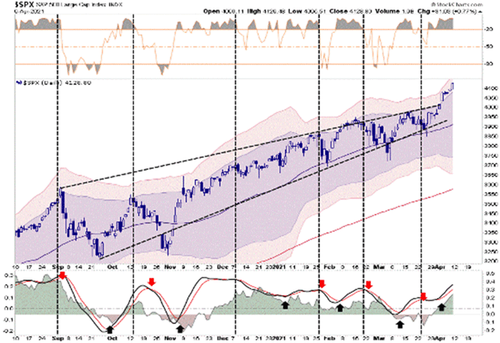

S&P futures were little changed, paring earlier declines with the Nasdaq underperforming following dismal Netflix guidance, which saw the company report its worst quarter in 8 years sending the stock 8% lower. At 7:00a.m. ET, Dow e-minis were up 13 points, or 0.04%, S&P 500 e-minis were up 0.50 points, or 0.01%, and Nasdaq 100 e-minis were down 27 points, or 0.20%.

Nasdaq futures edged lower on Wednesday as Netflix kicked off quarterly earnings for technology behemoths with a disappointing report which barely saw any subscriber growth in Q2, while concerns about a surge in global coronavirus cases hit demand for equities. Netflix tumbled 8.1% in premarket trading after its report showed slower production of TV shows and movies during the pandemic hurt subscriber growth in the first quarter.

“Markets remain very much caught between the rock of improving macroeconomic conditions and the treacherous waters of geopolitical risks and alarming Covid-19 case growth in some corners of the world,” according to ING Groep NV strategists including Padhraic Garvey in a note to clients.

Wall Street closed lower in the previous session as a global spike in coronavirus cases hit travel-related shares and investors had second thoughts about big U.S. banks’ apparently stellar earnings last week. Global stocks were also subdued on Wednesday due to rising concerns over spiking COVID-19 infections in Asia and their impact on oil prices.

“While the UK and the US may be moving towards re-opening, it’s not necessarily a straight line of recovery,” said Joshua Mahony, senior market analyst at IG. “What’s been happening in Brazil and India highlights the fact the virus is a massive issue.”

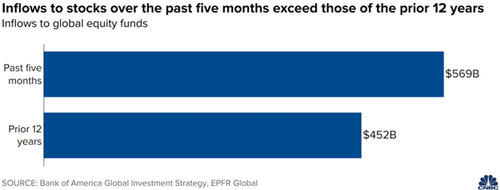

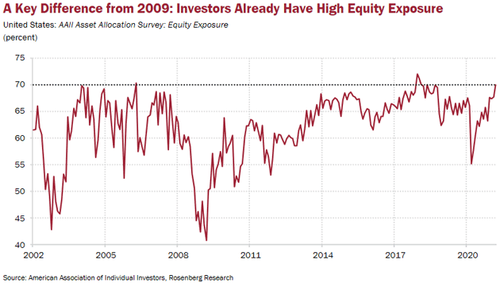

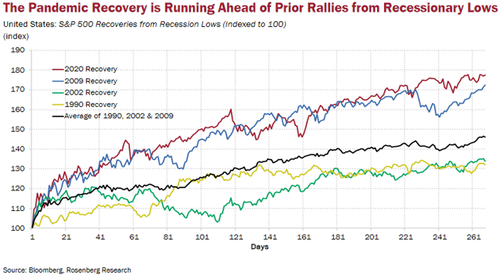

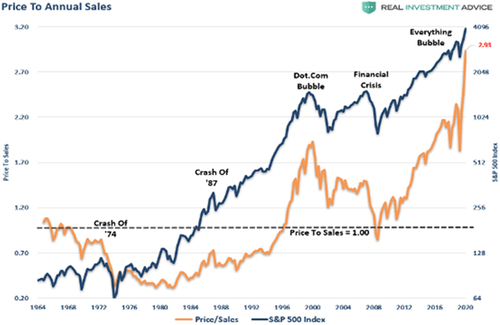

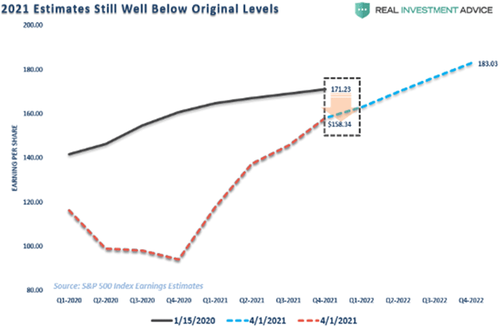

There are also concerns about stretched valuations, with global equities trading at all-time highs and earnings expectations surging as vaccination drives and stimulus programmes support global recovery.

