Kashkari Slams Fed Critics, Pretends Stimulus Isn’t Helping Wall Street

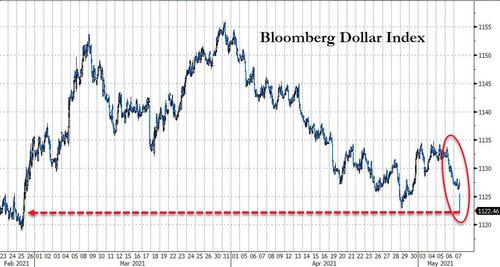

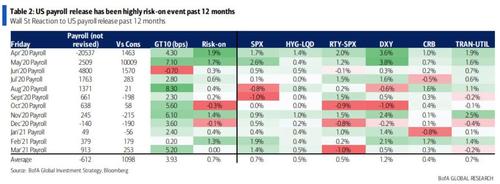

After Dallas Fed President Robert Kaplan spooked stocks by repeatedly suggesting that it was time to start discussing tapering of the Fed’s asset purchases, Friday’s job number offered doves on the Fed just the ammunition they needed to push back.

So we weren’t surprised to see Minneapolis Fed President Neel Kashkari appear on Bloomberg TV Friday morning just minutes later to defend the Fed’s dovish approach, while implying that hawks like Kaplan and Kashkari’s other “critics” on Wall Street may secretly be trying to sabotage the recovery.

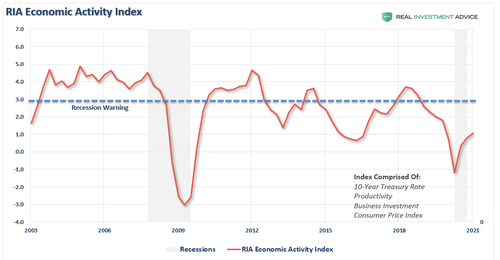

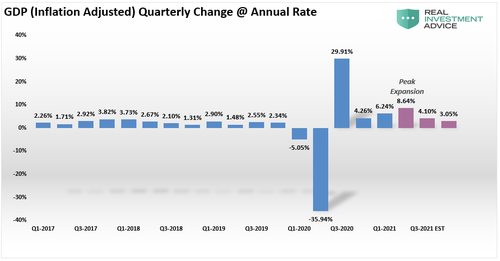

After the 3.7-sigma miss from the 1MM+ projections (one of the biggest in history and the biggest in decades), Kashkari insisted that Friday’s jobs number is the latest evidence that the US post-pandemic economic recovery “has a long way to go”.

“For all those people who have been saying ‘oh my gosh, the Fed needs to normalize quantitative easing,’ today’s job report is just and example of – we have a long way to go” Kashkari said. He added that he was “firmly in the camp” for maintaining the Fed’s policy stance, which presently entails buying $120 billion in assets every month, while keeping the Fed funds rate close to zero.

“Let’s not just forecast that the labor market will recover, let’s actually wait for the labor market to recover. As Chair Powell said a week ago, we’ve had one great jobs report, let’s not declare victory yet.”

It’s certainly convenient that just as dissenting voices on the FOMC were starting to speak out, Fed doves like Kashkari and Powell got essentially the perfect reading to justify their actions.

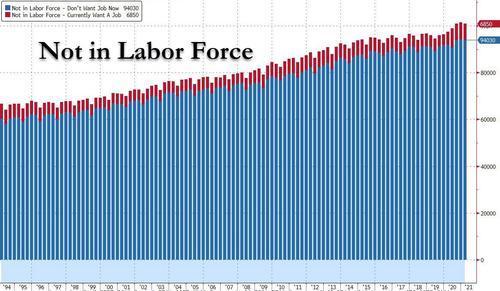

But even more notable than his defense of the Fed is the fact that, when confronted about the role that unemployment benefits may have played in depressing job gains, Kashkari openly acknowledged that the government is essentially paying people to stay home. Kashkari acknowledged that generous unemployment benefits are keeping workers out of the labor market, because workers are confident jobs will still be there in three or four months when the government money runs out.

“We hear all the same anecdotes…yes of course there are people who are on the sidelines and who are getting generous unemployment and they’re saying ‘yes we understand the labor market will be strong in three or four months…we know that dynamic is there,” Kashkari said.

