US index futures rebounded from Tuesday’s tech-led rout, with Nasdaq futures leading gains alongside shares in Europe as focus shifted away from inflation fears and turned to strong earnings and the global economic recovery. Nasdaq futs gained the most, rising 70.25pts or 0.52% to 13,606, S&P futures were up 14.25 points or 0.34%, and Dow futures were back over 34,000, up 57pts or 0.17% to 34,077. Oil and the dollar also climbed.

Some notable premarket movers:

- FAAMGs (Apple, Microsoft, Amazon.com, Facebook and Alphabet) rose between 0.3% and 0.9%.

- Value stocks also gained, with oil major Chevron Corp adding 1.3%, lender Goldman Sachs Group Inc up 0.7% and heavy machinery maker Caterpillar Inc gaining 0.3%.

- Ride-hailing company Lyft Inc rose 5.9% after it surprised Wall Street with significantly lower losses than expected.

- Rival Uber Technologies Inc is set to report earnings after markets close on Wednesday.

- T-Mobile US Inc gained 2.4% as it raised its full-year postpaid subscriber net additions forecast

The Nasdaq fell 1.9% on Tuesday, the most since March, in a rout sparked by fears of quickening inflation, and accelerated after Treasury Secretary Janet Yellen rattled markets with comments that interest rates may have to rise moderately to keep the economy from overheating. Coupled with stock valuations near the highest in two decades, it was enough to deliver the worst day for the Nasdaq 100 since March, even as Powell previously assured markets that interest rates will remain at current lows throughout the recovery.

However, Yellen later reversed the remarks saying she sees no inflation problem brewing and wasn’t forecasting interest-rate increases to rein in any inflation spurred by President Joe Biden’s proposed spending but the fiasco reminded investors that rates would have to rise at some point in the future.

“Moderate inflation and a slow moving Fed would continue to be supportive, but inflation and a reactive Fed may prove to be a negative for valuations,” said Tapas Strickland, a director of economics at NAB. “Either way yields and equities are likely to be in a dance as much better than expected economic data continues to challenge central banks’ rates guidance.”

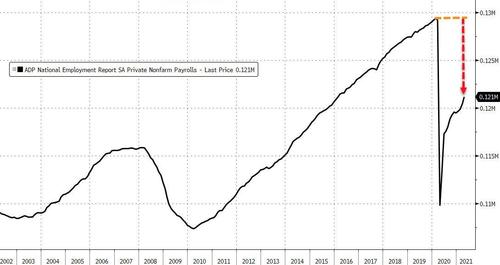

One such challenge looms on Friday when U.S. payrolls data are forecast to show a hefty rise of 978,000, while some estimates go as high as 2.1 million.

Meanwhile, soaring inflation sent commodities prices to their highest levels in almost a decade, with miners and energy stocks climbing the most among sectors in Europe. A gauge of commodities hit a decade high as copper rallied back above $10,000 a ton and oil topped $66 a barrel.

“The market’s focus will still be on growth restoration and how Covid develops over time,” said Cecilia Chan, HSBC Asset Management Asia-Pacific chief investment officer, on Bloomberg Television. She downplayed concerns about inflation and added that “the central bank will remain dovish.”

In Europe, the Stoxx 600 index gained 1.3% wiping out almost all of its 1.4% loss on Tuesday, with the German DAX jumping 1.3% and UK’s FTSE 100 gaining 1.1%. European markets bounced back on Wednesday after a sharp selloff in the previous session, helped by gains in commodity and banking stocks, while optimism about a strong earnings season and a speedy economic recovery dominated the markets. UK miners, including Rio Tinto, BHP Group and Anglo American, rose about 3% each as copper prices rose past a key psychological level of $10,000 a tonne, buoyed by optimism about a speedy recovery in the global economy. European tech stocks rose 1.8% after a 3.7% plunge in the previous session. Euro zone business activity accelerated in April as the bloc’s dominant services industry shrugged off renewed lockdowns and returned to growth, a survey showed.

Here are some of the biggest European movers today:

- Rational shares gain as much as 8.7%, most since Oct. 27, after the German catering equipment maker delivered 1Q results which Warburg says were “better than feared.”

