S&P futures started the weak flat with Nasdaq futures falling offset by surging commodity stocks as a new record in copper and iron ore prices stoked concern about whether inflation will derail a growth rebound in the world’s largest economy and spoil a record stock rally. Metal producers were among the biggest gainers in premarket trading, with Freeport-McMoRan, Cleveland-Cliffs and United States Steel all up at least 3%.

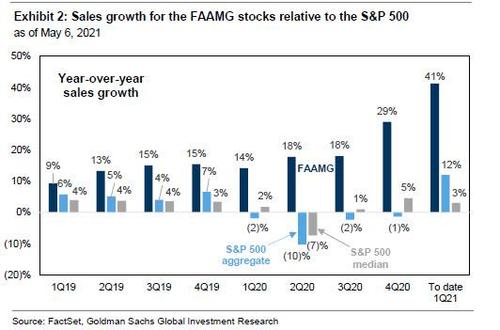

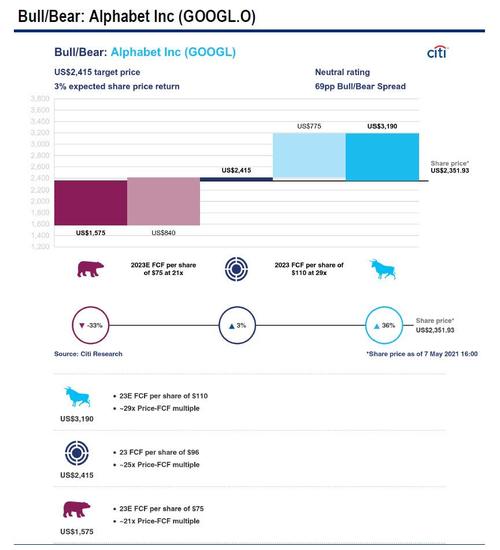

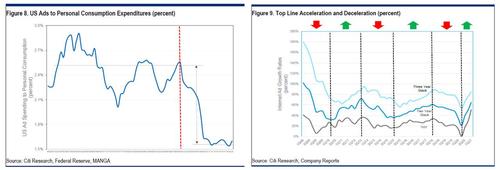

At 715 am ET, Dow e-minis were up 109 points, or 0.31%, S&P 500 e-minis were up 3.25 points, or 0.08%, and Nasdaq 100 e-minis were down 35.5 points, or 0.26%. The tech-heavy index has been whipsawed by the prospect of inflation which threatens longer-term profit expectations typical of the industry A downgrade by Citi of Internet stocks such as GOOGL did not help. Treasury yields steadied as traders brace for a busy week of auctions.

Some notable premarket movers:

- Copper miner Freeport-McMoran rose 3.5% premarket, while aluminum giant Alcoa gained 3.6% and steelmaker United States Steel Corp was up 3.1% as copper prices touched a record high and aluminum scaled a new peak.

- Chevron, Occidental Petroleum and Exxon Mobil all rose about 1% after a cyber attack on top U.S. pipeline operator Colonial Pipeline shuttered fuel network that transports nearly half of the East Coast’s supplies, lifting oil prices.

- Cybersecurity firm FireEye jumped about 6% as industry sources said the company was among those helping Colonial Pipeline to recover from one of the most disruptive digital ransom schemes reported.

- Some banks dipped after Malaysia’s 1MDB and a former unit have filed suits against several banks entities including JPMorgan Chase and Deutsche Bank as the nation seeks to recover assets worth more than $23 billion linked to the scandal-plagued state-owned investment fund.

The S&P 500 and the Dow ended at record closing highs on Friday as an unexpected slowdown in monthly jobs growth eased inflation worries and fueled bets that the U.S. Federal Reserve would remain accommodative for longer. With latest economic reports depicting that the U.S. economy is not recovering at the explosive pace as previously forecast, inflation numbers this week and comments from Federal Reserve officials could chart the next course for U.S. equities. Meanwhile, earnings season is in its final stretch with a record 87% of 439 S&P 500 companies beating estimates for profit. Analysts expect overall first-quarter earnings to jump 50.4% from a year ago, their strongest growth rate since 2010.

“Friday’s historical NFP (non-farm payrolls) miss has been a sigh of relief for the market; the Federal Reserve won’t pull away the punch bowl just yet,” said Ipek Ozkardeskaya, a senior analyst at Swissquote. “The post-NFP-high could leave its place to some hangover by Wednesday, when the U.S. will announce the April inflation data.”

