For the fourth morning in a row, futures are barely changed – a stark reversal to the previous euphoria that would see a big jump in risk sentiment in the overnight session – with Emini futures flat ahead of data that is expected to show a decline in weekly jobless claims, while shares of vaccine makers tumbled further after President Joe Biden’s plan to back intellectual property waivers on COVID-19 shots. The dollar weakened amid unchanged Treasury yields even as Japan and China returned from holiday.

Among the premarket movers, Tesla shares gained on a report from its quasi-PR publication Electrek, that its second-quarter production capacity is already sold out.

- Shares in Pfizer, Moderna, Johnson & Johnson and Novavax all involved in the making of COVID-19 vaccines, fell between 0.6% and 5.4% in premarket trading, after Biden said on Wednesday that he had backed a World Trade Organization waiver for vaccine intellectual property to enhance the fight against the pandemic.

- FAAMG stocks rose on Thursday, with Microsoft, Apple, Alphabet and Amazon.com gaining between 0.1% and 0.3%.

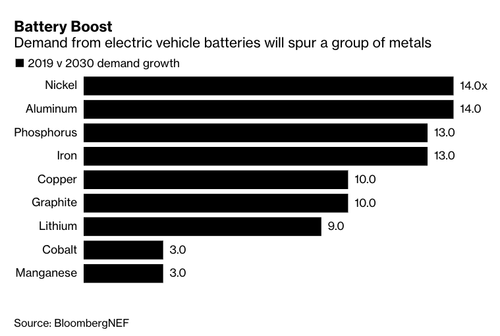

- In commodities, the surge continued with iron ore climbing to a record above $200/ton and steel futures hit fresh records amid renewed demand from China.

- IBM rose 0.4% as it introduced what it says is the world’s first 2-nanonmeter chipmaking technology for faster computing.

- Uber fell 3.6% as it signaled it would pay drivers more to get cars back on the road and disclosed a $600 million charge to provide UK drivers with benefits.

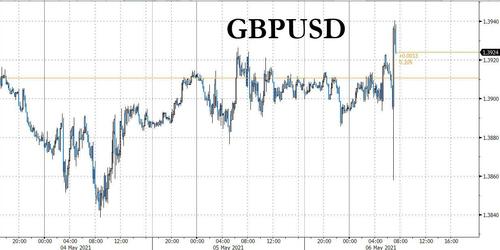

In Europe, the Stoxx 600 Index swung from a gain to a loss on a mixed batch of corporate results. Europe’s vaccine makers also plunged after the European Union backed a plan to discuss waiving vaccine-patent protections. The pound gained after the Bank of England slowed the pace of its bond buying and left rates unchanged. Here are some of the biggest European movers today:

- AB InBev shares climb as much as 5.3% to a more than 2-month high after the world’s largest brewer reported 1Q results that impressed analysts and said it picked internal candidate Michel Doukeris to replace long-standing CEO Carlos Brito.

- SES jumps as much as 11%, the most since November, after results, with Goldman Sachs saying that the satellite firm reiterating all of its full-year guidance should be taken positively.

- UniCredit climbs as much as 5.5%, most since Feb. 3, after the Italian lender beat estimates, with analysts pointing to strong capital, earnings driven by trading income, low provisions.

- Vitec gains as much as 11% to a record after the company forecast FY adjusted pretax profit to be materially above current market expectations. Jefferies sees double-digit upgrades to consensus analyst estimates following the update.

- Nel shares fall as much as 10%, extending losing streak to a seventh day. Norne says the “volatile ride” is continuing, however, sees more and bigger green hydrogen news in the pipeline.

- Shop Apotheke drops as much as 11%, to the lowest since Jan. 7, after 1Q results that analysts say missed expectations.

- LeoVegas drops as much as 18%, most since November 2018, after a 1Q report that Pareto said was somewhat below expectations, both regarding reported numbers and the trading update.