- Vestas shares extend gains to as much as 9%, with analysts saying it’s important that the wind-turbine maker maintained its guidance and that a weak start to the year was well-flagged.

- FLSmidth shares rise as much as 11%, the most intraday since since May 2020, after the machinery company reported earnings that beat analyst estimates on mining order intake and profitability.

- Virgin Money shares slide as much as 8.3%, most since Dec. 21; Investors are likely to focus on higher costs, which meant pre-provision profit in the fiscal first half was 5% below consensus, Citi (neutral) says in note.

- Alcon shares decline as much as 4.1% in Swiss trading after the eye care company reported 1Q results where strength in its surgical segment was offset by a slippage in contact lenses, according to Jefferies.

- Delivery Hero shares fall as much as 5.2% to EU121.20 after a group of the company’s shareholders sold 9.8 million shares in an accelerated offering on Tuesday.

“Yesterday’s sell-off in equities is a reminder that valuations in markets are tight,” Unicredit analysts said in a note. They, however, pointed out that earnings season continued to be supportive of risk appetite.

Earlier in the session, Asian shares swung between gains and losses with the Asia-Pacific Index ex-Japan flat as rallies in materials and finance shares were offset by a decline in the region’s technology sector. Markets in Japan, China and South Korea remain shut for holidays. India’s shares and bonds gained after the central bank approved 500 billion rupees ($6.8 billion) of liquidity to banks to support lending to vaccine makers, hospitals and providers of health services.

The materials sector was the best performing in Asia on Wednesday, with an MSCI industry gauge rising 0.6%. The rally in the region’s metal miners, cement producers and steel makers, set to outperform the benchmark for a fourth month, came as global commodity prices surged to their highest level in almost a decade. The ample liquidity provided by central banks, Wall Street’s bets on commodities to hedge the risks of inflation and China’s “voracious” commodity appetite are among factors behind the commodity price rally, according to a note from Rabobank. “One thing we can be sure of — prices seem to be moving significantly higher, and not just due to the expected base effects,” the bank said.

Financials were among the top-performing industries in Asia, with the Commonwealth Bank of Australia contributing the most of the day’s gains. Indian lenders rose after Reserve Bank of India governor announced new loan-relief measures. In contrast, semiconductor-related stocks in Taiwan and Hong Kong fell after U.S. Commerce Secretary Gina Raimondo called for a major increase in U.S. chip production capacity. Internet stocks also retreated after Treasury Secretary Janet Yellen’s remarks on the direction of interest rates caused a set of hiccups in U.S. financial markets. Country-wise, Thailand’s benchmark dropped 2%, the most in four months, after its central bank warned on growth amid a resurgence in virus cases, while keeping its benchmark interest rate unchanged.

In FX, the dollar traded mixed against its Group-of-10 peers, with commodity currencies rising against the greenback after Yellen said she wasn’t forecasting interest-rate increases to rein in any inflation spurred by President Joe Biden’s proposed spending, clarifying comments that had jolted markets earlier. The yen traded in a tight range with Japan’s markets still shut for holiday. The euro fell below the $1.20 handle only to find some buying interest at a two-week low of around 1.1990. The pound traded little changed, ahead of Thursday’s Bank of England policy decision and release of new forecasts, and with Scotland entering a key election. New Zealand’s dollar led an advance after an unexpected drop in the unemployment rate in the first quarter; the Aussie rose with other commodity currencies. Traders are pricing in a 75% chance that the Reserve Bank of Australia won’t roll its targeted yield-curve control bond at a July policy meeting, signaling the first rate hike could come mid-2024.

In rates, Treasuries remained under pressure after drifting lower during the London session, when cash trading resumed having been closed in Asia for final day of Japan’s Golden Week holiday. Treasury yields are cheaper by ~1.5bp across long-end of the curve, steepening 2s10s, 5s30s by less than 1bp; 10-year around 1.601% is higher by ~1bp vs nearly 3bp increase for U.K. 10- year. Gilts underperformed ahead of Thursday’s BOE policy decision, with some expecting an increase in hawkish rhetoric. U.S. Treasury makes May-July refunding announcement at 8:30am ET, and most dealers expect unchanged auction sizes. The dollar issuance slate was empty so far; seven issuers sold $4.6b Tuesday, pushing weekly total over $14b. Next week expected to be active with potential for a $10b+ jumbo deal.