European stocks were mixed as a really for banks and basic-resources companies such as Rio Tinto, BHP and Glencore countered declines in the tech and hospitality industries. Here are some of the biggest European movers today:

- Victrex shares rise as much as 9.5% after 1H results that Jefferies says were ahead of consensus.

- Superdry soars as much as 18% to the highest since January 2020 after the Telegraph’s Questor column said the stock has been “supercharged” recently, but recommended readers to “keep buying.”

- Hotel Chocolat jumps as much as 11% after the chocolatier reported revenue up 60% y/y for the eight-week period ended April 25. Liberum raised its price target to a Street-high, noting the “stellar period” despite stores being shut during Mother’s Day and Easter.

- ASTM rises as much as 8.7% in Milan and is the day’s best performer on the FTSE Italia All-Share Index after Gavio-Ardian’s NAF 2 raised its bid to EU28/share from EU25.60/share.

- Logista gains as much as 5.8% to highest level in 14 months after the Spanish distribution company reported a 33% increase in fiscal 1H net income versus the same period a year ago.

- Galapagos NV drops as much as 8.4% to the lowest since Dec. 2016 after a report that the biotech is seeking a “large deal” in the next 12 months.

- Juventus falls as much as 7.2%, the steepest decline since April 21, after the Italian soccer club lost to AC Milan on Sunday. The Turin, Italy based team is now fifth in Serie A, with only the top four clubs winning access to the top European competition.

Earlier in the session, Asian stocks climbed with key indexes in South Korea and Australia reaching new record highs, as prices of energy and other commodities surged. The materials group gave the biggest boost to the MSCI Asia Pacific Index, reaching its highest level in 13 years, helped by surging metals prices and strong company earnings. Energy stocks gained after a cyberattack put the largest U.S. oil-products pipeline out of action. Equities in Asia also got a lift from U.S. peers climbing to fresh records as weak jobs data bolstered the case for continued stimulus in the world’s largest economy. South Korea’s Kospi led gains among national benchmarks, as buying by institutional investors helped push it to a record. The main equity gauge in commodities-heavy Australia also reached a new high.

China stocks closed little changed on Monday after sliding late last week on news that the U.S. will likely maintain limits on investments in certain Chinese firms. Strength in steel and vaccine makers was partly offset by weakness in consumer and financial heavyweights. The CSI 300 ended 0.1% lower, weighed by a 2% drop in the consumer staples subgauge and a 0.6% decline in financials. Liquor maker Kweichow Moutai, pig breeder Muyuan Foods and Industrial Bank were some of the biggest drags on the index. Fosun Pharmaceutical gained by the 10% daily limit as its unit agreed to establish a joint venture with BioNTech for local production and commercialization of its Covid-19 vaccine. Steel makers continued to rally as iron ore futures soar, bringing the CSI 300 Materials Index up by 1.3%, led by Inner Mongolia Baotou Steel’s limit up and Jiangxi Copper’s 9.9% jump. The subgauge has risen for three straight sessions with a 5% increase. Citic Securities has joined a bullish chorus toward cyclical shares, touting strength in coal stocks due to tight supply which will likely lead to a price hike of the fuel. The broker also expects profitability for the sector to improve this quarter from a year ago, analysts including Zu Guopeng write in a note. The health-care heavy ChiNext Index climbed 0.4% and the Shanghai Composite added 0.3%. In Hong Kong, Meituan shares sank to a seven-month low after the Chinese e-commerce company’s billionaire chief executive officer shared and then deleted a poem on social media that some interpreted as a veiled criticism of Beijing

Japanese stocks rose, following U.S. peers higher after weaker-than-expected data eased concerns that the world’s largest economy will be withdrawing its stimulus. Auto and electronics makers were the biggest boosts to the Topix. SoftBank Group and Daikin were the largest contributors to gains in the Nikkei 225. Energy and metals-related stocks climbed with commodities prices, amid strong Japanese steelmaker earnings and the shutdown of the largest U.S. oil-products pipeline following a cyberattack. The yen was down about 0.2% to 108.85 per dollar after strengthening 0.5% Friday. U.S. stocks climbed to a record Friday, while Treasuries were little changed, after surprisingly weak jobs data eased fears about higher inflation and a cutback in stimulus. “U.S. rates didn’t jump as much last Friday following the jobs data. Relative stability there is helping money flow to risk assets,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank. “The yen is weaker today, also giving support to Japanese equities.”

