Authored by Emily Miller via Emily Post News (emphasis ours),

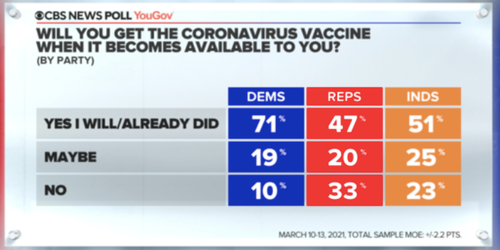

The media elite has been telling us for months that the vaccine hesitancy rate is highest among Republicans, in particular, the men. The press alleges that the MAGA-hat-wearing-uneducated-conspiracy-theorists GOP are to blame for the continuing pandemic. But, guess what? The media lied. It’s young, healthy people who don’t want to get vaccinated.

After six month of shots in arms, the vaccine hesitancy can be measured largely by who has not gotten one yet. The Centers for Disease Control (CDC) reported recently that:

Vaccination coverage and intent among adults are lowest among those aged 18–39 years.

The official data shows that, from March to May, one quarter of these young adults said they were unsure about getting vaccinated and another quarter said they will not get it

The CDC doesn’t even mention political affiliation as a factor. Among the 18 to 39-year-olds, the rates were lowest for those who were younger, black, poorer, less educated, uninsured and living outside metropolitan areas.

However, the media elite have not let these facts stand in the way of a good story. To continue the blame-the-Republicans narrative, the press use public opinion polls as a basis of their reports. That’s how we’re still seeing so many stories on Republican hesitancy despite the CDC saying it’s not the case.

The Washington Post is Obsessed

Look at what one outlet — The Washington Post — has published in just the past week:

HEADLINE: The GOP’s very stubborn vaccine skepticism

HEADLINE: A third of White conservatives refuse to get vaccinated — a refusal shown in polling and the real world

HEADLINE: We are in a race’: GOP governors implore residents to overcome vaccine hesitancy as delta variant rises

The Post even did its own poll to push this narrative more.

HEADLINE: Post-ABC poll: Biden earns high marks for handling the pandemic, but many Republicans resist vaccination.

The editors at The Post don’t see their own bias in the news side. But the opinion side was so determined to push this false narrative that it published two op-eds on the topic — one from the left and the sorta-kinda right.

Opinion by Marc Thiessen: If Biden wants to convince the vaccine hesitant, give Trump credit for the vaccines

Opinion by Max Boot: Republicans are preventing America from reaching Biden’s vaccination goal

The obsession by the Post editors in making sure readers blame Republicans for any more COVID deaths is just one tiny glimpse into the larger problem with the media pushing this false narrative.

How the Media Works

Going through the media stories about Republicans who supposedly won’t get vaccinated, there’s a clear pattern.

1) The outlet cites a public opinion poll, never the CDC statistics.

2) The reporter gets quotes from random “expert’“ who says the poll proves the GOP is the problem with ending the pandemic.

3) The journalist finds a twist to blame all this on Pres. Donald Trump.

Of course it benefits Pres. Joe Biden to blame the lack of vaccinations on Republicans and Donald Trump because otherwise he would take the hit.

Since Democrats have retaken the White House, the taxpayer-funded media outlets (VOA, NPR, PBS) have been cleared out of Republicans so that the liberals who report and produce in these outlets can return to their agenda.

So, look what the Voice of America is airing all over the world: “Unvaccinated Americans Whiter, More Republican Than Vaccinated.” The story follows the patterns of corporate media.

1) Cite a poll, not stats

Kaiser Family Foundation and never mention the CDC.

2) Get quotes to say the poll shows Republicans are the bad guys

In this case, the expert is just the head of the polling company: Liz Hamel, director of Kaiser Family Foundation’s Public Opinion and Survey Research

3) Blame Trump

In this story, they did it by quoting Hamel as the expert, like this:

For example, she said, “believing that the media has exaggerated the seriousness of the pandemic — that’s something that we heard President Trump saying when he was in office. It’s something that Republicans are more likely to agree with than Democrats. And people who believe that the pandemic has been exaggerated are much less likely to say they want to get the vaccine.”

The New York Times is Ground Zero

How did we get to this common knowledge that Republican men are the biggest holdouts of the COVID vaccine in the US? To answer that, we need to go back to March 2021 when people under 65-years old were first getting vaccinated and could provide real world data. Up to that point, the public opinion polls from as far back as June 2020 were hypothetical about getting a vaccine.

The The New York Times often sets the narrative for the rest of the media, especially TV news. This was the story in NYT on March 15:

HEADLINE: As Biden Confronts Vaccine Hesitancy, Republicans Are a Particular Challenge

The Times seems to have started the system for how to falsely claim Republicans are the most vaccine hesitant.

1) Cite poll, not stats—

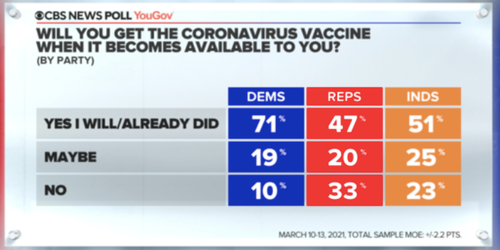

The evidence for the GOP being a “particular challenge” was a poll done by CBS News that the Times reported said one-third of Republicans would not be vaccinated compared with 10 percent of Democrats. That number is accurate, but The Times didn’t put it in perspective.

Overall, 22 percent of the people in the CBS poll said they will not get the vaccine, so “one-third” is not that big of a difference. (CBS said it “weighted” the results but didn’t publish the original numbers to show how.)

