After initially dipping as much as -0.7% during the early Asian session on fears that the Archegos margin call crisis which has already cost billions in losses at Nomura and Credit Suisse’s prime brokerage units could spread, futures have stabilized and at last check the Emini was down -0.3% to 3,952 after its remarkable late Friday surge which pushed the S&P just shy of an all time high, while quarter-end is expected to be in focus this week, favoring buying of Treasuries although it is debatable how stocks will trade today.

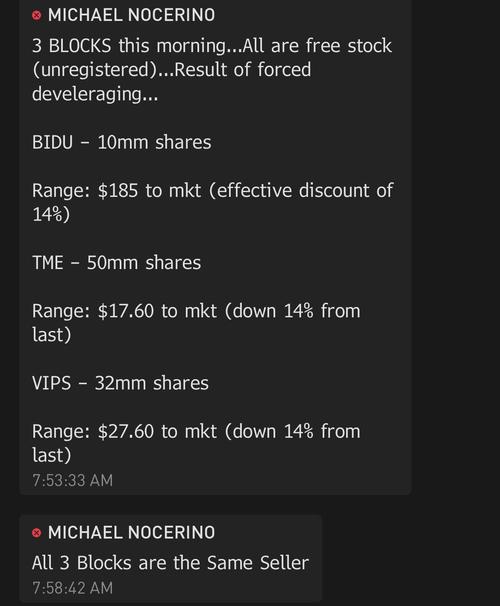

At the same time, Nasdaq 100 futures erased losses of as much as 1.2% to trade little changed as of 7:30am in New York following revelations that Archegos Capital Management LLC – Bill Hwang’s family office – was behind a $20 billion spree of block trades on Friday, selling Chinese tech giants and U.S. media firms. And with a number of banks exposed to Archegos and losing billions, investors are on edge lookout for signs of contagion.

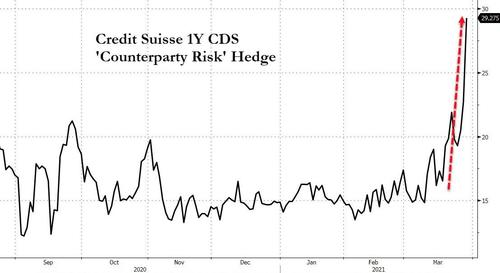

As noted earlier, Nomura and Credit Suisse warned of significant losses after Archegos defaulted, sending their stocks plunging by near record amounts.

Shares in Bank of America Corp, Citigroup Inc, JPMorgan Chase & Co, Goldman Sachs, Wells Fargo & Co and Morgan Stanley dropped between 0.8% and 3.3% in premarket trading.

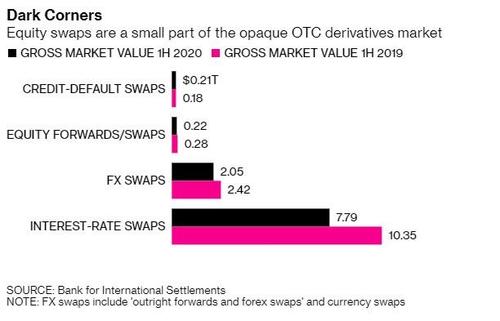

As Bloomberg reported this morning, much of the leverage used by Hwang’s Archegos Capital Management was provided by banks including Nomura and Credit Suisse Group through swaps or so-called contracts-for-difference, according to people with direct knowledge of the deals. It means Archegos may never actually have owned most of the underlying securities – if any at all.

Many of the stocks that were hammered on Friday were volatile in early trading, they have since stabilized and ViacomCBS, Discovery and a group of Chinese ADRs were trading mostly higher premarket, reversing earlier declines for some of the names. A ViacomCBS block trade that launched on Sunday has priced at $47 per share, according to a person familiar with the matter, after shares were said to be offered at $46-$47. ViacomCBS Class B shares are up 1.5% to $48.94 premarket, while the less-heavily traded Class A shares are up 6.7%; Class B slumped 27% on Friday. Shares in Discovery Inc rose about 5% after tumbling 27% on Friday, while U.S.-listed shares of Tencent Music rose 4% after nearly halving in value last week. ViacomCBS, Baidu and VIPShop fell between 0.2% and 1.5%.

“This incident reminded markets of the dark side of leverage, likely leading some players to cut their risk exposure near record highs to avoid any serious losses if the selling snowballs,” said Marios Hadjikyriacos, investment analyst at online broker XM in Cyprus.

