BMO: The Relationship Between Equity Vol And Financial Conditions Has All But Institutionalized The Powell Put

Tyler Durden

Wed, 09/02/2020 – 18:45

By BMO Capital Markets rates strategists Ian Lyngen, Ben Jeffrey and Jon Hill

The ability of 10-year yields to stabilize well above the 40-day moving-average of 62.7 bp offers solace to those expecting incremental gains toward higher rates to be the next theme in Treasuries. The overnight session also created an opening gap of note in 10s at 66.9 bp to 67.1 bp – subtle, but relevant as the market prepares for the upcoming series of jobs data culminating with Friday’s BLS report. NFP is a key input for the broader economic outlook, although it’s unlikely to change the prevailing macro narrative – at least not in a positive way. The midsummer resurgence of Covid-19 cases combined with the reality that the path to reopening the domestic economy has proven more challenging than most anticipated contributes to the collective sense that many firms will soon be forced to make difficult decisions regarding the viability of present business models and staffing levels. While this process had been delayed by the initial stimulus efforts on the part of Washington and the Fed, as the bailout programs run their course and the fiscal efforts are exhausted, the new normal (and all its uncertainty) comes into focus.

For its part, the Fed isn’t without options and comments from Brainard on Tuesday have garnered attention; specifically the transition from stabilization to accommodation. The notion that “With the recovery likely to face COVID-19-related headwinds for some time, in coming months, it will be important for monetary policy to pivot from stabilization to accommodation” is consistent with expectations from smarter minds than ours that the Fed will seek to increase the weighted-average-maturity of the current QE program. Suggesting this as another policy option isn’t new per se in light of what was learned from the July FOMC Minutes. Nonetheless, the most relevant takeaway is the Fed has additional accommodative measures readily available; even if such action may create a material challenge to the bear steepening trend that keeps threatening to accelerate.

For now, US rates appear content to consolidate in an all too familiar range with 10-year yields at 69 bp as stochastics edge right up against the midpoint of 50. The absence of strong technical extremes in the run-up to payrolls Friday establishes the groundwork for a relatively clean read in gauging the market’s response function to the jobs figures. Our expectations for the August data to be more market moving than the last few releases isn’t based on any particular skew higher or lower than the consensus, rather it’s in keeping with Powell’s comments on ‘the passage of time’ creating more economic clarity. The US economy is now far enough into the pandemic and expectations for the coming quarters are sufficiently refined that it follows intuitively that the pace of job creation (revival) seeing during Aug-Nov will level-set forecasts going into the final months of the year. There is little question winter is coming; because 2020 wasn’t bad enough already?

