US index futures are unchanged from Wednesday’s close after some rangebound trades in another illiquid, overnight session, as traders were paralyzed and unwilling to commit capital ahead of today’s critical CPI print which consensus expects to come in at 7.2% YoY headline and 5.9% core, but which may well surprise to the downside (we explained why yesterday) after beating expectations on 8 of the past 10 occasions. A miss will likely send yields lower and risk sharply higher, especially when considering that the BLS will revise its CPI basket weightings and seasonal adjustments today. On the other hand, an upside surprise could spur additional pricing for a 50bp rate hike at the March meeting, currently priced in the swaps market at around 28%, and as such the 830am CPI print will shape views on how aggressively the Federal Reserve will tighten monetary policy in coming weeks.

Contracts on the S&P 500 were flat, and the Nasdaq drifted lower after a broad Wall Street rally on Tuesday, US Treasury yields were lower as was the dollar while bond yields in most of Europe ticked higher, as did bitcoin which briefly rose above $45,000 .

“This inflation data will provide investors with more clues on how aggressive the Fed could be at its next policy meeting, sparking volatility in both bond and stock markets,” said Pierre Veyret, a technical analyst at ActivTrades.

Markets are pricing in more than five quarter-point Fed hikes in 2022. Some remain skeptical about such bets, such as Bokeh Capital Partners Chief Investment Officer Kim Forrest, who said on Bloomberg Television that she sees expects inflation to ease as government handout programs are removed.

Five to seven Fed hikes “is just so crazy — it’s a lot driven by bond people here who really just want to get that 10-year to the 3% rate and I don’t know that’s possible,” said Forrest, who expects maybe two Fed rate increases in 2022.

Walt Disney jumped in premarket trading after beating estimates, with positive surprises from streaming service subscriptions and theme parks. Twitter rose in premarket trading after announcing a $4 billion share buyback to offset earnings and projections that disappointed expectations. Coca-Cola and Pepsico also climbed on robust earnings. Here are some other notable premarket movers:

- Uber (UBER US) rises 5% in premarket trading after it reported fourth- quarter revenue that beat the average analyst estimate. Analysts say pandemic-linked headwinds may ease for the ride-hailing company.

- Mattel (MAT US) jumps 11% in premarket trading. The toy manufacturer reported an “impressive” beat in 4Q, according to Truist Securities.

- Twilio (TWLO US) shares jump 19% in U.S. premarket trading, after the infrastructure software company reported fourth-quarter results that beat expectations and forecast first-quarter revenue ahead of the analyst consensus. Analysts were particularly positive on the firm’s improved growth prospects.

- Shares of MGM Resorts (MGM US) rose 3% in post- market trading, after the entertainment company reported adjusted earnings per share for the fourth quarter above the average analyst estimate.

- Emcore (EMKR US) tumbles 16% in postmarket trading after the aerospace and communications supplier’s fiscal second-quarter revenue outlook missed the average analyst estimate.

- O’Reilly Automotive (ORLY US) shares rallied 9% in postmarket trading after the car-parts retailer’s 2022 profit forecast beat the average analyst estimate.

- Vimeo (VMEO US) slumped 21% in postmarket trading after the software company forecast full-year revenue growth below the average analyst estimate and said its chief financial officer is departing.

- Lumen Technologies (LUMN US) shares plunged over 11% in postmarket trading after the company’s 2022 adjusted Ebitda forecast missed the average analyst estimate.

- Impinj (PI US) forecast revenue for the first quarter that exceeded the average analyst estimate at the midpoint. The stock tumbled in postmarket trading after rallying more than 19% in the past four trading sessions.

While robust corporate earnings provided support for stocks this week, the U.S. inflation print is the center of attention on Thursday. Data are expected to show U.S. inflation exceeding 7%. A surprise reading either side could shift bets on the pace of Fed interest-rate hikes and inject more volatility into stocks and bonds.

