Authored by Omid Malekan,

Like most things, the undulations of the crypto markets are cyclical and meme-based. But thanks to the blockchain’s elimination of many of the frictions of the traditional financial system, the cycles happen faster. Take the simple fact that crypto markets trade 24/7, while most traditional markets do not. In any normal week, crypto trades for five times as many hours as stocks. That’s five times as much greed, fear and price discovery.

Every bull market has multiple cycles, and each cycle has its own tenor.

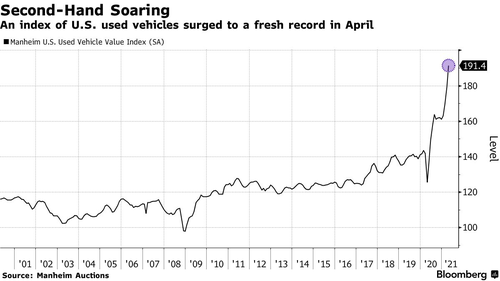

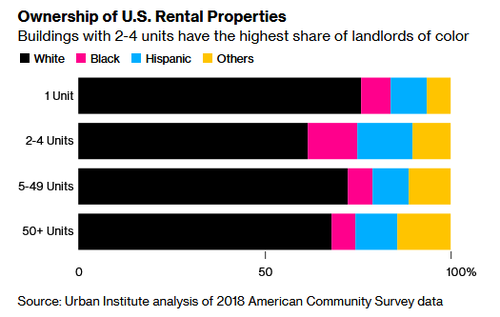

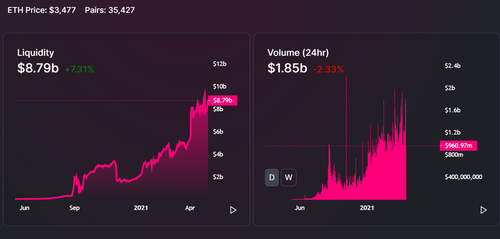

The first cycle of the current run was fairly simple, it was the ascent of Bitcoin. It could be seen in the rise of Bitcoin dominance over all other coins, a metric that rose from last summer to the start of this year and peaked at 70%, a 4 year high.

Market cap dominance of different coins

The second cycle was the rise of the newer alts, alternatively known as the “Ethereum killers.” With Bitcoin’s purpose and brand now fully cemented — thanks in part to the entrance of institutional buyers — the focus shifted to what comes next. Ether has been the number two crypto asset for a long time, but unlike Bitcoin, it’s status has often been contentious, even within the crypto community. For whatever reason, some existing investors and many new ones have always been looking for an alternative. This dynamic led to a second cycle where its would-be competitors rallied. The resulting surge in coins such as ADA, BNB, DOT, AVAX and SOL led to a surprising drop in Ethereum dominance, hitting a low of 11% just over a month ago, and repeated testing of the crucial 0.03 ETH/BTC cross rate.

Surprisingly, this relative decline in value happened just as multiple applications living atop Ethereum took off in adoption. Unlike Bitcoin, Ethereum is a platform that’s meant to be used, and the simultaneous surge in stablecoins, DeFi and NFTs showed that it was. And yet, this usage did not translate to success. Bitcoin was rallying because it was Bitcoin, and the Killers were rallying on the hope that they could someday siphon off some of Ethereum’s traction. But ETH itself kept underperforming. This was akin to Apple stock not going up despite the success of the iPod, but instead Microsoft rallying because it would eventually release the Zune.

My confusion over this development led to me surveying a bunch of people who were smarter than me to find out why. They gave me three answers, only one of which I agreed with.

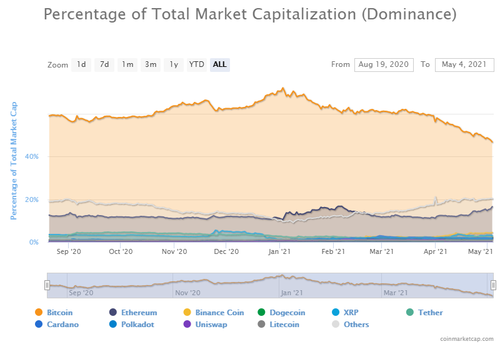

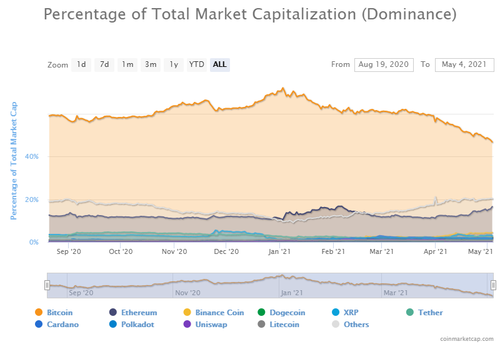

The first was that Ethereum fees were too high. This one struck me as shortsighted. Fees on any blockchain are a proxy for both adoption and security. Arguing that people would eventually abandon a platform because it’s too popular is akin to arguing that a crowded club would soon lose all its customers to an empty dive bar. Picking a decentralized platform is a lot like deciding where to party: going where the crowds are is the point — even if (and perhaps because) the cost of admission is high. The higher the mining revenues on any decentralized platform, the greater its security apparatus, so the higher the value amounts users are comfortable transacting.