Wall Street’s main indexes surged over 1% in a late-session rally on Friday as investors looking to rebalance their portfolios at the end of the quarter, piled into economy-linked banks, energy, materials as well as technology names. The Dow and the S&P 500 are less than 1% from their record highs, while the tech-heavy Nasdaq is still about 7.1% from its February all-time high. Investors have been focusing on the strength of the recovery, aided by vaccines, and inflation risks.

The value-intensive Europe appears to have put the Archegos fiasco in the rearvier mirror shockwave as the Stoxx 600 rose for a second day as gains for defensive sectors including food and beverages outweighed losses for cyclical sectors such as banks and travel.

“I don’t necessarily see that we’re going to have a big correction even with these block trades going on in the market,” Carol Pepper, Pepper International chief executive officer and founder, said on Bloomberg TV. “There is not a lot of bad news lurking that’s going to truly cause a major correction at least the next two to three months, therefore your dips are going to be modest.”

Earlier in the session, Asian stocks were also in the green after a mixed day, as tech shares gained while communication services and consumer discretionary stocks declined. Japanese brokerage Nomura Holdings was among the worst performers in Asia, plunging the most on record after warning of significant potential losses from an unnamed U.S. client. The losses are related to Friday’s unwinding of trades by Bill Hwang’s Archegos Capital Management, according to people familiar with the matter. The Topix index climbed 0.5% despite the drag from Nomura. Meanwhile, China’s CSI 300 Index ended the day up 0.2% as analysts called a market bottom. The country’s tech sector saw limited losses despite the selloff on Friday in the U.S., with the Hang Seng Tech index falling 1.8%, as analysts and fund managers saw the rout as a buying opportunity. Baidu shares fell 5% in Hong Kong, while Bilibili dropped on its debut there. Meituan was another laggard on the Asian gauge as the Chinese food-delivery giant slid 7.2%, after warning that it will remain in the red for several more quarters despite record revenues. Markets in India were closed for a holiday.

In rates, Treasuries were off best levels of the day, richer by more than 3bps across long-end of the curve. Treasury 10-year yields are richer by ~2.5bp at around 1.65%, outperforming bunds and gilts by 2bp and 3bp; curve spreads are mostly flatter, 2s10s by ~2bps. No Treasury coupon supply this week, and quarter-end rebalancing is expected to buying of Treasuries

In FX, the Bloomberg Dollar Spot Index advanced as the dollar climbed against most of its Group-of-10 peers, while risk-sensitive currencies fell, led by Scandinavian currencies; the euro fell, trading near its lowest level since November against the greenback. The pound led G-10 gains with traders focused on key levels in EUR/GBP against the backdrop of U.K.’s vaccination program far outpacing the European Union’s. Britons are being urged to follow the rules or risk a resurgence of the coronavirus as England takes a much-anticipated step toward exiting restrictions that have pummeled the economy and curtailed civil liberties. Commodity currencies were weighed down by a decline in oil prices after the giant container ship blocking the Suez Canal was partially re-floated. The yen was steady and the premium to hedge USD/JPY downside increased as spot is weighed down by deteriorating risk sentiment after Nomura Holdings warned of a “significant” potential loss arising from transactions with an unnamed U.S. client. The Chinese yuan fell to its weakest level since early December as investors sold emerging-market assets with weaker equity futures.

In commodities, West Texas Intermediate crude slid as much as 2.6% after the Ever Given was refloated in a first step to reopening the Suez Canal to traffic.

Looking at today’s calendar, we get UK February mortgage approvals, M4 money supply, consumer credit, while in the US we justhave the latest Dallas Fed manufacturing activity. Fed’s Waller speaks later. Later this week, U.S. President Joe Biden plans to unveil a further stimulus program with a tilt toward infrastructure. U.S.-China ties are also in focus, after a report that Washington isn’t ready to lift tariffs on Chinese imports in the near future, but may be open to trade talks.

