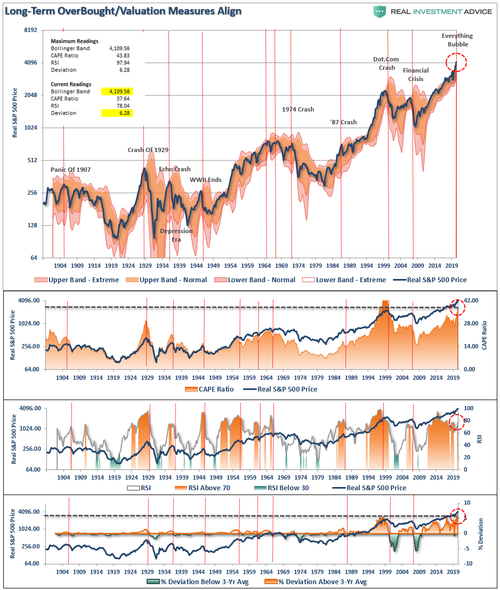

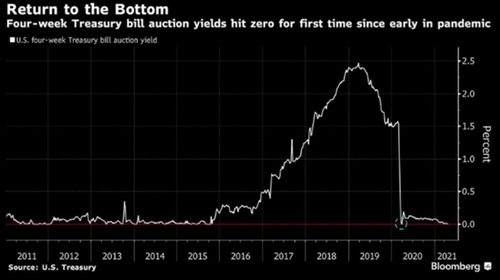

Debate rages over whether the expected jump in price pressures will be enduring enough to force the Federal Reserve into tightening policy sooner than current guidance suggests. US inflation expectations as measured by 5Y breakevens reached the highest level since 2006.

“There is a risk the discussion could trigger market volatility,” BlackRock Investment Institute strategist Jean Boivin said. “We believe investors should look through any such bouts of volatility. The Fed will likely be much slower than in the past to raise rates in the face of rising inflation.”

Yet even after the declines, the Nasdaq trades at 26 times the 12-month projected profits, while the gauge of European technology shares enjoys a valuation of 29 times.

And speaking of Europe, its benchmark Stoxx 600 index tumbled 2.1% the most this year, one day after touching a record high on Monday, but its Tuesday restart was a sea of red as London’s FTSE, Frankfurt’s DAX and the CAC 40 in Paris all dropped roughly 2%. Just 18 index members were up while a whopping 582 were down. Europe travel and leisure stocks underperformed the broad market, with the benchmark tracking the sector dropping as much as 4.3%, most since Dec. The Stoxx 600 Travel & Leisure Index was down 4.2% as of 10:11 am CET, worst-performing sector in Europe. Here are some of the biggest European movers today:

- THG shares jump as much as 19%, the most since September 2020, after the U.K. online retailer raised $1b for future M&A, adding Japan’s SoftBank as a cornerstone investor, and agreed to buy U.S. beauty company Bentley Laboratories for $255m.

- Morrisons shares gain as much as 1.3% after the British supermarket chain released 1Q sales that topped analysts’ estimates. Morgan Stanley (equal-weight) says results were positive and it sees scope for potential upside and operating leverage.

- Evolution Gaming shares slide as much as 12%, the most intraday since October 2018, after the company’s founders sold 4.2 million shares in an offering.

- Ceconomy shares plunge as much as 16% after the German consumer-electronics retailer reported a 2Q adjusted Ebit loss of EU146m and named Karsten Wildberger as its new CEO. Consensus estimates look too high, according to Bryan Garnier.

- Jenoptik shares fall as much as 13% in Frankfurt trading, the steepest intraday decline since March 2020, after posting 1Q earnings as Baader Helvea highlights a “mixed picture” for profitability.

- ThyssenKrupp shares fall as much as 6.3% after reporting second-quarter results, with Morgan Stanley (underweight) noting that the guidance raise had “no surprises” and could still be too conservative.