“The market is being somewhat sanguine about what will happen in the second half of 2022,” Sonal Desai, chief investment officer at Franklin Templeton Fixed Income, wrote in a note. “There is an expectation that inflation will decline sharply. I think that might be optimistic because a lot of the factors driving inflation will still be with us. The Fed is already behind the curve.”

Fed Bank of Cleveland President Loretta Mester and her Atlanta counterpart Raphael Bostic said all options are on the table for the size of policy makers’ first interest-rate increase in March, but Mester doesn’t see a “compelling case” for a 50-basis-point hike. They indicated they prefer the Fed to start reducing its balance sheet soon.

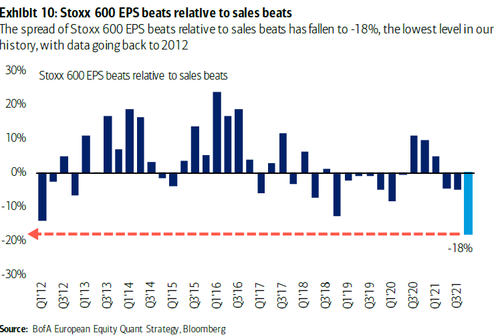

In Europe, the Stoxx Europe 600 Index erased earlier gains to drop 0.1%, dragged by consumer goods and personal care sectors after a slew of earnings reports. Personal-care heavyweight Unilever Plc dropped after sounding the alarm on cost increases, and L’Oreal SA declined even after reporting record sales, with traders focusing on eroding margins; Delivery Hero slumped after providing a disappointing guidance. Travel, real estate and health care outperformed. Siemens and AstraZeneca were lifted by stronger-than-expected earnings. Here are some of the biggest European movers today:

- Siemens shares jump as much as 8% after the company reported first-quarter earnings that analysts said beat estimates “across the board.” The gain is the steepest since November 2020.

- Societe Generale shares climb as much as 4.2%, to the highest since Oct. 2018, after the lender reported 4Q results that Jefferies says are “very strong,” with net profit 40% above consensus.

- Huhtamaki shares rise the most since July 2020, after the Finnish maker of food packaging reported adjusted Ebit for the fourth quarter that beat the average analyst estimate.

- AstraZeneca rises on 4Q earnings which beat analyst expectations on core EPS and product sales. Handelsbanken calls the outlook a “relief although broadly in line.”

- H&M rises after Deutsche Bank upgraded the company to hold, saying the Swedish fashion retailer has an attractive valuation on about “5.5% dividend yield that is growing.”

- Delivery Hero shares lose a quarter of their value in a record one-day loss following a quarterly update, with analysts saying that the online food delivery firm’s Ebitda guidance for 2022 is disappointing.

- Credit Suisse shares fall as much as 5.1% after the lender rounded off a challenging 2021 with a fourth- quarter net loss of CHF2 billion, with analysts calling the quarter “messy.”

Earlier in the session, Asian equities rose for a second straight day ahead of key U.S. inflation data due later that may provide clues on the Federal Reserve’s tightening pace. The MSCI Asia Pacific Index advanced as much as 0.7%, helped by technology and material stocks. Shares in Japan, Hong Kong and Taiwan rose on Thursday while mainland China’s CSI 300 declined. Global stocks have had a broadly positive week as the 10-year U.S. Treasury yield’s slip from multi-year highs helped boost demand for growth stocks. Still, the prospect of hotter-than-expected U.S. inflation spurring a big Fed rate hike has kept investors on edge. “Inflationary pressure will probably stay for a while –the takeaways from the current earnings season mean it is not going away for the next quarter or so,” Christina Woon, investment manager at Abrdn Asian Equities, said in an interview on Bloomberg TV. “So investors need to watch out for margins.” The Reserve Bank of India stuck to its dovish tone to ensure an economic recovery in a surprise move, while Indonesia’s central bank kept borrowing costs unchanged to maximize support for the economy

Japanese equities rose, capping a third day of gains and a second-straight weekly advance amid an extended rebound from the rate-driven selloff. Electronics and chemical makers were the biggest boosts to the Topix, which rose 0.5%, rounding a weekly advance of 1.7%. Tokyo Electron and Advantest were the largest contributors to a 0.6% gain in the Nikkei 225. “People are waiting for U.S. CPI figures,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co. “But for Japan stocks, earnings will likely continue to provide support.”

