Rabobank: Is It Possible The Fed Is So Stupid It Doesn’t Understand What It Is Doing

By Michael Every of Rabobank

Warning: May contain crisis

I am lucky in that I don’t have a serious food allergy, such as to peanuts. I fully grasp just how dangerous these can be to those that unfortunately do, and why we need clear food labels to show if there is even a trace of nuts. Having said that, I always find it ironic that when I get given the standard packet of peanuts on a plane, it is labelled: “Warning: may contain nuts”. Are there people who might not know that peanuts contain nuts? Apparently so.

On that front, there are headlines right round the financial world because the Fed’s latest Financial Stability Report –which is usually read about as carefully as the labels of food packaging for those with no allergies– contained the following warning:

“Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year….With investors ebullient on expectations for a strong rebound, it is important to closely monitor risks to the system and ensure the financial system is resilient….strong microprudential safeguards and macroprudential tools…will be important to address risks to financial stability and enable monetary policy to focus on maximum employment and average inflation goals.”

If this was the easier-to-understand ‘traffic-light’ food labeling system, it would be bright red, like the fat content on a pepperoni four-cheese pizza. Yet is there really anyone in markets who doesn’t see that this ridiculous bubble contains bubbles?

The vast majority know what’s going on. They also know the Fed itself has brought us here. And yet they believe that if things go wrong, again, the Fed –on long-established form– will bail them out – again. This used to be done “because deflation”; now it may be “because society”. Does it matter? Indeed, US markets went up even after being told they were too high by the Fed. As such, the underlying problems are only getting worse.

It’s honestly an open question if the Fed realize this or not. One would like to think they are cynical enough to know what they were doing, and hypocritical enough to then put out reports pretending where we are today is a surprise. Yet there is also the possibility they really are stuck in a crazy mental model and can’t predict that pouring excess liquidity into the financial system, not the real economy, doesn’t drive up productive business investment and inclusive wages, even after years of evidence to that effect.

“Drug dealer complains clients are addicted to drugs”https://t.co/cENwUiS9rj via @financialtimes

— Dylan Grice (@dylangrice) May 7, 2021

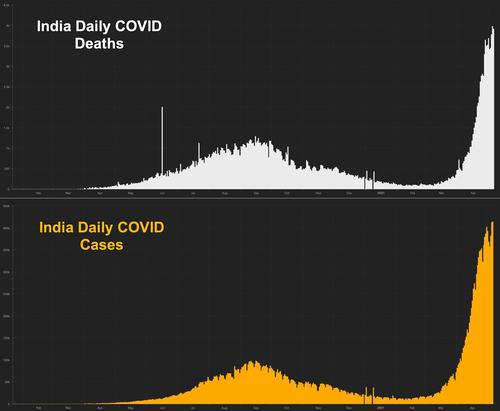

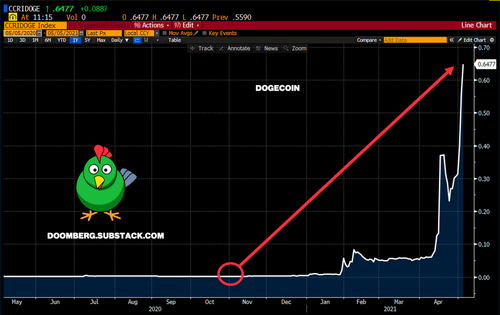

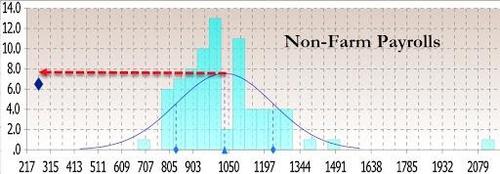

The counter-argument is that the only way the Fed could have injected this much liquidity and not seen it go into houses prices, or stock prices, or agri-commodities, or iron ore, or lumber, or Dogecoin, would have been to accept the market mechanism doesn’t work, and to hypothecate the inflow with the micro and macroprudential measures now flagged too late, or directly via MMT. Our global exponential liquidity system is guaranteed to create the risks ‘suddenly’ flagged by the Fed unless it’s strapped down, bisected, and/or hypothecated. But then we don’t get house-price booms or stock price booms or Dogecoin booms. And then where would we be?

By the way, a developed country with almost no peanut allergies is Israel, because of the ubiquity of the peanut-derived snack Bamba, which is loved by kids. Exposure to small amounts of nuts from an early age apparently prevents the deadly allergies that can arise if one has no contact with them. That’s what we used to think was true about risk too – in the classical Schumpeterian conception of how capitalism works. Now we have no risks – and get endless warning labels.

On which, was the stability report a heads up? The RBNZ have been mandated to ‘do something on housing’; the BOC tapered, moderately; the RBA are being dragged in that direction with a copy of the Domain property supplement clutched in hand; and the BOE yesterday tapered, moderately. How long until the Fed makes at least a move in the same direction, assuming this is not all a coincidence? What an anaphylactic shock that will be for some.

Meanwhile, in the broader world of unstable systems and risks we don’t want to see, the G7’s latest communique pre-amble states:

“We commit to strengthening open societies, shared values, and the rules based international order. We affirm that free and fair trade, and the free and secure flow of capital, knowledge, data, ideas, and talent is essential to our long-term prosperity. We affirm that liberal democracy and free and fair markets remain the best model for inclusive, sustainable social and economic advancement. We commit to tackling threats jointly and committing our resources to achieving shared security.”

China was called out, along with a Fun Club of Russia, Ukraine, North Korea, Iran, Syria, Chad, Somalia, etc. Recall when the G7 was all about GDP?

Meanwhile, China says the G7 is “ blatantly meddling” in its internal affairs, and Xi Jinping says that China is “invincible”, regardless of the challenges, while stressing the virtues of self-reliance, not liberal democracy or free and fair markets. China has also symbolically cancelled a high-level economic dialogue with Australia.

Within the G7 itself, Germany’s Merkel insists the EU-China investment treaty is still going ahead; wants to complete Nord Stream 2; is using a frigate to undermine the symbolism of a major Western naval exercise in the South China Sea; and is now also pushing back against US plans to waive virus vaccine intellectual property protections. At least she isn’t ramming her ship into a British one, or blockading ports, like the French.

The US is apparently going to look at the Phase One US-China trade deal again; and it has already decided to keep the Trump-era restrictions on Chinese investment in the US.

Yet Henry Kissinger argues re: China in the FT: “We should not use the human rights issue as a deliberate issue to undermine the existing structures, because if we do that we will be in a permanent confrontation.” So either the G-7 are spouting empty rhetoric, and/or Western markets’ new ESG focus doesn’t actually apply to a huge slice of the global economy; or Western-China relations are on the edge of either a Cold War schism or a pre-WW1 downwards spiral. What kind of warning label do we slap on that?

Tyler Durden

Fri, 05/07/2021 – 12:55

via ZeroHedge News https://ift.tt/3esadmp Tyler Durden