Earlier in the session, Asian stocks gained as much of the region reopened, with a rally in Japan driven by cyclical shares helping offset a selloff in China as both markets reopened after an extended holiday break. The MSCI Asia Pacific Index rose as much as 0.9%, with some earlier of that earlier gain trimmed after China said it was suspending a regular economic dialogue with Australia. Drugmakers were the biggest losers on the CSI 300 Index on news that the U.S. will support a proposal to waive intellectual-property protections for Covid-19 vaccines. Still, the broader Asian stock gauge was set to halt a four-day losing streak, its longest since March 25, thanks also to gains in Thailand and South Korea. Japan’s Topix index rose to its two-week high as traders returned following Golden Week holidays. That’s even as the nation was reportedly looking to extend a state of emergency for Tokyo, Osaka and the prefectures of Kyoto and Hyogo amid a continued rise in virus cases. “A softer yen vs the yuan, ongoing commodity reflation, blossoming global trade and a latent capex boom have masked the stumbling vaccine roll-out,”

Jefferies strategists including Sean Darby wrote in a note published Thursday. “Despite the sawtooth GDP trajectory Japan’s economic indicators are still holding up.” Sector-wise, reflation trades remained the focus in Asia, with cyclical stocks like Japanese automakers and financials contributing heavily to the gains. Technology and the communication-services sectors were laggards. In the U.S., the Russell 2000 Value Index has risen 1.1% this week, compared with a drop of 3.4% for its growth counterpart. In a surprising escalation, China officials announced a formal suspension of an economic dialogue with Australia, a further deterioration of relations between the two countries.

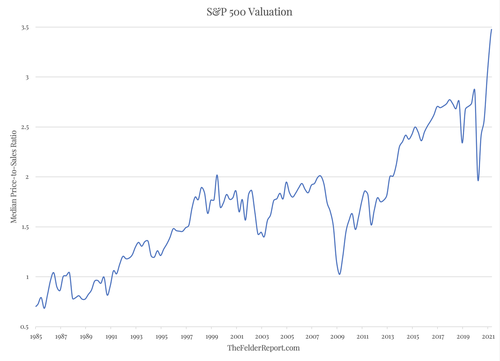

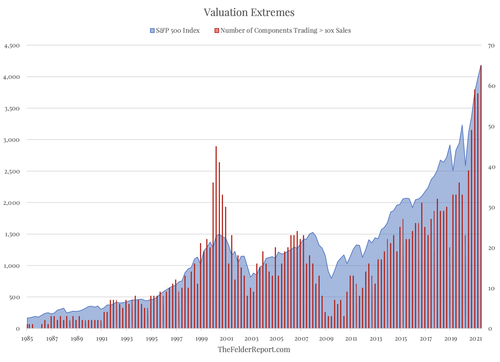

Amid mounting evidence of inflation, with even permabull JPMorgan warning that investors are not prepared for the coming non-transitory inflation shock, markets are increasingly focused on when the Federal Reserve might start throttling back its emergency support. Economists surveyed by Bloomberg expect the Fed will announce a reduction in the pace of bond purchases in the fourth quarter although today’s BOE tapering may push that forward.

While Chair Jerome Powell hasn’t yet shifted from his message that it’s too soon to discuss such a move, policy makers have begun to address the issue more directly. Overnight, Boston Fed President Eric Rosengren suggested that the U.S. mortgage market no longer needs as much support, advancing the debate on when the central bank might start tapering its monthly bond purchases. Meanwhile, the U.S. Treasury’s auction schedule suggested the government’s financing needs may have peaked.

At the same time, with Covid-19 cases starting to roll over, “reopening prospects should improve again, and the reflation trade should gather steam again over the coming months,” Esty Dwek, head of global market strategy at Natixis Investment Managers Solutions, said in a note. “The medium-term supports for equities remain unchanged.”

In FX, the Bloomberg Dollar Spot Index edged 0.1% lower, swinging from a 0.1% advance in the Asian session and the greenback was weaker against mosts of its Group-of-10 peers. European currencies dominated G-10 gains while the yen fell out of favor as risk sentiment was bolstered. The pound dropped after the BOE announced a dovish taper, while local and national elections also loomed on the radar. Norway’s krone held on to an early European session gain after the nation’s central bank sticked to its earlier communication that it will most likely raise rates in the second half of the year. The Australian dollar recovered most of its losses that followed after China’s indefinite suspension of economic dialogue with the nation; the currency was helped by stronger iron ore prices.