Indian stocks rose as the Reserve Bank of India’s monetary policy panel kept the benchmark interest rate unchanged to extend its stance of focusing on growth despite mounting inflation. The S&P BSE Sensex gained 0.8% to 58,926.03 in Mumbai while the NSE Nifty 50 Index advanced by a similar measure. The key gauges extended their rally into a third day. All but one of the 19 sector sub-indexes compiled by BSE Ltd. climbed, led by a gauge of power companies. “It is quite reassuring for stocks that the RBI has continued with an accommodative stance and kept the inflation estimate at its current level,” said Abhay Agarwal, a fund manager at Piper Serica Advisors Pvt. He sees rate-sensitive shares to be the biggest beneficiaries of the central bank’s decision and commentary. RBI’s priority on growth is not unwarranted given that economic recovery is yet to gather momentum while private consumption lags pre-pandemic levels, according to Naveen Kulkarni, chief investment officer at Axis Securities. “We believe over the medium term, policy rates are likely to gradually harden, and markets will continue to gauge impact from global policy changes,” he said. Corporate earnings for the quarter through December have been mixed, with rising input costs eating into margins of manufacturing-linked companies. Automaker Mahindra and miner Hindalco Industries were the latest Nifty 50 companies to report profit that beat analysts estimates. Of the 43 Nifty 50 companies that have reported quarterly numbers thus far, 23 either met or exceeded analyst estimates, 18 missed and two can’t be compared. Hero MotoCorp will be reporting results later Thursday. HDFC Bank contributed the most to the Sensex’s gain, increasing 1.8%. Out of 30 shares in the Sensex index, 26 rose and 4 fell

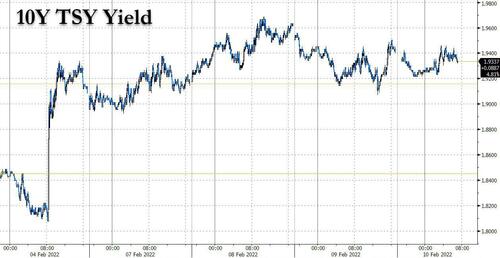

In rates, treasuries were richer across tenors led by front-end, with long-dated yields off session lows, steepening the curve ahead of January CPI report and 30-year bond auction. Yields were richer by more than 2bp across 2-year sector, steepening 2s10s by 1.7bp; the 10-year yield traded around 1.925%, outperforming bunds and gilts by 1.5bp and 0.5bp. Italian bonds lead euro-zone bonds lower as ECB rate hike wagers increase ahead of EU and U.S. inflation numbers. January CPI data is expected to show 7.2% y/y increase; an upside surprise could spur additional pricing for a 50bp rate hike at the March meeting, currently priced in the swaps market at around 28%. Treasury auction cycle concludes with $23b 30-year new issue at 1pm ET, week’s third and final sale; demand was strong for 3- and 10-year notes

Fixed income was broadly steady with the belly of the German curve underperforming U.K. and U.S. peers. Curve moves are modest, U.S. 2s10s ~1.5bps steeper ahead of today’s inflation print. Peripheral spreads have a small widening bias with 10y Italy ~2bps wider to Germany near 156bps. JGB futures snap higher, JPY goes small offered after a BOJ special purchase operation announcement.