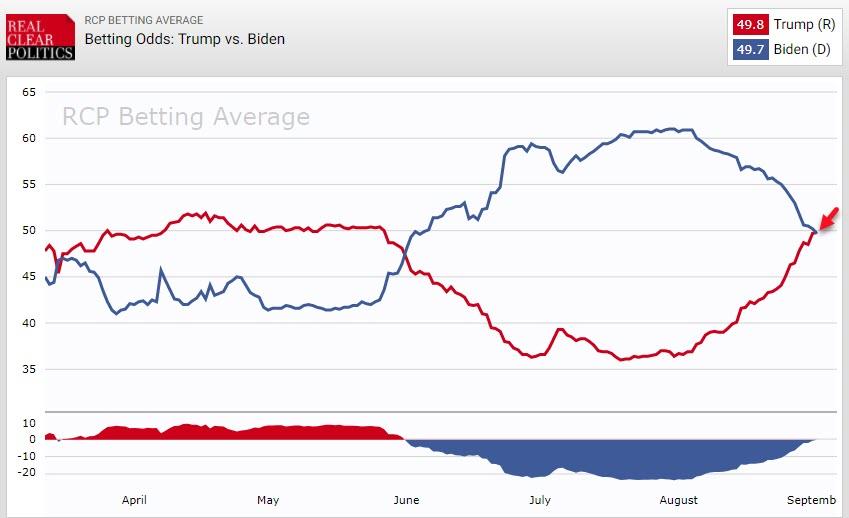

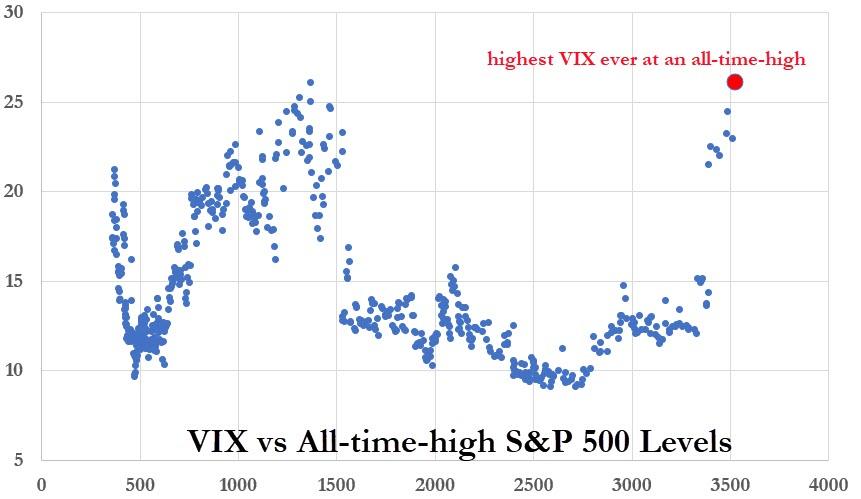

In the interim, the ongoing strength of the domestic equity market is challenging to ignore; try as we might. The overnight move saw S&P 500 futures establish a fresh all-time high at 3556 even as German retail sales disappointed and the media is focused on the newest round of Covid-19 flare-ups in the Midwestern states. In considering the event risks into year end, progress toward a vaccine remains the most relevant input for the direction of the economic outlook; although the phase III results can only go so far in reinforcing the optimism that continues to support risk assets and extend the sentiment that implies the resolution to the current episode will allow for the return of at least the semblance of the previous consumption, social, travel, and employment norms.

With that backdrop, this morning’s ADP will be meaningful in refining market expectations for the official BLS jobs numbers. The July performance (i.e. underestimating the actual private-NFP print by 1.295 million) will leave investors more cautious of taking the figures at face value. That said, if nothing else having the report in hand will clear the path to pricing to a consensus employment report in the typical fashion.

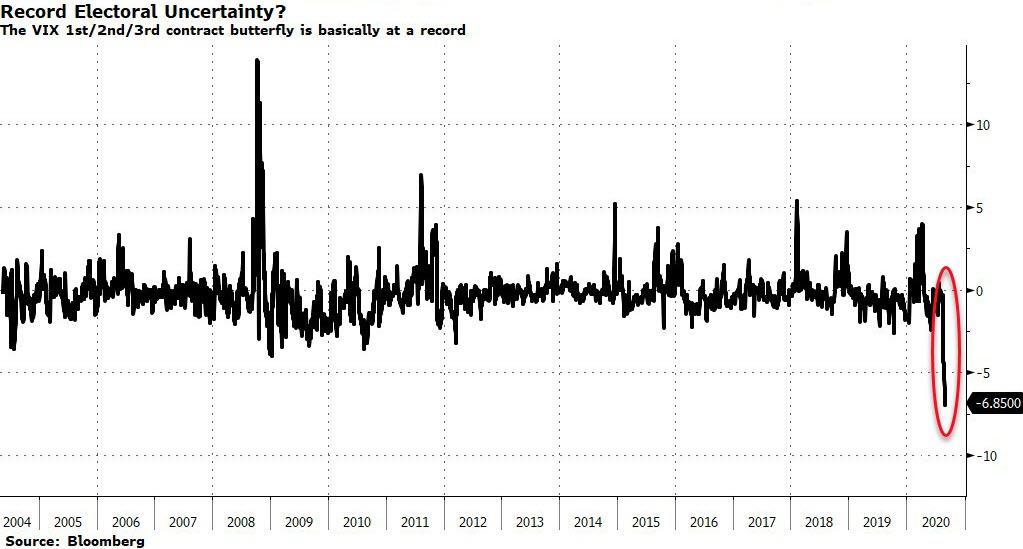

Tactical Bias

For the eighth [ZH: now ninth] consecutive session the S&P 500 reached all-time highs – a noteworthy development in any context, but especially remarkable given the rapidly approaching employment situation report in a global pandemic. We have once again reached a juncture when the data matters, and the paradigm of economic updates’ dismissal as stale information is in the process of shifting. This is a function of path of the pandemic and the fact that Covid’s resurgence in July and August will now be included in the new information. More generally, the transition to the new normal and ultimate pace of the normalization in the labor force will be the guiding themes for the balance of the year and into 2021. A high degree of uncertainty will remain a fixture of the outlook for the foreseeable future; so then why do risk assets continue to perform so well?

