Authored by Anthony Rozmajzl via The Mises Institute,

In the past couple of months, our esteemed public health experts have had a rough go of defending the supposedly settled science behind lockdowns and mask mandates.

White House covid-19 advisor Andy Slavitt was first on the chopping block back in mid-February, when he was reduced to parroting empty platitudes about social distancing after failing to explain why a completely open Florida had numbers no worse than a strictly locked-down California. Then comes media darling Dr. Anthony Fauci, who has had a particularly embarrassing series of public appearances of late. During a recent MSNBC interview Fauci expressed confusion and wasn’t “quite sure” as to why Texas was experiencing falling cases and deaths an entire month after lifting its mask mandates and capacity restrictions. Moreover, during a hearing with Representative Jim Jordan, Fauci completely dodged Jordan’s question of why Texas has lower case rates than some of the most notable lockdown states. Fauci, refusing to answer the question, simply responded that having a lockdown is not the same thing as obeying lockdowns. Fauci was correct here, but he indirectly claimed that citizens of New York and New Jersey, two notorious lockdown states, were complying less with mitigation measures than a state that had, and still has, practically none. A quick check of Google’s covid-19 mobility reports lays this counterintuitive claim to rest.

The American Media’s Agenda

When governments and media outlets around the world have successfully captured audiences by stoking fear of covid-19, the data that should so easily assuage this fear become irrelevant, and interviews like those mentioned above are simply brushed aside in favor of a fear-born allegiance to the “morally superior” government-mandated lockdowns, curfews, mask mandates, and more. This “scared straight” approach, as Bill Maher correctly described it, is the state’s bludgeon of compliance.

As far as scaring citizens straight, Project Veritas has released footage showing CNN employees explaining how the network plays up the covid-19 death toll to drive numbers. Especially disgraceful was CNN technical director Charlie Chester’s admission that the network doesn’t like to report recovery rates because “[t]hat’s not scary…. If it bleeds it leads.”

CNN isn’t alone in the fearmongering business. Thanks to the surplus of United States media outlets willing to churn up a disproportionate amount of negative covid-19 headlines—roughly 90 percent of covid-19 news in the United States is negative compared to 51 percent internationally—is it any surprise that nearly 70 percent of Democrats, 51 percent of Republicans, and almost 50 percent of independents think the chances of being hospitalized with covid-19 range anywhere from 20 percent to over 50 percent?

Where’s the Correlation?

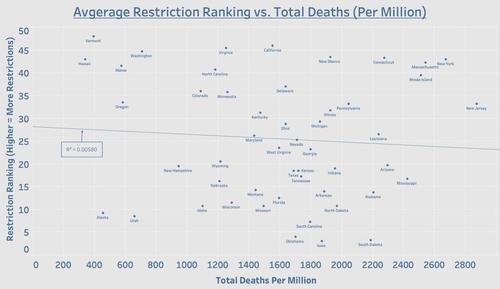

Government- and media-induced panic have blinded us to the data, which for the past thirteen months have consistently shown zero correlation between the timing, strength, and duration of mitigation measures and covid-19 incidence. Nowhere could this lack of correlation be more prevalent than among lockdowns and mask usage.

Leaving aside the disastrous and deadly consequences of government lockdowns—see here, here, and here—the evidence for lockdowns’ ability to mitigate covid-19 mortality remains scant.

