More ESG Fraud: BofA Finds That Tech Is One Of The Dirtiest Industries

Every several years it’s same old: not long after the start of the post-crisis era, the investing craze du jour was solar, followed by 3D printers; when that fizzled it was replaced with craft burgers/sandwiches which then morphed into the biotech bubble; when that burst blockchain companies and Initial Coin Offerings were the bubble darlings of the day, which in turn were replaced by cannabis stocks. Not longer after, the pot bubble burst, leaving a void to be filled.

That’s when the virtue-signaling tour de force that is ESG, or Environmental, Social, and Governance, made its first appearance, which just happened to coincide with the oh so obviously staged anti-global warming crusade spearheaded by a 16-year-old child (whose words are ghost-written by its publicity-starved parents) as well as central banks, politicians, the UN, the IMF, the World Bank, countless “green” corporations and NGOs, and pretty much everyone in the crumbling establishment.

After all, who can possibly be against fixing the climate, even if it costs quadrillions… or rather especially if it costs quadrillions – because in one fell swoop, central banks assured themselves a carte blanche to print as much money as they would ever need, because who evil egotistical bastard would refuse the monetization of, well, everything if it was to make sure future generations – the same generations these same central banks have doomed to a life of record wealth and income inequality – had a better life (compared to some imaginary baseline that doesn’t really exist).

And since the green movement was here to stay, so was the wave of pro-ESG investing which every single bank has been pitching to its clients because, well you know, it’s the socially, environmentally and financially responsible thing.

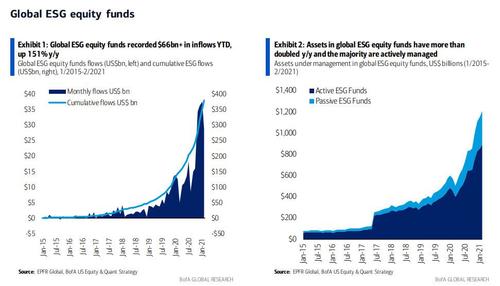

But a problem emerged: there are very, very few companies that actually check the E, the S and the G boxes all at the same time, and their market cap is tiny compared to the massive virtue-signaling inflows that enter the market every day by hypocrite asset managers who engage in all sorts of criminal activity and are thus desperate to show just what model citizens they are by way of their investment choices. As the chart below shows, cumulative inflows into ESG are growing at a staggering pace, which is also why the universe of ESG companies had to be expanded to include the companies with the larget market cap in the world.

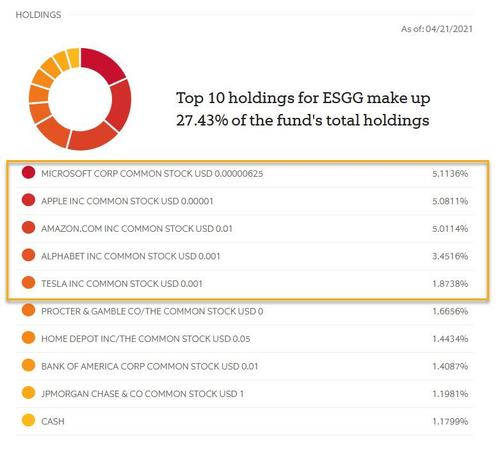

So goalseeking capital flows to available market cap, over the years it became the widely accepted standard that tech – for whatever reason – is the pre-eminent industry targeted by ESG funds. Indeed, a quick look at the eponymous ESGG ETF shows the its top five holdings which account for more than 20% of all the invested capital are the well known tech giga-caps: Microsoft, Apple, Amazon, Alphabet and Tesla.

So institutionalized has the “tech=ESG” identity become that a similar look at any other ESG fund will reveal an almost identical roster of top holdings.

There is however one problem: despite the conventionally accepted “wisdom” that tech is green, it actually isn’t. Yes, impossible – conventional wisdom is never wrong… except when it is, like in this case.

In a fascinating report published by BofA’s head quant Savita Subramanian, titled “10 surprises about the S&P 500 for Earth Day” (which pro subs can find in the usual place) and meant to commemorate Earth Day, the find what may be the biggest surprise of all.

“Tech, a big ESG overweight, isn’t all that green”

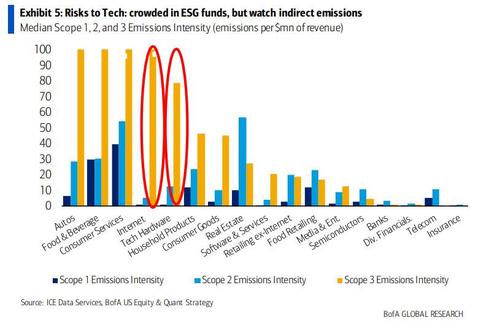

In a daring challenge to both Wall Street’s hypocrisy and conventional wisdom, BofA writes that “Technology is one of the most overweighted sectors by ESG funds, but we find it has some of the highest indirect emissions among service industries.“

To prove this point, Subramanian shows a chart revealing the Scope 1, Scope 2 and Scope 3 emissions intensity by industry, and finds that while Internet and Tech companies indeed have a low Scope 1 and Scope 2 emissions profile, their indirect, or Scope 3, emissions intensity is among the highest in the world, on par with such industries as Autos, and Food and Beverage, and far above household products, media and entertainment, banks, telecom and many others.

To be sure, these aren’t direct emissions – Google may not have a refinery at its headquarters, nor does it deposit toxic water in various streams across the US (that we know of), but its indirect emission profile is simply staggering.

A quick primer: according to the EPA, Scope 3 emissions are the result of activities from assets not owned or controlled by the reporting organization, but that the organization indirectly impacts in its value chain. Scope 3 emissions include all sources not within an organization’s scope 1 and 2 boundary. The scope 3 emissions for one organization are the scope 1 and 2 emissions of another organization. Scope 3 emissions, also referred to as value chain emissions, often represent the majority of an organization’s total GHG emissions.

Scope 3 emissions fall within 15 categories, though not every category will be relevant to all organizations. Scope 3 emission sources include emissions both upstream and downstream of the organization’s activities.

According to the GHG Corporate Protocol published by the EPA, all organizations should quantify scope 1 and 2 emissions when reporting and disclosing GHG emissions, while scope 3 emissions quantification is not required.

However, more organizations are reaching into their value chain to understand the full GHG impact of their operations. In addition, because scope 3 emission sources may represent the majority of an organization’s GHG emissions, they often offer emissions reduction opportunities. Although these emissions are not under the organization’s control, the organization may be able to impact the activities that result in the emissions. The organization may also be able to influence its suppliers or choose which vendors to contract with based on their practices.

Alas, most tech companies do not do this; instead they redirect and scapegoat. A good example is the recent and extremely vocal public outcry over bitcoin mining electricity consumption… which happens to be a tiny, tiny fraction of the electricity consumed, for example, by global cloud servers, or of the electricity consumed by charging Tesla cars, electricity which tends to originate in those evil, polluting coal power plants . But one doesn’t see a coordinated media bashing campaign targeting cloud. Wonder why.

So the next time some self-righteous CNBC talking head or religious ESG prophet talks your ear off about how only Microsoft, Apple, Google and TSLA are the paragons of ESG virtue and worthy of investment, show them the chart above and tell them to do something anatomically impossible.

Tyler Durden

Fri, 04/23/2021 – 05:45

via ZeroHedge News https://ift.tt/3ndy3VC Tyler Durden