Market Snapshot

- S&P 500 futures down 0.4% to 3,949

- STOXX Europe 600 little changed at 427.18

- MXAP up 0.2% to 205.17

- MXAPJ little changed at 676.86

- Nikkei up 0.7% to 29,384.52

- Topix up 0.5% to 1,993.34

- Hang Seng Index little changed at 28,338.30

- Shanghai Composite up 0.5% to 3,435.30

- Sensex up 1.2% to 49,008.50

- Australia S&P/ASX 200 down 0.4% to 6,799.49

- Kospi down 0.2% to 3,036.04

- Brent futures down 0.4% to $64.29/bbl

- Gold spot down 0.4% to $1,725.82

- German 10Y yield up 1 bps to 0.34%

- Euro down 0.1% to $1.1776

- U.S. Dollar Index little changed at 92.83

Top Overnight News from Bloomberg

- Biden will unveil the framework for a major infrastructure-and- jobs program on Wednesday in Pittsburgh, and later in the week offer the first glimpse of his 2022 budget — which promises to redirect federal funds to areas such as climate change and health care

- Turkish central bank Governor Sahap Kavcioglu said markets shouldn’t take for granted that he’ll cut interest rates as soon as April, when he sets monetary policy for the first time since his surprise appointment

- Chancellor Angela Merkel threatened to assert federal authority over pandemic measures to help stem the latest surge in Europe’s biggest economy

A quick look at global markets courtesy of Newsquawk

Asia-Pac equity markets eventually traded mostly higher as the region picked up the baton from last week’s late surge on Wall St although upside was capped and sentiment was somewhat choppy with participants tentative heading into quarter-end, as well as Friday’s NFP jobs data and Easter holiday closures. ASX 200 (-0.4%) failed to hold on to opening gains with the index pressured by underperformance in tech and a subdued financial sector, while a 3-day lockdown in the Queensland state capital of Brisbane and China’s final ruling for tariffs of between 116.2%-218.4% on imported wines from Australia clouded risk sentiment. Nikkei 225 (+0.7%) initially outperformed due to the recent JPY weakness and after the upper house of parliament approved a record budget of JPY 106.6tln for fiscal 2021 but with some weak spots including Nomura Holdings after it flagged a USD 2bln charge from losses in its US operations which was said to be linked to the Archegos margin call sell down. Note, gains for the Nikkei were trimmed ahead of the European entrance. Elsewhere, Hang Seng (+0.1%) and Shanghai Comp. (+0.5%) gradually composed themselves after the early choppy price action with sentiment eventually helped by stronger earnings from China’s megabanks including ICBC, CCB and Bocom, while Sinopec is higher despite posting lower profits and reports of the Co. is to acquire stakes in five assets from its parent valued at a total of nearly CNY 7bln. In addition, there was a large surge in Industrial Profits which grew by 178.9% Y/Y for January-February, although like the recent strong trade and activity data for China, it was most likely due to distortions from base effects and there was also some IPO-related disappointment in which Bilibili shares fell as much as 6% in its Hong Kong debut. Finally, 10yr JGBs were lower with prices subdued amid the outperformance in Japanese stocks, recent softness in USTs and with the lack of BoJ purchases in the market today, while the Summary of Opinions from the March meeting didn’t provide any meaningful fresh insights regarding the BoJ’s clarification that long-term yields can move +/-25bps from the 0% target.

Top Asian News

- Evergrande Sells Online Unit Stake for $2 Billion Before IPO

- Bilibili Drops in Hong Kong Debut as Tech Shares Lose Shine

- Turkey Says April Rate Cut Shouldn’t Be Taken for Granted

- Worst Yuan Selloff in Year Drives Traders Back to Daily Fix

European equities (Eurostoxx 50 +0.4%) have seen a relatively choppy start to the week ahead of quarter-end on Wednesday. From a macro perspective, concerns continue to mount about the impact of a third COVID-19 wave in some Eurozone countries with German Chancellor Merkel not convinced that measures taken thus far will be sufficient in slowing the spread of the virus. Stateside, White House Press Secretary Psaki stated that President Biden plans to split his Build Back Better package into two separate proposals in which the first part involving infrastructure will be unveiled on Wednesday and more details for the second part will be provided later in April. Note, stimulus hopes have not been sufficient enough to provide reprieve for US equity futures with the e-mini S&P down 0.4% and the e-mini Russell 2000 lagging, lower by 0.8%. Back to Europe, sectors are mixed with Food & Beverage, Media and Personal Goods faring better than peers. To the downside, Financials are a notable laggard amid losses in Credit Suisse (-13.8%) after the Co. warned there ‘could be highly significant and material (impact) to Q1 results’ due to a significant US-based hedge fund defaulting on margin calls last week; reports suggest the losses could be in the range of USD 3-4bln. Deutsche Bank (-4.5%) have also taken a hit this morning with reports suggesting the Co. also had exposure to the troubled fund, Archegos, however, sources have noted that Deutsche’s exposure is a fraction of what others hold. Elsewhere, softness can also be seen in other cyclically-exposed names (albeit, to a lesser extent) with Travel & Leisure and Basic Resources posting losses; downside for the latter has acted as a drag on the FTSE 100 (-0.1%). Oil & Gas names sit in mildly negative territory alongside losses in the crude complex after the refloating of the stuck tanker in the Suez Canal.