In rates, treasury futures retreated from session highs, following a drop in gilts after Bank of England in policy announcement said it will slow the pace of weekly bond buying to GBP3.4b. Total Asset Purchase Plan was unchanged at GBP875b. U.S. yields, little changed before the announcement, cheapened by ~1bp across long-end of the curve. 10-Year yields moved higher by ~1bp to 1.57% as gilts weakened following Bank of England policy decision, with U.K. 10-year yield flipping to cheaper on the day. Cash trading of Treasuries was done during Asia session for the first time this week following Japanese holiday. The dollar issuance slate includes BOC Aviation 3Y, Nordic Investment Bank 5Y FRN SOFR and EIB $1.5b 10Y; five borrowers raised $4.9b Wednesday, and next week is expected to be active with potential for a $10b+ jumbo deal.

Of note after today’s BOE taper announcement, which kept sovereign and corporate sizes unchanged despite hawkish dissent from outgoing MPC member Haldane who voted to reduce the Gilt remit by Gbp 50 bn to Gbp 875 bn instead, we have seen very volatile trade in UK debt and Sterling. The 10 year benchmark ticked up gradually initially before a spike to 128.51 and abrupt reversal to 127.78 where underlying bids have contained further losses, while the Pound dumped further below 1.3900 vs the Dollar to circa 1.3859 before reversing all and more of its decline to trade up around 1.3941. In short, a hawkish net reaction and perhaps more in recognition of 2021 growth and inflation forecast upgrades along with downward revisions to jobless rates from this year through 2023 rather than QE tapering within the existing framework.

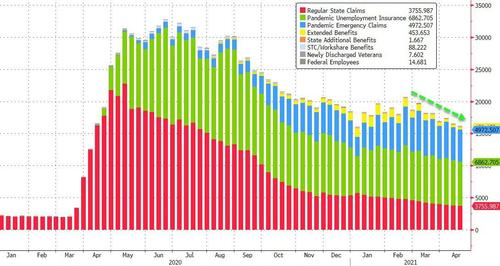

A Labor Department report will likely show initial jobless claims fell to 540,000 last week from 553,000 in the previous week. Investors are awaiting the Labor Department’s more comprehensive non-farm payrolls data on Friday, which is expected to show accelerating job growth in April.

Looking at the day ahead now, we get the weekly initial jobless claims, and the preliminary Q1 reading of nonfarm productivity and unit labour costs. Finally, earnings releases include Moderna, Linde, Rio Tinto and AIG. We also get comments from the Fed’s Williams, Kaplan and Mester.

Market Snapshot

- S&P 500 futures up 0.17% to 4,167.00

- STOXX Europe 600 fell 0.14% to 440.93

- MXAP up 0.7% to 206.23

- MXAPJ up 0.3% to 690.73

- Nikkei up 1.8% to 29,331.37

- Topix up 1.5% to 1,927.40

- Hang Seng Index up 0.8% to 28,637.46

- Shanghai Composite down 0.2% to 3,441.28

- Sensex up 0.5% to 48,917.26

- Australia S&P/ASX 200 down 0.5% to 7,061.69

- Kospi up 1.0% to 3,178.74

- Brent Futures down 0.19% at $68.83/bbl

- Gold spot up 0.39% to $1,793.90

- U.S. Dollar Index down 0.23% to 91.094

- German 10Y yield fell 0.3 bps to -0.231%

- Euro up 0.27% to $1.2038

Top Overnight News from Bloomberg

- Treasury Secretary Janet Yellen faces the challenge of speeding a debt-ceiling increase through Congress without shaking investor confidence, a potentially difficult task even with Democrats controlling both chambers and the White House

- JPMorgan Chase & Co. is further expanding its balance sheet in Frankfurt as it adapts to a post-Brexit Europe. The U.S. bank expects to add a similar amount to its European hub in 2021 as it did last year, according to its annual report for J.P. Morgan AG

- China announced that it was suspending a ministerial economic dialogue with Australia, in a largely symbolic move showing Beijing’s growing frustration with Canberra

- India reported its highest-ever daily tally of 412,262 new virus cases and also a record 3,980 deaths

