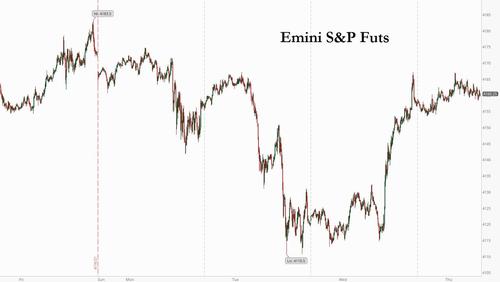

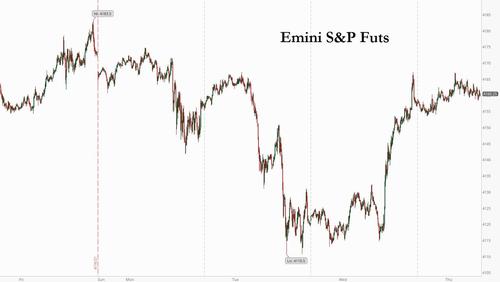

U.S. index futures traded flat on Thursday morning, rebounding from some early weakness ahead of today’s ECB meeting, as investors assessed earnings from companies, including Southwest Airlines and AT&T, while awaiting weekly jobless claims data for clues on the pace of recovery in the U.S. labor market. Treasury yields steadied near a five-week low.

At 7:30 a.m. ET, Dow e-minis were down 15 points, or 0.04%, S&P 500 e-minis were down 5 points, or 0.11%, and Nasdaq 100 e-minis were down 22 points, or 0.16%.

On Wednesday, Wall Street’s main indexes closed higher, recovering from a two-day decline in the previous session with value stocks gaining about 1.1%. Shares of AT&T gained 1% in premarket trading after the company’s wireless subscriber additions trounced analysts’ estimates. read more. Southwest Airlines posted a smaller-than-expected quarterly adjusted loss and forecast lower cash burn in the second quarter. The airline’s shares, however, fell 1.7%.

The recent Russell 2000 underperformance signaled the rotation toward growth-friendly cyclical stocks was slowing. Notably, the benchmark U.S. 10-year yield fell below its 50-day moving average for the first time since November.

With earnings season in its prime, Q1 earnings have surprised to the upside, with S&P 500 showing a 5% revenue surprise and 38% earnings surprise across 83 earnings reports, according to Saxo Bank. Among closely-watched reports, results from chipmaker Intel Corp. are due Thursday. The chipmaker is expected to post a drop in first-quarter revenue later in the day, with analysts looking forward to updates on its U.S. manufacturing plants and chips for automakers amid a global microchip supply shortage. Its shares rose 0.3% in premarket trading.

“While certainly investors have priced in a lot in terms of normalization in certain segments of the market, I still think that there is room to run,” Erin Browne, PIMCO multi-asset strategies portfolio manager, said on Bloomberg TV.

As vaccination rates rise and pandemic-weary citizens embracing more freedoms to drive growth in some major economies, MSCI’s broadest global gauge of stocks was up 0.3%, trading within 1% of its all-time closing high after a recent mini sell-off. However, concerns are mounting that a flare-up in coronavirus cases could derail the global growth rebound after investors piled into trades that benefit from re-opening economies.

“The summer earnings season will further test the trajectory of the recovery, but until then, vaccines rollout and economic reopening will be the main triggers for a further upside leg in this bull run,” Amundi Chief Investment Officer Pascal Blanque said in a note to clients.

In Europe, broad market indexes posted stronger gains with the Stoxx Europe 600 up 0.5%, bolstered by upbeat earnings from Volvo and Nestle ahead of the European Central Bank holding a policy meeting. Sales at the Swiss food giant grew more than twice the rate analysts expected amid a return to dining out.

“Markets are currently a tale of three Vs – standing at a crossroads of virus evolution, vaccination rates and v-shaped recoveries,” Societe General cross-asset strategist Alain Bokobza wrote in a note to clients. “Our overall stance is unchanged, i.e., no exuberance yet. Credit risk remains under control, so risk assets should continue to ride high… Stick to risk for now.”