Top European News

- Merkel Warns Lenient Regions She May Take Control of Covid Fight

- BlueBay’s Pound U-Turn Signals U.K. Post-Brexit Pain Starts Now

- Deliveroo Shaves $1.3 Billion Off Valuation as Investors Revolt

- Cazoo Agrees $7 Billion SPAC Deal With Dan Och in Blow to London

In FX, the Dollar remains mixed against major counterparts in contrast to gains vs most EM currencies, but gradually rising following relatively rangebound trade as the index nudges a fraction above last week’s 92.917 peak within a tight 92.919-729 band. However, residual positioning for March 31 that coincides with the end of the quarter and 2020/21 financial year could spark more price action and volatility as Monday’s session unfolds, especially in absence of any key data or events, aside from the weekly ECB QE updates and Dallas Fed manufacturing business index. Looking at portfolio rebalancing models, signals are said to be strongest and most bullish for the Buck against the Yen, but Usd/Jpy continues to encounter decent offers into 110.00 and is currently hovering above 109.60 after Japan’s upper house of parliament voted in favour of a record Jpy 106.6 tn budget for the next fiscal year and the latest BoJ Summary of Opinions effectively reiterated policy support due to the adverse impact of COVID-19.

- CAD/NZD/AUD – Ongoing weakness in oil prices is weighing on the Loonie as Usd/Cad straddles 1.2600 awaiting minor Canadian data tomorrow before monthly GDP and ppi on Wednesday, while the Kiwi is still suffering from NZ Government measures designed to cap house prices in advance of building consents, ironically, with Nzd/Usd sub-0.7000 and Aud/Nzd nudging nearer 109.50 even though the Aussie is softer vs its US rival under 0.7750 in wake of Brisbane beginning a 3-day lockdown.

- GBP/EUR – The Pound is outperforming as the UK starts stage 2 of PM Johnson’s exit from lockdown, but also as fears over a shortage of vaccines ease with the prospect of Moderna supplies arriving shortly. Cable is holding on to the 1.3800 handle, albeit just and with a large helping hand from the Euro via cross flows that have pushed Eur/Gbp down to a new y-t-d base around 0.8510, while Eur/Usd languishes below 1.1800 between 1.1795-63 parameters amidst downbeat remarks from ECB chief economist Lane and German Chancellor Merkel mulling the use of federal law to tighten pandemic restrictions.

- CHF – A rise in Swiss sight deposits and domestic banks suggests a return to intervention during SNB quarterly policy review week, but the Franc is a tad firmer vs the Buck and Euro through 0.9400 and 1.1050 respectively ahead of the March KOF indicator on Tuesday.

- EM – Contrasting performances from the Lira and Yuan, as Usd/Try pares back from 8.1730+ following comments from new CBRT Governor Kavcioglu playing down prospects of a rate reversal at the April 15 meeting or even in the coming months, while Usd/Cnh climbs to circa 6.5700 following a 6.5416 Usd/Cny midpoint fix from the PBoC and more angst between China and the US over trade tariffs and Taiwan. Elsewhere, the Rub, Mxn and Zar are all down with crude, Gold and other commodities irrespective of Russia indicating that it might use some of its wealth fund to buy bullion.

In commodities, WTI and Brent front month futures opened the first session of the week softer, which is in-fitting with Asia’s lead, but have since seen some upside from intra-day lows with Brent now trading flat on the day. Initial pressure came as a result of the Ever-Given container ship being refloated in the Suez Canal. Henceforth, many oil-laden tankers backed up will be free to move, which would see an increase of supply reaching its intended destination and stop the blockage of one of the world’s busiest waterways. Moreover, the anticipated movement of the ship saw an immediate reaction as oil prices moved sharply lower as potential supply fears were curbed. Elsewhere, fundamental drivers remain the same with focus on vaccination progress and lockdown measures. The May WTI contract trades towards the top-end of the USD 60.00/bbl handle (vs low 59.41/bbl) whilst its Brent counterpart trades low USD 64.00/bbl handle (vs low 63.13/bbl). Looking ahead, notable risk events include the JMMC & OPEC+ meetings later in the week, where expectations remain that OPEC+ will maintain lower output levels. Spot gold and silver are both in the red, with more notable losses in the latter alongside USD strength. Spot gold trades around the USD 1,725/oz mark (vs high USD 1,732/oz) and silver sub USD 25/oz (vs high USD 25.08/oz). In base metals, LME copper resides softer in early morning trade after giving back gains seen on Friday. Finally, Chinese steel futures opened the week on a firmer footing, with rebar and hot-rolled coil up more than 3% in the wake of firm domestic industrial & manufacturing activity data.