A quick look at global markets courtesy of Newsquawk

A mixed picture was observed in Asia-Pac stocks as the region took its cue from the indecision stateside where sentiment was clouded by disappointing data releases and the Nasdaq was dragged by weakness in tech and growth, although S&P 500 and DJIA remained afloat in which the latter posted a fresh intraday record with outperformance in the energy sector after Brent crude printed a fresh COVID-era high just shy of the USD 70/bbl level. ASX 200 (-0.5%) lagged after a couple of new COVID-19 cases were reported in NSW and with tech leading the declines across nearly all sectors aside from mining-related industries as underlying commodity prices benefitted from China’s return to the market. Furthermore, strong earnings from NAB failed to provide an uplift to the big 4 banks despite almost doubling its H1 cash profit, whereby its shares retreated from a yearly high, while Nikkei 225 (+1.8%) was boosted on reopen from the extended weekend on a foray above the 29,000 level and with the index underpinned by favourable currency flows. Hang Seng (+0.8%) and Shanghai Comp. (-0.2%) were both initially positive as China reopened from the Labour Day holidays with notable gains in the blue-chip energy names and Budweiser APAC front-running the advances post-earnings, although the risk appetite then soured amid weakness in the ChiNext which slumped over 3% due to pressure across biological stocks after the US administration voiced support for a waiver of COVID-19 vaccine patents and following an announcement by the NDRC to suspend all activities under the China-Australia strategic economic dialogue mechanism indefinitely, citing Australia’s disruption of cooperation with China. Finally, 10yr JGBs were marginally higher as they tracked the recent gains in T-notes which had been supported after the continued dovish Fed rhetoric and after the Treasury Quarterly Refunding hinted at auction size cuts in H2, while the presence of the BoJ in the market for JPY 650bln of JGBs in 5yr-25yr maturities also provided a tailwind for prices.

Top Asian News

- China Halts Australia Economic Dialogue in New Retaliation

- Mitsui Said to Mull Buyout of $12 Billion Hospital Chain IHH

- Nintendo Warns Chip Crunch May Hit Switch Despite Gaming Boom

- Apollo Bids A$4 Billion for Tabcorp Units in Australia

Major bourses in Europe see a choppy session and mixed trade with the earlier modest upside bias reversing (Euro Stoxx 50 -0.2%), this follows on from a similarly mixed APAC session which saw the return of Chinese and Japanese participants following their respective holidays. US equity futures meanwhile eke mild gains with no clear standout performer. The tone across the market is rather tentative heading into the BoE policy decision and US jobless claims, with participants also likely to keep some powder dry for tomorrow’s NFP release. Europe sees varying performances across the majors and peripheries, with Italy’s FTSE MIB (+0.3%) narrowly outperforming as banks are lifted in unison with a post-earnings UniCredit (+5.0%) and SocGen (+3.7%), although ING (-1.9%) bucks the trend. Sectors in Europe are mixed with no clear theme, albeit sectors have attained a downside bias in recent trade, and again distorted by earnings. Food & Beverage leads the gains and AB InBev (+5%) pulls up the sectors after topping revenue and volume growth forecast, whilst the Co’s Budweiser unit also saw a strong performance in Hong Kong. Autos also remain supported but have lost momentum in recent trade, though the sector was initially underpinned by Volkswagen’s (-2.0%) stellar earnings which also prompted a guidance upgrade. That being said, the group noted that the chip shortage is expected to be more significant in Q2 vs Q1. Elsewhere, Tech and Basic resources reside as the laggards following yesterday’s firmer performances. In terms of individual movers, Telecom Italia (-5%) opened lower a much as 9% amid rumours that the Italian government could ditch plans for a single broadband network. Meanwhile, Curevac (-18%) and BioNTech (-18%) plumb the depths in German trade after US President Biden stated that he will back a WTO waiver and the USTR also announced support for the waiver of vaccine-patent protections at the WTO – seen as a hindrance on companies’ profits.