In commodities, palladium soared to a record high on worries over short supplies of the metal used in emissions controlling devices in automobiles. Gold was left lagging at $1,776 an ounce . Oil prices climbed to seven-week peaks as more countries opened their borders to travellers, improving the demand outlook for petrol and jet fuel. Brent added 57 cents to $69.49 a barrel, near its highest since mid-March, while WTI rose 52 cents to $66.23 per barrel.

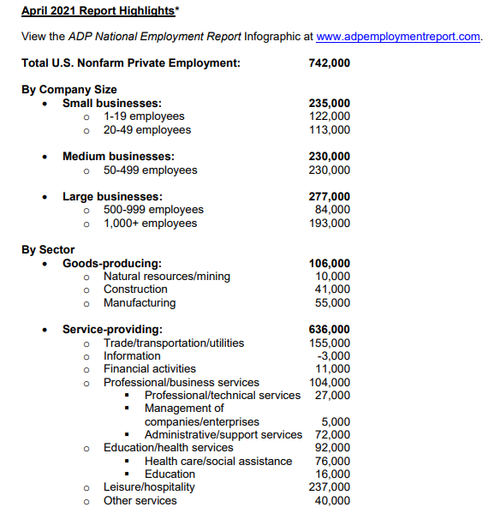

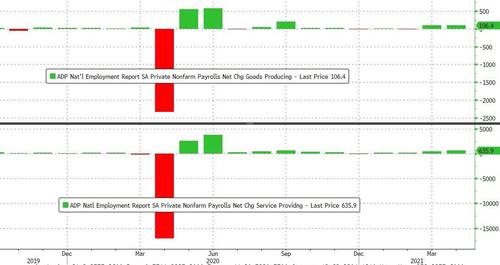

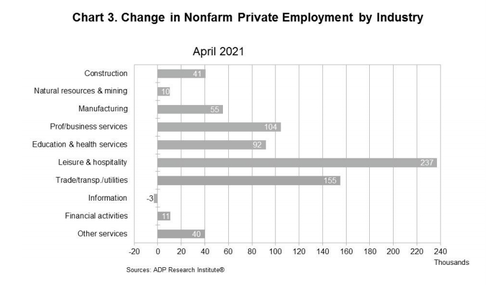

Market participants are now awaiting monthly jobs data from payrolls processor ADP, which is expected to show additions of 800,000 last month, compared to 517,000 job additions in March. A more comprehensive reading in the form of the Labor Department’s non-farm payrolls data is due Friday. Also on the radar is the Institute for Supply Management’s non-manufacturing purchasing managers’ index, which is expected to show a slight rise in April from March.

A look at the day ahead highlights include the April services and composite PMIs from around the world. In the US we get the April ISM services index from the US and the ADP’s report of private payrolls for that month too, along with the March PPI reading from the Euro Area. Central bank speakers include the Fed’s Evans, Rosengren and Mester, along with the ECB’s Lane, and earnings releases out today include PayPal, General Motors, Booking Holdings and Uber.

Market Snapshot

- S&P 500 futures up 0.4% to 4,174.75

- STOXX Europe 600 up 1.3% to 439.47

- MXAP down 0.27% at 204.75

- MXAPJ up 0.2% to 688.61

- Hang Seng Index down 0.5% to 28,417.98

- Sensex up 0.7% to 48,588.44

- Australia S&P/ASX 200 up 0.4% to 7,095.82

- Kospi up 0.6% to 3,147.37

- Brent Futures up 1.19% to $69.70/bbl

- Gold spot down 0.11% to $1,777.10

- U.S. Dollar Index up 0.09% to 91.371

- German 10Y yield up 1 bp to -0.23%

- Euro down 0.2% to $1.1994

Top Overnight News from Bloomberg

- India’s central bank announced new loan-relief measures for small businesses and pledged to inject 500 billion rupees ($6.8 billion) of liquidity to support the economy against a second deadly coronavirus wave

- Signs of inflation are picking up, with a mounting number of consumer-facing companies warning in recent days that supply shortages and logistical logjams may force them to raise prices

