Italian Premier To Resign As He Plots Latest Political Comeback

Pretty soon, Italy will be leaded toward its its 132nd federal government in roughly 160 years as PM Mario Conte, who led Europe’s third biggest economy through its most recent debt crisis, while also setting Italy on the path toward closer cooperation with China.

But despite barely surviving a handful of confidence votes, it appears the writing is now on the wall for Conte, and his time as premier and leader of Italy’s council of ministers is coming to a close.

Italian Prime Minister Giuseppe Conte will resign on Tuesday morning to avoid a damaging defeat in the Senate, as he maneuvers to try and return for another round of leadership, combating Italians who are maneuvering against him.

Conte

Conte will preside over a cabinet meeting at 0900 in Rome and then head to President Sergio Mattarella’s office where he will formally step down, according to a government statement.

The idea is that by preemptively offering his resignation to Mattarella, who oversees the formation of ruling coalitions, Conte will then likely be asked to take another shot at assembling another government, according to officials who asked not to be named discussing confidential deliberations.

The Five Star Movement, the biggest force in the current parliament, and lawmakers of the cenin favor of a trigger vote in the Italian Senate later this week.

However, the parliamentary math does not add up. The latest gambit for Conte’s political maneuvering stands to benefit from the fact that Five Star will plunge in the polls, and the party stands to lose the most if the government collapses and Mattarella decides early elections are unavoidable. Read More: Italian Deficit May Reach 9.2% This Year as Covid Costs Pile Up The twists and turns of the country’s latest Byzantine politicking have left even the most cynical Italians shaking their heads at a time when the pandemic-battered economy faces huge challenges, including how to spend the EU’s recovery package money and speed up the pace of vaccinations.

Conte stepped down after losing his governing majority in Italy’s Senate earlier this month, following a fight with a small coalition ally over how to spend massive funds offered by the European Union to help Italy recover from the impact of the pandemic. His resignation has triggered a search for a new governing majority, but if none can be found, then the EU’s third-biggest economy is likely to hold elections in coming months.

The breakdown of Italy’s left-leaning government shows that Europe’s political challenges of recent years, including the fragmentation of the political landscape and the rise of anti-establishment parties haven’t gone away, despite the pressure that the pandemic is putting on European politicians to work together across party lines.

Analysts who spoke with Bloomberg insisted that Conte’s push for a “unity government” is his best option, officials said. Yet, it has long been said that Renzi and Conte have a long-festering dislike of each other and have been ill at ease in a coalition of mutual convenience.

On the other hand, Conte could seek to forge a new coalition centrists – really, center-right politicians including unaffiliated lawmakers and former PM Silvio Berlusconi, who leads the center-right Forza Italia.

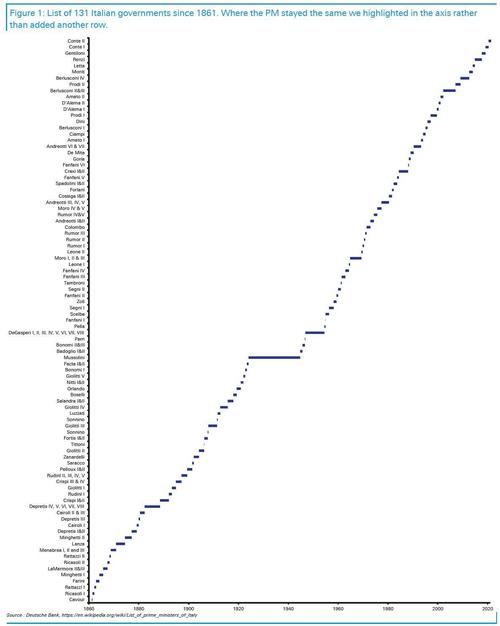

Here’s the full list of Italian leaders dating back to the Italian revolution back in the 1860s.

If Conte pulls off this maneuver on Monday and Tuesday, he will kick off his third government as PM. And just like that, the non-career politician pressed into service by a group of ideologically opposed anti-establishment parties will cement his reputation as the only man who could lead Italy, because he’s the only man who doesn’t want the job.

Tyler Durden

Mon, 01/25/2021 – 15:37

via ZeroHedge News https://ift.tt/3qTsuwq Tyler Durden