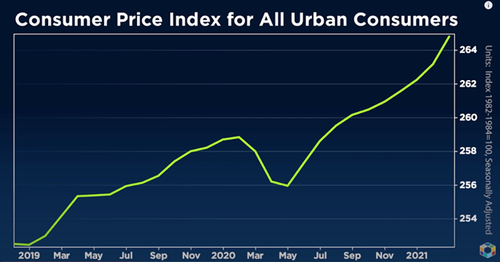

Earlier in the session, Asia’s main regional equity gauges suffered their biggest slide in nearly two months overnight; the MSCI Asia Pacific Index dropped as much as 2.2% at one point as a slump in information-technology stocks weighed on the market with Japan’s Nikkei and Hong Kong’s Hang Seng both closing down 3%. Asian stocks were poised for their lowest finish in six weeks, dragged down by a selloff in the region’s chipmakers amid renewed concerns of rising global inflation. Taiwan Semiconductor Manufacturing, Samsung Electronics and SK Hynix were among the top contributers to the measure’s decline. The Philadelphia semiconductor index, or SOX, tumbled the most in two months on Monday on concerns inflation was likely to surge in coming months. The drop in the tech gauge came ahead of the release of the U.S. CPI report due Wednesday, which is expected to show prices continued to increase in April. Rising inflation could lead the Federal Reserve to reduce easy money policies. “If yields go higher, it’ll be difficult for current valuations to hold,” said Takahiro Kusakari, chief investment officer at Sawakami Asset Management Inc. “In case of higher yields, technology stocks trading with extra risk premiums won’t be able to help it but be sold.”

Taiwan, Japan and Hong Kong were among the biggest losers in the region, while China outperformed. China’s main equities benchmark ended higher Tuesday, after a rebound in consumer staples offset the earlier selloff in commodity firms. With talk of tighter regulation from Beijing, Chinese tech heavyweights Baidu, Alibaba Tencent, collectively dubbed the BATs, all dropped more than 3%. Food delivery major Meituan tumbled as much as 9.8% too, leaving its value $30 billion lower in a week.

“We have been here before with inflation scares and extended valuations in technology fraying investor nerves,” Jeffrey Halley, senior market analyst with Oanda Asia Pacific Pte wrote in a note. “Nevertheless, the technical break of support by the Nasdaq overnight is significant. If it does not recapture that tonight, equities could be in for a torrid week.” The Nasdaq composite lost 2.6% on Monday, closing a touch below its 100-day moving average.

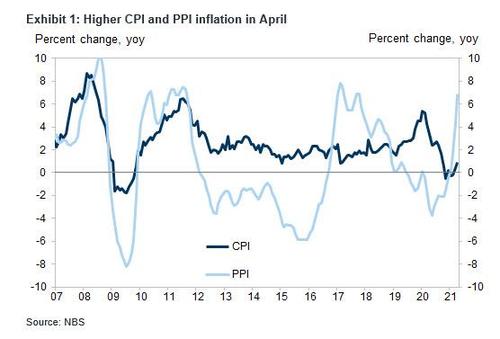

Emerging-market equities fell to the lowest level in almost a month and currencies in Asia weakened as data from China added to inflation worries, while strong commodity prices fueled a rally in the South African and Russian currencies. The worldwide slump in technology stocks sent the MSCI benchmark index to its biggest drop since March 24. Data showing contractions in the Philippine and Malaysian economies added to skepticism about a robust recovery this year amid a resurgence in coronavirus cases. China’s factory-gate prices surged more than expected in April on the back of rapid gains in commodities due to rising global demand and supply shortages. That’s stoking concerns about price increases around the world, with a measure of U.S. inflation expectations reaching the highest level since 2006, though data today showed slowing inflation in Russia and Egypt.

“The turnaround in risk sentiment is largely isolated toward Asian FX this morning, where losses have been driven by inflation concerns and poor performance in domestic equity markets,” said Ima Sammani, an Amsterdam-based currency analyst at Monex Europe Ltd. Brazil and India will also report price figures this week after Citigroup Inc.’s inflation-surprise index for emerging markets spiked last month to the highest since 2008, a sign investors may be underestimating the scale of the resurgence. U.S. Treasury yields rose for a fourth day today and the extra premium demanded for EM debt was unchanged. “It’s all about rates in the U.S. and how it contaminates risk markets,” said Francesc Balcells, chief investment officer for emerging-market debt at Fim Partners in London. “There’s a fair amount of nervousness on this but reflation is good for EM. The key is that real rates in the U.S. stay in check so as long as the Fed is not falling behind the curve, EM will be OK.”

