Futures Push Higher Ahead Of Fed Decision, Retail Sales

Tyler Durden

Wed, 09/16/2020 – 07:49

U.S equity futures and European stocks rose as investors awaited the decision of the Federal Reserve’s policy meeting later Wednesday and the August retail sales report which was expected to show a modest growth slowdown. Treasuries were steady and the dollar slipped.

After a modest dip early in the session following news that Facebook is facing an antitrust lawsuit by the FTC as early as late this year, S&P futures rebounded and hit a session high of 3,418.25 before paring gains to a 0.3% rise, as investors hoped for a renewed dovish pledge by the Federal Reserve to keep interest rates low for a prolonged period, with upbeat quarterly results from FedEx also boosting sentiment. After dropping for two weeks in a row, the S&P 500 has rebounded 1.8% in the past two sessions, with defensive sectors including real estate and utilities among the biggest gainers.

FedEx soared 10% in premarket trading after reporting a bigger-than-expected quarterly profit, helped in part by price hikes and lower fuel costs. Shares in peer UPS gained 4.6%, while Robinhood darling Kodak soared over 50% after an internal legal review cleared the company of option trade improprieties. Apple rose 0.7%, after ending the previous session just marginally higher, as it rolled out a new virtual fitness service and a bundle of all its subscriptions, Apple One. Other tech-related stocks including Alphabet, Amazon.com, Tesla and Microsoft all gained between 0.6% and 1.0%.

Investors have been looking for catalysts to take markets higher after an impressive global recovery sputtered in the first half of September, with some hoping that Powell will deliver more Kool-aid by boosting its dovish stance after adopting a more relaxed approach on inflation last month. That’s helping to shore up sentiment in the face of risks ranging from U.S. presidential elections and the prospect of a no-deal Brexit.

“Central banks are far from out of ammunition,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a note to clients. “Investors should be positioned for the upside in equities.”

“The Fed may follow up by announcing some new easing steps in accordance with its new regime, though the general market consensus seems to be that it will adopt a wait and watch approach,” said Lee Hardman, a strategist at MUFG in London.

The Fed’s two-day meeting is its first under a newly adopted framework that promises to shoot for inflation above 2% to make up for periods where it is running below that target, in other words not to raise rates for a long, long time. The FOMC will release its policy statement and economic projections at 2 p.m. ET followed by Fed Chair Jerome Powell’s virtual news briefing half an hour later.

On the covid front, overnight President Trump said a vaccine shot for the coronavirus could be ready within four weeks. Separately, China’s top bio-safety scientist said one may be available for public use as early as November or December.

European stocks rose for a fourth day as Zara-owner Inditex posted a quarterly profit, although UK blue-chip stocks came under pressure after a surge in the previous session. The STOXX 600 index inched 0.3% higher, extending on its winning streak. Inditex said current trade showed a progressive return to normality with online sales growing sharply and store sales recovering, pushing its shares 6.3% higher, and helping lift the Stoxx retail sector 1.1%. Meanwhile, London’s FTSE100 was dragged lower by a weakness in the banking sector. A bright spot in the market was a 26.4% surge in shares of the Hut Group, the first major British initial public offering in seven years. Swiss plumbing materials company Geberit rose 1% after saying it would buy back shares worth up to 500 million Swiss francs ($551 million) over two years. Sweden’s Handelsbanken rose 2.6% after revealing plans to close almost half of its branches and cut about 1,000 jobs over the next two years.

Signs of compromise emerged on the Brexit front, with Reuters reporting that Britain offered tentative concessions on fisheries in trade talks with the European Union last week, just as London was threatening to breach the terms of its divorce deal with the bloc.

“The only catalyst that I can see for European equities is Brexit that could push markets one way or the other,” said Julien Lafargue, head of equity strategy at Barclays Private Bank. “Europe, in our mind, is a trading market. You want to buy Europe when everybody hates it, you want to sell it when everybody loves it. At this stage, we’re at a neutral.”

