Daily Briefing – September 2, 2020

Tyler Durden

Wed, 09/02/2020 – 18:10

via ZeroHedge News https://ift.tt/3jJ9Eo7 Tyler Durden

another site

Daily Briefing – September 2, 2020

Tyler Durden

Wed, 09/02/2020 – 18:10

via ZeroHedge News https://ift.tt/3jJ9Eo7 Tyler Durden

Chicago, Portland, Baltimore – The Things We’ve Warned About Are Now Starting To Happen Everywhere

Tyler Durden

Wed, 09/02/2020 – 18:05

Authored by Michael Snyder via TheMostImportantNews.com,

Whether for good or for bad, the United States always sets an example for the rest of the world, and right now people all over the globe are watching violence fill the streets of our major cities. For years, we could all see anger building to extremely dangerous levels in our society, but I think that most Americans never believed that it would actually cause such an eruption. It has been heartbreaking to watch Americans fighting Americans, and I wish that all of our politicians would come together and form a united front in calling for an end to the violence. Instead, they just keep blaming one another, and things just continue to escalate.

And when I use the word “escalate”, I am not exaggerating one bit. There are more than 100,000 gang members living in the city of Chicago today, and according to the FBI, 30 gangs in the city “have made a pact” to shoot any police officer that draws his or her weapon in public…

A federal intelligence alert from the FBI field office in Chicago, Ill., warned that about 30 gangs in the city have made a pact to shoot police officers if they draw their weapons in public, ABC 7 reported on Monday.

Can you imagine what police officers in Chicago must be feeling right now?

I hope that they are well paid, because they are literally risking their lives on a nightly basis. This new intelligence report specifically said that these gangs have agreed to “shoot on-sight” any officer that draws a weapon, and the purpose of this violent pact is “to garner national media attention”…

The alert states that Chicago gangs have agreed to “shoot on-sight any cop that has a weapon drawn on any subject in public.”

“Members of these gang factions have been actively searching for, and filming, police officers in performance of their official duties,” the alert continues. “The purpose of which is to catch on film an officer drawing his/her weapon on any subject and the subsequent ‘shoot on-sight’ of said officer, in order to garner national media attention.”

Of course a lot of people have been shooting at Chicago police officers already. According to Chicago police superintendent David Brown, the number of CPD police officers that have been shot at this year has already smashed the all-time yearly record…

According to CPD Superintendent David Brown, there is an overall “sense of lawlessness” felt by local police, and the ‘danger to police officers is real and increasing.’

“I think it’s bigger than a suggestion,” said Brown. “I think 51 officers being shot at or shot in one year, I think that quadruples any previous year in Chicago’s history. So I think it’s more than a suggestion that people are seeking to do harm to cops.“

It is so sad to watch Chicago descend into complete and utter lawlessness.

Each weekend, the violence in Chicago makes national headlines, and last weekend was no exception. 50 people got shot, and that included “a mass shooting at a pancake house”…

Brown, now more than four months into his tenure, did not mention the grim milestone while talking to reporters. He also did not dwell on the toll from the weekend: at least 10 people killed and 40 others wounded by gun violence that included a mass shooting at a pancake house on the Far Southwest Side. A man died and four others were wounded as diners with children scattered.

In a little more than three hours beginning around 2 a.m. Sunday, Chicago police responded to 10 separate shootings, including three homicides and an attack on two officers who exchanged gunfire with an armed teen. All three were wounded.

In Portland, we are witnessing a different sort of chaos.

Political protests have been rocking the city on a nightly basis for three months straight, and on Monday night the protesters decided to target the mayor’s house…

Protesters in Portland gathered outside Democrat mayor Ted Wheeler’s apartment Monday night to ‘celebrate’ his birthday by letting off fireworks and singing ‘happy tear gas to you’.

A fire was lit in the street outside the 58-year-old’s apartment block in an upmarket area in the north of the city, as around 200 people gathered while blasting music, sounding horns, banging pots and pans, and playing drums.

This is a perfect example that shows why the violence is not going to end no matter who wins the election in November.

Ted Wheeler is not a Republican.

He isn’t even a moderate Democrat.

In fact, he is one of the most far left mayors in the entire country.

But they targeted his home anyway.

As I detail in my new book, so many people warned us in advance that tremendous rioting, looting and violence would erupt in our major cities. In some instances, these explosions of anger are being fueled by political unrest, but in other cases we are seeing acts of violence that are completely and utterly mindless. A perfect example of this is an incident which just took place in Baltimore…

Video emerged Monday on social media showing a man crossing a street and another man sneaking up behind him and slamming him in the back of the head, which resulted in the victim falling face-first to the sidewalk.

Just before the victim was hit in the head, a voice — presumably from one of the people recording the video across the street — can be heard whispering, “bitch you bet’ not run.” After the victim falls to the sidewalk, at least two people can be heard laughing and hollering in response.