Asian stocks rebounded from their biggest two-day drop in a month as investors appeared to look past surging virus cases around the world and focus on an economic recovery. Japanese shares led gains, recovering from being the worst performers in the region for two straight days after the BOJ reassured investors that it will be there to buy ETFs if the market drops. Electronics makers were the biggest boost to the Topix index, which rose 1.8%. The recent slump in shares prompted the Bank of Japan to step in and buy exchange-traded funds for the first time since March on Wednesday. Stocks in India rose after initial declines, shrugging off the country’s grim distinction of posting the world’s biggest one-day jump in coronavirus cases.

However, sentiment was down in China as some companies announced weak first-quarter earnings. The benchmark CSI 300 index dropped 0.2%, with Great Wall Motor and Wens Foodstuffs among the worst performers on the gauge. The MSCI Asia Pacific Index tracked the rise in U.S. shares to climb 0.9%, poised for its biggest gain in three weeks, with industrial shares among the outperformers as investors flocked back to cyclical stocks. While the virus resurgence and inflation are a concern, “we are recommending to investors that they should look at this period as a transitory one, focus more on equities than fixed income and focus on Covid-19, which generally speaking is moving in the right direction,” Stefan Hofer, chief investment strategist at LGT Bank AG, told Bloomberg Television

In Australia, stocks advanced, led by technology and health shares. The S&P/ASX 200 index shrugged off a wobbly start to close 0.8% higher to 7,055.40, marking its best session since April 8. The benchmark index was boosted by health and technology stocks. Megaport was the top performer after its monthly recurring revenue rose 7.9% q/q. Redbubble was the worst performer after its 3Q update missed expectations. In New Zealand, the S&P/NZX 50 index rose 0.3% to 12,577.48.

In FX, the Dollar Spot Index inched up while most Group-of-10 currencies consolidated recent ranges; The euro was slightly higher against the dollar before the ECB meeting, with no changes expected to the central bank’s plans to accelerate asset purchases until June to rekindle growth. The New Zealand dollar was the worst G-10 performer; it declined as much as 0.6% amid concern about a flare-up in virus infections in some countries

In rates, Treasuries were little changed after paring Asia-session gains that pushed 5- and 10-year yields below 50-DMAs. U.S. 10-year yields around 1.56% keep pace with bunds while gilts marginally outperform; with Euro Stoxx 50 higher by 0.7%, S&P 500 futures are little changed near top of Wednesday’s range. European sovereign bonds edged higher and the euro traded in a 30-pips range before the ECB decision, which isn’t expected to send it off on a wild ride, though any sign of momentum could be telling as to its medium-term bias

Meanwhile, oil added to losses with an increase in U.S. crude inventories compounding concerns around a choppy global demand recovery.

Looking at the day ahead now, the ECB meeting and presser will be the highlight. In addition, there are a number of US data releases, including the weekly initial jobless claims, existing home sales for March, the Chicago Fed national activity index for April and the Kansas City Fed manufacturing index for April too. Separately, we’ll get the advance Euro Area consumer confidence reading for April. Finally, earnings releases today include Intel, AT&T, Danaher and Union Pacific.

Market Snapshot

- S&P 500 futures little changed at 4,161.00

- Stoxx Europe 600 rose 0.5% to 438.83

- MXAP up 0.9% to 207.23

- MXAPJ up 0.4% to 692.60

- Nikkei up 2.4% to 29,188.17

- Topix up 1.8% to 1,922.50

- Hang Seng Index up 0.5% to 28,755.34

- Shanghai Composite down 0.2% to 3,465.11

- Sensex up 0.6% to 47,993.63

- Australia S&P/ASX 200 up 0.8% to 7,055.45

- Kospi up 0.2% to 3,177.52

- Brent Futures down 0.6% to $64.95/bbl

- Gold spot down 0.2% to $1,789.79

- U.S. Dollar Index little changed at 91.182

- German 10Y yield fell 0.9 bps to -0.271%

- Euro little changed at $1.2027

Top Overnight News from Bloomberg

- ECB President Christine Lagarde will be pressured to reveal how much longer the euro area will need intensified support on Thursday, after she and her colleagues hold their policy meeting

- The EU’s commissioner for financial services said the bloc isn’t under any pressure to help London financial firms access the market and warned there won’t be any decisions soon while Britain plots different rules for the industry