Some other notable premarket movers:

- Anthem Inc rose 2% after the health insurer raised its profit target for 2021, as strength in its pharmacy benefits management business helped it beat estimates for first-quarter earnings.

- U.S. railroad operator CSX Corp fell 0.9% after it missed estimates for first-quarter profit, hurt by frigid polar vortex temperatures, ongoing pandemic disruptions and higher fuel costs.

European stocks rebounded, with the Eurostoxx 50 rising as much as 0.8%, just shy of halving Tuesday’s sharp sell off, but it was the opposite in Asia, where financial markets took the brunt of a risk reassessment by investors as Covid-19 cases surge in the region. India reported a record of more than 2,000 deaths on Wednesday and Japan is moving towards declaring a state of emergency. While investors expect markets with high vaccination rates to avoid the worst of the setback, the global reflation trade appears to have paused for now.

The pan-European STOXX 600 index rose 0.4% after a blistering seven-week rally ran into a bout of profit-taking on Tuesday, when it fell 1.9%, its biggest decline in four months as positive earnings reports outweighed concerns over resurgent virus cases. European earnings are expected to rise a record 61% in the first quarter of 2021, according to Refinitiv IBES data, placing Europe on course for a rare outperformance versus corporate America.

European food-delivery stocks declined on Wednesday after news that Uber Eats plans to expand its service to Germany in the coming weeks, ramping up competition with Just Eat Takeaway. The world’s second-largest brewer Heineken NV gained 3.9% after it reported better-than-expected beer sales, helped by increased beer sales in Africa and Asia. French luxury goods group Kering was up 1.4% after Gucci’s revenue rebounded strongly in the first quarter. Oil & gas stocks got a boost despite weaker oil prices, as Deutsche Bank started coverage of stocks including Royal Dutch Shell and France’s Total with a “buy” rating. Among decliners, Italian football club Juventus slumped 12.7% after breakaway European Super League founder and Juventus chairman Andrea Agnelli said the league can no longer go ahead after six English clubs withdrew. Dutch food delivery company Just Eat Takeaway fell 4.5% after the Financial Times reported Uber Eats was planning to launch in Germany. Here are the biggest European movers:

- ASML shares climb as much as 5.8%, with ING saying that the semiconductor equipment maker’s results are “very strong” and that the company raised its FY21 guidance “significantly.”

- Heineken shares rise as much as 4.8% to the highest since Feb. 2020, after reporting 1Q figures that Jefferies (buy) said was a “better-than-expected start to the year.”

- Carrefour shares rise as much as 4.4%, the steepest gain in two months, after the grocer impressed with strong 1Q sales and a beat at its French hypermarkets, a crucial element of sentiment on the stock, while also announcing a buyback.

- Juventus shares fall as much as 13% as Europe’s rebel Super League edges toward collapse following a public outcry, with the six English clubs involved pulling out of the project late on Tuesday.

- Temenos shares fall as much as 5.8% after the co. reported 1Q figures, with Jefferies saying the results were “unlikely to drive any material upgrade” to consensus.

It was a mirror image of market sentiment earlier in the session, when Asian stocks tumbled as concerns over a new surge in infections around the world and the economic impact of potential lockdowns weighed on markets. Japanese shares were the worst performers for a second straight day, with the Topix sinking 2% to its lowest level in more than six weeks. Tokyo and Osaka are preparing to ask the Japanese government to declare a state of emergency as cases surge. Hong Kong’s Hang Seng Index slid 1.8%, while China’s CSI 300 Index’s defied the broader selloff in the region and rose 0.3%. The MSCI Asia Pacific Index fell 1.5%, on course for its steepest drop since March 24, with most major national benchmarks in negative territory. All sectors were in the red, with IT and industrials leading losses. Markets in India and Vietnam were closed for local holidays. The resurgence of virus in some Asian nations, with the current epicenter of the surge in India, is causing concern of derailed economic growth, said Nirgunan Tiruchelvam, head of consumer equity research at Tellimer.