- Oil extended a rally after U.S. stockpiles fell and investors applauded reopening drives in the U.S. and Europe that will aid demand. Brent neared $70 a barrel and West Texas Intermediate climbed for a third day as gasoline futures surged to the highest since July 2018

- Copper rallied back above $10,000 a ton, closing in on a record high as the reopening of major industrial economies sparks a blistering rally across commodities markets from iron ore to lumber

- A surge in steel consumption as the world emerges from its pandemic-induced slump is set to drive iron ore to an unprecedented high as the biggest miners struggle to keep up with the frenzied pace of demand. Expectations are building that benchmark prices can get to $200 a ton — topping the record $194 hit more than a decade ago

- The Group of Seven nations is considering a U.S. proposal to counter what the White House sees as China’s economic coercion. A paper was circulated before a two-day meeting of G-7 foreign ministers in London

- New coronavirus variants have proliferated across southern and eastern Africa, exacerbating the challenge of bringing the pandemic under control, analysis of the genomics data shows

- Citigroup Inc.’s global chief economist, Catherine Mann, is leaving the bank after three years in the job

A quick look at global markets courtesy of Newsquawk

Asian equity markets traded cautiously as the region battled to shrug off the tech-led declines in the US and amid holiday-thinned conditions due to market closures in China, Japan and South Korea. There was also plenty of attention on recent comments by US Treasury Secretary Yellen who stated that interest rates will have to rise somewhat to ensure the economy does not overheat, which added to the headwinds on Wall Street, although some of the jitters gradually eased given that the comments were taken somewhat out of context and was regarding the future not imminent policy, while Yellen later clarified that she is not predicting nor recommending a rate increase. ASX 200 (+0.4%) brushed aside the early indecision and climbed above the 7,100 level for the first time since early last year helped by much stronger than expected Building Approvals data and with gains in most the big four banks aside from ANZ Bank despite a surge in H1 cash profit which more than doubled to AUD 2.99bln as the CEO also flagged significant uncertainty. Hang Seng (-0.5%) was choppy after disappointing Retail Sales data for Hong Kong and continued absence of stock connect trade with the mainland, although downside was also limited after data from MOFCOM showed China’s online retail sales jumped 29.0% in Q1 and the China Iron and Steel Association noted a 15.6% output expansion for the nation’s steel sector. India’s NIFTY (+0.9%) was also mildly supported following RBI Governor Das unscheduled speech in which he eventually announced several measures including another INR 350bln of purchases of government securities and on-tap liquidity facility of INR 500bln for fresh lending to vaccine manufacturers and others.

Top Asian News

- ANZ CEO Not Ruling Out Purchase of Citi Australia Retail Assets

- Thailand Holds Rates, Warns on Growth Amid Its Worst Covid Wave

- RBI Steps Up Loan Relief, Liquidity for India’s Virus Fight

- Hong Kong Is a Renters’ Market as Prices Drop on Expat Moves

Major bourses in Europe trade higher across the board (Euro Stoxx 50 +1.3%) as the region stages a somewhat of a recovery or retracement from yesterday’s selloff, albeit putting the price action into context, indices remain some way off yesterday’s best levels. US equity futures also coat-tail on the sentiment seen across the pond, although gains across the futures are less pronounced with the RTY (+0.6%) modestly outperforming peers though the NQ (+0.5%) is catching up. The overall tone across the market however, is tentative with mixed final PMIs failing to spur much action, and as participants await a busy docket ahead in the run-up to tomorrow’s super-Thursday followed by Friday’s US jobs update. Back to Europe, varying gains are seen across the majors, whilst the periphery narrowly outperforms. Sectors in Europe are all in the green with cyclicals broadly performing better than defensives. Basic Resources top the charts as base metals are back on the grind higher. Oil & Gas is supported by the oil complex itself which is underpinned by the attempted revival of swift and safe international travel – namely between OECD countries. The Tech features among the gainers today, albeit after yesterday’s underperformance given Infineon, among other factors. Conversely, the Auto sector resides as one of the laggards as Daimler (-1.7%) is dealt a blow by Nissan offloading its stake at a discount, although losses are cushioned by Stellantis (+2.7%) strength post-earnings. Earnings-related movers this morning include the likes of Deutsche Post (+4%), Hannover Re (-1.2%), Siemens Energy (+0.4%), Hugo Boss (+5.5%), Axa (Unch), Veolia (Unch), Novo Nordisk (+2.5%) and Maersk (+4%). Finally, Delivery Hero (-4.0%) is among Europe’s laggards after reports stated that shareholders are looking to offload almost 10mln shares with a bookrunner guiding the price at a notable discount vs the last close.