U.S. breakeven rates, which factor in inflation, have scaled multi-year peaks. Most euro zone bond yields edged back up on Tuesday while a market gauge of long-term inflation expectations was nearing its highest in over two years. A host of Federal Reserve and European Central bank speakers this week will be closely watched by markets to assess how authorities are likely to respond.

A test case on U.S. inflation will come when the Labor Department releases consumer price index report on Wednesday. “Inflation’s shadow looms large and we do think that there is a limit to the Fed’s tolerance of inflation,” DBS Bank said in a note.

In rates, Treasuries were mixed after paring losses; headwinds include start of auction cycle with 3-year note sale and mounting concern about future inflation into April CPI release Wednesday. Another heavy corporate new-issue slate is expected after a handful of borrowers stood down Monday to give a wide berth to Amazon’s jumbo offering. Yields are slightly richer across long-end of the curve while front-end and belly cheapen slightly, flattening 5s30s spread by 1.3bp; 10-year yields around 1.605% with gilts and bunds lagging by around 3bp each, further capping Treasuries rally. Small block sales in Asia also weighed, including 0.9k in Ultra bonds, before two ~1.7k sellers in 10-year notes

In FX markets, Dollar Spot Index traded near session lows amid tight ranges and 10-year Treasury yields rose for a fourth day. Scandinavian currencies lead gains followed by the euro, which pared yesterday’s losses. Bunds extended their slide and underperformance against Treasuries after Germany’s sale of its first 30-year green bond. The pound hovered near the highest level since February, holding onto Monday’s gains following the Scottish election results; sales of five- and 40-year gilts are in focus, as well speeches by the Queen’s and BOE Governor Andrew Bailey. The yen edged lower as concern over rising U.S. inflation puts an upward pressure on Treasury yields and the dollar. The Canadian dollar stabilised near a four-year high, while the New Zealand dollar perched comfortably at February highs.

In commodities, oil prices gave up earlier gains as concerns that rising COVID-19 cases in Asia will dampen demand outweighed expectations that a major U.S. fuel pipeline could restart swiftly. U.S. crude dipped 0.66% to $64.49 a barrel. Brent crude fell to $67.84 per barrel as traders monitored progress on reopening the largest U.S. oil-products pipeline, which was paralyzed by a cyberattack, and is expected to be mostly back online by the weekend. Metal markets saw copper prices start to nudge higher again. They were last at $10,470 a tonne having hit a record high $10,747.50 the previous session. Iron ore had settled too after surging 7% on Monday.

Wednesday’s U.S. inflation report along with a series of U.S. government bond auctions this week are seen as the next factors to deepen or arrest the slide. The latest reading is expected to show an accelerated pace of consumer-price increases, with the year-on-year comparison made starker by the pandemic shock in 2020.

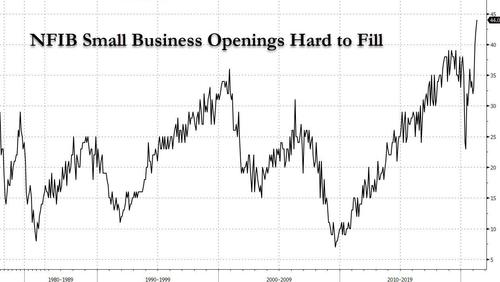

Looking at the day ahead now, and data releases from the US include April’s NFIB small business optimism index and the JOLTS job openings,. Central bank speakers include BoE Governor Bailey, the Fed’s Williams, Brainard, Daly, Bostic, Harker and Kashkari, and the ECB’s Knot and Hernandez de Cos. Otherwise, the Queen’s speech will be taking place in the UK, where the government outlines its legislative programme for the coming session of Parliament.