In FX, the Bloomberg Dollar Spot Index slipped to its weakest level since January 21 on the back of the disappointing U.S. jobs report Friday while the pound climbed to its highest level since February after U.K. elections denied Scotland’s main independence party an outright majority and strengthened the grip of the Conservatives. The Australian dollar led commodity currencies higher, rising to its strongest level since February as iron ore futures surged amid a commodities boom. The yen dropped from near a two-week high as U.S. Treasury yields climbed. Super-long bonds advanced, while two- and five-year notes drifted lower. The onshore yuan advanced to its strongest level since 2018 as it defied attempts by the central bank to slow its gains amid an improving outlook for China’s economy; PBOC set the daily reference rate at 6.4425, compared to the average estimate of 6.4370 in a Bloomberg survey of traders and analysts

In rates, Treasury futures pared losses into early U.S. session, leaving yields little changed with belly of the curve outperforming. Treasury yields are mixed after retreating from session highs, within 1bp of Friday’s close; 10-year around 1.57%. Gilts are under pressure with 10-year yield higher by ~2bp; U.K. pound rallied to the highest level since February after Scottish National Party fell short of a majority in the country’s parliament. On supply front, Treasury new-issue auctions Tuesday-Thursday totaling $126b. Dollar IG issuance is also in focus with two jumbo deals expected this week, as early as Monday. Corporate bond underwriters anticipate $40b-$45b this week in front-loaded USD IG sales, including two jumbo transactions; the larger one is expected as soon as Monday, the other as soon as Tuesday.

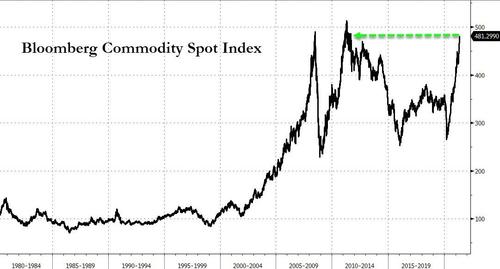

In commodities, copper jumped to a record while iron ore futures surged more than 10%, adding to concern about inflation. Oil surged with WTI and Brent both rising and gasoline surged as much as 4.2% to the highest since May 2018 after a cyberattack forced the closure of a key U.S. pipeline. Ethereum rose above $4,000 for the first time ever after an increasingly bullish JPMorgan listed 6 reasons why ETH would keep rising.

Looking at today’s calendar, there are no major events; at 2pm the Fed’s Evans Discusses Economic Outlook.

Market Snapshot

- S&P 500 futures little changed at 4,226.00

- STOXX Europe 600 little changed at 444.83

- MXAP up 0.6% to 208.75

- MXAPJ up 0.5% to 698.13

- Nikkei up 0.5% to 29,518.34

- Topix up 1.0% to 1,952.27

- Hang Seng Index little changed at 28,595.66

- Shanghai Composite up 0.3% to 3,427.99

- Sensex up 0.7% to 49,543.66

- Australia S&P/ASX 200 up 1.3% to 7,172.80

- Kospi up 1.6% to 3,249.30

- Brent Futures up 0.6% to $68.72/bbl

- Gold spot up 0.3% to $1,836.40

- U.S. Dollar Index little changed at 90.20

- German 10Y yield rose 0.1 bps to -0.203%

- Euro little changed at $1.2157

Top Overnight News from Bloomberg

- President Joe Biden is preparing for his first face-to-face meeting with the top two congressional Republicans, Mitch McConnell and Kevin McCarthy, just as the GOP is ramping up opposition to his $4 trillion economic plan, a rallying point for the party amid infighting over allegiance to former President Donald Trump

- It’s back to square one for the dollar. Friday’s worse-than-expected U.S. employment data saw the Bloomberg Dollar Spot Index drop decisively below its 2021 uptrend, putting it back to little changed for the year. The biggest one-day slide in five months has also put the greenback at risk of a further decline toward the lowest since February 2018

- Three-month dollar-yen cross-currency basis sits around minus four basis points, the smallest in a year, in a sign investors are lending out more of the U.S. currency for better returns overseas. Three-month Japan government bills with a currency hedge currently yield about 0.17%, compared with only one basis point for similar-maturity Treasuries