Top European News

- Alphawave, Holders Seek $1.1 Billion in London Tech Listing

- SocGen Posts Rebound With Best Equities Revenue Since 2015

- UniCredit CEO Orcel Signals Interest in M&A to Boost Growth

- Telecom Italia Slumps on Report Single Network Loses Support

In FX, the Buck continues to meander ahead of Friday’s potentially pivotal US jobs data, with the DXY encountering offers and resistance on approaches towards 91.500, but finding underlying bids for support into and around 91.000. However, the index and Greenback in general have been undermined by another sub-consensus ISM and mainly dovish Fed speak that have prompted renewed bull-flattening in US Treasuries alongside what appears to be a largely technical recovery in several major and EM counterparts. Ahead, another pre-NFP proxy in the form of Challenger lay-offs, latest weekly and continuing jobless claims, Q1 labour costs and productivity plus more Fed commentary from an array of officials. Meanwhile, the Euro may have derived some comfort or momentum from better than expected Eurozone data as retail sales and German industrial orders both beat expectations, but the rebound in Eur/Usd from just below 1.2000 to around 1.2045 looks more chart-based and positional after the headline pair found a base above a Fib retracement level yesterday and managed to close a few pips above the round number. Nevertheless, the 100 DMA remains a formidable hurdle and the Euro could yet be hampered by option expiries totalling 2.7 bn between 1.2025-15 and the 1.2000 strike, not to mention the fact that 200 and 50 DMAs have crossed in deathly fashion. Similarly, the Franc has clawed back losses vs the Dollar to retest 0.9100+ levels compared to circa 0.9165 at worst so far this week and is also firmer against the Euro as the cross eyes 1.0950 in the ongoing absence of visible intervention.

- CAD/GBP/JPY/AUD/NZD – All rangebound vs their US rival, though mildly divergent as the Loonie extends to new 3 year peaks of 1.2240 before Friday’s Canadian labour report showdown with its NA neighbour, while the Pound remains perky either side of 1.3900 (and 0.8650 against the Euro) awaiting the BoE from midday and in wake of an unexpected upgrade to the final UK services PMI. Elsewhere, the Yen is still contained inside 109.50-00 with option expiry interest from 109.00-05 (1.1 bn) perhaps keeping Usd/Jpy underpinned on return of Japanese markets following Golden Week, and the Aussie is well off overnight lows with assistance from upbeat RBA remarks (Deputy Governor Debelle noting that the economic recovery has been significantly better than even the most optimistic expectations – see 10.00BST post on Headline Feed for more) to counter further deterioration in relations with China. Note, the latter has suspended Strategic Economic Dialogue measures indefinitely, pushing Aud/Usd back to 0.7700 at one stage and Aud/Nzd down further below 1.0750 as the Kiwi gleaned some support from improvements in ANZ’s preliminary April business survey to keep Nzd/Usd on the 0.7200 handle.

- SCANDI/EM – A hawkish hold from the Norges Bank, but no material change in policy guidance (details available on Headline Feed at 9.00BST) has left the Nok weaker for choice and sub-10.0000 vs the Eur again, as crude prices ease back from fresh cycle highs, but the Brl could continue to outperform after the BCB matched market expectations with another 75 bp hike and signalled 3 in a row for the key Selic rate at the next convene. Turning to the Try, no change is anticipated from the CBRT at noon, though the tone of the accompanying will be the defining factor as the new Governor attempts to walk a tightrope between keeping President Erdogan on side and returning runaway inflation back to target.

In commodities, WTI and Brent front-month futures remain choppy within tight with the former retreating to sub-65.50bbl levels after failing to top USD 66/bbl, whilst Brent July dips back under USD 69/bbl from a high of around USD 69.40/bbl. News flow for the complex has again remained light in early European hours and in the run-up to key risk events including the BoE decision alongside the US IJC and a slew of central bank speakers, which could see some sentiment-driven oil action in the absence of oil-specific catalysts. Elsewhere, spot gold and silver have been tracking the waning Dollar and yields with the yellow metal reaching levels close to USD 1,800/oz before encountering barriers, whilst spot silver trades on either side of USD 26.75/oz. On the topic of precious metals, Shanghai gold exchange said it is to lower margin requirement from May 7th on gold contracts to 8% from 12%, and will also lower trading limit on gold contracts to 7% from 12% from 10th May. Base metals meanwhile were bolstered overnight upon China’s return to the markets – although sentiment was dented as China announced the indefinite suspension of the Sino-Aussie economic dialogue. LME copper is back under USD 10,000/t whilst the Shanghai contract played catch-up. Dalian iron ore futures continued to surge in APAC trade to reach an intraday record high. Shanghai aluminium hit an 11yr high with traders citing the Chinese/Aussie spat stoking supply concerns.