In FX, the Bloomberg Dollar Spot Index gave up a modest gain as the greenback slipped against risk-sensitive peers, led by the kiwi; short-end Treasury yields slipped. The euro edged up a second day to near $1.1450; yield curves bear-steepened in the region, and peripheral bonds underperformed the core. One-month implied volatility in the euro now captures the next ECB meeting and the relative premium suggests options are fairly priced. The pound led gains before a speech by BOE Governor Andrew Bailey. Sweden’s krona was the worst performer, dropping as much as 0.6%, after the Riksbank kept up its dovish monetary-policy stance as Governor Stefan Ingves blocked a push from officials for stimulus withdrawal; Swedish yields dropped by up to 7bps, led by the front end. The yen weakened while Japanese government bonds fell with the benchmark 10-year yield rising to a six-year high amid wariness over U.S. CPI data ahead of a Japanese holiday on Friday. The BOJ offered to buy an unlimited amount of bonds at a fixed rate, pushing back against traders that are testing its yield curve control policy.

In commodities, crude futures drift: WTI trades either side of $90, Brent near $91.50. Base metals trade well with most up over 1.5%, Spot gold trades a narrow range near $1,833/oz.

To the day ahead now, and the aforementioned US CPI release will be the main highlight. Other data releases include the US weekly initial jobless claims and the monthly budget statement for January. From central banks, we’ll hear from BoE Governor Bailey, ECB Vice President de Guindos, and the ECB’s Lane and Villeroy. Earnings releases include The Coca-Cola Company, PepsiCo, Philip Morris International and Twitter. Finally, the European Commission will be publishing their latest economic forecasts.

Market Snapshot

- S&P 500 futures down 0.2% to 4,569.50

- MXAP up 0.6% to 191.62

- MXAPJ up 0.7% to 630.21

- Nikkei up 0.4% to 27,696.08

- Topix up 0.5% to 1,962.61

- Hang Seng Index up 0.4% to 24,924.35

- Shanghai Composite up 0.2% to 3,485.91

- Sensex up 0.9% to 58,996.33

- Australia S&P/ASX 200 up 0.3% to 7,288.45

- Kospi up 0.1% to 2,771.93

- STOXX Europe 600 little changed at 473.35

- German 10Y yield little changed at 0.24%

- Euro up 0.1% to $1.1442

- Brent Futures up 0.6% to $92.07/bbl

- Gold spot down 0.1% to $1,831.24

- U.S. Dollar Index little changed at 95.48

Top Overnight News from Bloomberg

- The ECB will take a gradual approach to unwinding some of its ultra-expansionary monetary policy, Governing Council member Olli Rehn says in Helsinki seminar

- Euro-area inflation will ease below the ECB’s 2% target next year, according to new draft projections from the EU that will feed the growing debate about how quickly to raise interest rates

- Worries about Britain’s cost of living crisis and a shortage of workers pushed U.K. starting salaries up by their third-fastest pace on record in January, according to a survey that will add to growing concerns at the BOE about inflation and rampant wage gains

- The BOE’s quantitative easing program is on course to book a 3 billion-pound ($4.1 billion) loss in the coming weeks as the central bank’s massive bond holdings start their journey from government cash cow to a drain on the public finances

- EU and U.K. attempts to jump-start negotiations over the post-Brexit trading relationship in Northern Ireland have so far failed to make any progress, and diplomats see little chance for any substantial progress until they get past a key election scheduled for May

- Bank of Japan chief Haruhiko Kuroda says that it’s impossible for the central bank to make a hawkish turn before his term ends next year, Mainichi newspaper reported, citing an interview with the governor

- Some of this year’s worst-performing emerging markets will get another chance to lure back bond investors after their first round of aggressive rate hikes failed to contain inflation. At least seven countries including Russia, Mexico and India are set to follow Poland and Romania, which raised benchmark rates this week

A more detailed look at global markets courtesy of Newsquawk

Asian stocks traded mixed as participants digested another deluge of earnings and US-China frictions. ASX 200 (+0.3%) was supported by tech and with financials boosted after AMP and NAB reported higher H1 profits. Nikkei 225 (+0.5%) finished off highs with the index swayed by a choppy currency and numerous earnings. Hang Seng (-0.2%) and Shanghai Comp. (-0.3%) were subdued after Hong Kong reported its first COVID death in five months, while Biden administration is said to mull trade actions on China. Nifty 50 (+0.7%) was initially choppy heading into the RBI decision but was then lifted after the central bank kept the Repurchase Rate at 4.00% and unexpectedly maintained the Reverse Repo Rate at 3.35%.