- Developing world heavyweights including Brazil, China and India will report inflation data this week against a backdrop of quickening growth that’s being fueled by months of easy money and fiscal largess. Citigroup Inc.’s inflation-surprise index for emerging markets spiked last month to the highest since 2008, a sign investors may be underestimating the scale of the resurgence

- ECB will look at its PEPP program in June and “we can augment or reduce our purchases of assets as needed, so as to maintain favorable financing conditions, Chief Economist Philip Lane says in Le Monde newspaper interview

- Riksbank Governor Stefan Ingves says there’s still considerable scope for more monetary supported if necessary, according to minutes of the central bank’s latest rate meeting

- As China moves closer to rolling out the world’s first major sovereign digital currency, speculation over the global implications has reached a fever pitch

A quick look at global markets courtesy of Newsquawk

Asian equity markets began the week mostly positive as the region reacted to last Friday’s disappointing jobs data stateside where Non-Farm Payrolls severely missed expectations and saw major US indices hit fresh record highs as the data supported the case for continued stimulus efforts. ASX 200 (+1.3%) was led higher by the mining related sectors after underlying commodity prices extended on gains which saw copper prices print fresh record levels and Dalian iron ore futures jumped by 10% at the open to hit limit up, while the energy sector was also lifted following a ransomware attack that forced the shutdown of the Colonial Pipeline, which is the largest refined products pipeline in the US and transports 45% of the east coast’s fuel supply. Furthermore, M&A related newsflow added to the encouragement with Crown Resorts among the best performers after it received an improved offer from Blackstone and a separate merger proposal from Star Entertainment. Nikkei 225 (+0.6%) benefitted from favourable currency flows and as participants took the recent state of emergency extension within their strides as this was widely flagged beforehand, although there were increased concerns regarding the Olympics after a recent poll showed 59% of the Japanese public think the games should be cancelled. Hang Seng (-0.1%) and Shanghai Comp. (+0.3%) were less decisive amid lingering concerns of a regulatory crackdown and with the Chinese telecom firms hampered after their failed appeal against a NYSE delisting. However, energy and biopharmaceuticals names outperformed after Sinopharm’s COVID-19 vaccine was approved by the WHO for emergency use listing and Fosun Pharma’s subsidiary agreed with BioNTech to set up a JV for COVID-19 vaccine production and commercialization. Finally, 10yr JGBs were lacklustre amid the mostly positive risk tone in the region and following the recent tumultuous price action in T-notes in the aftermath of the US jobs data, although downside in JGBs was stemmed amid the presence of the BoJ in the market for JPY 925bln of JGBs with 1yr-5yr maturities.

Top Asian News

- China’s Much-Hyped Digital Yuan Fails to Impress Early Users (1)

- Thai Lender Ngern Tid Surges on Debut After $1.1 Billion IPO (1)

- Inflation Debate Hits Emerging Markets With Pimco Standing Firm

- HSBC On Track to Hire 1,000 Wealth Managers in Asia by 2021

Cash bourses in Europe trade mixed (Euro Stoxx 50 -0.3%) after the lukewarm momentum at the cash open lost steam as participants await the next catalyst – with the Monday docket somewhat mundane but the rest of the week looking livelier with US CPI/Retail Sales, Chinese inflation, ECB minutes, German ZEW, monthly oil market reports, the Aussie budget and UK GDP. US equity futures meanwhile are similarly mixed with some mild underperformance seen in the tech-laden NQ as US yields continue to recover from the NFP trough, with the US 10yr meandering around 1.60%. Back to Europe, the indices vary in performance – the IBEX 35 (+0.1%) and FTSE 100 (+0.1%) are kept afloat by the notable outperformance in basic resources as copper and iron ore prices continue to rip higher as speculative bets mount over the recovery and ramp-up in EV production. This sees the likes of Rio Tinto (+3.2%), BHP (+2.8%), Antofagasta (+2.5%) among the Stoxx 600 winners at the time of writing. Elsewhere, banks are supported by the high yield environment whilst Italy’s FTSE MIB (+0.5%) outperforms as its heavyweight banking sector cheers further rhetoric surrounding banking consolidations. The downside meanwhile sees Travel & Leisure – with UK airlines lower (easyJet -3.3%, Ryanair -1.2%, IAG -2.7%) after the UK green-list of countries was not well received as Spain, France, and Greece have been omitted for the time being. In terms of individual movers, MAN SE (+27%) surged and hold onto gains after Traton (+2.4%) offered a 27% premium to MAN’s minority shareholders in a bid to squeeze them out. Deutsche Bank (+0.6%) shares meanwhile were dented as reports suggested the Co. and JP Morgan (Unch pre-mkt) are among those being sued by 1MDB, although the broader banking sector’s performance has cushioned losses.