A quick look at global news from Newsquawk

Asia-Pac stocks traded mixed as the region struggled to maintain the momentum from the US where the major indices snapped a 2-day losing streak led by advances in small caps which resulted in the Russell 2000 finishing higher by more than 2%, and cyclicals were also favoured with materials, energy, financials and industrials the outperformers in the S&P 500. ASX 200 (+0.8%) was marginally higher with the index kept afloat by strength in gold miners and real estate although gains were capped amid China-related tensions after Australia cancelled the Victoria State MOU and framework agreement with China regarding the Silk Road economic belt that was signed in 2018, while China was said to strongly oppose the cancellation and warned that the action is bound to further deteriorate bilateral relations. Nikkei 225 (+2.4%) outperformed and reclaimed the 29k level with the index largely unfazed by a mixed currency and potential state of emergency declarations for four prefectures which the government will reportedly decide on this Friday. Hang Seng (+0.5%) and Shanghai Comp. (-0.2%) both initially opened higher but then briefly pared all their gains amid ongoing concerns of tighter regulation and continued overhang from US-China tension after the US Senate Foreign Relations Committee backed the Strategic Competition Act of 2021 to send the bill to a full vote at the Senate, while a bipartisan group of lawmakers also proposed legislation calling for USD 100bln in science funding to keep US competitive with China and other nations. Finally, 10yr JGBs were higher and resumed its gradual approach towards a 2-month high amid the eventual upside in T-note futures in the aftermath of a solid 20yr auction stateside, although the gains were only marginal amid the outperformance of Japanese stocks and lack of BoJ purchases in the market today.

Top Asian News

- China’s SAIC to Form $770 Million Auto Investment Fund With CICC

- Hyundai First-Quarter Profit Jumps on Luxury Car, SUV Demand

- Japan’s Nidec Replaces CEO as It Targets Booming EV Market

- SK’s Battery Materials Unit Sees a Shortage for EV Component

Equities in Europe trade with comfortable gains across the board (Euro Stoxx 50 +0.9%) as sentiment picked up from a mixed APAC handover and as earnings season kicks into gear with traders now eyeing the ECB’s decision and presser later. State-side, US equity futures trade sideways awaiting catalysts whilst the RTY experiences mild underperformance. Back to Europe, the general direction across bourses remains positive but individual performances vary – largely due to a slew of large-cap earnings in the EU pre-market. The AEX (+1.3%) and SMI (+1.1%) stand as the top performers with the former feeling second winds from ASML (+2.9%) earnings. Meanwhile, the latter is buoyed by Nestle’s (+3.6%) performance post-earnings, in turn offsetting pressure from Credit Suisse (-5.6%) whose shares plumb the depths amid substantial US hedge fund-related costs coupled with probes by the Swiss and US watchdogs regarding the Archegos situation. Credit Suisse noted that they have exited 97% of the related position, with a CHF 600mln impact seen in Q2. Thus, Europe sees its financial sectors as the current laggard, whilst the upside sees Food & Beverages, closely followed by Tech. The broader sectors however do not portray an overarching theme. In terms of individual movers, AstraZeneca (+1.1%) has shrugged off reports that the EU is said to be getting ready to launch legal proceedings against AstraZeneca over complaints it failed to deliver on its pledges. On the flip side, Aggreko (-2.4%) is pressured as Liontrust Asset Management (12% stake) is reportedly intending to oppose the GBP 2.3bln takeover deal by a consortium involving TDR and I Squared, according to sources. Meanwhile, earnings-related movers include the likes of Volvo (+3.5%), SAP (+1.5%), Hermes (+3%), Renault (-2%) and Orange (-2%).

Top European News

- Hedge Fund IPM of Sweden Is Set to Close Amid Pandemic Losses

- SAP CEO Says Cloud Unit Had ‘Blowout Quarter’ in Turnaround

- Alphawave to Raise $500 million in Rare London Semiconductor IPO

- Commercial-Property Loan Defaults Surge 44% on U.K. Lockdown

In FX, Not quite all change in the major pecking order, but the tables have turned for the Franc and Kiwi, as Usd/Chf retreats through 0.9150 from yesterday’s high just shy of 0.9200 and Nzd/Usd lets go of the 0.7200 handle again. Encouraging Swiss trade data revealing a significantly wider surplus swelled by key watch exports may be helping the Franc leverage more from the latest bout of Greenback weakness, while the Kiwi looks somewhat taken aback by a marked change in direction in Aud/Nzd cross flows from sub-1.0750 lows to the upper 1.0700 area in wake of a rise in NAB business sentiment that is helping the Aussie deflect further angst with China over the cancellation of the Silk Road MOU and framework agreement. Indeed, Aud/Usd is holding near 0.7750 as attention turns to preliminary PMIs.