Top Asian News

- BOJ Seeks to Rein in Yields With Unlimited Fixed-Rate Purchases

- BOJ to Conduct Unlimited Fixed-Rate JGB Purchases at 0.25%

- Credit Suisse Hires 80 Wealth Bankers for Asia Growth

- India’s Central Bank Chief Says Crypto Is ‘Not Even a Tulip’

European bourses are mixed/positive having pulled back modestly from a firmer cash open, individual movers heavily dictated by pre-market earnings. Sectors are mixed with Basic Resources outperforming while Consumer Products/Services are pressured on earnings dynamics.

Top European News

- Italy Is Set to Approve Start of Process to Sell Airline ITA

- U.K. Salaries Jump as Workers Grapple With Cost-of-Living Crisis

- Delivery Hero Slumps Most on Record as Outlook Disappoints

- Turkey Kicks Off Latest Round of Capital Injections in Banks

Central Banks:

- BoJ to purchase unlimited 10yr JGBs on Feb 14th at 0.25% (#363, #364 and #365); decided on fixed rate operation given recent yield moves. Will firmly keep policy to keep 10yr yields around 0%.

- Riksbank maintains its Repo Rate at 0.00% as expected. QE maintained for Q2 (SEK 37bln for Q1 2022); three hawkish dissenters on QE. Q1 2024 rate path lifted marginally; even if the risk of too low inflation has declined, it still remains. Governor Ingves says a rate hike is inching closer than we earlier believed.

- RBI kept the Repurchase Rate unchanged at 4.00% and maintained accommodative policy stance, as expected, but also surprisingly held the Reverse Repo Rate at 3.35% (exp. 20bps increase). RBI Governor Das said the MPC flagged potential downside risks to activity from Omicron and they are seeing some loss of momentum for economic activity, while the MPC was of the view that continued policy support is

- warranted for a durable and broad-based recovery.

- ECB’s Rehn says it is more preferable to progress one step at a time in normalising monetary policy in an uncertain environment; will use all tools to stabilise inflation around 2%.

In FX, DXY somewhat deflated into US CPI even though expectations are lofty, as Fed’s Mester sees no compelling case for 50bp March liftoff. Riksbank rattles SEK with only minor rate path tweak and no real tilt from transitory inflation view. BoJ undermines YEN by announcing unlimited JGB purchases to prevent 10 year yield spiking further from target. ZAR continues shine alongside Gold in the run up to SA State of Nation Address. Turkish Finance Minister is to announce “a new support package” on Feb 12th; will focus on measures to curb recent price rises whilst providing support to export firms, plans to bring “under-the-mattress gold” into the Turkish banking system.

In fixed income, core bonds back-off after a fade below midweek highs as US CPI looms before the long bond refunding leg. JGBs buck the bearish trend as the BoJ steps in to defend its YCT via unlimited purchases of 10 year maturities from February 14th.

In commodities, WTI and Brent remain choppy in fairly tight ranges in the context of recent performance, focus very much on geopols as Russian military drills commence. White House said President Biden and Saudi King spoke about commitment to ensure stability of global energy supplies, while Energy Intel noted that Saudi’s King Salman stressed importance of maintaining balance and stability in oil markets, highlighting importance of maintaining the OPEC+ agreement. OPEC MOMR to be released at 12:45GMT/07:45EST. Spot gold trades sideways and confirmed support at USD 1,830/oz, which acted as resistance on the way up. Base metals derived support in APAC hours while Coal pulled-back given recent commentary.