If The New York Times reporters had looked at the poll independently of the conclusion by CBS News, they might have looked at other factors. The age difference in the poll shows young people were above average for vaccine hesitancy — just as significant of a divider as party affiliation.

Those under 30 years old who said they won’t get a vaccine were 26 percent compared to only 15 percent over 65 years old. The divide is just as big as party affiliation when you look at actual hesitancy, people who are not sure. That is split 31 percent of young people and only 10 percent of older people.

If the story had instead concluded that age was the most important factor, then this NYT story in March would match the facts now from CDC that show young people are not getting vaccinated. Instead, just as the vaccine first became available for people under 65-years-old, The Times concluded this:

The administration is seeking help in urging Republicans to get inoculated. But the president said he was not sure how much value there was in enlisting his predecessor.

2) Expert says poll proves Republicans are the problem

The Times refers to a reporter asking Pres. Biden about the alleged Republican vaccine problem at a press conference.

REPORTER: Should President Donald Trump help promote the vaccine among skeptics, sir, especially those Republicans who say they’re not willing to take it?

THE PRESIDENT: I’m hearing a lot of reports from serious reporters like you saying that. I discussed it with my team, and they say the thing that has more impact than anything Trump would say to the MAGA folks is what the local doctor, what the local preachers, what the local people in the community say.

Notice how Biden legitimizes the blame-Republicans theory by saying it’s coming from “serious reporters like you.” He never said it’s true or factual because there’s no evidence of it. The media and the Biden White House have the same agenda.

3) Blame Trump

This was a layup for Biden since the reporter did it for him. The Times just piled on by saying Trump is to blame because he got his vaccine “in secret.”

Media Follows The New York Times

As I wrote earlier, the TV networks generally take The New York Times stories and put them to video. Since The Times used a poll from CBS to blame Republicans, CBS then used someone else’s poll to continue the hit job. This story is from April 7:

HEADLINE: Many Republican men are hesitant to get coronavirus vaccine: “I don’t think it’s necessary”

CBS followed the pattern to establish the narrative.

1) Cite poll

They cited this poll without linking to it:

A recent Marist poll in partnership with NPR and PBS NewsHour found 49% of Republican men said they would not take the vaccine when it’s available to them.

2) Quotes to back up the poll as fact

CBS interviewed someone named Steve Mitchell who has “been polling Republicans in the state of Michigan for more than 30 years.” It’s a stretch to interview one guy in one state to assess the entire country, but that was how CBS could make this story stick.

Then CBS interviewed one guy in Michigan named Chris Howe who has no expertise or public position but just described as a “conservative living in Clarkston, Michigan, where he runs his own hardwood flooring business.” The point of using Howe is to get the juicy headline. But it is taken totally out of context.

Howe said he already had COVID so has the antibodies. The headline reads “I don’t think it’s necessary,” and it leaves out the second part of what Howe said: “”I have gotten it and I have not died.” Of course it’s not necessary if you have natural immunity. But that doesn’t fit the narrative of this story.

3) Blame Trump

This story doesn’t blame Trump directly, but says this :

In an interview with Fox News, former President Donald Trump said that he’s taken the vaccine. “It’s a great vaccine. It’s a safe vaccine. It’s something that works” he said.

Cable TV Blaming Republicans

A couple weeks later, CNN does a report with this headline “Vaccine hesitancy among Republicans emerges as Biden’s next big challenge.” It says:

And the hurdles that lie ahead for President Joe Biden in persuading Americans who did not vote for him to take the vaccine are coming into sharper focus as resistance among Republicans, White evangelicals and rural voters persists even though vaccines are now widely available.

CNN is able to write this as fact by doing the standard three steps to get to blame Trump.

1) Cite a poll, not hard numbers

Even though this story was produced after people under 65-years-old started getting vaccinated, CNN did not use any actual statistics from the CDC. Instead it used a Monmouth poll that asks people if they got the shot. CNN was thus able to report that: “a stunning 43% of Republicans said they would likely never get the vaccine.”

2) Expert quotes to back up the poll

CNN is of course totally in the tank for Biden, so it doesn’t try to back up the poll but instead uses administration officials to allegedly prove that Republicans not getting vaccinated will kill people. CDC Director Dr. Rochelle Walensky is cited:

“Because this virus is an opportunist, we anticipate that the areas of lightest vaccine coverage now might be where the virus strikes next.” She added that with only modest protection for the oldest people within the US population, “many more deaths” could ensue.

3) Blame Trump

CNN’s business model is talk about how bad Trump is 24/7. So it’s not a surprise that the report on vaccine hesitancy just blames Trump without even a connection. The report says:

Trump has also seemed uninterested in helping to combat vaccine hesitancy even as some have urged him to do a public service announcement and greater publicity to encourage his supporters to get vaccinated. Trump did not get his vaccine on camera like other former US presidents.

CNN concluded— without any facts— that Trump is to blame for alleged Republicans holdouts who are stopping our country from ending the pandemic.

It remains unclear whether Trump will weigh in to help the Biden administration address vaccine skepticism, but Biden needs to find a way to get the message out to Trump’s base that vaccines are safe, and in fact, necessary, for America to beat the virus.

Media Bias Seeps Into Science

The most disconcerting of all The New York Times followers is the supposedly data-based journal “Scientific American.” The headline in its June issue is “Do Republicans Mistrust Science?” Here’s how it explained this totally non-scientific theory.

….. [click here to read the rest of the investigation]