Top European News

- BioNTech Rises in Premarket After China JV, EU Order

- Jailed Ex- Wirecard CEO Sues Chubb to Pick Up His Legal Bills

- SocGen to Expand Corporate Banking After Trading Losses

- Hedge Fund Star Guiding $1.3 Trillion in Norway Talks Talent

In FX, sterling is sharply outperforming in similar vain to this time last Monday when most in the UK where absent due to the early May Day Bank holiday, and several factors are aligning to propel the Pound beyond key or psychological levels against its major counterparts. Indeed, Cable has breached the 1.4000 mark that has been impervious since late February and now looks primed for a run at the next round number with the aid of ongoing Buck weakness in wake of last Friday’s US labour data disappointment, but also after Scottish election results over the weekend revealing a win for the SNP, but a single vote short of the absolute majority needed to call another independence referendum. Meanwhile, UK Health Minister Dorries has alluded to the possibility that very good data regarding vaccinations and COVID-19 developments could prompt PM Johnson to bring forward the next stage of reopening from lockdown, and Sterling is also benefiting at the expense of the Yen as the Gbp/Jpy cross rallies to a new 153.30+ y-t-d high and Usd/Jpy rebounds markedly from just under 108.50 to probe 109.00 at one stage against the backdrop of rising US Treasury yields and curve re-flattening. However, the Greenback remains depressed overall and the index has dipped below the last base ahead of 90.000 from late February (90.125), albeit marginally within a 90.097-342 band ahead of employment trends and a speech by Fed’s Evans.

- AUD/CAD/NZD – A blistering rise in iron ore prices, record increase in the case of copper and a stellar improvement in NAB business sentiment in contrast to slightly weaker than anticipated retail sales, are all helping the Aussie extend gains vs its US and NZ rivals, with Aud/Usd approaching 0.7875 and Aud/Nzd back within striking distance of 1.0800. However, the Kiwi is also holding firm against its US peer and only pips shy of 0.7300 following fairly upbeat remarks from NZ Finance Minister Robertson on the domestic recovery overnight, and the Loonie is having a close look at offers around 1.2100 with support from firm WTI after the closure of the Colonial Pipeline in the US (biggest for refined products) due to a ransomware attack.

- EUR/CHF – The cross is on a more even keel either side of 1.0950 as the Euro and Franc both take advantage of the Dollar’s demise to trade above 1.2175 and 0.9000 respectively at best, with Eur/Usd also underpinned by a significantly better than forecast Eurozone Sentix Index and Usd/Chf not that surprised to see a modest rise in weekly Swiss domestic bank sight deposits.

In commodities, WTI and Brent front-month futures are on a modestly firmer footing at the start of the week in what is seemingly a move in sympathy with RBOB gasoline in wake of the Colonial Pipeline being taken offline after a cyber-attack. The pipeline is a major artery for the delivery of refined products to the East Coast, transporting some 2.5mln BPD of products and accounting for around half of the East Coast’s consumption. Similar to the playbook during the Texas deep freeze, the bullishness of the situation will likely be determined by how prolonged the issue is – with no timeline touted thus far. Furthermore, it is worth keeping the geopolitical angle on the radar as preliminary findings indicate that the group involved in the hacking could be tied to Russia. Sticking with geopolitics, the general tone regarding the Iranian talks essentially remains that “progress is being made, but differences remain”, with little new to report on this front. WTI gapped higher above USD 65/bbl and trades around the middle of a USD 0.7/bbl range. Brent is back under USD 69/bbl having printed a USD 68.44-69.20 intraday range so far. Elsewhere, spot gold and silver are relatively uneventful and await fresh catalysts around recent ranges of USD 1830-39/oz and USD 27.40-82/oz respectively. Focus overnight and in early hours has been on the surge in base-metal prices, with LME copper hitting record highs, whilst Shanghai copper rose over 5% and Dalian iron ore futures hitting fresh all-time highs, surging some 10% – with traders and analysts citing speculative bets placed on re-inflation and the recovery.