Chinese stocks closed slightly higher, bucking broad weakness across Asia, as investors are optimistic that a climate summit set to bring leaders of the world’s two biggest economies together will help ease political tensions. The benchmark CSI 300 index rose 0.3% to the highest since April 8, supported by gains in health-care and bank stocks. Energy companies were the biggest decliners, after oil slumped the most in two weeks with the resurgence in virus cases casting a cloud over global economic recovery prospects. Hong Kong’s Hang Seng Index fell as much as 2.2%, following a drop in U.S. equities overnight that marked their first back-to-back decline since late March. A-share investors are looking forward to the climate meeting on Thursday for positive signals about China-U.S. relations, while traders in Hong Kong “tend to be more cautious when placement plans in the market increase,” said Stanley Chan, an analyst with Emperor Securities. Vaccine makers such as Zhifei Biological and Walvax Biotech were among the best performers in the CSI 300 Index, while banking shares advanced after Ping An Bank reported strong earnings for the first quarter. Still, foreign investors offloaded A shares via the mainland-Hong Kong stock link for a second day, selling a net 1.1 billion yuan in the biggest outflow in nearly two weeks. Hedging demand in the broader market has been high, with the latest data showing the value of Chinese stocks being shorted climbed to an all-time high of 152 billion yuan on Tuesday.

Australia’s S&P/ASX 200 index fell 0.3% to 6,997.40, dropping to a one-week low as growing cases of Covid-19 around the world renewed concerns over the pandemic’s economic impact. Nuix was the benchmark’s worst performer, falling to an all time low after the company cut revenue guidance. IDP Education was among the best performers, climbing the most since Feb. 25. In New Zealand, the S&P/NZX 50 index fell 1.1% to 12,535.34

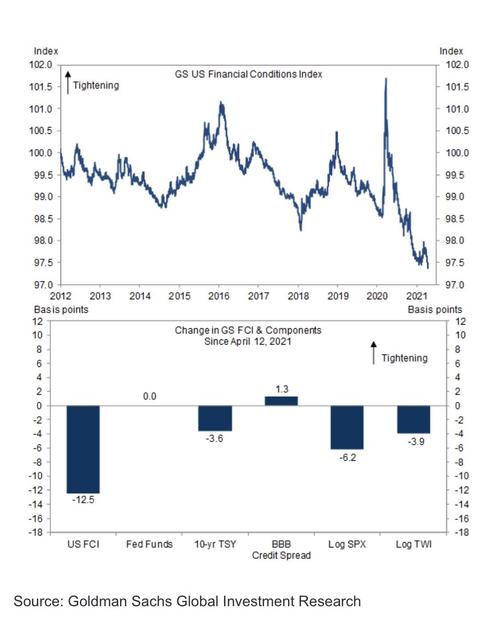

In rates, Treasuries paused a rally that sent the 10-year yield to its lowest level in more than five weeks and within reach of 1.5%. The yield curve was steeper after declining during European morning, and ahead of a $24BN 20-year bond reopening auction at 1pm, whose WI yield is ~2.165%, ~12.5bp richer than last month’s, which stopped 2bp through the WI level. Yields were higher by 1bp-2bp at long end, steepening 5s30s by ~1bp; 10-year around 1.57% is 1.3bp cheaper on the day. Gilts are weakest European debt market following a 15-year bond auction, while Italy outperforms. Treasuries were underpinned in Asia as Nikkei fell more than 2% with rising domestic Covid-19 cases spurring shutdowns.