US Event Calendar

- 8:30am: Jan. CPI YoY, est. 7.2%, prior 7.0%; CPI MoM, est. 0.4%, prior 0.5%, revised 0.6%

- 8:30am: Jan. CPI Ex Food and Energy YoY, est. 5.9%, prior 5.5%, CPI Ex Food and Energy MoM, est. 0.5%, prior 0.6%

- 8:30am: Jan. Real Avg Hourly Earning YoY, prior -2.4%, revised -2.0%; Real Avg Weekly Earnings YoY, prior -2.3%, revised -2.0%

- 8:30am: Feb. Initial Jobless Claims, est. 230,000, prior 238,000; Continuing Claims, est. 1.62m, prior 1.63m

- 2pm: Jan. Monthly Budget Statement, est. $23b, prior -$162.8b

DB’s Jim Reid concludes the overnight wrap

I’ll be honest, life is so dull for me at the moment that work is my salvation. 9.5 days down on crutches now and 32.5 to go. Given I only went through the same thing on my other knee in September and October last year it is fair to say I’m ready for a decent stretch of no injuries. As is my wife who has to deal with me and also our 6-year old Maisie who is going to continue to be in wheelchair for the best part of this year. For those that have kindly asked the good news is that she’s swimming 4 times a week now and absolutely loves it. In fact she’s very good now and is a couple of years better than her age so that is one silver lining that has come out of her hip condition. The only benefit for me is that as I’m not going outside much, my usual blast of January onwards hay fever has not really made an appearance this year. Usually the silver birches (I think) at the golf course are my Kryptonite at this time of year. It is usually horrendous.

The Kryptonite for markets is undoubtedly inflation at the moment and it’s that time again with US CPI today the main event of the week. Last summer on a couple of occasions I suggested that the then upcoming day’s US CPI number could be the most important economic data release in perhaps a generation given the potential for regime change. However the summer inflation prints whilst consistently higher than expected were largely shrugged off by the market so my hyperbole was clearly misplaced. Without repeating my mistake, we are approaching a crucial point for US CPI. If we don’t start gliding lower in line with expectations soon, the market is going to be pricing some 50bps Fed hikes into the equation for 2022. Today’s number is a complicated one as Omicron could create distortion that unwind next month.

As readers will likely be familiar, recent months have seen repeated upside surprises, with the monthly headline CPI print above the consensus estimate on Bloomberg for 8 of the last 10 releases, sending the year-on-year number up to +7.0% for the first time since 1982. In terms of what to expect, our US economists are looking for a further increase in the year-on-year figure to +7.2% (in line with consensus), with core also rising to +5.8% (consensus 5.9%). That said, their view is that the month-on-month measure should subside to +0.38% from +0.58% in December, which would be a 5-month low and mark a third consecutive decline in the monthly reading. Core is expected to dip to +0.40% from +0.58% mom.

The wildcards might be lodging away and airfares due to Omicron. These fell -2.7% and -8.6% last August around the Delta variant. So the risks feel a touch skewed toward the downside this month even if that will likely be a temporary thing given the Omicron wave is well past the peak. Structurally we still see primary rents and OER as seeing enough upward pressure to keep the glidepath lower (when it comes) more shallow than the market thinks regardless of what happens today. As an aside, food prices continue to increase which won’t help, with Bloomberg’s Agriculture Spot index up +1.68% yesterday to its highest levels since 2011.

We’ll have to wait and see what happens, but it was only last Friday that a much stronger-than-expected jobs report turbocharged calls for a 50bp hike from the Fed. Immediately afterwards, futures moved to pricing in a more than 40% chance one could happen, although that number’s since fallen back to 30% this morning. Fed Chair Powell notably did not rule out moving by 50bps at the press conference after the last meeting, and a higher-than-expected inflation number today would only add fuel to the fire.

On the other hand, yesterday we did begin to see some signs of pushback on recent market pricing, with a number of central bank officials adopting a more cautious and measured tone relative to the market narrative of recent days. The comments on Monday evening from the ECB’s Villeroy after the European close that there “were perhaps reactions that were very high and too high in recent days” helped matters from the get-go. We then heard from the Fed’s Mester (a voter on the FOMC this year), who didn’t find a compelling case for raising rates by +50bps at liftoff. And earlier in the day, BoE Chief economist Pill also said that “I worry that taking unusually large policy steps may validate a market narrative that bank policy is either foot-to-the-floor on the accelerator or foot-to-the-floor with the brake”.