US Event Calendar

- 8:30am: May Initial Jobless Claims, est. 538,000, prior 553,000; Continuing Claims, est. 3.62m, prior 3.66m

- 8:30am: 1Q Nonfarm Productivity, est. 4.3%, prior -4.2%; Unit Labor Costs, est. -1.0%, prior 6.0%

- 9:45am: May Langer Consumer Comfort, prior 55.0

DB’s Jim Reid concludes the overnight wrap

US equities faded into the close last night after an earlier global rebound from Tuesday’s falls. Although investors took heart from dovish comments from Fed officials ahead of tomorrow’s US jobs report, the news later on that the US favoured waiving intellectual property protections on vaccines sent a number of pharmaceutical companies lower late in the session. Overall, the S&P 500 had only edged up +0.08% by the close, but with cyclicals outperforming strongly for a second straight day as energy (+3.33%), materials (+1.32%) and banks (+1.02%) saw solid gains. Tech shares rebounded early in trading, with the NASDAQ gaining nearly +0.9% intraday, before paring those gains and finishing down -0.37% on the day. It was the seventh straight losing session for the index as software (-0.70%) and media (-0.41%) shares were among the industries that fell yesterday. Meanwhile in Europe, the rebound was much stronger, with the STOXX 600 (+1.82%) more than erasing the previous day’s declines as the index similarly closed just shy of its all-time record, and the DAX rose +2.12% to recoup nearly all of Tuesday’s -2.5% loss.

In terms of those Fed speakers, the tone struck was a pretty dovish one that didn’t signal concern about inflation, helping yields on 10yr Treasuries to end the day down -2.6bps at 1.566%. Fed Governor Bowman said that “The risk that inflation remains persistently above our long-run target of 2% still appears small”, while Chicago Fed President Evans said he worried that inflation expectations were a bit below the 2% target, and that the risk of an inflation outbreak was “remote”. Boston Fed President Rosengren was another to strike a relaxed tone on the issue, saying he thought that an acceleration in inflation “is likely to prove temporary”. Fed President Mester added that given the low levels of inflation for a long period, “some increase in inflation expectations and actual inflation would be a welcome development.” She also wouldn’t consider any increase “to be the type of sustainable increase needed to meet the forward guidance on our policy rate.” Lastly, Vice Chair Clarida echoed Chair Powell’s comments that it was not yet time to talk about tapering and that the base case remains that the economy will not overheat. Paradoxically however, the lack of concern on the inflation front came as breakevens rose to fresh multi-year highs, with those on 10yr breakevens up +4.4bps to 2.47%, their highest level since 2014. And 5yr breakevens hit even higher levels, climbing another +3.9bps to 2.71%, marking their highest level since 2008.

One important factor in the inflation debate has been the major rise in a number of key commodities recently, with yesterday seeing another move higher. WTI oil prices were up +0.62%, as Brent crude also rose +0.30%, while copper advanced +0.07% to a fresh high for the decade just ahead of me needing to buy a load for my final (hopefully) renovation project of my life. US Lumber futures meanwhile topped $1,500 for the first time and have risen over 50% in just the last month. Corn prices continued their ascent of late with another +1.14% rise of their own. Overall, this helped the Bloomberg commodity index (+0.62%) to advance for a 4th day running, bringing its gains over the last year to +48.01% and +18.15% YTD. And in case you think this is just a pandemic rebound, we’ve now moved beyond that with the 2-year change for the index at +15.51%.

Overnight in Asia, markets are seeing a pretty mixed performance as a number reopen again after recent public holidays. Japanese equities have strongly outperformed, with the Nikkei up +1.70%, while the Hang Seng (+0.15%) and the KOSPI (+0.38%) have seen modest gains of their own. However, the Shanghai Comp has fallen -0.22% this morning and S&P 500 futures (-0.07%) are also pointing slightly lower. One story developing overnight is that China announced they were indefinitely suspending activities under their Strategic Economic Dialogue with Australia, which has sent the Australian Dollar lower this morning. This comes after the Australian government suspended agreements between the Belt and Road Initiative and Victoria State, and amidst deteriorating relations between the two sides of late.