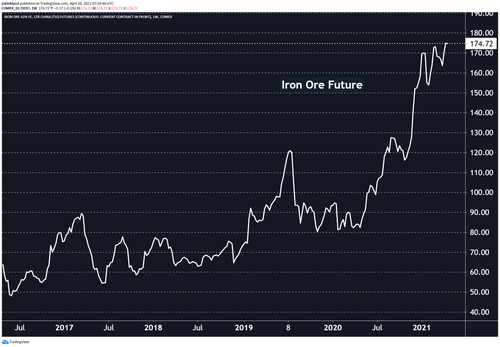

In FX, the dollar rose for a second day, the longest streak since March and was higher against most of its Group-of-10 peers thanks to a short squeeze, though most currencies traded in narrow ranges. The Canadian dollar led gains before a Bank of Canada policy announcement, in which it’s poised to pare back its asset purchases amid a stronger-than-expected economic recovery. The euro fell a second day, nearing the $1.20 handle; the ECB meeting on Thursday carries little risk of setting off fireworks in the currency market as overnight volatility in euro-dollar trades below 10%, which is the second-lowest reading on the day before an ECB policy decision since March 2020. The pound dipped slightly, and was on track to fall for a second session, consolidating after a winning streak and as inflation accelerated less than expected. The yen rose against many of its Group-of-10 peers as investors sought refuge in haven assets amid a renewed surge in Covid-19 cases in many regions; Asian stock indexes fell after the World Health Organization cautioned that coronavirus infections were on the rise in all regions except Europe, with India driving a surge in Asia. The Australian dollar was weighed down by a price decline of the nation’s key export iron and amid the risk-off tone in the Asian session.

In commodities, crude drifted lower with WTI dropping 1.3%, failing to breach $62.50, while Brent slipped back on a $65-handle, failing a test of $66.50. Spot gold reverses modest early strength to trade near $1,780/oz. Base metals are mixed with LME aluminum and tin outperforming.

There are no major U.S. economic data scheduled Tuesday; ahead this week are existing home sales, Markit manufacturing PMI and new home sales. Earnings releases today include Verizon and NextEra Energy.

Market Snapshot

- S&P 500 futures little changed at 4,126.75

- Stoxx Europe 600 rose 0.4% to 435.54

- German 10Y yield rose 5.0 bps to -0.249%

- Euro down 0.2% to $1.2013

- MXAP down 1.4% to 204.96

- MXAPJ down 1.1% to 688.22

- Nikkei down 2.0% to 28,508.55

- Topix down 2.0% to 1,888.18

- Hang Seng Index down 1.8% to 28,621.92

- Shanghai Composite little changed at 3,472.93

- Sensex down 0.5% to 47,705.80

- Australia S&P/ASX 200 down 0.3% to 6,997.48

- Kospi down 1.5% to 3,171.66

- Brent Futures down 0.6% to $66.15/bbl

- Gold spot up 0.2% to $1,782.20

- U.S. Dollar Index little changed at 91.31

Top Overnight News from Bloomberg

- Investors trying to predict the European Central Bank’s stimulus plans are about to run into deeper uncertainty even as the clouds around the pandemic start to lift

- As strategists line up with sell recommendations on bonds ahead of this week’s European Central Bank meeting, there’s been a resurgence of bearish bets via the Euribor options market

- Germany’s Greens are in a position to make history, surging past Angela Merkel’s conservative bloc in the race to replace the four-term chancellor after September’s election

- European Union lawmakers reached a late- night deal to make the bloc’s ambitious climate goals legally binding, paving the way for a torrent of new rules and standards to overhaul the entire economy

- Germany is nearly doubling the pace of vaccinations after an increase in supplies and the decision to let general practitioners administer doses in their regular offices. France, Italy and Spain are following a similar trajectory

- U.K. households took on more debt and suffered a bigger hit to incomes during the pandemic than those in France and Germany, according to new research that indicates weakness in the potential for an economic recovery