Market Snapshot

- S&P 500 futures down 0.8% to 4,152.00

- STOXX Europe 600 down 1.9% to 436.89

- MXAP down 2.0% to 204.14

- MXAPJ down 1.7% to 683.64

- Nikkei down 3.1% to 28,608.59

- Topix down 2.4% to 1,905.92

- Hang Seng Index down 2.0% to 28,013.81

- Shanghai Composite up 0.4% to 3,441.85

- Sensex down 0.8% to 49,107.22

- Australia S&P/ASX 200 down 1.1% to 7,096.97

- Kospi down 1.2% to 3,209.43

- Brent Futures down 1.1% to $67.55/bbl

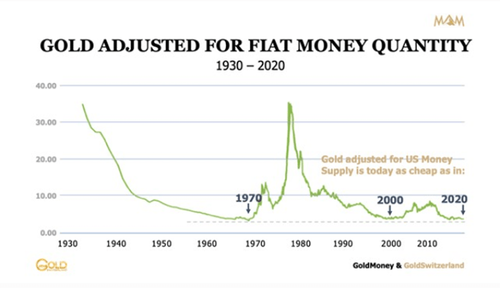

- Gold spot down 0.0% to $1,835.40

- U.S. Dollar Index little changed at 90.27

- German 10Y yield rose 0.43 bps to -0.169%

- Euro up 0.1% to $1.2144

Top Overnight News from Bloomberg

- Investor confidence in Germany’s economic recovery jumped to the highest level in more than 21 years after the country’s vaccine rollout gained speed. The ZEW institute’s gauge of expectations rose to 84.4 in May from 70.7 the previous month. A measure of current conditions improved, as did prospects for the euro zone

- With the ECB widely seen slowing bond buying in July as the economic recovery gains traction — which is already being reflected in higher yields — this bet focuses on the next step being a greater chance of rate hikes. The largest wagers in Euribor options are targeting markets to price in higher rates in late 2024

- England reported no deaths from Covid-19 in its latest daily update, a milestone that highlights the effectiveness of the U.K.’s vaccine program in stopping the spread of the disease

- Palestinian militants in the Hamas-ruled Gaza Strip bombarded southern Israel with dozens of rockets overnight, and Israeli aircraft pounded their facilities in lethal raids, after a showdown over Jerusalem erupted into one of the most intense confrontations between the sides in years

- German inflation could climb above 3% as the economy recovers from the pandemic, but it won’t last and the European Central Bank will look beyond such volatility, Executive Board member Isabel Schnabel said in an interview

- China’s factory-gate prices surged more than expected in April, fueled by rapid gains in commodity prices, adding to global inflation concerns

- Norway is relying on its $1.3 trillion sovereign wealth fund more than ever, as the country ratchets up spending without turning to bond markets to provide economic relief from the pandemic. The government is raising its so-called structural non-oil fiscal deficit for 2021 to 403 billion kroner, or almost $50 billion, compared with 369 billion kroner last year, it said on Tuesday. The withdrawals, as a share of the world’s biggest wealth fund, will reach 3.7%, compared with the central bank’s estimate of 3.3%

Quick look at global markets courtesy of Newsquawk

Asia-Pac bourses traded with firm losses on spillover selling from the tech-led declines on Wall St, where all major indices were dragged into the red amid higher yields and inflationary concerns, although the downside in the DJIA was contained after it briefly breached the 35k level for the first time ever. ASX 200 (-1.1%) was pressured amid underperformance in tech and with the commodity-related sectors subdued by a pullback in copper and iron ore futures from record levels which was not helped by reports of tougher supervision by China’s exchange. Nikkei 225 (-3.1%) was the biggest decliner after Japanese Governors warned that a nationwide state of emergency cannot be ruled out and as participants digested a slew of earnings updates, with better-than-expected Household Spending data doing little to stem the losses in Japan, while the KOSPI (-1.4%) succumbed to the broad risk aversion which overshadowed the strong early trade data for May which showed Exports jumped 81.2% Y/Y during the first 10 days of the month. Hang Seng (-2.0%) and Shanghai Comp. (+0.3%) weakened as the large Chinese tech stocks were impacted by the industry sell-off which resulted to losses of around 4% for the Hang Seng TECH Index, while a pullback for commodity prices and mixed inflation data in which Chinese CPI printed below forecast but PPI rose by its fastest pace since 2017, added to the uninspired mood; though sentiment did recover marginally from lows at the tail-end of the session. In addition, China released its latest Census which showed population growth in 2010-2020 slowed to 5.38% from 5.84% the decade before and the NBS chief noted that China’s population is declining, ageing is deepening and that steps must be taken to ensure a balanced population growth. Finally, 10yr JGBs were marginally higher amid the underperformance of Japanese stocks but with gains capped amid mixed results at the 10yr JGB auction and following the whipsawing in USTs where early gains were wiped out as yields recovered heading into this week’s refunding auctions and heavy corporate supply including a USD 18.5bln offering from Amazon.