But there are other factors at work, he argued, citing women unable to return to work for child-care reasons, and people who are still afraid of contracting the virus, as examples of workers who must still be coaxed back into the labor market before stimulus can be safely withdrawn. But these will likely be resolved on their own as the virus wanes.

But in trashing those who would dare to criticize the Fed, Kashkari – as he often does – set up a straw man opponent: the market participants who are purportedly angry with the Fed for sabotaging their business. In the interview, he insisted he had “zero sympathy” for his critics on Wall Street.

“For my friends on Wall Street, and I have a lot of them, I hear from them all the time complaining about the Fed’s policies that are mucking up their trading strategies,” the former Goldman Sachs Group Inc. and Pacific Investment Management Co. executive told Michael McKee on Friday in an interview on Bloomberg Television. “I have zero sympathy — because there are still 8 to 10 million Americans who want to work, who ought to be working.”

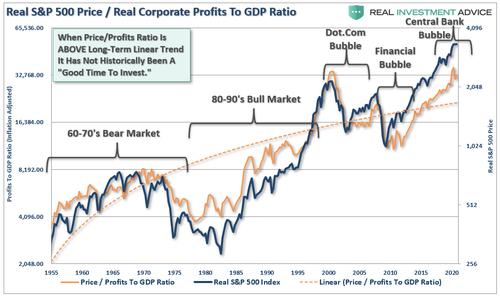

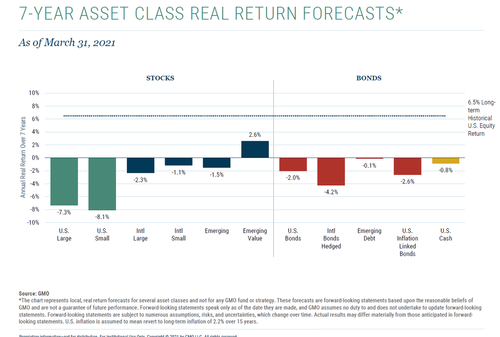

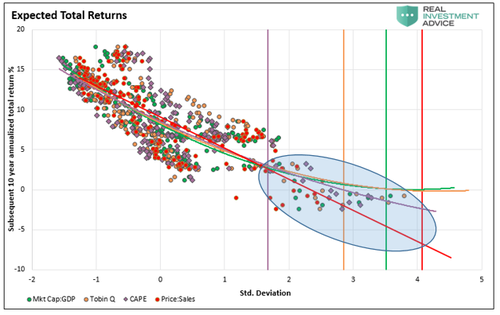

Of course, in an age where anybody can seem like an investing genius simply by observing the mantra that “stocks only go up”, we certainly don’t hear too many complaints. Yet, Kashkari insists on criticizing Wall Street, while ignoring the fact that the Fed’s policies have driven one of the most lucrative bull markets in history (while sending stocks back to record highs on Friday).

Did Kashkari fall on his head today?

“For my friends on Wall Street, and I have a lot of them, I hear from them all the time complaining about the Fed’s policies that are mucking up their trading strategies”

Yes, it’s a chorus of complaints about the Fed propping up markets

— zerohedge (@zerohedge) May 7, 2021

That being said, Kashkari added that he would be “open” to debating the finer points of the Fed’s policy, like the exact amount of assets that the central bank should be buying.

“I don’t see any reason right now to change something that is working,” Kashkari said. He noted the quantitative easing is an “inexact science.”

“You know, could someone say ‘oh, instead of 120 [billion] you should be buying 110,’ sure we could have that debate,” he said.

“What we’re doing right now, I think, is supporting, certainly the housing market, supporting financial markets in general, keeping the yield curve lower, keeping the 10-year down, which bleeds through into all sorts of other different interest rates across the economy,…providing a lot of support to accelerate that recovery,” he said.

To sum up, here’s a distillation of Kashkari’s logic: Friday’s weak jobs number justifies even more stimulus. More stimulus allows more workers to postpone return to the labor force as restaurants and retail outlets refuse to hike wages to the degree needed to lure more workers back to the work force.

Procyclical stimulus:

Not enough jobs as employers can’t find workers who opt for government stimulus instead; and the poor jobs number ensures that even more stimulus will be handed out, ad inf.

— zerohedge (@zerohedge) May 7, 2021

Was, rinse, repeat.

Readers can listen to a clip from the interview below:

Tyler Durden

Fri, 05/07/2021 – 10:20

via ZeroHedge News https://ift.tt/2R1lgKm Tyler Durden