Looking ahead to today, the UK will be at the centre of attention once again as an array of local and regional elections take place, along with the Bank of England’s latest policy decision. Starting on the politics, the Covid-19 pandemic meant that all of last year’s scheduled elections were pushed forward a year, meaning that today’s round of elections are probably going to be the biggest and most important electoral test for the political parties this side of the next general election. That will include elections to the Scottish and Welsh Parliaments, mayoral elections in key regions such as London, the West Midlands and Greater Manchester, a House of Commons by-election in Hartlepool, as well as a range of other contests.

For markets, the vote that will probably be of most interest is the Scottish Parliamentary elections, where a majority for pro-independence parties would lead to fresh calls for another referendum on independence from the UK. So definitely one to watch, though longer counts this year means we won’t be able to bring you any fresh info on that tomorrow. Nevertheless, something we might know the result of in 24 hours’ time is the other major contest of interest, which is the by-election in Hartlepool for the House of Commons seat, and also the first by-election since the last general election. This is highly significant since Hartlepool is one of the pro-Brexit ‘Red Wall’ seats in northern England that the governing Conservatives won in significant numbers from the opposition Labour Party at the last election. And although Hartlepool was actually won by Labour in 2019, a poll from Survation that came out earlier this week suggested that the Conservatives would gain the seat off Labour by 50%-33%, which would be another setback to Labour’s electoral prospects. Those wanting more info you can find our UK economists’ preview on the whole electoral day here.

As mentioned the BoE are also making their latest decision today, though our economists are not expecting any changes in the policy settings. That said, they think it’s a close call between May and June on when they’ll begin to taper their QE operations, even if they expect them to wait until next month on balance. A growth upgrade would give the MPC enough ammunition to taper QE, but our economists’ base case is that they’ll wait a little longer for the hard data to align with the strong soft data. Again, you can find the full preview here.

Ahead of the BoE, sovereign bond yields moved higher across Europe, with those on 10yr bunds (+1.0bps), OATs (+1.5ps) and BTPs (+3.7bps) all rising. Something of note was that the Italian-German spread continued to inch wider, reaching a 3-month high yesterday of 113bps.

On the pandemic, there are increasing signs that the rate of case growth has begun to slow again at the global level, with the numbers from John Hopkins showing that the week-over-week change in global cases has begun to fall from its peak last week. Furthermore, there were some promising trial results from Moderna’s booster shot, which was found to boost antibodies against the Brazilian and South African variants. Otherwise, the other main vaccine news was regarding its likely extension to younger age groups, with Canada becoming the first country to authorise the Pfizer vaccine for use in 12-15 year olds. Meanwhile in the US, Dr Fauci said that he expected an emergency authorisation from the FDA “within several days”. As mentioned above, there was also the news that the US would support a proposal to waive intellectual-property protections for Covid-19 vaccines. US Trade Representative Tai acknowledged that any resolution will take time to implement and that the other member states would have to be on board. Lastly, at a G20 meeting on Tuesday the members all supported vaccination passports as a way of boosting confidence in the global tourism and travel industries.

Looking at yesterday’s data, US releases slightly surprised to the downside, with the ISM services index unexpectedly falling to 62.7 in April (vs. 64.1 expected). Furthermore, the ADP’s report of private payrolls came in at +742k (vs. +850k expected) ahead of tomorrow’s jobs report. Over in Europe meanwhile, the final composite PMI for the Euro Area was revised up a tenth from the flash reading to 53.8, and the services number was revised up two-tenths to 50.5.

To the day ahead now, and the main highlight will be the aforementioned Bank of England decision, as well as the array of elections taking place in the UK. Other central bank events include the publication of the ECB’s Economic Bulletin, a monetary policy decision from the Central Bank of Turkey, and remarks from ECB President Lagarde, Vice President de Guindos and the Executive Board’s Schnabel, along with the Fed’s Williams, Kaplan and Mester. Data releases include Euro Area retail sales for March, German factory orders for March and the April construction PMI, as well as the UK’s final services and composite PMIs for April. From the US, there’s also the weekly initial jobless claims, and the preliminary Q1 reading of nonfarm productivity and unit labour costs. Finally, earnings releases include Moderna, Linde, Rio Tinto and AIG.