Top Asian News

- New Outbreaks Threaten Status of Places That Had Virus Contained

- TSMC Is Stuck in the Middle of a Global Panic Over Chip Supply

- SK IE Technology Pares Gains After Doubling in Trading Debut

- Japan’s Struggling Regional Banks Consider Overdue Mergers

Stocks in Europe see hefty losses across the board (Euro Stoxx -2.0%) as the region plays catch-up to the sell-off seen on Wall Street yesterday and across APAC overnight. Markets are wobbling on inflationary concerns – stoked by the elevated post-NFP yields alongside the recent bull run across some commodities including copper, iron, and lumber to name a handful – with inflation being a key theme across the Q1 earnings. These inflation woes are reflected across US equity futures with the tech-laden NQ (-2.6%) weighed on heavily whilst the YM (-0.1%) remains cushioned ahead of the US CPI figures tomorrow. Back to Europe, major bourses are for the most part experiencing broad-based losses with the AEX (-2.3%) narrowly underperforming amid notable downside in some large-cap names including Shell (-2.8%), ING (-2.6%), and ASML (-2.4%). European sectors are in a sea of red with defensives faring marginally better than cyclicals as a whole. Delving deeper, Telecoms, Food & Beverage, Household Goods, and Healthcare are the “better” performers with Banks also at the top of the table amid the higher yield environment; though still very much negative on the session. Moving to the other end of the spectrum, Tech lags in a continuation of global sectoral underperformance whilst yields are an additional headwind. Travel & Leisure however, is the notable underperformer as tourist hotspots France, Spain, Greece and Italy will not likely be added to the UK travel “green list” anytime soon, whilst Lufthansa (-3.2%) is reportedly preparing for a EUR 3bln rights issue and Evolution Gaming (-8.6%) further pressures the sector following a share offering. Basic Resources kicked the day off as one of the laggards, but the sector has since trimmed losses with base metals remain elevated. Out of the handful of companies in the green across Europe, THG (+12%) tops the chart amid reports that Softbank will take a stake in the Co., Deutsche Bank (-2.3%) meanwhile fails to shrug off reports that the US DoJ has closed their probe into the Co. regarding their role in the 1MDB scandal.

Top European News

- Schaeffler, Timken Said to Weigh Bids for $1.5 Billion ABB Unit

- Renishaw Said to Face Uphill Battle to Sell Over Steep Price

- Life-Insurance Startup Ethos Valued at More Than $2 Billion

- England Reports Zero Covid Deaths for First Time in 14 Months

In FX, global bond yields are rising on renewed inflation vibes and debt and equities show little sign of resuming any real inverse correlation in the traditional manner associated with relatively pronounced bouts of risk aversion, or appetite for that matter, but the Dollar has gleaned some support from safe-haven demand along with technical encouragement after evading deeper losses vs major and EM counterparts. On that note, the index is looking a bit more comfortable on the 90.000 handle within a 90.359-089 range having recovered from a 90.032 low on Monday, albeit with the Buck still mixed against its G10 protagonists awaiting NFIB, JOLTS and another heavy slate of Fed speakers.

- EUR – The Euro has recoiled into a slightly tighter band vs the Greenback from 1.2132 to 1.2170 and could be more inclined towards chart levels while monitoring EGB/UST differentials and some decent option expiry interest either side (1.5 bn at 1.2095-1.2100 and 1.2125 before 1.6 bn between 1.2185-90). However, Eur/Usd may get a belated boost from a much better than expected German ZEW survey, and the headline economic sentiment reading especially.