US Event Calendar

- 2pm: Fed’s Evans Discusses Economic Outlook

DB’s Jim Reid concludes the overnight wrap

I took our twins to their first football practise this weekend at three and three-quarters. I haven’t seen so many headless chickens since Liverpool last played. They were a bit intimidated at the start of the session and wouldn’t stop holding each other’s hand which is not ideal in trying to play football. By the end of the session they were on opposite sides and kicking each other. Normal service had resumed.

This followed an epic battle at the end of last week in markets. I can’t remember an intellectually more fascinating data print than Friday’s payroll number. It had the market in a real spin trying to interpret it.

I lean on the side that the poor payrolls number (266k vs 1 million expected) is highly indicative of how difficult it is to hire at the moment as the economy fires back. My CoTD on Thursday (link here) showed that the small business “Jobs hard to fill” index was at record highs last month. This is a something that only happens late cycle and definitely not at the start. Some of this is in the logistics of hiring in a pandemic, and some of this is likely that the fiscal support is so generous that the incentive to rush back is low for many. There are signs this is leading to higher wages. One way to look at this is that companies need to outbid the government to get workers.

DB’s Matt Luzzetti pointed out on Friday that if we look at one area of the economy to avoid the overall jumbled picture, then we can see signs of rapid wage growth. He points out that within the leisure and hospitality sector, wage growth for production and non-supervisory workers rose a record 2.7% MoM in April. Over the past three months, wages for this set of employees have risen by more than 25% on an annualised basis even though job growth is strong here. (See here for more)

So for me the payroll report was a mix of a freak release and signs of how difficult it is to hire at the moment. This report can still be seen as inflationary. This was perhaps illustrated by the fact that 10yr breakevens rose above 2.50% on Friday (+5bps on the day) and to their highest levels since April 2013. 10yr nominal yields collapsed 8bps within seconds of the release but recovered all of it within 90 mins and rose a further 1.5bps into the close. All on what might be the biggest data miss in history relative to expectations. Yields had already fully recovered before President Biden speech where he used the report as the basis that more stimulus was needed saying its “clear the economy still has a long way to go.” The President will be touting his plans for infrastructure and social spending that could total to as much as $4 trillion over the course of the next few months, and the weaker jobs report is likely to be a big talking point.

Overnight, Asian markets have started the week on the front foot with the Nikkei (+0.55%), Shanghai Comp (+0.06%) and Kospi (+1.59%) all up. An exception to this pattern is the Hang Seng (-0.33%). Futures on the S&P 500 are also up +0.18% while yields on 10yr USTs are up +1.7bps to 1.596%. In FX, the British pound is up +0.27% after the SNP missed out by one seat on an outright majority in Scotland polls (more below). In commodities, iron ore prices are up a stunning +9.12% and are trading at new record highs while WTI oil prices are up +0.52% after a cyberattack led to the closure of the Colonial Pipeline. The operator has currently given no timeline for a restart.

Turning to the latest on the pandemic, the share of US hospital beds occupied by COVID-19 patients fell to 5.37%, the lowest since October while weekly new cases in the US dropped to the lowest level since the end of September. Elsewhere, India continues to remain the worst impacted country and continued to report over 400k daily new cases over the weekend. India also reported over 4000 fatalities now for two days in a row. See global comparisons in our tables in the main body of this report.

To the week ahead now before we recap last week in markets. Normally the week after payrolls is relatively quiet for US data but with the first Friday of the month falling quite late we are instead going into a busier week than normal with the all important CPI on Wednesday the stand-out. The headline YoY rate is likely to be around 3.6% with it being nearer 4% in May. Analysts expect that to be close to the peak but from that point on it will be fascinating to see whether it does progressively mean revert lower or remain fairly elevated. We’ll preview more later in the week. We’ll also get the numbers on US producer prices (Thursday), retail sales and industrial production (both Friday), so plenty for markets to watch out for. Chinese inflation tomorrow is also a potentially important release.

Back to the US, this week will also see President Biden hold a bipartisan meeting with House and Senate leadership, where the administration’s economic proposals are expected to be on the agenda.

The week is a quieter one from central banks, with all the major ones having made their latest monetary policy decisions for the time being. However, we’ll still hear from a number of Fed speakers over the coming days, with eight FOMC voters including NY President Williams (Tuesday), Governor Brainard (Tuesday) and Vice Chair Clarida (Wednesday). It was remarkable how choreographed the Fed speakers were last week. Is that good (shows unity) or bad (hints at reduced levels of debate)?