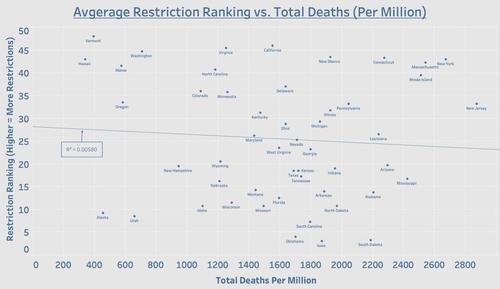

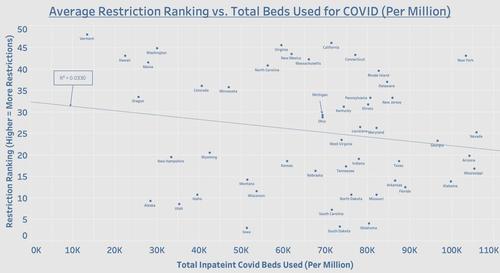

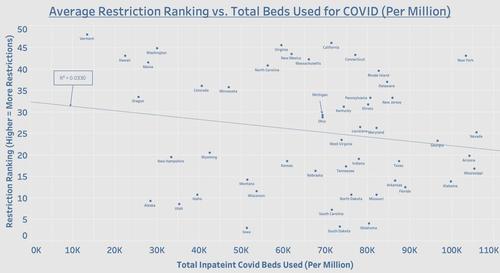

Looking at the United States, we can address the widely believed notion that states with more intense lockdowns will see fewer covid-19 deaths by plotting each state’s average restriction ranking over the past thirteen months against the total number of covid-19 deaths for each state. To get the average ranking, the author averaged data from Oxford University’s Blavatnik School of Government—this source ranked each state by the average time spent at a stringency index measure greater than sixty up until mid-December 2020—and Wallethub, which also ranked each state by stringency using a weighted average of various measures from January 2021 onward. Now, if the past year’s worth of sanctimonious lectures from public health experts have any scientific weight behind them, we should see a very strong negative correlation between the intensity of states’ restrictions and total covid-19 deaths.

Source: Data on deaths (as of Apr. 28, 2021) from the NYTimes Covid-19 Data Bot. Data on restriction rankings from the NYTimes Covid-19 Data Bot (through December 2020); Adam McCann, “States with the Fewest Coronavirus Restrictions,” WalletHub, Apr. 6, 2021 (since January 2021); and Laura Hallas, Ariq Hatibie, Saptarshi Majumdar, Monika Pyarali, and Thomas Hale, “Variation in US States’ Responses to COVID-19” (Blavatnik School of Government Working Paper No. BSG-WP-2020/034, December 2020).

Contrary to what the public health experts have been telling us for more than a year, there is no correlation between the strength of a state’s lockdown measures and total covid-19 deaths. In fact, notorious lockdown states such as New York and New Jersey have some of the worst mortality numbers to date. To blame noncompliance for these poor numbers is ridiculous on its face considering states with no restrictions, such as Texas and Florida, have far fewer deaths than New York and New Jersey. In fact, you’ll find that every state that has either removed its mask mandate or all covid-19 restrictions entirely is outperforming New York and New Jersey in terms of deaths.

The same lack of correlation can be seen when comparing average lockdown stringency with the total number of patients hospitalized who have suspected or confirmed covid-19. As a point of clarification, the author summed the current number of patients hospitalized each day to arrive at the total number of patients hospitalized. This will result in slightly inflated total numbers since patients may spend more than one day in the hospital, but having applied the same aggregation method across all states, the total hospitalization metric still provides an accurate assessment of covid-19 hospitalizations in each state.

Source: Data on hospitalizations (as of Apr. 24, 2021) from the US Department of Health and Human Services. Data on restriction rankings from the NYTimes Covid-19 Data Bot (through December 2020); Adam McCann, “States with the Fewest Coronavirus Restrictions,” WalletHub, Apr. 6, 2021 (since January 2021); and Laura Hallas, Ariq Hatibie, Saptarshi Majumdar, Monika Pyarali, and Thomas Hale, “Variation in US States’ Responses to COVID-19” (Blavatnik School of Government Working Paper No. BSG-WP-2020/034, December 2020).