Video of this deeply disturbing attack has been posted on Twitter, and watching it made me incredibly sad.

How evil do you have to be to celebrate when some random person is knocked unconscious by a brick to the head?

I truly wish that the entire country could come together and agree to bring an end to the violence. But of course that isn’t going to happen. If anything, societal tensions are likely to get even higher as we approach election day in November.

It should deeply grieve all of us when we see Americans fighting Americans. There is so much anger and hatred all around us, and any nation that becomes utterly consumed by anger and hatred has no future.

Ultimately, what we really need is to learn how to truly love one another, but unfortunately that is not a very popular message at all these days.

via ZeroHedge News https://ift.tt/3bj1DmO Tyler Durden

Facebook May Soon Prevent Australian Users From Sharing News On Its Platform

Tyler Durden

Wed, 09/02/2020 – 17:45

Facebook is now threatening users and publishers in Australia, saying they could be blocked from the platform as a result of a proposal in the country that would force big tech to pay for carrying the content of newsgroups.

Facebook would “reluctantly stop allowing publishers and people in Australia from sharing local and international news on Facebook and Instagram” if the legislation becomes effective, according to FT.

The company wrote in a statement: “This is not our first choice — it is our last. But it is the only way to protect against an outcome that defies logic and will hurt, not help, the long-term vibrancy of Australia’s news and media sector.”

Meanwhile, Australia looks like it has no intent of backing down. Josh Frydenberg, Australia’s treasurer, said: “Australia makes laws that advance our national interest. We don’t respond to coercion or heavy handed threats wherever they come from.”

The move comes after years of criticism social media platforms have faced about their ability to influence elections. Governments in places like Spain and France have already put into effect similar proposals.

The Australian legislation could pass as soon as December and seeks to make Google and Facebook pay news publishers for content and to address what it calls the “fundamental imbalance in bargaining power between digital platforms and news providers”. It also includes language set up to prevent Facebook and Google from discriminating against Australian news providers.

According to Rod Sims, chief executive of Australia’s competition regulator, this means all international news would have to be removed from Facebook and Google’s platforms. “First of all, you have to think what would Google Search be if it had no news at all? I think Google Search would be much diminished,” Sims said.

Google responded: “That means we’d have to undertake a mass cull of content globally to stop them being visible to Australians — we’d have to remove all foreign newspapers, bloggers, YouTube citizen reporters, but also sports reporting, discussions of global health issues, tweets about current events, and literally endless other types of content from all sources around the world.”

It continued: “The country presumes that Facebook benefits most in its relationship with publishers, when in fact the reverse is true.”

via ZeroHedge News https://ift.tt/3hUsRTh Tyler Durden

Will You Choose Freedom?

Tyler Durden

Wed, 09/02/2020 – 17:25

Authored by Stacey Rudin via The American Institute for Economic Research,

In George Orwell’s classic dystopian novel “1984,” protagonist Winston wonders whether he is the only person who retains a real memory and doubts the narrative of The Party. He has no way to find out whether everyone else truly believes the government-revised version of history, or simply acts like they do; discussing such matters is verboten, punishable by vaporization: deletion from history. Fortunately we are not quite at that point in the United States — no one has yet been vaporized.

However, we seem to be imprisoned by the force of social disapproval just as surely as Winston was imprisoned by the threat of instant death. Millions of lockdown opponents won’t make their position known even to their closest family and friends; taking a position publicly is unthinkable — they would lose social standing, clients, and possibly even their jobs. Thanks to this dynamic, the pro-lockdown crowd enjoys the appearance of majority consensus, and everyone gets…more lockdown.

If we all spoke freely, the result would be different. We are allowing social dynamics to control us by dictating which opinions are “acceptable.”

This creates two distinctly misguided groups:

one made up of people who hold secret views and behave inauthentically in order to please others, harboring secret resentment;

the second believing it is larger and more powerful than it actually is. This false reality is not good for anyone. Believing you have legitimate support when you have only silenced dissent with intimidation is a great way to drive yourself off of a cliff.

Opinions must be freely expressed and properly dealt with to ensure good decisions are made. What this demands of us is the courage to speak even when our views are unpopular; to listen even when we would rather not hear; and to stop reflexively disregarding people who disagree with us as inherently defective. This country is built on free competition and debate, on checks and balances, on diversity of background, experience, and viewpoint. It is through resolving conflicts that we achieve justice and find equilibrium. Pretending we have no disagreements so we can avoid confrontation is a cowardly relinquishment of freedom without a fight. It betrays the American spirit.

In 1978, Gulag survivor Aleksandr Solzhenitsyn gave a speech, “The World Split Apart,” in which he predicted an impending crisis in the Western world due to its excess of comfort and prosperity.