For evidence we’ll look to the rates market and Treasury yields that once again struggled to rise on Tuesday and a curve that further retraced last week’s steepening efforts. The juxtaposition of lower yields and higher stocks can be chalked up to the market’s faith that the Fed will not hesitate to offer additional accommodation in aggressive fashion. Said differently, the relationship between equity volatility and financial conditions has all but institutionalized the Powell put meaning that there is limited scope for risk assets to fall in the very near term. It is worth emphasizing that the speed of a correction matters, as a gradual repricing to more modest revenues and differed expansion plans holds far different implications than a 15% drop over just a few days. This is not to imply that reaction function will be put to the test because of ADP or NFP, but it does make the rally in equities a difficult one to fade just yet.

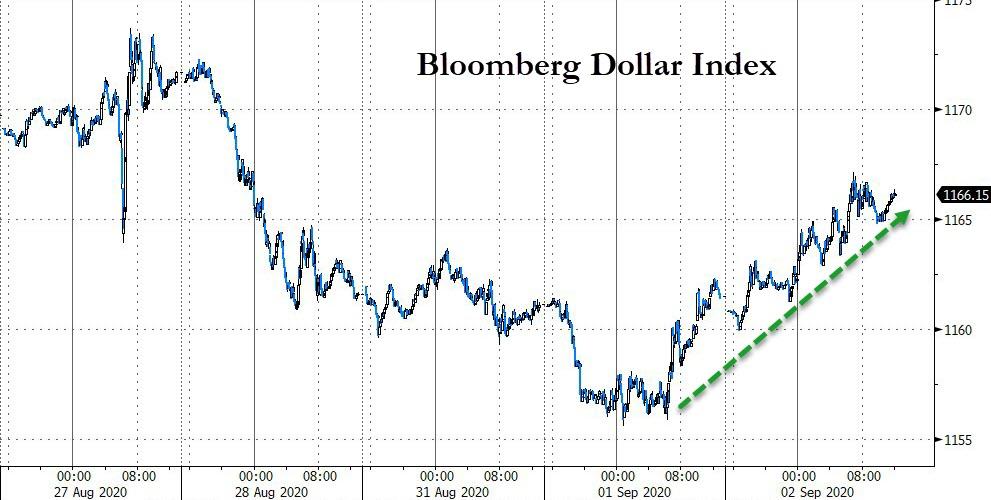

As another outlet for the Fed’s dovish efforts, the dollar weakened past 1.20 to the euro today for the first time since H1 2018. We’re of the mind that especially in FX, one country’s weaker currency is another country’s problem, especially as it relates to export-sensitive economies such as the euro area or Japan. The reality is that by the end of the year, there are few scenarios that could drive 10-year yields >1.50% but several where the USD-weakness trend and equity strength turn over. This isn’t to say that we expect the dollar to rebound sharply in the near term, rather it is a possibility with all the associated implications for aggregate financial conditions and the health of the recovery.

The moves in 5s/7s, while not as closely watched as 2s/10s or 5s/30s, gave some solace to our tactically motivated flattener. After reaching as steep as 23 bp, the fact that we’ve seen momentum move back from the cusp of oversteep and stochastics on the verge of crossing suggest there is greater room for the compression to extend. Our initial 20 bp target was just shy of being achieved on Tuesday, and in the event we see that level traded through, our next area of focus will be a local flat at 17.3 bp. In sticking with the tactical drivers of the trade and chatter of YCC moderating, we’ll be attuned to exit opportunities leading into NFP to avoid that economic event risk.

Finally, Wednesday will bring a heavier slate of Fedspeak than we’ve seen in recent months with Williams, Mester, and Daly scheduled to provide comments. All three will no doubt opine on the recent long-run framework shift, and we’re hard-pressed to believe that there will be anything but greater support for the evolution. The unanimous front has thus far proved effective in its reflationary ambitions, though it’s worth noting that we’re approaching a major technical inflection point for 10-year breakevens. For almost four months, 10-year BEs have drifted higher, on Monday testing the 1.82% level that has held on three separate occasions since May 2019. If the FOMC is going to be successful at re-establishing inflation expectations at a higher structural level, we’ll need to see a breach of this resistance in the near term, and an attempt at something more akin to the low 200 bp level. This will be a key question for the remainder of 2020.

via ZeroHedge News https://ift.tt/2Zhpr5R Tyler Durden