US Event Calendar

- 10:30am: March Dallas Fed Manf. Activity, est. 14.5, prior 17.2

Central Banks

- 11am: Fed’s Waller to Speak at Peterson Institute

DB’s Jim Reid concludes the overnight wrap

As we start the week and the final three days of Q1, investors have been bracing for potential further block trades following a wave of sales on Friday that saw a number of US media companies and Chinese technology firms lose significant ground. Multiple news outlets have cited sources saying that Archegos Capital was behind the trades, with ViacomCBS and Discovery both seeing their largest ever daily declines on Friday, as each fell by more than -27%. The big concern over the weekend was whether more are coming this morning, though overnight in Asia markets seem little impacted by the developments overall, with the Nikkei (+1.13%), Hang Seng (+0.33%), Shanghai Comp (+0.79%) and Kospi (+0.14%) all moving higher. A notable exception to this was Nomura, however, which is the worst performer out of the 225 companies in the Nikkei this morning with a -15.05% decline, after the firm flagged a possible $2 billion loss thanks to transactions with a US client, which Bloomberg reported was tied to the Archegos moves. Nevertheless, US futures are also pointing lower overnight, and those on the S&P 500 are down -0.51% this morning.

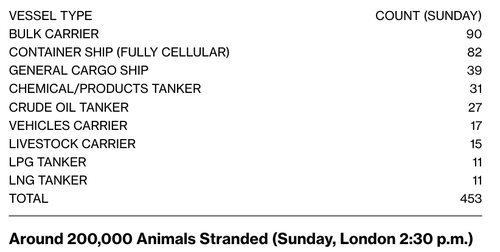

The other big developing story overnight is that the Ever Given ship blocking the Suez Canal has been successfully refloated, according to Inchcape Shipping Services, with the ship currently being secured. The news has sent oil prices lower this morning, and WTI (-1.59%) and Brent crude (-1.27%) prices have both fallen in response, even though it isn’t yet apparent how long it’ll take before the container ship can be moved out of the way and the canal cleared for others to pass through. For reference, the ship has been obstructing the route since Tuesday and it’s longer than the Eiffel Tower in length, and a number of container ships have already taken alternative routes and gone round the Cape of Good Hope, even though that adds over a week to the journey time. The big question will now be how long before the Canal is back to normal service, as 12% of global trade goes through this route, and the issue has only added to the existing supply chain disruption thanks to the pandemic.

Looking to the week ahead, the spotlight will remain on the pandemic as investors are becoming increasingly worried at the rising number of cases in multiple regions, which in turn is raising the prospect of further restrictions and limits on economic activity. Europe in particular is facing a potential 3rd wave driven by the new variants, and over the last week we saw the German lockdown extended until April 18 (albeit with a U-turn over the Easter weekend restrictions), more French regions placed under lockdown, and a number of Eastern European countries also moving to toughen up restrictions. The coming days could see further measures announced, with German Chancellor Merkel saying in an interview last night that she could use federal law to take control of the pandemic response from the states. And this isn’t just affecting Europe either, with the Australian city of Brisbane announcing a 3-day lockdown from 5pm local time today due to an outbreak of the UK strain. The newsflow from Europe lately has shown a markedly different situation to the US, which is significantly outpacing the continent in terms of the vaccine rollout, while President Biden last week announced a new goal of 200m vaccine doses in the US within his first 100 days. By the close on Friday the gap between yields on 10yr US Treasuries and German bunds stood at their widest level in more than a year, with a spread of 202bps. More broadly, Covid-19 jitters have been evident elsewhere in financial markets, with oil prices down from their peak at the start of the month in part due to fears of weakening economic demand, whilst the STOXX Travel & Leisure Index in Europe is down by more than 3% since its peak less than 2 weeks ago.