“The Western world has lost its civil courage, both as a whole and separately . . . Such a decline in courage is particularly noticeable among the ruling groups and the intellectual elite. Should one point out that from ancient times declining courage has been considered the beginning of the end? Even biology knows that habitual, extreme safety and well-being are not advantageous for a living organism. Today, well-being in the life of Western society has begun to reveal its pernicious mask . . . The next war (which does not have to be an atomic one and I do not believe it will) may well bury Western civilization forever.”

Democracy lives or dies based on the characters of the people that comprise it. In centuries past, those who fought to build this country learned lessons about the value of freedom the hard way and passed down their wisdom: “Those who would give up essential liberty, to purchase a little temporary safety, deserve neither liberty nor safety.” We didn’t heed the warning. We just willingly sacrificed the Constitutional rights they fought for in order to hide from a virus with a 997 out of 1000 survival rate.

Many who were disquieted by the widespread elevation of fear into virtue never said a word due to concern over “looking bad,” hoping someone else would step up to fight against the absurd new moral construct calling good, hardworking people murderers if they won’t sacrifice their entire lives and livelihoods for an indefinite period. It is hard not to see ourselves in Solzhenitsyn’s observation:

“A fact which cannot be disputed is the weakening of human beings in the West while in the East they are becoming firmer and stronger…We [in the East] have been through a spiritual training [producing] stronger, deeper, and more interesting characters than those generally produced by standardized Western well-being.”

We got away with our lack of character-building challenges for quite awhile, but when “disaster” struck it laid us bare. We met the enemy, and he is us. We can’t deny our puny, pathetic fear of suffering and dying — or, worse, our fear of a lack of control over dying. We are used to having control. We are never forced to face our vulnerability because prosperity protects us. But now, that prosperity has become its own character-development exercise. We will have to learn the hard way, just like our ancestors, that freedom places demands on us. That any “land of the free” must also be a “home of the brave.”

We really must insist on a society where multiple opinions, including political opinions, are allowed and respected. The alternative is tyranny. In elite communities, social acceptance is ever more conditioned on perfect agreement with the “liberal” political view, even when the “liberal” party betrays liberalism by imposing endless, abusive restrictions on liberty. It helps none of us to participate in this facade of unified agreement. It focuses our energy on social climbing and amassing power over improving society. “We all agree, so our opponents must be stupid and bad people! Let’s GET them!” Winning and warring becomes the focus; hatred the order of the day — all because of the absence of an openly-stated alternative view.

This has gotten so bad that currently, installing “the right” yard sign is sufficient to prove you are a good person. If your neighbor were brave enough to install an opposing sign, it would mean he’s a bad person — the two of you would stop speaking. You might tell your friends you live next door to a Neo-Nazi, and you’d tsk-tsk together. His sign might be stolen or vandalized—and you’d secretly be happy that your views are “winning,” never worrying that in this atmosphere, destruction of his property could be coming next. (Your property will be safe, after all.)

While your yard sign is supposed to mean you are a good and kind person — “Hate Has No Home Here” — your team is the one destructing property and stifling alternative views, and you won’t even accept your neighbor in your life unless he agrees you can never be wrong. When the election happens and your neighbor’s politician carries the day, you become convinced that “his team” must have cheated. We can imagine the rest.

This one-opinion-allowed atmosphere is not freedom. It is fascism, as defined by Madeline Albright:

“a fascist is someone who claims to speak for a whole nation or group, is utterly unconcerned with the rights of others, and is willing to use [any] means necessary to achieve [his or her] goals.”

This is an attempted erasure of individuality; an insistence on conformity which would be alarming to classic liberalist John Stuart Mill, who famously wrote:

“the only purpose for which power can be rightfully exercised over any member of a civilized community, against his will, is to prevent harm to others.”

Mill’s is a principle to build a society on. We are doing the opposite today.

The only way to counter our current suppression dynamic is for each of us to get out there and say what needs to be said, to whoever needs to hear it, no matter how much wannabe fascists may hate you for busting up their facade of superiority. The alternative is to become their prisoner: “care about what other people think and you will always be their prisoner.” The choice is yours: betray yourself, or betray the person trying to dominate you. Choosing the former is is a symptom of the weakening of character referenced by Solzhenitsyn; the latter is a sign of strength and fighting spirit. If you don’t agree with lockdown, you should shout it from the rooftops — and never back down. If you don’t step up, you may soon find yourself living in an authoritarian state, and when that occurs, you can only blame yourself. You voluntarily traded in your freedom for a little temporary safety. You wanted “to be liked,” so you gave away your most precious asset: liberty.

“From this instant on, vow to stop disappointing yourself. Separate yourself from the mob. Decide to be extraordinary and do what you need to do — now.” ~ Epictetus

Many people think of freedom as the ability to do “what you want,” whatever feels good in the moment, and the ability to conform other people to their desires. However, this external focus makes you a slave to your most immediate desires and aversions — you are controlled by your own frustration and fury when something you dislike comes to pass. True freedom comes not from controlling outcomes but from accepting them; from understanding our own limitations.

