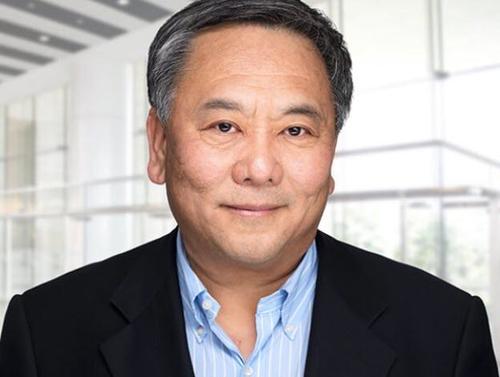

Authored by Mark Dittli via TheMarket.ch,

Chen Zhao, Founding Partner and Chief Strategist of Montreal-based Alpine Macro, has been analyzing global financial markets for more than thirty years. Numerous investors worldwide know him as the long-serving Chief Strategist of BCA Research.

Today, Zhao is confident about equity markets. He sees the ingredients for a strong recovery in the global economy, and he believes fears of higher inflation are overblown. He sees the potential for the Federal Reserve’s monetary policy to inflate a new speculative bubble. «This bubble is going to be a whole lot bigger than the tech bubble of the late nineties, and it will probably run a whole lot longer than we think», says Zhao in an in-depth conversation with The Market NZZ.

His main concern is the growing conflict between the United States and China. Today, the risk of escalation over Taiwan is greater than at any time in the last 40 years, Zhao warns.

Mr. Zhao, in February and March, we have witnessed a sharp upward move in long term US bond yields, temporarily causing a sell-off in the Nasdaq. What do you make of this?

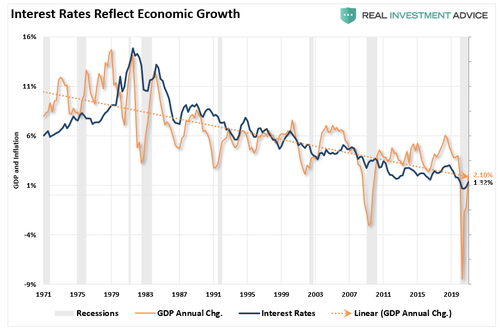

Whenever bond yields rise, you should conceptually decompose this movement into two stages. One is reflective, meaning the bond market is trying to tell you something about the underlying economy. Rising bond yields are reflective of stronger economic growth. However, a market selloff could also move into a phase where bond yields become too high, constraining economic activity. In my judgement, what we are witnessing right now is purely reflective. The ISM manufacturing index is at its highest level since 1983, the world economy is in a strong recovery mode. Higher yields are consistent with the economy getting stronger. Under these circumstances, I would be more concerned if bond yields did not rise.

Aren’t rising inflation expectations also playing a part?

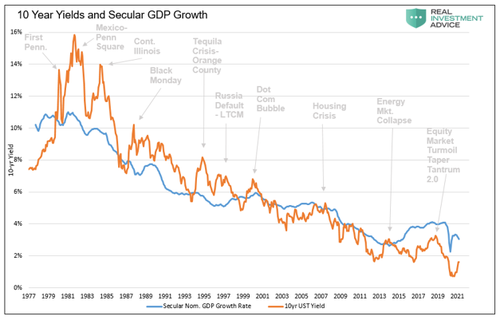

I don’t see a clear breakout in inflation expectations. People forget that during the decade after the global financial crisis, inflation expectations have fallen apart. Markets became much more concerned about deflation. Inflation breakeven rates currently are between 2 and 2.2%, whereas the average range during the decade before 2009 was more like 2.5 to 3%. So inflation expectations are simply in the process of being normalized.

Do you see room for a further rise in yields?

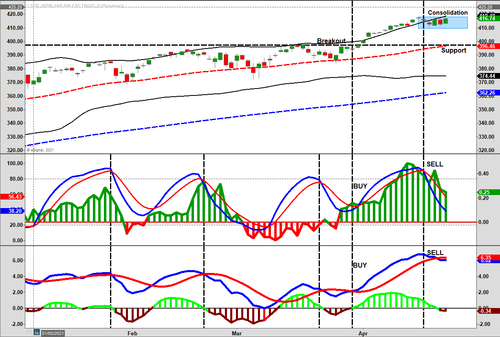

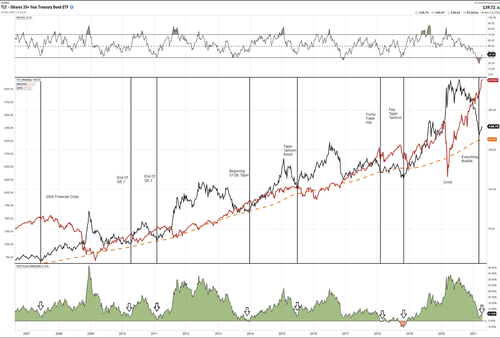

Our model says ten year Treasury yields are pretty much at fair value today, at around 1.5%. But we know that if we have a cyclical move in financial markets, nothing stops at fair value. Markets always undershoot or overshoot. So I could see yields rise towards 2% or even a bit more. If they approach 2%, we would be active buyers of long term Treasuries.