A quick look at global markets courtesy of Newsquawk

Asian equity markets mostly slumped as the negative mood rolled over from the US where the major indices extended on declines led by underperformance in energy and financials amid lower oil prices and yields. In addition, earnings releases did little to spur risk appetite and Netflix shares slumped around 10% after hours despite beating on top and bottom lines, as its subscriber additions were significantly below forecasts and Q2 estimates also underwhelmed. ASX 200 (-0.3%) was negative with the energy sector the worst hit following the recent retreat in oil prices and as participants digested the latest quarterly updates including from BHP which reported a decline in iron ore output and lower than expected shipments. Nikkei 225 (-2.0%) was heavily pressured by a firmer currency and with the government reportedly to declare an emergency in Tokyo, Osaka and Hyogo due to COVID-19 whereby a formal decision could be made as soon as this week. Hang Seng (-1.8%) and Shanghai Comp. (U/C) conformed to the lacklustre mood amid concerns of a regulatory crackdown after MIIT noted that China is to strengthen its inspections of internet companies and although mainland bourses eventually showed resilience, the Hong Kong benchmark languished near its lows after having gapped below the 29k level amid notable losses in the oil majors and with Anta Sports the worst hit among the blue chips after reports its controlling shareholder will offload 88mln shares. Finally, 10yr JGBs were higher following the recent gains in T-notes and as the broad risk aversion spurred a flight to safety, with prices helped by the BoJ’s presence in the market for JPY 955bln of JGBs in mostly 1yr-3yr and 5yr-10yr maturities, while the central bank also offered to buy JPY 75bln in corporate bonds with 3yr-5yr maturities from April 26th.

Top Asian News

- China Is Said to Mull Supporting Huarong With PBOC Funds

- BlackRock Cuts China Tech Holdings on Policy Woes

- Japanese Stocks Cap Worst Two-Day Slide Since June on Virus Woes

- Toshiba Drops After Disclosing CVC Buyout Offer Has Stalled

European bourses trade higher across the board (Euro Stoxx 50 +0.8%) following a mixed APAC session as earnings season starts picking up pace. State-side, US equity futures are somewhat mixed, with sideways trade seen in the ES and YM whilst the tech-laden NQ lags slightly and the cyclically-driven RTY outperforms. The underperformance in the NQ could be a function of the rising yields in European hours, but maybe more so on Netflix (-8% pre-market) post-earnings. Barclays, suggests that sentiment surrounding earnings has rarely been so bullish in recent years, but the bank acknowledges that cyclicals are logically expected to lead the bound in earnings, and expect Q1 metrics to lead to more selectivity in finding value stocks offering better risk-reward – “Consensus estimates of 30% Q1 EPS growth in the US and 53% in Europe are not out of reach given easy Y/Y comps and stronger demand, but a lot seems priced in. Lofty P/Es leave little room for upside and stretched technicals raise correction risks. Yet, provided earnings deliver, we think dips should be bought and see equities grinding higher”, the bank says. Back to Europe, the Dutch AEX (+1%) narrowly outperforms amid support from ASML (+4.7%) after reporting strong earnings, and updated revenue growth guidance, and the early completion of its share buyback programme, noting that it saw significant demand across all market segments in Q1. That being said, commentary surrounding the chip shortage in the release was sparse. Nonetheless, ASML has provided the IT sector with impetus and thus outperforms. Sectors, in general, are mostly firmer with no standout theme nor risk bias. Meanwhile, the retail sector is propped up by Kering (+1.6%) post-earnings who reported a string of strong metrics – albeit with low-base effects in play – but providing positive omens for the likes of LVMH (+2.0%), Richemont (+0.5%), whilst Hugo Boss (+6.0%) trades firmer with participants pointing to very vague and unconfirmed speculation that the Co. could be a takeover target, whilst another trader mentioned LVMH as a potential party that could be involved. Earnings-related movers this morning include the likes of Heineken (+4.0%), Carrefour (+4.0%) Roche (+1.5%), and Ericsson (-0.3%). Elsewhere, Just Eat Takeaway (-4.5%) and Delivery Hero (-0.9%) trade lower amid reports that UberEats is looking to enter the German market.