The second argument was that Ethereum was technically inferior. This I agreed with, but only as a standalone observation. The original Ethereum white paper was published 8 years ago and all of the newer platforms have benefited from its stumbles. But those stumbles have also helped it (and its community) achieve a certain amount of antifragility, something its newer rivals lack. Having a more efficient consensus mechanism or better programming language are wonderful when they exist inside a white paper or on a ghost chain that nobody actually uses. They are a whole other thing with tens of billions on the line on a day like Black Thursday.

Whatever Ethereum lacks in terms of technical specs (which is plenty) it more than makes up for in terms of aggregate user experience, development tools and supporting infrastructure. When it comes to technological adoption, the best tech often does not win. The first application to reach critical mass does, because the switching costs are too high. This is especially true when there are network effects in play. To that point, I would argue that Ethereum has already passed the point of no return. Nevermind any comparison to its supposed rivals, it now routinely surpasses Bitcoin in terms of mining revenues, average transaction costs, dollar amount settled and total transaction count.

source: TheBlock

The third explanation was that crypto speculators are like little kids. They prefer shiny new toys they can fantasize to be capable of anything (over a million transactions per second! Using any programming language! saving the children in Africa!) over the real deal. This one resonated with me, as I’ve seen it before. To us grizzled veterans, the current wave of Ethereum killers are the third generation. There was a time when people were tripping over themselves to buy coins like EOS and Tron because their platforms were also better, faster and cheaper.

To paraphrase Orwell, people have a remarkable ability to assume false beliefs and hold on to them, despite mounting evidence to the contrary. But such false beliefs eventually bump up against reality, often on a battlefield. In crypto, the battlefield in question is one of adoption and evolution. Put differently, every doge has its day, but most eventually fade away because they serve no purpose beyond speculation. The world only needs so many decentralized platforms, and the energy consumption of proof-of-work or the cost of capital of proof-of-stake lead to certain winner-take-most tendencies. To the extent that everything in this world is about security, a smaller platform with a less valuable coin is a dangerous thing.

Bitcoin is and always will be Bitcoin. The race for #2 is not as interesting as it seems. There will always be niche platforms that serve specific functions, but those might be replaced by viable (and more secure) Layer 2 alternatives.

So here we are, and the price of ETH is suddenly surging, with ETH dominance back up to a more respectable 17% and the cross rate double the recent low. A lot of people have been asking me why. A more appropriate question might be what took so long.

* * *

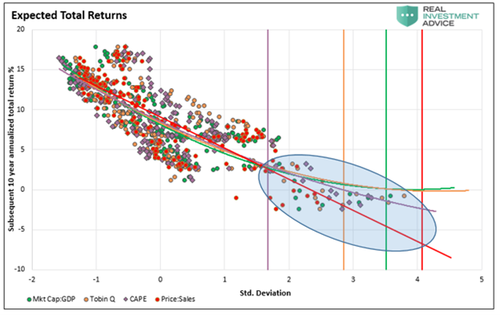

The rebound in the price of ETH has some people wondering how one might value a different kind of cryptocurrency, one that’s not as singularly defined as Bitcoin. Here I find ethereum easier to tackle. Bitcoin is money, and the value of money is highly relative. Ethereum on the other hand is a digital platform, and smart people have been putting valuations on digital platforms for a long time. I’m not one of those people, and ultimately find price the least interesting aspect of crypto. But for those willing to try, I have a few suggestions. To value ETH, and to see why some people still consider it undervalued despite the recent surge, consider the following:

Payments:

Non-blockchain based payment platforms such as PayPal, Visa, Mastercard and Ant are currently among the most valuable properties around. Their combined market cap is greater than that of the world’s banks. Ethereum is also a payments platform, not just for crypto and a gazillion other things, but also for fiat. It’s far more versatile than the above, offers better economics and is growing rapidly, thanks to the killer application of fiat stablecoins.

On-chain stablecoin volume surpassed $500b in the month of April. That’s already twice what PayPal moves in an entire quarter. It has increased by 1600% since the last time I made the case for why ETH was undervalued on the payments potential alone, which was only 20 months ago. PayPal volume has only grown by 50% in that window and the card networks have grown far less. Ethereum will continue to take market share because it offers features that those legacy rails never will, such as global access (including for the unbanked), programmability, transparency, real-time settlement, and cryptographically guaranteed DVP vs an infinite number of other value stores. No amount of investment or upgrading of the existing payment infrastructure will achieve these features. Visa could spend a billion dollars upgrading VisaNet but it will never move stocks (that’s why it’s throwing in the towel and embracing stablecoins, just as PayPal is looking into issuing its own).