Earlier in the session, Asian stocks also gained, led by health care and communications. Markets in the region were mixed, with Australia’s S&P/ASX 200 and Taiwan’s Taiex Index rising, and Jakarta Composite and Shanghai Composite falling. The Topix gained 0.2%, with Shin Nippon Bio and Marusan Securities rising the most. The Shanghai Composite Index retreated 0.4%, with Zhenjiang New Energy and Beijing Dahao Technology posting the biggest slides.

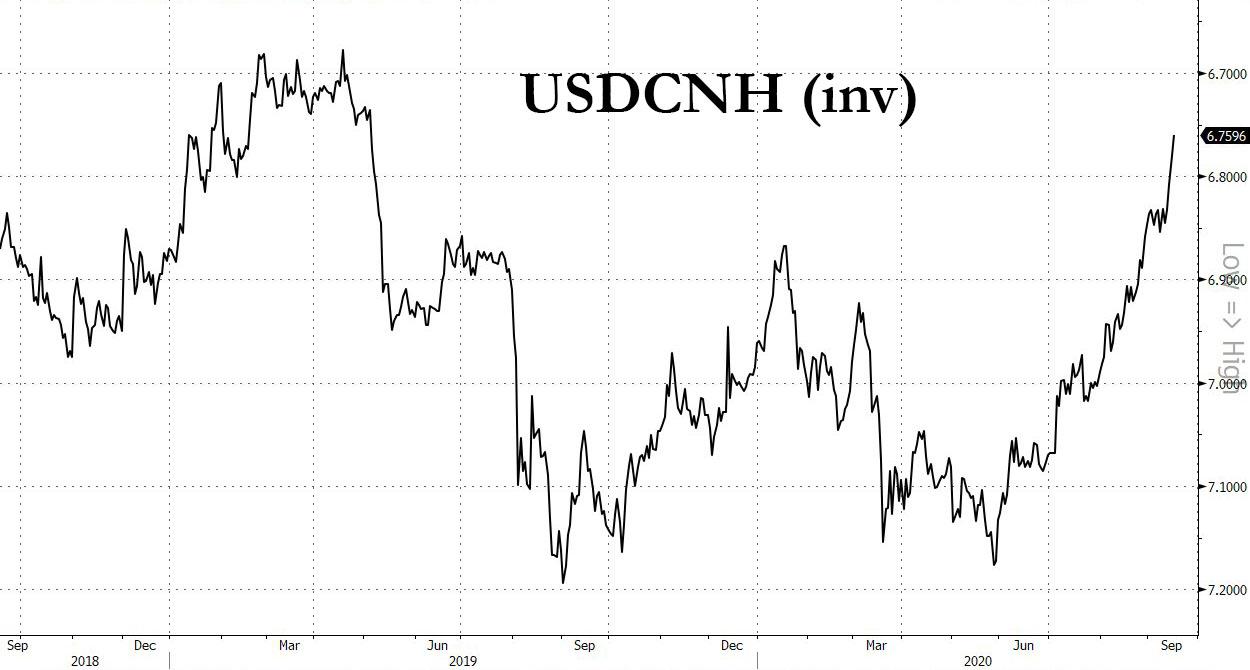

In FX, the U.S. dollar fell across the board on Wednesday as expectations grew that the U.S. central bank may hint at more policy action, while the Chinese yuan vaulted to its highest level since May 2019. The Bloomberg Dollar Index extended its longest losing streak in a month with a fourth consecutive day of declines after China’s central bank raised the daily reference rate for the nation’s currency and amid a continued rally in risk assets. Investors have turned bullish on China, with the prospects for the world’s No. 2 economy improving on the back of strong retail sales and industrial output data. In offshore trade, the Chinese currency, which is on track for four straight months of gains, notched a fresh 16-month high, hitting 6.7536 per dollar. “People are starting to embrace a new theme, which is that China is managing much, much better than anyone else,” said Davis Hall, head of capital markets in Asia at Indosuez Wealth Management.