Top European News

- Putin to Address Nation as Russia Braces for Navalny Protests

- Heineken Beer Shipments Beat Estimates on Emerging Market Growth

- Blackstone Sells Mega-Office to Funds Investing $1.2 Billion

- Roche Sees Return to Sales Growth as Drugs Unit Turns Corner

In FX, the buck has bounced further from worst levels, albeit remaining soft against a few major and EM counterparts, and still largely in corrective trade rather than any real change in fundamentals. However, the technical landscape is getting more constructive as the index climbs from a higher low above 91.000 after closing over the 100 DMA and carves out a higher high at 91.388 ahead of MBA weekly mortgage applications and Usd 24 bn 20 year issuance that could keep US Treasuries on a bear-steepening trajectory, and supportive for the Greenback all else equal.

- CHF/EUR/JPY – All conceding ground to the Dollar, with the Franc back below 0.9150, Euro holding just above 1.2000 and Yen retreating though 108.00 again following a relatively strong safe-haven rally overnight when APAC bourses suffered heavy losses in sympathy with US stocks over the preceding session. Indeed, Usd/Jpy hit lows circa 107.88 at one stage, but perhaps crucially from a chart standpoint held just above key Fib support at 107.77 (38.2% retracement), in keeping with the DXY’s rebound on Tuesday from a cloud base protecting a Fib level.

- NZD/CAD/GBP/AUD – The Kiwi is still ‘outperforming’ or at least putting up more resistance than most in the face of the Buck revival, and slightly firmer than expected NZ inflation data could be helping to keep Nzd/Usd afloat between 0.7162-87 parameters, on top of stronger Aud/Nzd tailwinds as the cross loses further momentum below 1.0800 to probe under 1.0750. Conversely, stronger than forecast Aussie retail sales have not offered Aud/Usd much encouragement in the low 0.7700s, and the pair appears to have decoupled somewhat from Usd/Cnh-Cny that remain anchored around 6.5000. Elsewhere, the Loonie is now pivoting 1.2600 following its oil-related reversal and awaiting Canadian CPI before the BoC for fresh direction that may be bullish if the Bank does tweak guidance to flag measured QE tapering. Meanwhile, the Pound derived little if any independent impetus via UK inflation data that was somewhat mixed, as Cable manages to stem declines from 1.4000+ to roughly 100 pips and meanders either side of 0.8625 vs the Euro.

- EM – Not much reaction to softer than anticipated SA core CPI given that the headline readings matched consensus and the Rand seems content to rotate on a 14.3000 axis eyeing Gold that in turn is fixated on US yields and the Greenback within striking distance of Usd 1800/oz, but capped by recent peaks. In contrast, the Lira is lurching towards 8.2000 and ironically, though not without president amidst a tirade from Turkish President Erdogan about the nation’s battle against interest, inflation and exchange rates.

In commodities, WTI and Brent front month futures see another choppy European morning but are ultimately softer, with the former sub-USD 62/bbl (61.64-62.56 intraday range) at the time of writing, whilst the latter extends losses under USD 66/bbl (65.53-66.52 range). The choppiness in the crude complex in recent weeks goes to show the near-term uncertainty surrounding the supply/demand imbalance in the context of rising COVID infections during the recovery phase, and as geopolitical tensions remain heated on multiple fronts. Yesterday, we also saw reports that the US House is advancing the NOPEC bill, which essentially aims to restrict OPEC’s influence on prices via deep production-cuts, although this is unlikely to materialise ahead of the JMMC meeting next week. Note, the US has been at loggerheads with OPEC over the higher crude prices feeding to American consumers ahead of an expected rebound in demand heading into the summer months. Further adding to the bearish narrative, yesterday’s Private Inventory report printed a surprise build, albeit modest, with traders now eyeing the weekly DoE figures as the next scheduled catalyst – with the headline expected to show a draw of almost 3mln bbls. Elsewhere, spot gold and silver have largely been moving in tandem with the Dollar throughout early European hours amid a lack of fresh catalysts, with the former hitting highs just shy of USD 1,800/oz (1,776-1,788 range), ahead of its 100 DMA at USD 1,803/oz. Spot silver oscillates on either side of USD 26/oz. Turning to base metals, copper prices in Shanghai fell almost 1% amid COVID woes surrounding India and Japan as the countries enter targeted lockdowns. Meanwhile, Chinese steel futures rose due to concerns over stricter capacity and output controls from regulators in the coming months.