Don’t you see structural inflation building up?

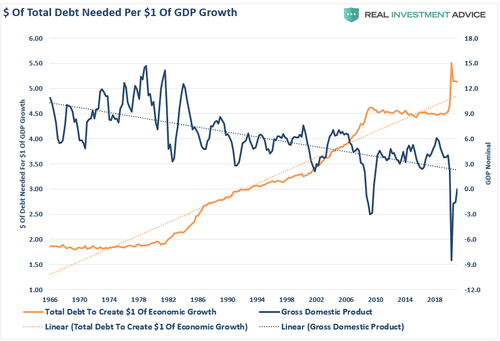

No, not at all. There is a widespread misunderstanding of this issue. Many people look at the fiscal position of the United States and see a budget deficit of almost 20% of GDP. The Fed balance sheet has expanded by $7 trillion since the beginning of the pandemic, M2 has exploded upward. How can this not be inflationary? Well, in my experience, something that is too obvious is usually wrong.

How so?

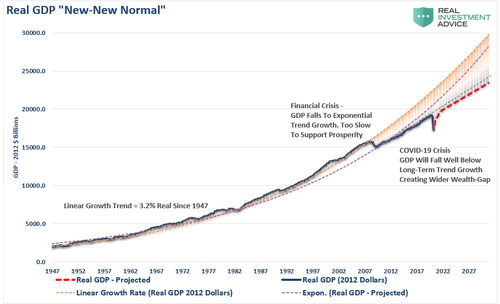

What happened is this: For all of 2020, the US government unleashed $3.5 trillion in various rescue packages, as a result of which the federal government debt rose by $3.6 trillion. At the same time, the household sector’s disposable income increased by $3.5 trillion, and household savings shot up by $5.5 trillion. In other words, American households not only saved up all the transfer payments they received from the government, but they even saved $2 trillion more from their own income. These rescue programs did absolutely nothing to generate aggregate final demand or GDP growth. What we have seen was not a fiscal stimulus to boost aggregate demand, but a transfer payment. This was no different than a one-time tax cut. We know that people’s spending behaviour is determined by their outlook for sustainable income. If you give them a one-time tax cut, they will save it. This is what the Permanent Income Hypothesis says and this is what has happened.

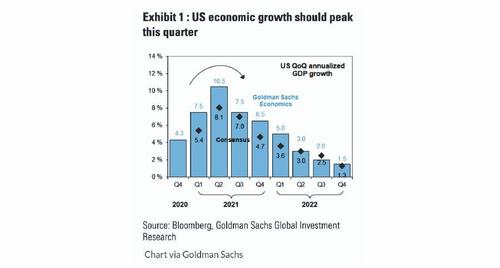

Don’t you think there is a huge amount of pent-up demand that will be released once the economy fully reopens?

Yes, there will be a demand surge. Consumption spending has been repressed for over a year as a result of Covid-19 related restrictions. When the world economy reopens, this spending will be released. But this is not inflationary, as the boom will be temporary. People won’t party for the next twenty years. They will party for the next six months or so. For inflation to be a true threat, you need aggregate demand exceeding aggregate supply on a sustainable basis. I don’t see that happening any time soon. The government subsidies simply amount to a huge balance sheet swap: government debt as a share of GDP has gone up, while consumers’ net worth has gone up even more. This balance sheet swap has nothing to do with excessive aggregate demand.

Does that also mean you don’t see a structural bear market for bonds, where yields would drift higher over the coming years?

Correct, I don’t see the drivers for structurally higher yields. That’s why I think that ten-year Treasury yields above 2% would represent a good buying opportunity.

What would it take for you to change your mind?

I will change my mind if the government took over and built lots of roads and bridges and have it all financed by the Fed.

Isn’t that what the $2.3 trillion Biden infrastructure plan will do?