Lockdown advocates accept nothing: they firmly believe they can dominate this virus, even though it took 200 years to eradicate smallpox, and influenza is still not controlled even with drugs and a vaccine. They are such slaves to the illusion of control that they have descended back into darkness, forsaking the science of herd immunity in favor of miracle cures (lockdown, masks) and faith healers (politicians). The lockdown masterminds knew just how to exploit this ingrained trait: they knew we would behave like Skinner’s superstitious pigeons.

“A pigeon is … put into a cage. A food hopper may be swung into place … so that the pigeon can eat from it … If a clock is [set] to present the hopper at regular intervals with no reference whatsoever to the bird’s behavior, operant conditioning usually takes place. The bird tends to learn whatever response it is making when the hopper appears. The experiment might be said to demonstrate a sort of superstition. The bird behaves as if there were a causal relation between its behavior and the presentation of food, although such a relation is lacking.”

The pigeon believes it can control automatic food delivery; we believe we can control infectious disease epicurves. There is no difference. We are attributing agency to natural events — an evolutionary mechanism ripe for exploitation, particularly once we are scared. The truth is that every epidemic in history has followed the same path, the path to herd immunity, and we cannot change that endpoint for this epidemic or any other. When we delude ourselves otherwise, we give over our wellbeing to politician “saviors,” who give us authoritarianism.

We are begging for tyranny and a police state, all because we cannot accept our lack of control over viruses and billions of other people. Prior generations took this lack of control for granted. They never conceded to lockdown, but we did without even a debate. Having never been genuinely challenged, and accustomed to exercising choices and controlling outcomes, we believed we could first stop death, and then magically return to our free and ordered lives as soon as we wished it. Instead, we lost both our safety and our liberty.

“By accepting life’s limits and inevitabilities and working with them rather than fighting them, we become free. If, on the other hand, we succumb to our passing desires for things that aren’t in our control, freedom is lost.” ~ Epictetus

Lockdown could end today if all world leaders could be as honest as Norway’s and still retain hope of re-election: “I probably took many of the decisions out of fear. Worst-case scenarios became controlling.” Unfortunately, the media jumps on every suggestion of imperfection in the public figures it dislikes as confirmation they are irredeemable. “Top epidemiologist admits he got Sweden’s COVID19 strategy wrong!,” screamed the headlines when Anders Tegnell said he would be happy to learn about strategies used effectively by other countries to keep COVID19 out of nursing homes. Tegnell immediately clarified the media’s perversion of his statement, but the damage had been done: to this day, lockdown advocates gleefully declare “Sweden already admitted it made a mistake!” This is belied by Sweden’s failure to change course in the intervening months, but they do not notice: having concluded Tegnell is a “mistake-maker,” they pat themselves on the back, dismiss him, and move on.

They are fundamentally misguided. As Epictetus said, “the impulse to blame something or someone is foolishness, there is nothing to be gained in blaming, whether it be others or oneself.” A willingness to admit to imperfection in self and others is a sign of strength, not weakness. Socrates knew that he was intelligent because “I know that I know nothing.” People willing to acknowledge inherent human vulnerability take more risks, and earn more rewards — ala Tegnell, whose nation has lower per-capita mortality in 2020 than it did in 2015, orders of magnitude lower than heavily locked-down areas like New Jersey and Michigan.

While he has not yet been recognized for his heroic integrity, Tegnell already won: you can’t hide from facts. His decisions have already been vindicated, and his example proves the benefits of exercising essential freedom. He wasn’t held back by a fear of “looking bad” and needing to be perfect, which led to a good result for everyone — the greatest good for the greatest number.

We should free all of our leaders to behave this way by ceasing to blame them for natural disease outcomes, and thereby free ourselves from interminable lockdowns.

via ZeroHedge News https://ift.tt/2F0TKpO Tyler Durden

China Slams ‘False & Biased’ Pentagon Report Warning Chinese Nuclear Arsenal To Double