In the U.K. the Scottish question will remain in focus with the SNP just failing to win a majority but still seeing a strong set of results. With the Scottish Green Party they do have a pro-Independence majority. Staying on UK politics, this week will also see the Queen’s Speech take place tomorrow, which is where the government outlines its legislative agenda for the coming session of Parliament. We could see some interesting policy desires from a government emboldened by very good election results on Thursday.

Earnings season is winding down now, with more than 430 of the S&P 500 companies having reported. Nevertheless, we will get a few more releases this week, including 16 from the S&P 500 and a further 74 from the STOXX 600. Among the highlights include Marriott today, before Nissan and SoftBank report tomorrow. Then on Wednesday we’ll hear from Allianz, Deutsche Telekom, Iberdrola, Bayer, Commerzbank, Merck and Toyota. Thursday sees reports from Disney, Airbnb and Alibaba, and Friday includes Honda and Toshiba.

To recap last week, risk markets continued to reach new highs as cyclicals led the way. The poor US jobs number on Friday sparked a rally as it was interpreted that the Fed would remain accommodative for longer. This came after the Federal Reserve warned earlier in the week that markets were vulnerable to “significant declines” if risk appetite falters, but little seems to be affecting investors’ confidence for now. The S&P 500 rose +1.23% (+0.74% Friday) on the week to finish at a new record high, with the index having now risen 8 of the last 10 weeks. Cyclical sectors drove the majority of gains as banks (+4.43%), transports (+3.89%) and energy (+8.58%) stocks outperformed growth stocks on the week.

The NASDAQ fell back -1.51% (+0.88% Friday), while the mega-cap NYFANG index saw greater losses of -2.87%, which is third straight weekly loss for the heavily concentrated tech index. The VIX volatility index fell -1.7pts to 16.7, which is the second lowest weekly close in the implied volatility index since the start of the pandemic. European banks (+2.22%) rose to their highest levels post-pandemic as cyclicals also drove gains on this side of the Atlantic. European stocks overall reached their own record highs as the STOXX 600 gained +1.72% (+0.89% Friday) over the week, with the FTSE 100 (+2.29%) and IBEX (+2.77%) outperforming other bourses.

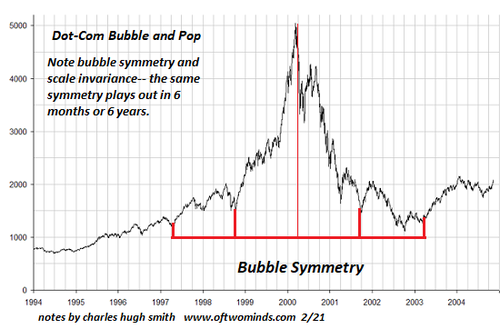

Commodity prices rose to their highest price levels since September 2011. Inflation worries and supply bottlenecks has seen the Bloomberg Commodity Index – comprised of 23 raw materials including oil, metals and agriculture products – rise +3.73% last week to its highest levels in nearly a decade, and +81% since the March 2020 lows. Copper futures gained +6.41% to reach its record high of its own, while Brent (+1.40%) and WTI (+2.08%) crude rose to their highest levels since early March. Prices on agriculture products have also risen sharply over the last few months with corn this week rising +4.43% and now up over +150% since August.

In a week where most asset prices rose, government bonds were no different. US 10yr yields finished the week -4.9bps lower (+0.8bps Friday) at 1.577% – the fourth weekly drop in yields over the last five weeks. The global benchmark is now -16.3bps lower than the March 31 closing highs of 1.74% although we did rise 9.5bps off the immediate post payroll lows into the close. The week’s move was driven by the drop in real rates (-14.8bps) which overcame the smaller, but substantial, rise in inflation expectations (+9.9bps). As discussed earlier, 10yr breakevens are now above 2.50% for the first time since April 2013. European rates also fell back last week with 10yr bund yields falling -1.3bps and UK gilt yields declining -6.7bps. In FX, the dollar index fell back -1.15% – the 4th weekly loss out of the last 5 and it now sits at its lowest levels since late February.

To finally complete the payroll picture we saw a very weak 266k print (vs 1.0mn expected). Additionally, March’s number was revised down to 770k (vs 916k previously). This would seem to take discussion of tapering off the table for the June Fed meeting and could raise questions on what constitutes a “string” of good data, which Fed Chair Powell said was among the parameters needed to begin talking about slowing bond purchases. The unemployment rate rose slightly to 6.1% (5.8% expected) from 6.0% the month prior.