“The dollar got sold on last 3 FOMC (Federal Open Market Committee) days so we continue with that pattern today”, noted Kenneth Broux, a strategist at Societe Generale. Trading could, however, easily and quickly shift soon after the statement, Commerzbank foreign exchange analyst Antje Praefcke warned via Reuters.

The Japanese yen also made significant gains during the session and touched levels not seen since the end of July, briefly going under 105 per dollar. The euro rose 0.27% to $1.1852. Sterling reversed earlier losses and rose 0.6% to $1.2995 in what would be its biggest daily rise in 2-1/2 weeks before a meeting of the Bank of England on Thursday, when policymakers may strike a downbeat assessment for the struggling economy.

In commodities, crude oil rose above $39 a barrel following a surprise drop in U.S. crude stockpiles. Gold continued trading in a narrow range, last seen at $1,963/oz.

In addition to the Fed’s decision, investors are also awaiting retail sales data for August, due at 8:30 a.m. ET, with expectations of a reading of 1.0% compared with July’s figures of 1.2%.

Market Snapshot

- S&P 500 futures up 0.3% to 3,410

- STOXX Europe 600 up 0.3% to 372.19

- MXAP up 0.5% to 174.35

- MXAPJ up 0.6% to 573.76

- Nikkei up 0.09% to 23,475.53

- Topix up 0.2% to 1,644.35

- Hang Seng Index down 0.03% to 24,725.63

- Shanghai Composite down 0.4% to 3,283.92

- Sensex up 0.5% to 39,239.04

- Australia S&P/ASX 200 up 1% to 5,956.13

- Kospi down 0.3% to 2,435.92

- Brent Futures up 2.6% to $41.57/bbl

- Gold spot up 0.7% to $1,967.52

- U.S. Dollar Index down 0.1% to 92.94

- German 10Y yield fell 0.2 bps to -0.481%

- Euro up 0.2% to $1.1867

- Brent Futures up 2.6% to $41.57/bbl

- Italian 10Y yield fell 2.2 bps to 0.793%

- Spanish 10Y yield fell 1.0 bps to 0.261%

Top Overnight News from Bloomberg

- Federal Reserve officials are expected to project rates staying near zero though 2023, reinforcing the message delivered by Powell in late August that they will delay tightening policy to achieve inflation that averages 2% over time

- Coronavirus vaccines will be ready for public use as early as November or December in China, a top scientist said, which would make the country one of the first in the world with an inoculation

- The U.K. inflation rate fell to the lowest since 2015 last month, driven by government tax cuts and other stimulus designed to dig the economy out of the depth of the coronavirus crisis

- Bank of England officials are expected to lay the groundwork this week for yet more monetary stimulus as optimism over the U.K.’s economic rebound from the coronavirus pandemic fizzles out

- The European Union’s executive proposed toughening the bloc’s emissions targets in a move that’ll force industry to face stricter pollution standards. The bloc willsell 225 billion euros ($267 billion) of green bonds as part of its landmark recovery fund, a watershed moment for an expanding market

- Japan’s parliament formally elected ruling party stalwart Yoshihide Suga — the 71-year-old son of a strawberry farmer — to be the country’s first new prime minister in almost eight years

- Boris Johnson has held talks with rebels in the U.K.’s ruling Conservative Party in an attempt to win their backing for his controversial law rewriting part of the Brexit deal he struck with the European Union last year