- AUD/NZD – Some retracement may have been in order anyway after yesterday’s extended gains against their US rival to circa 0.7891 and just over 0.7300 respectively, but consolidation off recent highs in base metals and other commodities allied to a downturn in risk sentiment has ensured that the Aussie and Kiwi have pulled back anyway. Note, very little reaction to the Australian Budget, thus far, as Aud/Usd continues to hover sub-0.7850 and the cross under 1.0800 on mixed revised deficits vs prior forecasts and Westpac expectations.

- GBP/CAD/JPY/CHF – All narrowly divergent vs their US peer, as the Pound unwinds some of its all round appreciation, though keeps its head above 1.4100 and around 0.8600 against the Euro amidst robust UK consumption surveys and confirmation from PM Johnson that the 3rd phase of lifting lockdown restrictions will go ahead next Monday. Elsewhere, the Loonie has stalled into 1.2075 against the backdrop of waning oil prices pre-OPEC MOMR and API weekly inventories, the Yen is hovering just over 109.00 and Franc a similar distance below 0.9000 and under 1.0950 against the Euro.

- SCANDI/EM – The Nok and Sek are both holding up quite well given the potentially bearish mix of retreating bonds and stocks as a mark of souring risk sentiment, with the latter possibly taking on board former 12 month Swedish money market inflation expectations on the eve of official CPI data. Meanwhile, strong Chinese PPI could be propping up the Cnh, but the Try is not getting much respite even though Turkish ip was considerably stronger than anticipated in March.

In commodities, WTI and Brent front month futures are choppy but off worse levels with the former re-eying USD 64.50/bbl (vs low 64.09/bbl) and the latter inches back towards USD 68/bbl (vs low 67.50/bbl). The losses today seem to be stemming from the soured mood across stock coupled with some unwind of the Colonial Pipeline premium as it is expected to be largely online by the end of the week. Desks note that supply tightness to the US East Coast will likely be eased with increased flows of seaborne cargos. That being said, the longer the situation takes to resolve, the greater the likelihood refineries will need to start cutting run rates. Elsewhere in terms of geopolitics, tensions remain high in the Strait of Hormuz chokepoint as the US Navy stated that it had to fire warning shots as IRGC boats – whilst Press TV reports suggested that JCPOA talks hit a deadlock by its the US refusal to moved 500 individuals from its sanctions list. Elsewhere, Saudi and Iran have been sounding more sanguine in their separate negotiations which could see the simmering down of an ongoing spat between the countries on either side of the Persian Gulf. In terms of COVID, eyes remain on India’s escalating situation with reports today suggesting that the Indian Oil Corp has cut operating rates at refineries to 85-88% (late-April 95%) due to high product stock with COVID-19 impacting demand, whilst BPCL cuts crude imports by 5% in May and 10% in June; expects May fuel consumption to decrease by 5% vs April. Onto metals, spot gold, and silver remain within a tight range and are supported by the suppressed Dollar, with the former comfortable north of USD 1,800/oz (1831-38 range) whilst the latter holds its USD 27/oz handle (27.13-47 range). Meanwhile, the base metals complex is back on the rise with LME copper back above USD 10,500/t with traders citing the mounting speculative bets on inflation and EV production, whilst overnight, Chinese stainless steel and iron ore rose near-10% apiece as production curbs also spurred supply woes.

US Event Calendar

- 10am: March JOLTs Job Openings, est. 7.5m, prior 7.37m

- 10:30am: Fed’s Williams speaks at SOFR Symposium

- 12pm: Fed’s Brainard Discusses U.S. Economic Outlook

- 1pm: Fed’s Daly Speaks at Community Bankers Event

- 1:15pm: Fed’s Bostic Speaks to Rotary Club of Alexandria, Louisiana

- 2pm: Fed’s Harker Speaks on Economic Outlook

- 2:30pm: Fed’s Kashkari Discusses Economic Outlook

DB’s Jim Reid concludes the overnight wrap

In the U.K. yesterday we learned that as of next Monday we will be able to use our own judgement as to social distancing with close family and friends. I delightedly showed my wife this but she said that she would like to continue to observe the 2 metre rule that first started when the twins were born.