Tyler Durden

Wed, 09/02/2020 – 17:05

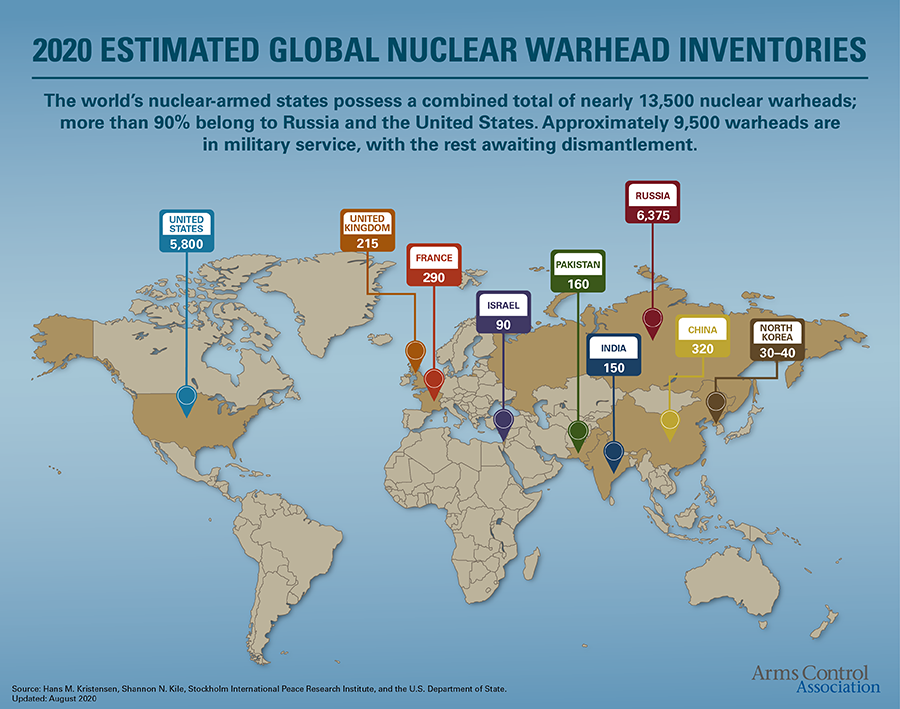

China has vehemently rejected a new Pentagon report released Tuesday that forecasts the communist-run country will at least double its number of nuclear warheads over the next decade.

“Over the next decade, China’s nuclear warhead stockpile — currently estimated to be in the low 200s — is projected to at least double in size as China expands and modernizes its nuclear forces,” the Pentagon stated in its annual report on Chinese military capabilities.

The report said China could do this based on its currently available nuclear material, and further that numbers of warheads for intercontinental ballistic missiles capable of threatening the US is “expected to grow to roughly 200 in the next five years.”

This is the first time the Pentagon has issued a specified numerical prediction related to China’s nuclear program. If accurate, this would mean that by the end of 2030, the PLA’s nuclear warhead arsenal would soar past 400 or 500 – still very far behind American and Russian arsenals – which each having well over 3,500 active nuclear warheads.

China’s foreign ministry on Wednesday slammed the report as full of “bias” and inaccurate information.

Arms Control Association has put the total number of China’s nuclear warheads at 320, compared to America’s significantly higher 3,800 stockpiled warheads.

Congress is currently debating a pending $700 billion defense authorization bill, also as Beijing has consistently rejected invitations to join three-way disarmament talks with the US and Russia, as the latter two attempt to keep the New START nuclear arms reduction treaty alive.

via ZeroHedge News https://ift.tt/32ToIbE Tyler Durden

Highway To Hell

Tyler Durden

Wed, 09/02/2020 – 16:45

Submitted by The Swarm Blog,

In March, Bill Ackman made a stunning comment on CNBC, when he said “hell is coming”. However, a few days after that, we learnt that Pershing Square had finally gone all-in on US recovery. Even if his degree of dishonesty was stratospheric, Ackman could be finally right about what is coming from an economic perspective.

To be clear, the US economy may enter a depression soon. And there are many reasons for that.

The first reason is the fact that financial risks have risen to a record level. Do not get confused by the stock market rebound: the Nasdaq mania is not the anticipation of a strong recovery. It is the preliminary sign of a coming financial disaster that is likely to destroy household’s confidence for good.

The inevitable crash that will occur sooner or later could be one of the worsts crises since the 1929 crash, and perhaps since the burst of the South Sea Company bubble. What people fail to understand, is that the big tech mania is likely to lead to a massive funnel effect.

First, the level of concentration is at a record level as everyone is rushing to buy the same technology shares or large cap ETFs (see To Be Passive is to Let Others Decide for You). Second, short volatility bets are a big threat, as many investors (especially structured funds) believe that selling puts has become risk-free thanks to the “Fed put” (see Stranger Things). Last but not least, more and more traders are now buying short-term out of the money call options, forcing market makers to hedge their books buying index futures or stocks.

Needless to explain why this “concentration + short downside volatility + gamma squeeze” cocktail is highly explosive. When it reverses, or at least when the tech bull run stops, then you may expect a record volume to the downside. Everyone will become a seller of the same securities: retail traders, ETFs, options sellers, market makers, and every trend follower on Earth.

In other words, most investors or traders might be trapped in a room on fire with one small exit door.

The economic impact of such a crash might be devastating as the American financial system is already under perfusion.

In my opinion, if it happens, then the Federal Reserve is likely to fail too, as the Banque de France did during the 18th century. Zero interest rates and infinite QE have already been implemented. What could be heavier than that? Equity QE? At this point of the bubble, the US central bank may have already lost control, which means that a financial collapse might be unstoppable.

Besides, beyond the terrible impact of Covid-19 pandemic and months of lockdowns, it is important to understand that Western economies are structurally ending an economic super cycle (i.e. a Kondratiev wave), as evidence by slowing GDP growth rates for the past three decades. First, because of ageing population that has led to deflationary pressures and lower revenue growth. Second, because the Chinese boom is over.