A quick look at world markets courtesy of NewsSquawk

Asian equity markets traded mixed and only partially benefitted from the tech-led gains in US, with the region tentative heading into the upcoming flurry of central bank announcements beginning with the FOMC later today. ASX 200 (+1.0%) and Nikkei 225 (+0.1%) were positive with Australia buoyed as the tech and telecoms sectors found inspiration from the outperformance of their counterparts stateside, while the advances in Japan have been tempered by a firmer currency and mixed data which showed a surprise Trade Surplus and narrower than expected contraction to Exports, although Exports were still at a substantial decline and Imports missed to suggest a weak consumer profile. In addition, participants await incoming PM Suga’s inauguration and the conclusion of the BoJ’s 2-day policy meeting which kicks off today. Conversely, Hang Seng (U/C) and Shanghai Comp. (-0.4%) lagged after a neutral PBoC liquidity operation and ongoing US-China tensions following the WTO ruling that US tariffs on China violated trade rules, as the US have spoken against the WTO announcement and President Trump suggested he may do something about the WTO following the ruling, while it was also reported the US is to announce charges related to Chinese hacking and blacklisted a Chinese developer in Cambodia, amid allegations they built facilities on land seized from locals which could be used to host military assets. Finally, 10yr JGBs were flat with price action stuck near the 152.00 resistance level and amid the indecisive risk tone, while participants were also tentative as the BoJ begins its 2-day policy meeting.

Top Asian News

- Japan’s Parliament Elects Yoshihide Suga as New Prime Minister

- Singapore to Pay Citizens for Keeping Healthy With Apple Watch

- Digital Money Thefts Deal Setback to Japan’s Cashless Drive

- Stocks Rally to Revive Indian IPOs in Worst Year Since 2016

European cash bourses eke mild gains (Euro Stoxx 50 +0.1%) alongside US equity futures (ES +0.4%, NQ +0.4%, YM +0.4%) amidst a relatively light session thus far in terms of news flow, and in the run up the FOMC policy decision later today. Cash bourses are mostly higher with the exception of the FTSEs (FTSE 100 -0.1%, FTSE MIB -0.2%) whilst broad-based gains are experienced throughout the rest of the region. UK’s FTSE sees a number of large-cap mining names consolidating after yesterday’s firm performance. Sectors across Europe are mostly higher with no real risk profile to be derived. The retail sector leads the charge, with the likes of Inditex (+7.5%) and Salvatore Ferragamo (+8.9%) propping up the sector post-earnings, whilst the IT sector coat-tails on the Wall Street sector performance yesterday. In terms of individual movers, Lufthansa (-1.6%) share remain pressured as sources said the group could cut its fleet by 130 planes and cut further jobs, altogether equating to around 28k vs. Prev. indicated 26k, while separate reports said the Co. has cut its year-end flights guidance. Meanwhile, the main shareholders of Caixabank (+0.3%) and Bankia (+2.3%) have given the green light for a merger, with a meeting reportedly called for tomorrow to approve to approve the terms, according to sources.

Top European News

- THG Shares Soar After $2.4 Billion IPO to Ride Online Boom

- Sweden’s Biggest Bank Says Cost Cuts to Hit 1,000 Employees

- Hitachi Abandons U.K. Nuclear Power Project in Blow to Industry

- VW Follows Daimler in Making Green-Bond Debut for Electric Cars

In FX, it is hardly a surprise to see the Dollar mostly rangebound and the index recoil to its confines around the 93.000 axis that has been pivotal for a while, as many if not most currency market participants keep positions light in the run up to the FOMC. However, US retail sales data looms before the big event and often possesses the potential to surprise given a wide spread of forecasts either side of consensus for the headline number and key control group GDP component. For now, the DXY is holding within a 92.852-93.189 band as major counterparts largely respect recent support, resistance and round number or psychological levels.

- AUD/NZD/NOK – Marginal outperformers on a combination of factors, including strength in underlying commodities and crude, while the Aussie has piggy-backed yet another firm PBoC CNY fix and the Kiwi is underpinned by better than expected Q2 current account balances and the NZ Government upgrading its 2020 GDP and unemployment rate projections. Aud/Usd and Nzd/Usd are consolidating above 0.7300 and 0.6700 respectively, as Eur/Nok retreats from close to 10.7200 through 10.6500.