Banking:

So-called Neo banks, challenger banks and FinTechs are also hot properties. They may not be as valuable as the payment providers, but expected to be a disruptive force in financial services. Many are not that innovative, as they just take a hundred year old business model and execute it using APIs and the cloud. They are incremental in their innovation, more Blu Ray disk than Netflix.

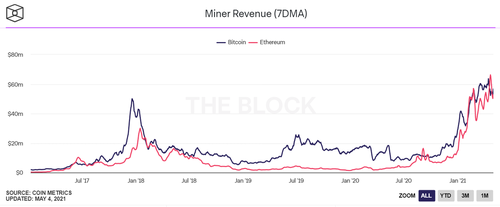

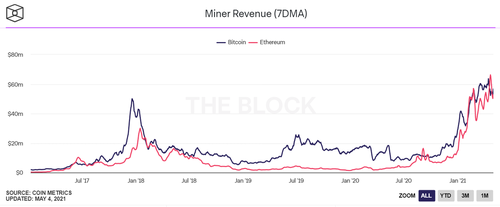

Thanks to DeFi, Ethereum is home to the hottest and fastest growing true FinTechs in the world, some of which operate on business models that have never existed before. MakerDAO is already bigger than 97% of all American banks, thanks to a balance sheet that is almost 50x larger than the median (it also earns close to $160m a year in pure profit — enough to make many FinTechs drool).

Maker has a $4B loan portfolio & expected to make $160m in the next year

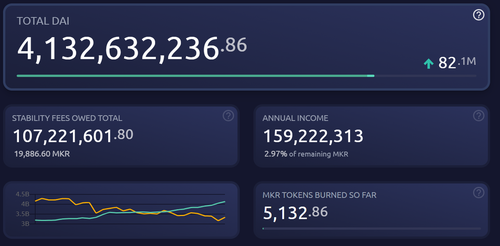

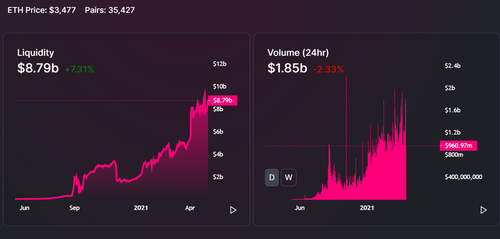

Uniswap V2 is less than two years old, but already trades more volume than most centralized crypto exchanges. It also boasts 35,000 different trading pairs, making it the most comprehensive financial market in the history of the world. It’s liquidity providers earned over $100m in revenues, in April!

There are many other examples and more funky DeFi solutions coming everyday. Cumulative revenues for DeFi properties on Ethereum have already surpassed $1b, having more than tripled this year alone.

NFTs:

Beeple’s “Everydays: The first 5000 days,” one of the most valuable works of art ever sold, lives on Ethereum. As does the second most valuable type of digital collectible, and a majority of the most popular digital art marketplaces. There are also popular virtual games such as Gods Unchained and virtual worlds such as Decentraland. Some of these properties boast over a billion dollars in accumulated value and tens of millions of dollars worth of daily trading volume. There is an Ethereum based music streaming service that has surpassed 3 million active users, placing it ahead of Jay-Z’s Tidal service by some measures.

A Meebit

I have no idea how one goes about putting a valuation on such things, but millions of people are engaged and committing real capital on a daily basis. If Spotify, Activision Blizzard and Substack are valuable, then so are these properties.

To be fair, not all of the value generated from the activities listed above go directly to the Ethereum platform. Many have contributors and governance token owners who capture a substantial amount of the value. But all inherit the overall security framework provided by Ethereum blockchain, and all pay for transaction fees in ETH. The more the above services grow, the greater the demand by their users to acquire ETH to pay for everything (Side note: this dynamic highlights the absurdity of the velocity of money approach to valuing crypto tokens that was the vogue a few years ago).

Part of the appeal of having all of these services on one platform — as opposed to fragmented across many — is their interoperability and composability. Fiat stablecoins often make up the most active trading pairs on Uniswap, and fractionalized NFTs are deposited as collateral into DeFi. The extent of innovation across these three functions is unlike anything that exists in the off-chain world, as we are witnessing a once in a lifetime reinvention of payments, banking and pop culture.

So, what’s an ETH worth? I don’t know.

What I do know however is that some of the fastest growing and most innovative developments out there are happening on this one platform. But unlike more traditional platforms, there is no Ethereum Inc. to invest in, no shares to buy. The only way to capture the network effects and value created by the platform is to own the coin. If that idea confuses you, then welcome to the future.

Lastly, some people are bothered by Ethereum’s linear inflation, as they’ve been trained by Bitcoin to expect their coin to be disinflationary. This is an incomplete argument, as it only looks at the supply side of a cryptocurrency. Just as important is the demand curve, and Ethereum has far more of it than any other smart contract platform. That’s not to say that we will once again revisit the flippening, but it explains the current surge. The timing is prescient, as we’ll soon also have the launch of various L2 solutions, and a disinflationary London Hard fork.

As I said, what took so long?