The importance of China on US economy has always been underestimated. Hu Jintao stimulus plan in 2009 had been one of the main drivers of the world post-Lehman recovery. However, he was severely criticized by his successor Xi Jinping who claimed that such measures were responsible for China’s financial imbalances.

Today, Chinese authorities say that they have opened a new era, evolving toward a lower but “more sustainable” growth model. Moreover, China is also willing to become more independent from an economic and financial perspective. Therefore, you should not bet on a massive stimulus plan from the PRC that would save the US economy. Especially after years of so-called “trade war” and aggressive remarks by the Trump administration.

To summarize, the Fed already went all-in, huge amounts of debt have been added, defaults and bankruptcies are rising, China is no longer willing to support the ”best economy ever”, and the political picture of America is a giant mess. Thus, all that remains is a virtual wealth effect driven by a market that has become an old-school casino.

Please bear in mind that economic systems and capital markets are complex systems. They are driven by nonlinear dynamics and self-organized criticality. Everything looks fine, until it is not. Beyond a certain point, that we may not be able to measure precisely, the fragile order of those systems is likely to be suddenly broken. Risks do not matter, until they do significantly. There will be no additional warning, as well as no turning back. This is how nature works.

Who remembers this French movie scene? “It’s about a society on its way down. And as it falls, it keeps telling itself: ‘So far so good… So far so good… So far so good.’ It’s not how you fall that matters. It’s how you land.”

via ZeroHedge News https://ift.tt/2EQeVLG Tyler Durden

81 Scientists Back Biden After He Commits To Shuttering Economy If Advised… By Scientists

Tyler Durden

Wed, 09/02/2020 – 16:24

81 Nobel laureates – scientists who should, in theory, be apolitical – have endorsed Democratic presidential nominee Joe Biden in his bid for the White House, according to The Hill.

In an open letter released on Wednesday, the scientists praised the former Vice President for his “willingness to listen to experts,” after Biden said he would ‘shut down the US‘ if scientists told him to.

The signatories represent the largest group of Nobel laureates to endorse a candidate for office, according to the Biden campaign.

“At no time in our nation’s history has there been a greater need for our leaders to appreciate the value of science in formulating public policy,” their letter reads.

“During his long record of public service, Joe Biden has consistently demonstrated his willingness to listen to experts, his understanding of the value of international collaboration in research and his respect for the contribution that immigrants make to the intellectual life of our country,” they added. –The Hill

The letter is reminiscent of the 70 Nobel laureates who endorsed Hillary Clinton in 2016, while 76 endorsed Barack Obama in 2008.

Rep. Bill Foster (D-IL) – which The Hill notes is the only physicist in Congress, organized the Nobel winners for Biden’s endorsement, according to CNN.

Perhaps it’s worth noting that Pew found in 2009 that at least 81% of scientists are Democrat or lean left.

Or, maybe they just like Biden’s amazing IQ?

via ZeroHedge News https://ift.tt/3hSPBTB Tyler Durden

S&P Reaches Critical Resistance, Valuation At Record High As Liquidity Crashes

Tyler Durden

Wed, 09/02/2020 – 16:00

The S&P 500’s P/E multiple just broke above the all-time highs from the dotcom bubble…

Source: Bloomberg

As the S&P 500 reaches a critical resistance level…

Source: Bloomberg

And the record surge higher in stocks is occurring as liquidity crashes to record lows…

Source: Bloomberg

Nasdaq from +1.3% to -1% to +1.0% – Composite broke above 12,000 today. The Dow and S&P massively outperformed today with a massive panic-bid all afternoon…

“Party On Dudes!”

AAPL was down $170BN today, more than an ‘Exxon’…

TSLA tanked for the second day in a row…

After the carmaker became more valuable than 18 other automakers in the U.S., western Europe and Japan combined…

Source: Bloomberg

Bonds were mixed today with the long-end bid and shorter-end (out to 5Y) flat, but this has erased the entire post-Powell “inflation is coming, inflation is coming” speech spike in yields…

Source: Bloomberg

So much for the end of the bond bull market…

Source: Bloomberg

The dollar rallied today, extending yesterday afternoon’s surge…

Source: Bloomberg

The Ruble tumbled after German claims that “worst military grade nerve agent ever” was used to poison Navalny…

Source: Bloomberg

Bitcoin was rejected at $12k again…

Source: Bloomberg

And Ethereum could not quite make it to $500…

Source: Bloomberg

Oil plunged today rejected at $43 once again (on Russia production and Nalvany headlines)…

Dollar’s gains took the shine off gold today…

Real yields continue to suggest gold goes higher…

Source: Bloomberg

Silver futures too, having tagged $29…

Finally, uncertainty around the forthcoming election has never been so extremely priced into vol markets. With betting markets now seeing Trump back in the lead over Biden…

The volatility curve is pricing is massive relative and sudden risk around the election period…

Source: Bloomberg

As Bloomberg macro strategist Cameron Crise notes, “in the history of the VIX futures contracts, we’ve never had an event risk command this sort of premium into forward-dated vol at a specific tenor.”