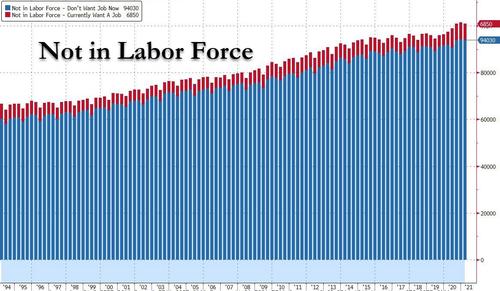

So as we attempt to get our lives back after the pandemic, the economic repercussions will reverberate for a while with Friday’s payrolls still creating fierce debate in markets. We are doing a 24hr flash payrolls poll as to whether you think the huge downside miss on Friday represented a) Labour supply constraints, b) Lower demand for labour, c) Measurement errors and likely later revised, d) Don’t know. You can click on the answer that you think is most representative. We will print the answers in today’s CoTD later.

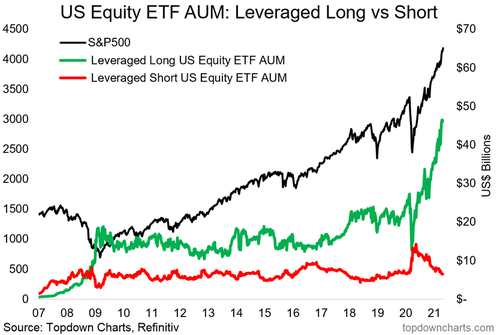

So fascinating markets yet again with inflation worries higher now than they were before the horrendous payrolls miss. All this ahead of tomorrow’s all-important CPI release in the US, with various expectation measures rising to new highs as investors are anticipating a jump in the annual CPI to its highest level in years. The jitters sent tech stocks sharply lower, with the NASDAQ (-2.55%) and the FANG+ index (-3.61%) of megacap tech seeing big declines – with the best performing FANG+ index member being Google (-2.56%) while Tesla (-6.4%) was the worst. It was the worst days for the NASDAQ and the FANG+ index since March 3rd and 8th respectively. The S&P 500 fell back -1.04% as the recent cyclical winners such as energy (-0.05%), banks (-0.20%) and materials (-0.41%) were not able to keep the broader index afloat amidst the heavy tech losses. The best performing US industries yesterday were the defensives such as household products (+1.36%) and utilities (+1.02%). Earlier Europe’s STOXX 600 (+0.10%) gained slightly, having closed before the steepest US declines, whilst the Dow Jones (-0.10%) actually traded above the 35,000 mark for the first time intraday before falling back to just worse than unchanged.

Given the inflation concerns, it was no surprise that breakevens roes to fresh multi-year highs in numerous countries yesterday even if they were off their intraday highs at the close. In the US, 10yr breakevens were up +2.6bps to 2.53%, their highest level since 2013, while the 30yr rate was up +3.0bps to 2.35%, the highest since 2014. The 5y5y forward inflation swap (+2.7bps) also closed above 2.5% for the first time since 2018. Similar moves were seen in Europe too, with German 10yr breakevens up to 1.42%, their highest level since 2018, and their Italian counterparts at 1.38%, their highest since 2013. Yields on 10yr Treasuries were up +2.5bps at 1.602%, as inflation expectation overcame a small drop in real yields (-0.1bps), which fell for the 5th time in the last 6 sessions. Meanwhile in Europe, yields on 10yr bunds (+0.3bps) only saw a modest rise as those on OATs (-0.4bps) and BTPs (-3.7bps) fell back.

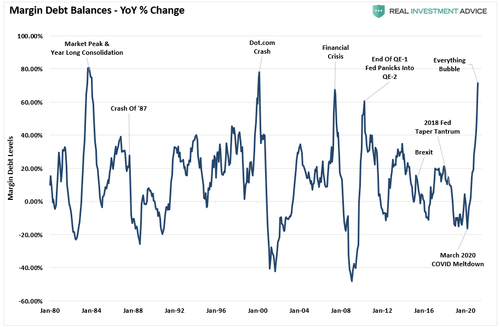

Asian markets have taken Wall Street’s lead this morning with the Nikkei (-2.98%), Hang Seng (-2.15%) and Kopsi (-1.34%) all trading deep in the red while the Shanghai Comp is down a more limited -0.27%. Futures on the S&P 500 (-0.55%) and the Nasdaq (-0.97%) are also pointing to a weaker open in the US later today. European futures are also pointing to a sharply lower open with Stoxx 50 futures down -1.37% and those on the Dax down -1.24%. Not helping sentiment China’s April PPI came in 0.3 percentage points higher than expectations at +6.8% yoy while, the CPI printed -0.1% weaker than expectations at +0.9% yoy. The rise in PPI was likely driven by the continued rise in commodities with Bloomberg commodity spot index up c. +65% yoy.