- DXY – The Dollar index has succumbed to more selling pressure after running out of steam into 91.500 on Wednesday and then relenting to the Loonie’s post-BoC resurgence, but underlying bids ahead of recent lows are helping to keep the DXY contained between 90.999-91.204 bounds in the run up to this week’s first real batch of US data in the form of jobless claims and existing home sales.

- EUR/JPY/CAD/GBP – Having survived several rigorous tests of the 1.2000 level, the Euro found 1.2050 vs the Buck almost as impregnable and is now hovering around 1.2025 awaiting the ECB, albeit without much aspiration for anything meaningful in terms of policy insight to trade off. However, the post-meeting press conference and Q&A always hold potential for something unexpected – full preview of the event available in the Research Suite and to be posted on the Headline Feed before 12.45BST. Elsewhere, the Yen seems to be in a quandary in advance of Japanese CPI given hefty option expiry interest at the 108.00 strike (1.6 bn) and bigger expiries between 108.30-40 (2.6 bn), but key technical resistance at 107.77 (38.2% Fib retracement of the move from 110.97 to 102.59) still proving too tough to scale. Meanwhile, the Loonie has lost a bit of its aforementioned BoC inspired gusto and is straddling 1.2500 in the absence of further impetus that is highly unlikely to come via Canadian new home prices today, and Sterling is fading as well following a test of 1.3950 vs the Greenback, though should derive more independent impetus from UK retail sales and flash PMIs on Friday if not public finances, while the below-forecast CBI metric failed to induce any action.

- SCANDI/EM – The Nok has recouped a chunk of its midweek losses to retest offers into 10.0000, and perhaps with the aid of an improvement in Norwegian Q1 industrial sentiment, but the Try has depreciated further through 8.3500 at one stage vs the Usd with no assistance from a fall in Turkish consumer confidence or reports that US President Biden plans to officially acknowledge the Armenian genocide and likely exacerbate already fractious relations between NATO nations. Moreover, the Lira still has CBRT minutes to come. Conversely, the Cnh/Cny and Rub continue to contend quite well with heightened China/US-Australia and Russia/US/EU etc strains circa 6.4900 and 76.2100.

In commodities, WTI and Brent front month future are again choppy but within a tighter range than seen in recent days, with the former on either side of 61/bbl (60.61-61.27/bbl range) and the latter oscillating around USD 65/bbl (64.58-65.26/bbl). The complex continues to balance the scales with the demand side of the equation weighing rising cases vs vaccinations – with energy consultancy firm FGE forecasting the Indian COVID outbreak to hit 500k BPD in oil demand in May. Meanwhile, the supply side tackles OPEC+, Libyan and Iranian supply developments – with Petro-Logistics suggesting Iranian exports remain elevated at 500k BPD thus far in April and may not hit 2020 lows as JCPOA talks continue – with the US said to be mulling lifting some oil-related sanctions. Tensions with Russia are also eyed as drills are underway, with over 40 warships and 20 support vessels in military drills in the Black Sea, and north of 10,000 partaking in drills in Crimea. Turning to OPEC+, there remains a lack of official communication from the secretariat on whether an OPEC+ meeting will follow next week’s JMMC. If an OPEC+ meeting is to go ahead, then the door remains open for a potential tweak to the output quotas set through July in wake of the COVID developments and some limited vaccine rollouts in light of rare blood clot reports. Russia has remarked that next week’s meeting will likely focus more on current market dynamics, intimating just a JMMC meeting, whilst some also suggested that it will be difficult to carry out two meetings during the Islamic period of Ramadan. Elsewhere, spot gold and silver have been moving with firming Dollar, with the former waning off its 1,797/oz intraday peak to reside at session lows, whilst spot silver failed to sustain an upside breach of USD 26.50/oz overnight. Over to base metals, LME copper is relatively flat but still in close proximity to USD 9,500/t, whilst Shanghai copper overnight dipped with trader citing consolidation following the recent rise. Chinese steel futures hit record highs with some pointing to expectations of robust demand.