This proposed package is a step towards that kind of transition. But don’t forget, this is a rather small piece of cake, because it envisions spending roughly $2.2 trillion over eight years, so each year it would add only about 0.8 or 0.9% of GDP adjusted for inflation. On top of that, Biden is proposing higher taxes to fund it. So his infrastructure plan creates some growth on one hand, while taking it away with higher taxes on the other hand. Its net impact will only be around 0.4 or 0.5% of GDP per year. This won’t be a game changer in terms of inflation.

What else would tell you that we are indeed moving through a profound transition towards higher inflation and higher interest rates?

In my view, central banks have been completely wrong in their thinking about the Phillips Curve for the past 30 years, meaning that every time the labor market got too strong, they felt they had to raise rates, because they feared wage inflation would kick in. But we know now that there are a lot of things standing in the way between a strong labor market and actual wage inflation. In an environment of rising productivity, you can have higher wages and still lower inflation. Fundamentally speaking, free market capitalism is deflationary.

Why?

Neither you nor I are paid more than our marginal output. In our society as a whole, labor is always paid at or below its marginal output. In a socialist economy, it’s the other way round, because workers are usually paid more than their marginal output. So unless we change our system into a much more socialist type, and unless we had a substantial decline in labor productivity, I don’t see a return of structural inflation.

What is different today compared to the 1970s, when we had structural inflation in our Western economies?

In the 1970s, we had powerful unions in the US which drove up labor cost but kept productivity low. This was the legacy of President Roosevelt’s New Deal which, in my view, was very socialist. In addition, you had a collapse in the Bretton Woods System which drove down the Dollar by 50%, leading to a spike in goods price inflation. Finally, the US was a manufacturing power in the 1970s and the oil crisis created enormous stagflation pressures. None of this is true today.

There is a tug of war going on between the Fed and financial markets: The Fed says they will stay dovish for a long time, while markets expect a lift-off in short term rates next year. Who is right?

If you think about last decade, Fed policy was always too tight: The projected interest rate path by the Fed, as seen by the so-called Dot Plots, was always higher than market expectations. Because of that, we had a number of financial tremors: The taper tantrum in 2013, the collapse in commodity prices in 2015, the collapse in stock markets in late 2018. We had almost ten years of undershooting inflation and periodic stock market chaos as a result of monetary policy being too tight. In the end, the Fed always caved in and moved towards the market. Now it’s the other way round: The Fed is more dovish than market expectations. The market has priced in four or five rate hikes through 2023, while the Fed suggests they won’t do anything before 2024.

Which side is right?

If you only looked at the lessons of the last decade, you’d say the market is right. But the difference today is that the Fed has abandoned its old reaction function and wants to stay ultra-stimulative until inflation is above 2% for a while. The Fed is now adamantly saying they are willing to be late this time, allowing the economy and inflation to run hotter than they would have in the old days. If that’s the case, then markets may be wrong because they still assume the old reaction function of the Fed. So we don’t know yet, but it’s possible that the Fed will stay dovish much longer than markets think.

What would the consequences of this new Fed policy be?

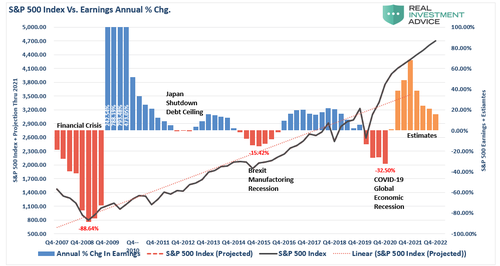

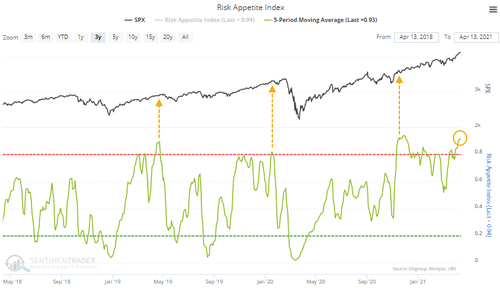

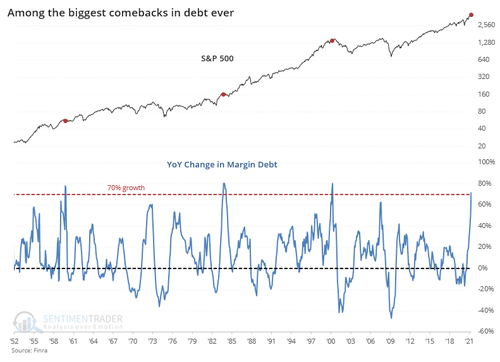

One conclusion is pretty obvious: The stock market has already gone crazy and will likely go even crazier. If you read the work of Charles Kindleberger, you know that asset bubbles are perennial, they grow back every ten years or so, and they are usually driven by easy monetary policy and lots of liquidity. So this new reaction function by the Fed, plus the support from fiscal policy, means that markets will go through a very bubbly period.