Speaking of inflation, my chart of the day yesterday (link here) discussed the debate over whether the big downside miss in payrolls on Friday would mean higher inflation moving forward. I lean towards the inflation side, and pointed out DB’s Francis Yared work highlighting that the quits rate (which reflects voluntary departures and workers’ true bargaining power) shows a much tighter labour market than the unemployment rate, and has seen a better correlation to wages since the pandemic started than the unemployment rate. The quits rate has bounced back to its pre-Covid levels, so adds to increasing signs that workers are recovering power quickly while firms are finding it hard to fill new roles.

Though the prospects of higher inflation was spoiling the market mood, the rally in commodity prices seemed to run out of steam by yesterday afternoon, with Bloomberg’s commodity spot index actually snapping a run of 6 successive gains to close -0.61% lower on the day – only the 2nd daily loss for the index since April 16. Copper prices (-0.68%) had hit an all-time high earlier in the day, while oil prices also pared back their gains into the afternoon as both Brent crude (+0.06%) and WTI (+0.03%) finished just above unchanged. Even corn futures (-3.20%) shifted lower, in spite of having risen for the last six weeks in a row.

In the UK, Prime Minister Johnson announced that restrictions in England would be eased further from May 17, with indoor mixing in groups of up to six people or two households being allowed once again, while indoor venues including pubs, restaurants, museums and cinemas would also be able to reopen. Separately, the UK Covid-19 alert level was moved from level 4 to level 3. No covid deaths were reported yesterday in England for the first time in 14 months. There was additional good news from elsewhere in Europe as Austria announced that their planned reopening would go forward with small groups being allowed to gather and hospitality establishments will reopen. Spanish Prime Minister Sanchez announced that the country is on track to reach herd immunity in about 100 days when 70% of the population will be vaccinated – if current trends continue. In the US, weekly cases rose by the slowest rate (+0.88%) since the pandemic started and the lowest total (+286k) since mid-September. On the flipside, the pandemic is seen to be firming its grip over Asia with the Asahi Newspaper reporting that Japan’s regional governors have called on the central government to consider declaring a national emergency while Malaysia moved to close schools and banned social gatherings. The Apple Daily also reported that Taiwan’s Premier Su Tseng-chang may announce tighter Covid-19 restrictions. Lastly, Bloomberg reported that the WHO will classify a fast-spreading strain of Covid-19 first identified in India as a variant of concern.

Back to the UK, sterling was the strongest performing G10 currency yesterday (+0.96% vs USD) following the results of various local and regional elections over the weekend, hitting its highest level against the dollar since February. The move seemed to be driven in part by relief among some investors that the SNP had fallen just short of a majority in the Scottish Parliament, though given the pro-independence Greens can get them there, the reality is that the lack of majority for the SNP on their own has limited implications for independence. Instead the bigger question for the coming months and years will be what the UK government’s approach is, since they’re the ones with the power to authorise a legal Scottish referendum, as happened in 2014. That said, speculation has in turn been rising that the question of whether the Scottish government could hold a referendum without the UK government’s consent could end up in the courts, so one to watch moving forward potentially.

To the day ahead now, and data releases from the US include April’s NFIB small business optimism index and the JOLTS job openings, while Europe’s include Italian industrial production for March and the German ZEW survey for May. Central bank speakers include BoE Governor Bailey, the Fed’s Williams, Brainard, Daly, Bostic, Harker and Kashkari, and the ECB’s Knot and Hernandez de Cos. Otherwise, the Queen’s speech will be taking place in the UK, where the government outlines its legislative programme for the coming session of Parliament.