- JPY/EUR – Also firmer vs the Greenback, but the Yen and Euro are still waning ahead of 105.00 and 1.1900 amidst more decent option expiry interest, between 105.25-15 in Usd/Jpy (1.4 bn) and 1.1835-25 in Eur/Usd (1.1 bn), with the latter also wary about ECB insinuations regarding the strength of the single currency. Back to the Yen, next up the BoJ and in the interim mixed Japanese trade metrics and Suga approved by the lower house as new PM.

- GBP/CHF/CAD/SEK – The Pound appears top heavy again above 1.2900 against the Buck and 0.9200 in Euro cross terms as the Brexit implications of the IMB continue to hamper Sterling in addition to formidable technical hurdles in Cable from 1.2933 to 1.2935 (200 WMA/Fib and 55 DMA) and some pre-BoE caution. Elsewhere, the Franc remains stuck in a 0.9100-0.9050 rut, like the Loonie between 1.3200-1.3150 awaiting independent direction from Canadian CPI and the Swedish Krona within 10.4320-10.4035 vs the Euro in wake of Sweden’s ESV fiscal watchdog revising its GDP forecast for this year to show less contraction than envisaged in June, as per other state and private entities.

- EM – Apart from the ongoing appreciation of the Yuan and gains fuelled by the depressed Dollar/oil price rebound, pretty mundane midweek session trade awaiting Fed policy pronouncements, guidance, the SEP and chair Powell’s press conference. However, the Lira is still struggling to pare declines from record lows under threat of EU sanctions following a warning from the EP that a resolution to that effect will be on Thursday’s agenda.

In commodities, WTI and Brent front month futures are continuing the grind higher seen during the APAC session as the complex is underpinned by the large surprise drawdown in Private crude inventories (-9.5mln bbls vs. Exp. +1.3mln bbls) alongside developments in the Gulf of Mexico. Hurricane Sally has been upgraded to a Category 2 hurricane as it makes landfall, with the latest update noting that historic and life-threatening flooding is likely through Wednesday along and just inland of the Florida Panhandle. The BSEE estimated Hurricane Sally cut 26.9% of US gulf offshore oil production (prev. 21.4%) and Nat Gas shut off in the region is seen at 28.0% (prev. 25.3%), whilst refining activity is also closely watched due to its vulnerability to flooding, and as just under 54% of US capacity sits in PADD III in the Gulf Coast. Meanwhile, the JMMC gears up to meet tomorrow, with eyes on any commentary regarding oil prices and market outlook. Sources last week said the recent price decline has caused concern in Riyadh, however, not enough to induce panic, and Saudi is planning to keep production steady. “We are likely to see the group once again put pressure on those who are still producing above their quota levels to comply”, ING predicts, with reports also noting that OPEC+ compliance in August stood at 101%. Looking ahead, the weekly EIA crude stocks will be released at the usual time, with the headline expected to show a build of 1.271mln bbls. Elsewhere, precious metals benefit from the softer USD, with spot gold extending gains above USD 1950/oz having had tested the level to the downside in overnight trade. Spot silver holds its head above USD 27.00/oz after printing a base at USD 27.02/oz – with eyes turning to the FOMC decision. In terms of base metals, LME copper erased earlier losses with the aid of a weaker Dollar, whilst Dalian iron ore futures fell overnight amid falling steel margins in China dampening the demand outlook for the base metal.