How big can this bubble get?

If you look at history, all speculative bubbles got killed by tightening monetary policy. You never had a bubble burst while monetary policy was still easy. Asset bubbles pop when central banks tighten policy to a point of yield curve inversion. Today, we’re far away from that. That’s why I think this bubble could get a whole lot bigger.

Would you say we’re only at the beginning of this process?

I’d say we are in the early stages of a stock market bubble, especially in the United States. There are many signs of speculative behaviour, be it Bitcoin, Gamestop, and so on. But it’s not as pervasive yet as it was in the late 1990s. When the technology bubble burst in 2000, everybody was bullish. Today, many people, even large banks, are still bearish. When they throw in the towel, then the final phase will begin. This bubble is going to be a whole lot bigger than the 90s and it will probably run a whole lot longer than we think.

You don’t see the risk of the bond market assuming the job of tightening conditions by rising long term yields?

Historically, rising yields hurt the economy and stock prices only when both the long and the short end of the curve were moving up. It’s usually not the case to see the long end of the curve move way up while short term rates remain pressed down, as they are today. There is a limit to the pain long term rates can create for the economy, because borrowers can always slide down the maturity curve to avoid having to pay higher interest rates. So if you put it all together, I think ten year yields can’t move much higher than their fair value, while short term rates remain at zero.

What will happen then?

The most likely scenario I see today is that we’ll have an expanding equity bubble for the next two years, with multiples going way higher. Then comes the point where the Fed just can’t remain dovish anymore. They will raise rates. At that point, the end would be nigh. a bursting asset bubble would be inevitable, and this is always very deflationary. When that happens, we could see zero nominal yields in the U.S.

Late last year, everyone was bearish on the dollar. Now the Greenback has surprised by strengthening since January. Why was that?

Don’t forget that the dollar had dropped almost 11% last year. Getting into 2021, it was very oversold, jammed with shorts. So a natural rebound from this position was to be expected. Going forward, I see the prerequisites in place for a further weakening. In the last 20 years, every time the world economy slumped, the dollar strengthened, and every time the world economy got better, the dollar weakened. Right now, we see an improving world economy, hence the dollar should weaken.

What’s the reason for that pattern?

People say the dollar is a safe haven currency, but I don’t see it that way. The Yen and the Swiss Franc are much better safe havens. From the 1970s through the 1990s, the dollar was pro-cyclical, i.e. strengthening with a stronger world economy. This changed around the year 2000. The reason in my view is that large parts of the developed world are in a liquidity trap. And in a liquidity trap, there is infinite demand for dollars, because the dollar demand curve is flat. So every time where we have an economic slump, it means the liquidity trap is deepening, hence the demand for dollars is going up. And every time the economy gets better, the liquidity trap is getting shallower, with demand for dollars shrinking. So, if I take the view that the world economy in the second half of this year is starting a boom, then logically, we cannot have a stronger dollar. We have never had a booming world economy and a stronger dollar since 2000.

When you look at world equity markets, which geographies and sectors currently offer the best opportunities?

I am very value conscious, so I like European stocks, they have underperformed for a long time. I would overweight Germany, France and Italy; their valuations are way more attractive than the US market. If we have a world economic boom, these markets will do very well. The US is difficult to underweight, because it’s so huge, but on the fringe I would suggest to overweight non-US stocks, i.e. Europe and Japan. I think the Japanese market can have one last, big upleg before this bull market is over.

An economic boom and a lower dollar should be bullish for emerging markets, right?

We must keep in mind that today’s emerging markets are very different from 20 years ago. Today, more than 40% of the MSCI EM index is made up by China. In China, the equity market is predominantly driven by big tech, with stocks like Alibaba and Tencent. So China has a similar issue like the US tech sector: In an environment of rising bond yields, these high-multiple stocks tend to underperform. Besides, China has begun to tighten policy, which is a negative for EM performance as a whole. I would shift more towards the commodity segment, meaning Latin America. They have been beaten down badly because of the Bolsonaro screwup in the pandemic crisis, but for every grief there is a price, and I think Brazilian assets are cheap enough to absorb all the negatives. I particularly like commodity markets like Chile. I also like Australia and Canada. These are places where value is better, and they are well positioned for rising commodity prices.