US Event Calendar

- 7am: April MBA Mortgage Applications +8.6%, prior -3.7%

DB’s Jim Reid concludes the overnight wrap

This morning we are launching our latest monthly survey. We revisit a few Working from Home (WFH) questions given that many countries will be providing increased access to the office over the next few months. We’re very interested to hear what you think the permanent arrangements will be. We also ask about whether you have or would consider moving further away from your normal office given WFH options. We also ask about your thoughts on vaccine passports and on potential implications of the upcoming German election. In terms of markets we ask what you think are the biggest risk to the current relative calm (yesterday accepted). In addition we ask all the normal directional questions. The survey will stay open until Friday morning London time. All help very welcome. The link is here.

Well I’m glad I had a post jab lie in yesterday as I had 2-3 hours of night sweats and was unable to sleep. Yesterday I was groggy and my Apple Watch told me my resting heart rate was 17bpm higher than normal. I spend my life obsessed with the calories and heart rate function on the Apple Watch so yesterday was a big outlier on both!! I’m feeling a bit better this morning so hopefully I’ll be more alert today with more Apple calories burnt off! In fact the side effects are lingering longer than the new European Super League.

Yesterday saw some rare market side effects to the pandemic as a fairly out of the blue selloff in global equities was the main story. This came in the shadow of a significant rise in cases across multiple regions over recent weeks, and as I covered in my chart of the day yesterday (link here), the global rate of increase now stands at its highest level since the start of the pandemic, with recorded cases up by more than 5m a week now. India has been the biggest contributor to that with an exponential rise in cases lately, but the increase has been much more widespread with others including Turkey, Argentina and Japan similarly grappling with a renewed wave. For markets, the risk is that this latest increase in cases starts to undermine the narrative that the global economy is on an inexorable path back to normality as the world gets vaccinated, with multiple economies facing the threat of fresh restrictions on mobility. Furthermore, a higher level of cases circulating around the world raises the odds of a new and potentially more dangerous variant emerging, with the nightmare scenario being that it proves more resistant to our existing portfolio of vaccines. Anyway that’s not here yet but the continued rise in global cases is increasing the risks. By the way we’ve revamped the columns on our daily vaccine table (below and in the link) to make it a bit easier to understand. All feedback welcome.

Looking at the moves in more depth, Europe experienced the brunt of the selloff and the STOXX 600 (-1.90%) suffered its worst day so far this year, with many of the continent’s other indices including the DAX (-1.55%) and the CAC 40 (-2.09%) seeing sizeable declines as well. The fact that Covid concerns were at play was evident in the sectoral breakdowns, with the STOXX 600 Travel & Leisure index seeing a -3.69% decline, whilst other cyclical industries including banks (-3.67%), energy (-3.07%) and basic resources (-3.02%) led the STOXX 600’s move lower. Over in the US, the major indices likewise fell back, including the S&P 500 (-0.68%), the NASDAQ (-0.92%) and the Dow Jones (-0.75%), while the small-cap Russell 2000 fell a larger -1.96%. 63% of S&P 500 members saw their shares fall back with a similar mix of cyclicals leading the declines as US banks (-2.79%), energy (-2.66%) and consumer durables (-2.82%) being among the largest laggards. Another notable sign of stress could be seen in the volatility indices, with the VIX index of volatility up another +1.4pts in its biggest daily increase since late March. With the reflation trade seeing a set back today’s U.K. inflation data just after we hit inboxes will be interesting.

In earnings news that will get the attention of inflation-watchers, Procter & Gamble (+0.83%) said on their earnings call before the US open that the company would be boosting the prices of some consumer products due to higher commodity costs. Elsewhere in earnings, Johnson & Johnson (+2.33%) reported stronger sales than expected and increased guidance even in the face of its vaccine pauses. After the close, Netflix fell back as much as -12.7% in after-hours trading as the company announced it added only 3.98mn subscribers last quarter, missing estimates of 6.29mn and its forecasted 6.0mn.