That pushback held more water in Europe, where there was a rally across all maturities and countries, with yields on 10yr bunds (-5.3bps), OATs (-5.5bps) and BTPs (-9.6bps) all moving lower on the day. Bunds saw their first yield fall in 12 days and ended the longest run of increases since reunification in 1990. Meanwhile in the US, the yield curve twist flattened, with 2yr Treasuries +2.3bps higher and 10yr Treasuries down -2.2bps, bringing the 2s10s yield curve to a fresh low of just +57bps yesterday, the lowest closing level since October 2020. Nevertheless, US rate moves were small in magnitude with most investors looking to CPI today as a key risk event.

Even with some pushback to the recent yield rises, the global tightening continued apace yesterday, with Romania’s central bank announcing a 50bps hike in their monetary policy rate, and Iceland’s central bank announced a 75bps hike in their 7-day term deposit rate as well, their biggest hike since 2008.

With the bond rout easing yesterday, equities continued their advance as both the S&P 500 (+1.45%) and Europe’s STOXX 600 (+1.72%) closed at their highest level in a week. It was a very broad-based advance for both indices; 428 companies in the S&P were in the green, the second-highest number of 2022 so far, while every sector advanced. Tech and mega cap stocks put in a strong performance in particular, with the NASDAQ (+2.08%) and the FANG+ index (+2.44%) both seeing a decent advance for the second day running.

Overnight in Asia, equity markets are struggling to find direction with the major indexes fluctuating in the morning trade. The Nikkei (+0.33%) and Kospi (+0.25%) have reversed early morning losses while the Shanghai Composite (-0.10%), CSI (-0.52%) and the Hang Seng (-0.48%) are all moving lower. Meanwhile, shares of China Evergrande Group in Hong Kong are up +2.99% after reports came in that the embattled developer plans to deliver 600,000 apartments this year and will refrain from selling off its assets to repay its debt. Elsewhere, the Reserve Bank of India (RBI) decided to keep its repo rate unchanged at +4.0% and will continue with its accommodative stance to foster economic growth. Additionally, the central bank has projected real GDP growth at +7.8% for FY 2022-23. Looking forward, equity futures are pointing to a weak opening in the US with contracts on the S&P 500 (-0.21%) and the NASDAQ (-0.30%) both lower ahead of the crucial US inflation data later today.

On the data front, Japan’s producer price inflation in January came in +8.6% year-on-year, which is a slight decline from the previous month’s +8.7%, but was still some way above the +8.2% expected. Against that backdrop, Mainichi reported Bank of Japan Governor Kuroda saying that there is “no chance” that monetary easing would be reduced, and that the chance of a big increase in inflation as seen elsewhere was “very low”.

Staying on central banks, the Boston Fed named Susan Collins, an economist serving currently as executive vice president of University of Michigan, as their new President. Regional Fed Presidents get to vote on the FOMC every three years, and this year the Boston Fed President is up. We’re sure to learn more about her monetary policy views before she assumes office in July.

Finally, a number of countries have been removing Covid restrictions lately, and in the UK Prime Minister Johnson announced yesterday that all remaining restrictions in England could end later in February. He said he’d be announcing a plan to live with Covid on February 21, so if we do see an end to restrictions that will provide an interesting example to other countries amidst increasing political momentum to get back to normal. Over in the US, Dr Fauci also said in a recent FT interview that he hoped that pandemic restrictions could end in the months ahead, whilst New York Governor Hochul said that the state’s mask mandate for businesses would end today.

To the day ahead now, and the aforementioned US CPI release will be the main highlight. Other data releases include the US weekly initial jobless claims and the monthly budget statement for January. From central banks, we’ll hear from BoE Governor Bailey, ECB Vice President de Guindos, and the ECB’s Lane and Villeroy. Earnings releases include The Coca-Cola Company, PepsiCo, Philip Morris International and Twitter. Finally, the European Commission will be publishing their latest economic forecasts.