“That obviously suggests that markets anticipate some pretty incredible fireworks.”

The spread between October and November VIX futures is also wide at about -1.7 instead of about 0.2, which history suggests it should be based on the level of the spot VIX, according to Crise. Of course, none of this vol disturbance has held back stocks.

Source: Bloomberg

Today’s all-time-high in the S&P 500 was accompanied by the highest level ever for VIX at an all-time high stock print…

Source: Bloomberg

But we give the last words to Liberty Blitzkrieg’s Mike Krieger:

“Today is one of the most bizarre days in the stock market I can remember and that’s saying a lot…”

We’d say that about sums things up in general everyday!

via ZeroHedge News https://ift.tt/3lFGHuW Tyler Durden

Robinhood Faces SEC Probe For Misleading Customers About HFTs Frontrunning Their Orders

Tyler Durden

Wed, 09/02/2020 – 15:52

A few months ago, we published an amusing account of how the Ken Griffin-owned HFT firm Citadel sicced its army of white-shoe lawyers on Zero Hedge after we dared to explain to our audience exactly why RobinHood – and now its discount brokerage predecessors, all of whom have followed RH’s lead and abandoned trading fees – can afford to charge its clients nothing: Because the company takes all of that retail order flow and auctions it off to the highest HFT bidder, enabling them to profit by – and we want to be very careful with our language here – “trading ahead of customer orders,” a practice otherwise known as “front-running”.

With so many mom-and-pop traders parlaying their stimulus checks and enhanced unemployment benefits in the stock market, our warnings were promptly ignored (hardly a surprise – nobody cares when things are going good).

But as the S&P 500 roars to yet another record high – accompanied this time by a disconcerting rebound in the VIX – WSJ reports that the SEC is almost ready to slap Robinhood with a $10 million fine for failing to disclose to its customers exactly how their order flow would be packaged and sold to the HFT firms.

To be sure, a deal likely won’t come this month – and the fraud investigation is ‘civil’ in nature.

Of course, as one twitter user pointed out, the fine is just another slap on the wrist, before everybody carries on with business as usual.

Robinhood will get a little fine and biz as usual will continue.

— Zr1Trader (@ZR1Trader) September 2, 2020

That is, until the music stops.

via ZeroHedge News https://ift.tt/3jBsOw3 Tyler Durden

Creating Perverse Asymmetries To Extort The “Little Guy”: The Special “Screw You” Of Junk Bond Bailouts

Tyler Durden

Wed, 09/02/2020 – 15:35

Authored by Charles Hugh Smith via OfTwoMinds blog,

LENDING is now the sucker’s game.

Editor’s note: This is a guest post by my friend and colleague Zeus Yiamouyiannis, Ph.D., who has contributed essays to Of Two Minds since 2009.

This is part 3 of a 5 part series entitled When the World Market Itself Is Fake, Economic “Value” Loses Any Real Meaning.

So this is the program: Devalue or deflate everything owned by the “little people”, buy it up for pennies on the dollars with unlimited free money, and attempt to use this massive financial asymmetry between the super-wealthy and the ordinary to manipulate markets back upward through artificially goosed “demand” backed by empty, cheap-money purchasing power.

Big banks only care about low interest rates so it can be gentleman-“lent” (i.e. given) to big corporations with huge fees attached (a major source of profit). Won’t that make lending impossible and unworkable to mom-and-pop businesses, etc.? Isn’t lending a big part of Big Bank business?

Answer: Less and less! Credit unions and smaller banks make lending a big part of THEIR business, but now less than half of Big Bank business and profit comes from lending money to the little people.

Big banks make more and more of their big money through manipulation of assets and gambling in the market and in investment and insurance scams confirmed and accelerated from 2008 onward. And why wouldn’t they? They can afford to gamble on higher return risks indefinitely (they think) because they will always be backstopped, no matter how immoral or even criminal their behavior. Too big to fail, too big to jail has become not just a mantra but a business plan.

The real world has been severed from the minds and wallets of the elites for some time, at least since 2008, and arguably since Reagan in the early 1980s… and they’ve gotten away with it now for four decades. Have they used up stores of wealth or extracted them in a predatory, unbalanced manner? You bet! Have they gotten away with it, and continue to be rewarded more richly with each audacious theft and transfer of wealth? You bet!

It is simple psychology and blindness created by self-interest over and against a collective interest. These so-called cheating “elites” no longer think they have to pay attention to the vast majority of the world’s population (even though they should, and this will eventually come to bite them).