US Event Calendar

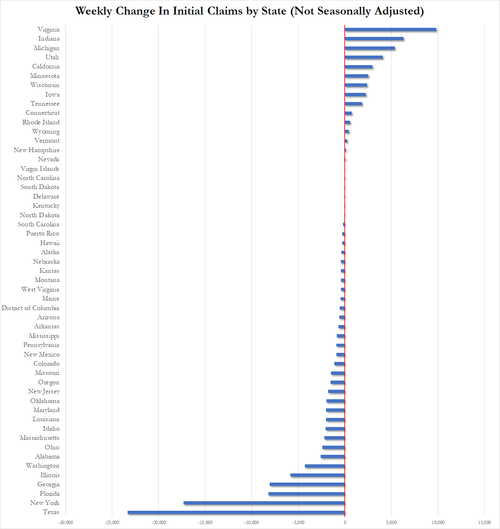

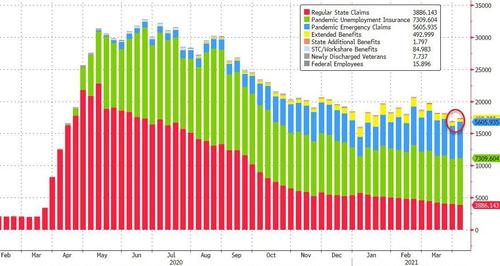

- 8:30am: April Initial Jobless Claims, est. 610,000, prior 576,000; Continuing Claims, est. 3.6m, prior 3.73m

- 8:30am: March Chicago Fed Nat Activity Index, est. 1.25, prior -1.09

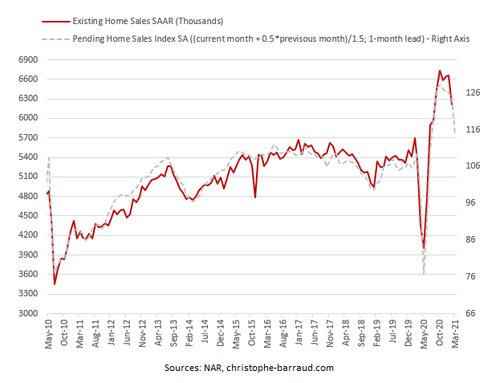

- 10am: March Existing Home Sales MoM, est. -1.8%, prior -6.6%

- 10am: March Leading Index, est. 1.0%, prior 0.2%

- 10am: March Home Resales with Condos, est. 6.11m, prior 6.22m

- 11am: April Kansas City Fed Manf. Activity, est. 28, prior 26

DB’s Jim Reid concludes the overnight wrap

Welcome to Earth Day which will no doubt get more focus over the years ahead as we go through a green revolution. The main market highlight to look forward to is the ECB meeting which we’ll preview below.

Before we get there, global equities stabilised yesterday following their bumpy start to the week, though investor doubts about the recovery continued to linger given the recent major spike in Covid cases across a number of key regions. By the close of trade, the S&P 500 had recovered +0.93% and Europe’s STOXX 600 was up +0.65%, but in both cases they still hadn’t quite recovered to their record highs. It was a fairly broad-based advance, with cyclical sectors including materials (+1.87%), energy (+1.48%) and semiconductors (+2.28%) among the leading industries in the S&P. The Dow Jones (+0.93%) matched the S&P’s gain while the small-cap Russell 2000 (+2.35%) outperformed on the day after underperforming in the early part of the week. The FANG+ index (+0.29%) underperformed thanks to Netflix (-7.40%) seeing its worst daily performance since November. The move lower for the streaming service came after their earnings release the previous day reported that the number of new customers fell well short of expectations.

For sovereign bonds, the performance was rather muted on either side of the Atlantic, with yields on 10yr US Treasuries falling back -0.3bp. Bunds (0.0bps), OATs (-0.3bps) and gilts (+0.9bps) were similarly dull, while BTPs (-2.6bps) rallied slightly. But precious metals had another decent performance as concerns about the economic recovery picked up, with gold prices (+0.85%) reaching their highest level in almost 2 months at just under $1800/oz, and silver (+2.82%) having its best daily performance in over a month. Elsewhere in commodities, WTI (-1.75%) and Brent (-1.88%) both fell back even as some European countries announced Covid-19 restrictions would be easing in the coming weeks. The US dollar index fell slightly (-0.14%) for its 7th daily loss in the last 8 sessions and is now on track for its third weekly decline in a row – the first time that would have occurred since December if the dollar does not rally into the weekend.