Top European News

- UBS Chairman Axel Weber Apologizes for Archegos Loss

- Bahrain May Follow Gulf States by Selling Oil, Pipeline Assets

- Vestas Gains After Wind Turbine Maker Maintains Guidance

- London Emerges From Lockdown Harder Hit Than Much of the U.K.

In FX, the Greenback is not universally firmer against G10 counterparts, but has gained sufficient ground vs several index components to surpass Tuesday’s US Treasury Secretary inspired spike high and print a new best since April 19, albeit fractionally at 91.436 vs 91.430 on April 21 and 91.425 on the day after. The Franc is trailing in wake below 0.9150 having probed 0.9100 yesterday and Monday, with no reaction to in line Swiss CPI (naturally), but Euro weakness is arguably more eye-catching as the 1.2000 marker is finally breached irrespective of mostly softer than expected Eurozone services and composite PMIs. Eur/Usd is now banking on Fib support in the form of a 38.2% retracement from 1.1704 to 1.2150 at 1.1980 rather than decent option expiry interest between 1.2050-55 (1 bn) or any desire to retest the 100 DMA in that vicinity. Back to the DXY, 91.500 is the obvious nearest resistance level and next upside objective ahead of 91.748 and 91.813 (latter being the high on April 16) awaiting ADP, the services ISM and yet more Fed speak.

- NZD/AUD/CAD – All resisting the Buck’s latest advances, and in the case of the Kiwi recouping all and more of its Yellen rate rise knee-jerk losses with the aid of NZ jobs data that beat consensus on all counts. Indeed, Nzd/Usd has rebounded even more firmly from the low 0.7100 zone to 0.7175+ before fading, and probably also boosted by the RBNZ’s FSR flagging further tightening of LVR restrictions if required to keep a lid on property prices. On that note, NZ building consents are due later tonight and Aussie building approvals exceeded expectations by more than double to help Aud/Usd reclaim 0.7700+ status ahead of a speech from RBA’s Debelle on Thursday. Elsewhere, the Loonie has also regained composure after Tuesday’s disappointing Canadian trade balance, though largely on the back of a more pronounced recovery in crude prices as Usd/Cad retreats through 1.2300 compared to just over 1.2350 at one stage yesterday. However, 1.1 bn option expiries at the round number could well keep the Loonie in check, like 1 bn at 0.7750 for the Aussie.

- GBP/JPY – The Pound and Yen are relatively resilient in the face of broad Dollar strength as well, with Cable containing declines sub-1.3900 to circa 1.376 amidst favourable Eur/Gbp cross flows under 0.8650 and towards the 50 DMA that comes in at 0.8620 today. Meanwhile, Usd/Jpy has withdrawn into a narrower band inside 109.50-00 following Monday’s false breaks either side, but still lacking depth on the final day of Golden Week in Japan.

- SCANDI/EM – The aforementioned leg up in oil post-bullish API weekly inventory update that has lifted WTI over Usd 66.50/brl and Brent close to Usd 70 is propelling the Nok back beyond 10.0000 against the Eur, but the Sek is lagging near 10.2000 regardless of an acceleration in Sweden’s services PMI or marked pick up in new manufacturing orders. Similarly, the Rub and Mxn are weaker despite the ongoing crude rally, while the Try is also suffering from a rise in year end Turkish inflation expectations, but the Zar is deriving some underlying support via SA’s Whole Economy PMI extending above the key 50.0 threshold.