Asian markets have taken Wall Street’s lead this morning with the Nikkei (-1.90%), Hang Seng (-1.63%) and Kospi (-1.59%) all down. Chinese bourses are an exception though with both the CSI (+0.32%) and Shanghai Comp (+0.15%) up. Futures on the S&P 500 are down -0.15% while those on the Nasdaq are down a larger -0.39% with weak earnings from Netflix not helping. Nonetheless, European futures are pointing towards a slightly more positive open with those on the Stoxx 50 (+0.18%) and the Dax (+0.19%) both up.

The risk-off moves yesterday benefited sovereign bonds, with yields on 10yr US Treasuries falling -4.6bps to 1.559%, its lowest closing level in over a month. The same pattern was seen in Europe too, where yields on 10yr bunds (-2.7bps), gilts (-2.4bps) and BTPs (-1.2bps) all moved lower as investors became somewhat less confident on the economic recovery. Over in FX, the Euro remained above $1.20 while the dollar index gained (+0.19%) for the first time in 7 sessions. Bitcoin (+1.05%) broke a mini-slump of its own, rising for the first time since last Thursday after substantial losses over the weekend.

In Germany, the race to be the CDU/CSU chancellor candidate was finally resolved in favour of CDU leader Armin Laschet, with the CSU’s Markus Soeder conceding yesterday after Laschet’s victory in a vote of the CDU’s leadership. Laschet is a relative moderate within the CDU, but polls indicated that he was less popular than Soeder, who many had hoped would increase the conservatives’ electoral appeal in September’s elections. Nevertheless, recent polling averages show the CDU/CSU are still the favourite to remain in power, meaning that Laschet has a decent shot at becoming Chancellor after Angela Merkel stands down, even if they are currently on track to score a lower vote share than in 2017. However, yesterday a poll by Forsa showed 28% of respondents support the Greens, 21% the CDU/CSU, and 13% the center-left SPD. It should be noted that the SPD party got a similar bounce before the 2017 election when Martin Schulz was selected as their chancellor candidate. The party closed a double digit gap to poll neck-and-neck with the CDU/CSU, but this only lasted a couple of months, and then the polling reverted. It is impossible to know whether this will repeat, but a bounce for a new leader being confirmed is not uncommon worldwide. An interesting few months ahead. A Green Chancellor would certainly be a huge long-term structural change story for Germany and Europe.

As mentioned at the top, the pandemic has remained in focus for investors given the deteriorating global picture. Looking at some of yesterday’s developments, Indian PM Modi said that lockdowns should only be used by states as a last resort, and they would not be needed if citizens took precautions. Nevertheless, increasing numbers of areas have moved to tougher restrictions recently in light of the rise in cases. Over in Japan, Sankei has reported that the Japanese government will declare a state of emergency in the Tokyo, Osaka and Hyogo regions. The country has seen its number of new cases quadruple since the low in late February/early March, with new cases now running at their most rapid since January. On the more positive side, the Nikkei has reported overnight that Japan is to receive an additional 50 million doses of Pfizer vaccine by the end of September. Elsewhere, the Netherlands are planning to ease restrictions starting next week with the nighttime curfew ending along with limits on the number of patrons allowed at shops and restaurants.

Finally on the vaccine front, the European Medicines Agency’s safety committee said that there was a possible link between the J&J vaccine and unusual blood clots, but that the overall benefits outweighed the risk of side effects. This was followed by the news that shipments will be restarted to the EU at once. We haven’t yet heard from the US authorities on their own review, but Bloomberg have reported that it should follow by the end of the week. Dr Fauci in recent days has said that the country could allow use of the shot with some form of restriction or warning, similar to what the EMA announced yesterday.

There wasn’t a great deal of data out yesterday, though the UK unemployment rate came in at 4.9% in the three months to February (vs. 5.0% expected). This was better than expected, but the real-time PAYE data from HMRC showed a decline in payrolled employees of -56k in March relative to the February number.

To the day ahead now, and the data highlights include the UK and Canadian CPI readings for March. On top of that, we’ll hear from BoE Governor Bailey and Deputy Governor Ramsden, with the Bank of Canada also deciding on rates. Finally, earnings releases today include Verizon and NextEra Energy.