Overnight in Asia, markets are following Wall Street’s lead with the Nikkei (+2.04%) outperforming while the Hang Seng (+0.46%) and Kospi (+0.39%) are also up. However, the Shanghai Comp (-0.05%) is trading a touch lower. Futures on the S&P 500 (-0.16%) are also trading lower while yields on 10y USTs are down -2.4bps to 1.533%. European futures are pointing to a positive open though with those on the Stoxx 50 up as much as +0.56%. In other news, Bloomberg reported that the SEC is exploring how to increase transparency for the types of derivative bets that sank Archegos Capital. The report also added that the SEC is also under pressure from Capitol Hill to shed more light on who’s shorting public companies after the GameStop frenzy.

Looking ahead, one of the main highlights today will be the ECB’s latest monetary policy decision and President Lagarde’s subsequent press conference. In contrast to the sharp rise that took place at the start of the year, longer-term nominal bond yields have been broadly stable since the March meeting, and our economists write in their preview (link here) that a change in the policy stance is unlikely. Meanwhile a decision on whether or not to maintain the new faster pace of PEPP purchases will be made after a joint assessment of financing conditions and the outlook for inflation at the Council meeting on 10 June. However, it’s unclear at this point whether they’ll maintain the higher pace of PEPP purchases beyond June. It’s also worth mentioning that the ECB’s Strategy Review is continuing, which they’ll conclude internally in June and publish in September, and our chief European economist Mark Wall has just released a podcast in which he offers his preliminary assessment of the landing zone for the review. You can find that here.

In terms of the latest on the pandemic, the German Bundestag voted in support of the government’s proposed law that would enable them to take greater control of the pandemic response, having failed to reach an agreement with the states. The measures would see new restrictions imposed in areas with more than 100 cases per 100k people over 3 consecutive days. These would include a 10pm to 5am curfew, while nonessential shops would be open by appointment only and would close altogether if the cases went above 150. Furthermore, in-person teaching would close if cases rise above 165. In other European countries, many indicated they would soon be easing restrictions following the recent wave. In France, a government spokesman said that travel restrictions between regions would be eased on May 3 and schools would reopen in the coming weeks. Greece is planning on easing most restriction during the first week of May as well, while Poland’s health minister said that some of the nation’s curbs would be eased in 11 of the 16 regions from Monday. Finally in the UK, there was further good news on case numbers as the 7-day reported average fell to 2,463, its lowest since early September when the number of tests were less than a third of their current levels. In the US, President Biden has called on employers to utilise a tax credit provision in the recent stimulus bill to give workers paid leave to get vaccinated. This comes as the Biden administration met its goal of 200mn shots in the first 100 days yesterday and 90% of all Americans now live within 5 miles of somewhere they can get inoculated. Elsewhere, the situation in India has continued to worsen with the country recording 314,835 new cases over the past 24 hours, according to Indian Health Ministry data. This is the highest number of daily cases seen by any country since the pandemic began.

Looking at yesterday’s data, the UK CPI reading for March rose by less than expected to +0.7% (vs. +0.8% expected), which marks the second month running that inflation has surprised to the downside. Nevertheless, core inflation was in line with consensus at +1.1%. We also got the CPI release from Canada, where base effects helped inflation rise to +2.2% in March (vs. +2.3% expected), up from +1.1% in February. Staying on Canada, the central bank there struck a hawkish tone yesterday, with a reduction in the weekly pace of government bond purchases to C$3bn from C$4bn. Furthermore, they brought forward their estimate of when economic slack would be absorbed to the second half of 2022, having not seen it until 2023 before, which is significant since they’re committed to holding the policy rate at the effective lower bound until that point. Unsurprisingly, the Canadian dollar was the strongest-performing G10 currency yesterday, gaining +0.90% against the US dollar in its best daily performance since last June.

To the day ahead now, and the aforementioned ECB meeting is likely to be the highlight. In addition, there are a number of US data releases, including the weekly initial jobless claims, existing home sales for March, the Chicago Fed national activity index for April and the Kansas City Fed manufacturing index for April too. Separately, we’ll get the advance Euro Area consumer confidence reading for April. Finally, earnings releases today include Intel, AT&T, Danaher and Union Pacific.