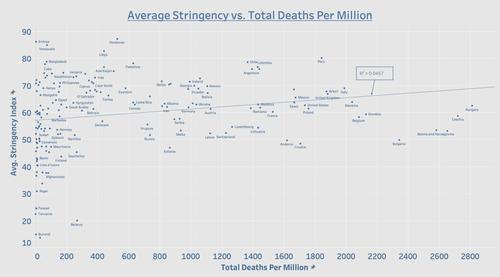

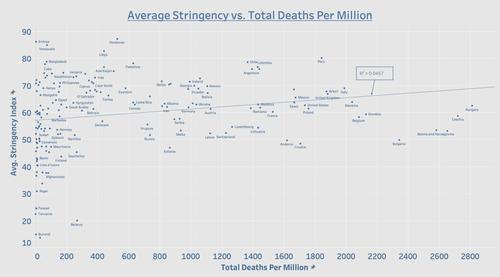

Internationally speaking, the data continue to expose lockdowns as the single greatest public health failure in human history. Plotting lockdown stringency against total covid-19 death toll reveals, yet again, zero correlation between the two variables.

Source: Data on deaths (as of Apr. 28, 2021) and lockdown stringency (as of Apr. 28, 2021) from Our World in Data.

In light of a year’s worth of data showing wildly different mortality and hospitalization outcomes for fifty states with fifty very different lockdown stringencies, as well as drastically different mortality outcomes for 166 countries with 166 different lockdown stringencies, one can only marvel that such a deadly and ineffective policy can be recommended by public health experts.

If the lockdowns failed to mitigate the spread of covid-19 in the United States just as in dozens of countries around the world—remember, the lockdowns fail without even taking their costs into account—it’s possible that mask usage is the missing piece of the mitigation puzzle.

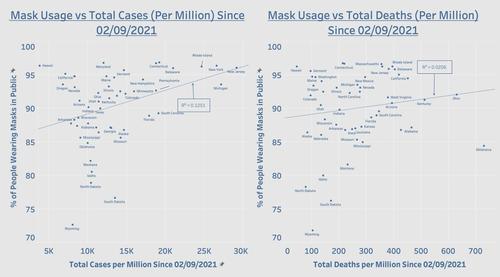

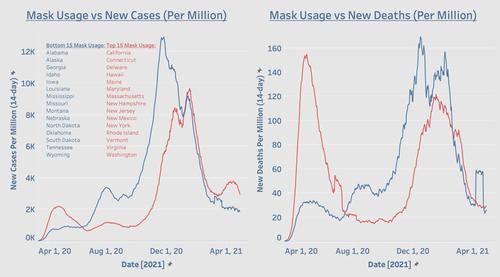

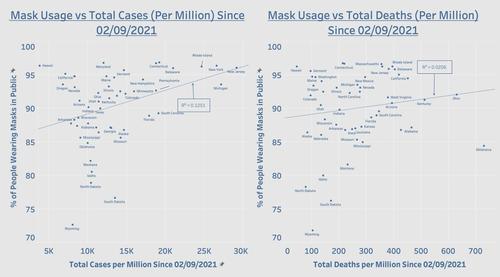

It wouldn’t be fair to the reader to post quite literally hundreds of charts that show the exact opposite outcomes the media would have you expect after regions remove or institute mask mandates—Ian Miller has done more work in this area than anybody else. It also wouldn’t be fair to claim that mask mandates and mask usage are synonymous. However, based on reactions to states lifting their mask mandates, I don’t think any proponent of mask wearing would seriously expect the same level of mask usage should mandates be lifted. Nevertheless, the claim that mask usage negatively correlates with cases and deaths is easily refuted with a quick look at the data. Given the data available, we’ll again only be looking at the fifty states.

Source: Data for cases and deaths (as of Apr. 28, 2021) from the NYTimes Covid-19 Data Bot. Mask usage data from the Delphi Group’s COVIDcast.

Even though the trend lines travel in the exact opposite direction of what our public health experts would have us expect, the correlations are statistically meaningless. Note that the above chart only covers the 2.5-month period starting February 9, 2021, which is when COVIDcast began reporting mask usage numbers for each state. Therefore, the author included only the cases and deaths that occurred during this 2.5-month period. Despite this truncated time period, 2.5 months should have been more than enough to have exposed any sort of meaningful correlation between mask usage and both cases and deaths.