In commodities, WTI and Brent front-month futures are firmer on the session with the former around USD 66.50/bbl (vs low 66/bbl) and the latter just under USD 70/bbl (vs low 69.25/bbl). The complex has been underpinned by optimism surrounding swift and safe international travel, with reports yesterday suggesting that some Euro Zone holiday hotspots could be given the green light for travel from the UK. Meanwhile, yesterday’s Private Inventory (crude: -7.7mln bbl vs exp. -2.3mln bbl) report added further fuel to the bullish fire as the refined product inventories also proved to be constructive – with eyes on confirmation from the weekly DoEs with headline expectations pointing to a draw of 2.3mln bbl. Elsewhere, spot gold and silver are uneventful within recent ranges at USD 1,775/oz and above USD 26/oz as prices track the Buck in the run-up to today’s risk events including ADP and ISM Services. Finally, LME copper has regained a footing above USD 10,000/t with traders citing the higher demand prospect underpinning the red metal.

US Event Calendar

- 8:15am: ADP employment change in April; est. 850k

- 9:15am: Markit US services PMI; est. 63.1; Markit US composite PMI

- 9:30am: Fed’s Evans Speaks on Economy on Monetary Policy

- 10am: ISM services index; est. 64.1

- 11:00am: Fed’s Rosengren Speaks on the Economic Outlook

- 12:00am: Fed’s Mester Speaks to Boston Economic Club

DB’s Jim Reid concludes the overnight wrap

Financial markets saw a pretty major selloff yesterday, although the market collectively scratched its head as to what caused the scale of the falls. Candidates included Chinese/Taiwan tensions, fresh pandemic issues (e.g. fresh Singapore restrictions and India’s IPL cricket tournament being cancelled) and most likely US Treasury Secretary Yellen’s comments that rates may need to rise to prevent economic overheating. Yellen, who is also a former Fed Chair, said in an interview released yesterday that “it may be that interest rates will have to rise somewhat to make sure our economy doesn’t overheat,” and that this “could cause some very modest increases in interest rates.” Her remarks were likely speaking about market pricing of longer-term rates rather than breaking historic convention and commenting on monetary policy.

However, it was uncertain just how high she sees rates climbing as Secretary Yellen also commented that she expects the US to remain in a low interest rate environment for some time, but the government still needs to make sure deficits remain “manageable.” Later in the day White House Press Secretary Psaki said that “Secretary Yellen certainly understands” the importance of the Fed’s independence. She also noted that President Biden and Yellen are taking any “inflationary risk incredibly seriously.” Regardless, just after the market closed new headlines came out with Secretary Yellen indicating that she was not predicting or recommending that rates increase and that she is not expecting inflation to be a problem. She also mirrored her successor’s confidence that the Fed had the tools necessary to address inflation if it were to occur. So it seems like a small matter of fact statement has been magnified around financial markets, which just shows how sensitive we all are to rates and inflation.

Having said this, could the selloff be as simple as a sign that the pace of US growth is peaking? Regular readers will know that we’ve been flagging DB’s Binky Chadha’s work from last month (link here) where he looked at all ISM peaks since WWII and found 37 such occurrences. The S&P 500 fell -8.3% (median) after those growth tops. Given the stretched positioning in this cycle he was/is expecting something at the top end of a 6-10% correction over the next couple of months. So with the ISM falling on Monday from 64.7 to 60.7 (65.0 expected) it’s possible we’ve seen the peak in the rate of change in growth that has previously heralded a correction. As such was some of the sell-off a delayed reaction to Monday’s quite notable fall in the ISM?

Looking at the market moves in more depth, the S&P 500 closed -0.67% lower though it was a fairly binary sectoral move with growth giving way for value and cyclical stocks. The index was down as much as -1.53% intraday, before recovering in the US afternoon primarily on the back of banks (+1.36%), materials (+1.04%) and telecoms (+0.88%). Tech stocks saw the brunt of the losses with tech hardware (-2.97%), semiconductors (-1.87%) and software (-1.40%) causing the NASDAQ (-1.88%) and the FANG+ index (-2.35%) to fall back significantly. The VIX index of volatility surged +1.2pts to move back above 20pts for the first time in over a month in trading, before closing at 19.48pts. European indices similarly saw major declines yesterday, with the DAX (-2.49%) seeing its biggest daily loss so far this year as the Europe-wide STOXX 600 also fell -1.43%.