Over in the US, one of the main highlights this week will be on Wednesday, when President Biden is due to deliver a speech unveiling his new infrastructure plan, as part of his “Build Back Better” agenda. We’re obviously yet to get the full details on the exact size and composition of the plan, but multiple outlets have reported that it will be in the $3tn range, with part of the cost offset via tax increases. In terms of what measures to expect, his campaign plans included a lot of emphasis on sustainability and the transition to a greener economy, while the tax measures he outlined included raising the corporate tax rate from 21% to 28%, along with higher income taxes on those earning more than $400,000. After that, the next step will be to turn the proposals into legislation, but as our US economists wrote in the world outlook, such a plan won’t win sufficient support from Republicans, so will need to go through the reconciliation process that allows legislation to pass the Senate with just a simple majority. This is what happened with the $1.9tn American Rescue Plan that Biden signed earlier this month, and they expect it to be passed along party lines in late summer or Q4.

Staying on the US, this Friday will also see the release of the March jobs report, where our economists are expecting a +800k increase in nonfarm payrolls as many states reopen or scale back lockdown measures, and this would be the strongest monthly job growth since August. Furthermore, they’re expecting that the unemployment rate will fall to a post-pandemic low of 6.0%. This would come against the backdrop of some decent labour market data out of the US recently, with the weekly initial jobless claims for the week through March 20 falling to a post-pandemic low of 684k. Nevertheless, even if the +800k growth in nonfarm payrolls were realised, that would still leave the total number of nonfarm payrolls more than 8.6m beneath its pre-Covid-19 pandemic peak, and this shortfall is something that Fed Chair Powell has been emphasising, which just shows the distance there’s still to go before the economic damage from the pandemic is repaired.

Elsewhere, the main data highlight will likely be the release of the manufacturing PMIs from around the world on Thursday. The flash releases we’ve already seen have been incredibly strong, with the numbers for both Germany (66.6) and the Euro Area (62.4) coming in at all-time highs, while the US was also at a decent 59.0. An interesting question will be whether the strength in the price gauges we saw in the flash PMIs will be reflected in other countries too, since that would add further support to the idea that inflationary pressures are building in multiple regions. The other data release of note from Europe will be the March flash inflation prints, with the Euro Area number coming out on Wednesday. Our European economists expect headline HICP to pick up to +1.4% yoy, and core inflation to rise to +1.2%.

To recap last week now, risk assets had reached new highs by Friday as the seemingly relentless rise in global bond yields took a breather following their steep climb. The S&P 500 rose +1.57% on the week, closing at a record high following a +1.66% gain on Friday – which also marked the largest single day move for three weeks. The weekly move was driven by cyclicals as financials, industrials, and energy stocks gained while technology stocks continued to underperform. The NASDAQ fell back -0.58% on the week even with a strong Friday gain (+1.24%), while the highly concentrated megacap NYFANG index lost -4.04% over the course of the week and is now down -0.43% YTD. European stocks somewhat shrugged off worries of further shutdowns as the STOXX 600 gained +0.85% over the five days to reach a post-pandemic high, with the German DAX (+0.88%) outperforming other bourses slightly.

Over in rates, 10yr Treasury yields finished the week -4.9bps lower (+3.9bps Friday) at 1.672% – bringing an end to a run of 7 consecutive weekly moves higher. The move was driven by lower real yields (-10.1bps), which overcame increasing inflation expectations (+5.1bps), which themselves reached new heights. Indeed, 10yr breakevens closed at 2.36% on Friday, their highest level since 2013. The rally in rates was seen across the curve as 30yr yields fell -5.7bps on the week and shorter-dated 5y yields fell back -1.9bps. In Europe, there was a similar move lower over the week, with 10yr bund yields down -5.2bps last week and gilts dropping -8.1bps. The moves in European sovereign debt came as weekly data showed the ECB’s net purchases under their Pandemic Emergency Purchase Programme (PEPP) rose to €21.1bn in the week to March 19, which was the fastest pace since December.

In terms of data from last Friday, the US personal income and spending releases for February showed a pullback after the $600 stimulus check in January and ahead of the anticipated March spike from the current round of checks. Incomes were down -7.1% (-7.2% expected) in February, following a +10.1% rise in January, while spending fell -1.0% (-0.8% expected) after January’s upwardly revised +3.4% increase. The final reading of the University of Michigan’s consumer sentiment index for March rose to a one-year high of 84.9, up from the initial 83.0 reading earlier this month. Under the surface a gauge of expectations rose 9 points to 79.7 – the largest one-month advance since 2009. Meanwhile in Europe, the Ifo business expectations indicator for March from Germany rose to 100.4 (95.0 expected), the highest level in almost three years. Italian consumer confidence for March actually fell back, however, dropping to 100.9 from the prior month’s 101.4 reading. Lastly, UK retail sales excluding fuel for February rose +2.4% mom (+1.7% expected), though down -1.1% yoy.