I predict this plays like a Sylvester and Tweety cartoon. Think of Sylvester teasing and ridiculing the brutish bulldog on the chain (much like the traders who called honest investors they took advantage of “muppets”– recall that?).

This works until the bulldog is no longer chained, and then there is hell to pay. This chain comes off when the rip-offs are so ridiculous and arrogant that you get a full-on revolt.

Big banks and global elites will continue to extrapolate and chase ever more gaudy returns by manipulating asset prices (esp. stocks) upward, in a way that is disconnected completely from the markets and in a way that savages the stores of wealth of ordinary people. Zero to negative interest only add grease to the rails and fuel to the fire.

What can you look toward as a ‘canary in the coal mine’ indicator of when things will go south in the equities market? My bet: Junk bonds and junk bond ETFs may well serve as the internal black swan to this teetering mafia-like financial enterprise. Junk bond markets are a special kind of crazy right now, but they follow an oddly transparent logic of manipulation when you look at them closely.

Evidence #1? On April 9, 2020 for the “first time in its 107 year history” (Counterpunch) the Fed changed its terms and bought junk bonds, bailing out at the trashiest level yet, the deceits of the big players, particularly private equity firms.

This chart from Counterpunch shows the effects of this insane enabling.

What did this predictably teach insolvent companies and private equity firms? If the lowest of the low are being rescued, then it’s a sure bet that ANY company with a sizable footprint in the market will be rescued.

Evidence #2: There is an exponential rise in the Fed’s free backstop/money-printing program for zombie companies like Carnival Cruises. In short, it’s feeding time at the zoo for financial predators and scavengers.

According to Wolf Richter’s August 26, 2020 blog, The Zombie Companies Are Coming:

In the second quarter, companies that had been taken over by private-equity firms issued over $31 billion in junk-bonds, the highest level since 2014, according to Dealogic. The third quarter is on the same track: In July, companies owned by private-equity firms issued $10 billion in junk bonds… And it goes far beyond private equity firms….

Carnival, the largest cruise-ship operator, with a deep-junk credit rating of triple-C, and whose revenues collapsed to near nothing as all its cruises have been canceled, while the restart of its cruises gets pushed out further and further, well, in early August, it sold its third bond issue since the Pandemic: $900 million in junk bonds, with a yield of nearly 10%.

Is this sustainable? Of course not, but I am almost certain this will be the short term reality.

The gaudy returns in specious value of stocks manipulated upwards (and whatever bets are placed on this movement, i.e. derivatives, swaps, etc.), will far outstrip whatever benefit or damage TO BIG BANKS (they don’t care about the broader economy) created by cratering the lending industry along with the savings of mom and pop.

Disaster capitalism has a long and lowly history among these guys, but it has always “benefited” them to make others feel pain and then use that pain to leverage their own positions, the “gun to the head” approach. Name one time in the last four decades this hasn’t worked? There has been substantial talk of the Fed backstopping the stock market by buying up stocks directly if needed, because now the financial markets are entangled in the equities markets.

LENDING is now the sucker’s game. You get paid back in inflated poor man’s dollars on an asset that has skyrocketed– the worst of both worlds, whereas BORROWING has the best of both worlds, cheap or free money to endlessly invest in limited assets, that by so investing pushes their prices even higher!

You see the twisted logic. Stick mom and pop with the consequences, people who have to make a real living in the real world, and use your manipulation of a fake world to extract real wealth, and create a cycle of concentration that keeps exchanging things of counterfeit value (derivatives, borrowed money) for things of real value (hard assets, businesses, etc. as private equity firms do) and then inflate the value of the real thing by artificially manipulating money supply.

This has been done for decades by private equity firms/leveraged buyout/corporate raiders. They profit HANDSOMELY by hollowing out the economy and creating stress and debt, which they take advantage of by breaking up these companies or allowing them to go bankrupt (after they’ve sold their shares) and by selling the chop-shopped parts. This same strategy will be waged at large to hollow out and ravage nations. There is nothing I can see that stands in the way of this obvious looting. Bernie Sanders would have, but Trump won’t and Biden has no history of standing in the way of looting. The people themselves will have to demand justice.

What will this justice look like? In the short term it’s going to mean, strategically refusing to patronize these zombie companies, and sticking strictly to locally-owned businesses, and getting involved on the local political and civic level to create forms of decentralized exchange, but that will be for a future essay.

What is the way out of this for the common person? Part 4 will discuss fighting and winning against the big bullies. Part 5 will discuss the 3 C’s –”Cash, Coin, and Community” as alternative forms of value and economy to guide an independent, non-predatory, non-parasitic, creativity-driven economy.

copyright 2020 Zeus Yiamouyiannis

Parts 4 and 5 will discuss healthy, pro-democratic, creative alternatives to the current rigged system.

* * *

My recent books:

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World ($13)

(Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print) Read the first section for free (PDF).

* * *

If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

via ZeroHedge News https://ift.tt/32Ul69H Tyler Durden