US Event Calendar

- 8:30am: Retail Sales Advance MoM, est. 1.0%, prior 1.2%

- Retail Sales Ex Auto MoM, est. 1.0%, prior 1.9%

- Retail Sales Control Group, est. 0.3%, prior 1.4%

- 10am: Business Inventories, est. 0.1%, prior -1.1%

- 10am: NAHB Housing Market Index, est. 78, prior 78

- 2pm: FOMC Rate Decision

- 4pm: Net Long-term TIC Flows, prior $113.0b; Total Net TIC Flows, prior $67.9b deficit

DB’s Jim Reid concludes the overnight wrap

Striking a chord today will be the Fed, who’ll be making their latest monetary policy announcement later. This is the FOMC’s first meeting since they released their revised Statement on Longer-Run Goals and Monetary Policy Strategy at Jackson Hole, in which they announced the move to a flexible average inflation target, thus allowing inflation to overshoot 2% following a period in which it’s been below target. There was also a change to the wording around their maximum employment objective, now saying that policy will be informed by its “assessments of the shortfalls of employment from its maximum level.” Though the change in the strategy opened the door to adjustments in forward guidance and asset purchases at this meeting, the communications from the Fed since then have signalled a lack of urgency on delivering meaningful changes to the policy stance. As a result, our US economists don’t think there’ll be any changes to the Fed’s forward guidance on interest rates, but do see the FOMC reframing their asset purchases as being focused on providing accommodation, rather than aiding market functioning. This meeting will also feature the release of the quarterly Summary of Economic Projections, which they think should reflect a meaningful upgrade to the near-term growth and inflation forecasts. On the dot plot, they think there’ll be continued unanimous support on holding the policy rate steady through 2021, with a firm majority still seeing the policy rate at the zero lower bound in 2023. See their full preview here.

Risk assets saw a solid overall performance yesterday ahead of the Fed’s decision, though US markets gave up about half their gains late in the session while remaining up on the day. The S&P 500 finished +0.52% higher for its 3rd consecutive daily advance, but was up as much as +1.1% midday. Tech stocks outperformed again, with the NASDAQ up +1.21%. The market dip from the peaks came around midday NY time, about the same time as a story reported a lack of consensus on US fiscal stimulus – more on that below.

Europe earlier saw solid gains, as the STOXX 600 closed up +0.66%. Banks underperformed on both sides of the Atlantic though and were the worst industries in their respective indices, with the STOXX Banks index down -1.49%, and the S&P 500 banks industry group down -2.48%. Meanwhile oil prices rebounded, with Brent Crude coming off its 3-month low thanks to a +2.32% advance – only the second daily gain in the last ten sessions.

Overnight one interesting story is that the US Federal Trade Commission, which has been investigating Facebook for more than a year over whether the social media giant has harmed competition, could file a case by the end of the year. The news report added however that no final decision has been made on this. Facebook is down -1.86% in overnight trading. Meanwhile, yesterday a Senate Judiciary panel laid out a case for how Google has used its dominance in search and digital advertising to benefit its products and harm competition. This comes ahead of preparations by the Justice Department to sue Google in coming weeks. This is all coming at a time when only 1 in 3 Americans are holding a positive view of Big Tech, as was highlighted by Apjit Walia from my team in a research piece earlier this month. He thinks they’ll come in for increased scrutiny post the election.

Asian markets are largely trading up outside of the Hang Seng (-0.24%) and Shanghai Comp (-0.24%) this morning. The Nikkei (+0.12%), Kospi (+0.27%) and Asx (+1.0%) are all higher along with S&P futures (+0.21%). In FX, the onshore Chinese yuan is up a further +0.15% to 6.7728. Brent crude oil prices are up +1.68% to $41.21. As we go to print, Yoshihide Suga has been elected Japan’s new prime minister by the lower house.

There hasn’t been a great deal of new news on the coronavirus over the last 24 hours, though we did hear from President Trump, who said in a Fox & Friends interview yesterday that “We’re going to have a vaccine in a matter of weeks”. He has doubled down overnight saying that the one would be ready within 3 to 4 weeks. This is going to be an interesting dynamic given there are just seven weeks to the election. The President’s interview came just prior to reports that researchers monitoring the Pfizer vaccine have reported no safety issues after 12,000 patients received a second of two doses. Staying on a vaccine, we also heard from the head of Germany’s vaccine regulator that the first approvals could be granted at the end of this year or early next year. Our latest Exit Strategy Tracker contains the latest on vaccine developments so please see it here.