It is worth noting that Rhode Island and New York, each with some of the highest mask usage rates and lockdown stringencies in the country, are leading the pack with some of the largest case increases since early February. What is more, in the 2.5 months since early February the ten states with the highest rate of mask usage have been doing worse in both cases and deaths than the ten states with the lowest rate of mask usage.

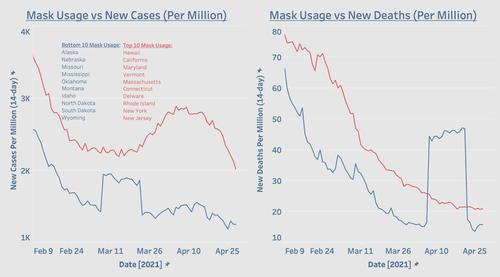

Source: Data for cases and deaths (as of Apr. 28, 2021) from the NYTimes Covid-19 Data Bot. Mask usage data from the Delphi Group’s COVIDcast.

Remember, we aren’t measuring the amount of rules that simply say you have to wear a mask. What’s being measured is the percentage of people actually wearing masks in public in each state. It’s quite difficult to look at the trends depicted above and make the case not only for continuing mask mandates, but wearing masks at all.

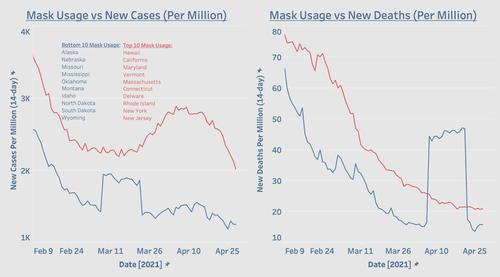

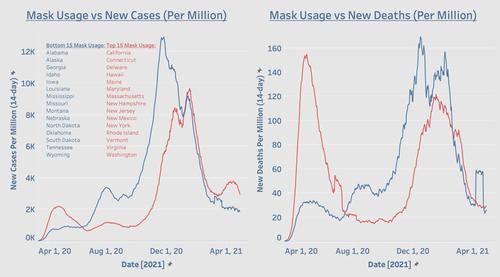

Some may have an issue with the fact that the trends above only cover the couple of months since February. Let’s assume, for the sake of a more complete picture, that mask usage trends were consistent for each state since the start of the pandemic. We can also expand our filter to the top and bottom fifteen states to account for some states’ movement in and out of the top and bottom ten states.

Source: Data for cases and deaths (as of Apr. 28, 2021) from the NYTimes Covid-19 Data Bot. Mask usage data from the Delphi Group’s COVIDcast.

In terms of cases, from April to around mid-June, states with the lowest rates of mask usage were outperforming states with the highest rates of mask usage. This trend reversed from mid-June through mid-January and then reversed again in favor of states with the lowest rate of mask usage.

In terms of deaths, states with the lowest rates of mask usage outperformed states with the highest rates of mask usage from April until mid-July. From mid-July to mid-February, death trends were more favorable to states with the highest rates of mask usage, but after mid-February death trends again became more favorable to states with the lowest rates of mask usage. Again, if we are assuming fairly consistent rates of mask usage across the entire duration of the pandemic while also assuming that the science behind masks is truly settled, it’s quite difficult to explain away any period of time in which states with the lowest rates of mask usage were outperforming states with the highest rates.

The supposedly settled science behind both lockdowns and mask mandates has always been in serious trouble but is even more so now. Completely leaving aside the incredible death toll of the lockdowns, their numerous social and psychological costs, the totalitarian denial of our most basic liberties, and the decimation of tens of thousands of small businesses, they would still be a miserable failure by nearly every covid-19 metric we have available. Though, to be fair, the lockdowns did make our cities quieter. But aside from that, the data continue to deny that either lockdowns or mask mandates are effective tools for mitigating the spread of covid-19.