Amidst the decidedly risk-off tone among investors, haven assets outperformed in response, with both the dollar (+0.38%) and sovereign bonds advancing yesterday. Yields on 10yr Treasuries ended the session down -0.5bps at 1.592%, some way beneath their intraday high of 1.621%, in a decline that coincided with the Yellen headlines. The move was driven by lower real yields (-1.0bps) rather than inflation expectations (+0.4bps). However there was a noticeable rise in inflation breakevens at shorter maturities, with the 3yr breakeven up +4.9bps to 2.795%, a level not seen since 2006. For Europe, yields on 10yr bunds (-3.4bps), OATs (-2.7bps) and BTPs (-1.2bps) all moved lower.

The rise in the dollar came even as commodity prices rose to their highest price levels since late 2011. Dovetailing inflation worries into the piece highlighted above by our colleague Luke on supply bottlenecks, the Bloomberg Commodity Index – comprised of 23 raw materials including oil, metals and agriculture products – rose +1.05% yesterday to its highest levels in nearly a decade, and +77.3% since the March 2020 lows. The rise has been driven by a confluence of factors. Energy and metal prices have increased as demand for travel and consumer products have rebounded with the pandemic abating somewhat, while crop prices have gained on particularly dry seasons in Brazil, the US and Europe. Supply shocks, exacerbated by the pandemic, have pushed raw material prices higher. Lastly, commodities are an oft-used inflation hedge and investor positioning could be playing a role as well.

Overnight in Asia, a number of markets are still closed for holidays including in China, Japan and South Korea, though the Hang Seng (+0.06%) and Australia’s ASX 200 (+0.64%) have both moved higher this morning. Futures markets in the US and Europe are similarly pointing to a recovery from yesterday’s selloff, with those on both the S&P 500 (+0.30%) and the STOXX 50 (+0.85%) advancing. And speaking of commodities, oil prices have climbed further overnight, with Brent crude (+0.78%) at $69.43/bbl, which is its highest level in over 7 weeks and just shy of its post-pandemic closing high at $69.63/bbl in March. WTI oil prices (+0.79%) have also risen this morning to now trade at $66.20/bbl, which would be their highest closing level in two years.

On the pandemic, the surge in cases in India saw the Indian Premier League cricket tournament suspended, following a number of players testing positive. Meanwhile Singapore has moved to toughen up restrictions on gatherings and at their borders following a cluster of cases that has been linked to new variants. In Tokyo, Prime Minister Suga is reportedly considering keeping the greater Osaka and Tokyo areas in a state of emergency after the orders were originally supposed to end on May 11. Meanwhile in the UK, Prime Minister Johnson said there are “no plans to deviate from the earliest dates set out in the roadmap” for reopening the economy.

In terms of vaccine news, the EMA announced they are starting their rolling review of the Sinovac Life Sciences’ vaccine in order to allow its use in the EU. The Chinese-based company’s vaccine joins the Russian Sputnik V vaccine on the review list. Moderna’s chairman announced in an interview yesterday that the company has started trials of the efficacy of its vaccine in lower doses in order to boost supply as the pandemic continues. In the US demand has started to slow in certain areas and the Biden Administration has told the state Governors that it would start reallocating vaccines that are not claimed in order to better meet demand in all areas. President Biden also set the new target of 70% of all Americans getting at least one dose of vaccine by July 4th with 160mn adults fully inoculated. Currently the CDC reports that 56% of all US adults have gotten one jab and 105mn adults are fully vaccinated.

In terms of yesterday’s data, the US trade deficit came in at a record $74.4bn in March, in line with expectations. Meanwhile US factory orders were up +1.1% that month (vs. +1.3% expected). Over in Europe, the UK’s final manufacturing PMI for April came in at 60.9 (vs. flash 60.7), and mortgage approvals in March fell to 82.7k (vs. 86.5k expected).

To the day ahead now, and the data highlights include the April services and composite PMIs from around the world. Otherwise, there’s also the April ISM services index from the US and the ADP’s report of private payrolls for that month too, along with the March PPI reading from the Euro Area. Central bank speakers include the Fed’s Evans, Rosengren and Mester, along with the ECB’s Lane, and earnings releases out today include PayPal, General Motors, Booking Holdings and Uber.