We see a world of inverted roles: After the financial crisis, China embarked on a huge monetary and fiscal stimulus. Today it’s the U.S., while China is tightening. What’s going on?

If you look at the net increase in Chinese fiscal deficit in terms of fighting the pandemic, it was about 4.7% last year, as opposed to about 15% of GDP in the US. Of course, China got the pandemic under control earlier, but that’s not all. The key thing is, their fiscal deficit spending is 100% infrastructure, whereas in the Western world we talk about 10 to 20% of GDP being dumped into the system through transfer payments. The fiscal multiplier in China is huge, while in the US it is practically zero. The second thing is this: After 2008, China went on a construction spree, financed by an avalanche of credit creation. For ten years since then, the central government has been concerned about the economy getting overleveraged. This time, they are comparatively stingy and Beijing wants to slow down the credit creation process early.

The stock market in China is not happy about that.

The stock market is very sensitive to changes in liquidity conditions. If credit growth is slowing down, stocks perform poorly. So it’s not a great time to buy Chinese equities right now. But from a broader economic point of view, I don’t think we’ll see the kind of tightening shock in China like we saw in 2015. So even though it might not be a great time to buy stocks due to liquidity conditions, I think the Chinese economy will do reasonably well, which also means a good environment for commodity prices.

What makes you confident that policy makers in China won’t commit a mistake and tighten too much?

They have not created much credit excesses this time, so there is no reason for them to tighten aggressively. Geopolitically, the leadership in China has reached the conclusion that America is trying to suffocate the Chinese economy. So they have to maintain growth momentum by letting foreign investment money coming in.

Has there been a change in thinking towards the US in Beijing since Joe Biden assumed the presidency?

I think both sides are too far on the path of great power rivalry already. America represents the incumbent power, and China is the rising power that is challenging the US. I personally believe that we in the West don’t get the full picture of Sino-US confrontation. We only get the western side of the story, we never get to see the Chinese perspective through our media.

What is the Chinese perspective?

Within China, there is a strong feeling that the Americans have destroyed the bilateral relationship to cater to purely domestic political needs, starting with Donald Trump. They feel that they are treated unfairly, in a confrontation that is unprovoked. Even when it comes to Hong Kong, we only know Beijing violated the concept of One Country Two Systems by imposing the new security law, but how about the social upheavals and civil unrest in the two years leading up to the change of law? No one said anything here. The US accused the Chinese of not playing by the rules, but the Chinese say they have played by the rules that were written by the US. They have joined the WTO and have slowly opened up their system. They signed the Paris Treaty. They have honoured all the international obligations, then Trump came and uprooted the very system that America had built. So the Chinese feel that the Americans suddenly want to change the rules again. The consensus in Beijing now is that the US wants to derail China. Once you have a consensus like that, it’s difficult to change.

Will Biden continue on that path?

Biden has inherited Trump’s policies. That’s unfortunate, but there’s not much he can do. Trump’s China policy served his domestic agenda, hitting China in order to score points at home. As a result of that, public opinion of China spiralled down. Biden can’t turn that back. And again, the consensus in China is that America wants to keep China down. We must prepare for a long confrontation.

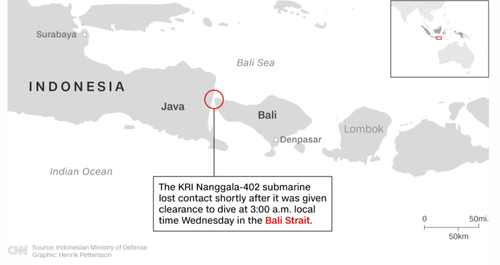

Do you see the risk of that confrontation turning hot?

Washington is playing with the very nerve of the Chinese national interest, which is Taiwan. Since the beginning of bilateral diplomatic relations in the 1970s, one core commitment of the US was the One China Policy, avoiding official contact with the government in Taiwan. But Trump changed that, and Biden continues to follow the Trump script. This is very dangerous. Since 1979, there has been a tacit understanding on both sides that if the US does not encourage separation, the Chinese side will not resort to any military action. Now this tacit agreement has been thrown out of the window. Because Washington has seemingly encouraged official contacts with Taiwan, China feels the need to show their commitment to retake the island to maintain territorial integrity. That’s why we have incursions into Taiwanese air space practically every day. There is a reaction feedback going back and forth. I think there is a strong consensus among the Chinese leadership that within the next five years, if the US continues along this path, they might as well just take the risk of invading Taiwan. Then, all bets are off. The risk of some kind of confrontation is the highest in 40 years.