In terms of case numbers, Western Europe remains a source of concern, with the entire Irish cabinet going into self-isolation yesterday after their Health Minister Donnelly had been tested. Dublin has closed all bars that do not serve food and has asked residents to not have visitors from more than one home come to their house. Elsewhere, both Spain and the UK’s case numbers remained above 3,000, and in Italy a further 1,229 were reported. Here in the UK, the government acknowledged the strain in the country’s testing ability with Health Secretary Hancock telling the House of Commons, “we have seen a sharp rise in the numbers coming forward for a test… we will be able to solve this problem in a matter of weeks.” In the US there were over 50,000 new cases yesterday compared to 26,000 new cases last Tuesday. Summer virus hot spots continue to cool off though, with California and the Houston-area of Texas posting their lowest positivity rates on data going back to April. Elsewhere, confirmed cases in India have reached the 5 million mark as the country is now topping 90k new cases almost on a daily basis. Furthermore, as per Bloomberg, the official counts of confirmed cases and deaths are marred by underreporting and inadequate testing.

While we will hear about any changes to the US monetary policy in a few hours, don’t hold your breath when it comes to fiscal. Congressional leaders met again yesterday to discuss. A follow on stimulus bill has been discussed since July with both parties remaining quite far apart. Yesterday, we heard from White house advisor and the President’s son-in-law Jared Kushner that an agreement may not come until after the election, while Speaker Pelosi threatened to keep the House in session until another fiscal deal is done. Lawmakers in the House are currently expected to recess on 2 October in order to campaign ahead of the 3 November elections. A bipartisan group of 50 lawmakers in the House put a $1.5 trillion bill on the floor that aimed at being a middle ground for both parties with elements of both parties’ original salvos, however leading members in both parties have already said it was both not enough and too much respectively. The concern continues to be that the proximity to the election is causing an apparent lack of political incentive of either side to act.

While this was going on, Sovereign bonds had a mixed performance yesterday ahead of the Fed, with 10yr Treasury yields up +0.7bps, having closed within a 4bps range over the last week. Bund yields were also up but just +0.1bps, though gilts underperformed once again, as 10yr yields rose +2.3bps. Over in commodities, platinum had another strong performance, rising +1.62% for a 5th straight session, while copper fell -0.11% as it came down from its 2-year high the previous day.

Looking at yesterday’s data, US industrial production rose by a below-consensus +0.4% in August (vs. +1.0% expected), though July’s reading was revised up half a percentage point to +3.5%. Meanwhile capacity utilisation rose to 71.4% in August, which is noticeably higher than the 64.1% in April, but still down from the 76.9% back in February. We also got the Empire State manufacturing survey, which rose to 17.0 (vs. 6.9 expected). Here in the UK, the unemployment rate in the 3 months to July rose to 4.1% as expected, which is the first time the jobless rate has been above 4% since October 2018. In addition, the more up-to-date estimates for August 2020 from Pay As You Earn Real Time Information showed the number of payroll employees was down by -695k (or -2.4%) compared with March 2020. Finally, the ZEW survey from Germany showed investor expectations rose to 77.4 in September (vs. 69.5 expected).

To the day ahead now, and the aforementioned Federal Reserve decision will be the highlight of the day for investors. This morning there’s also European Commission President Ursula von der Leyen’s State of the Union address. Otherwise, we’ll also hear from the ECB’s Hernandez de Cos and Holzmann, and can expect a monetary policy decision from the Brazilian central bank. Data releases from Europe include UK CPI for August and the Euro Area trade balance for July, while the US releases include August retail sales and the September NAHB housing market index.

via ZeroHedge News https://ift.tt/33Cfwcj Tyler Durden