Via PrestonByrne.com,

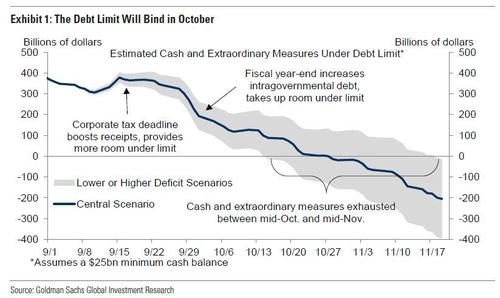

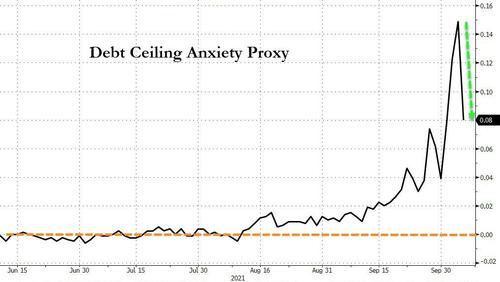

Much has been made lately of the possibility of minting a trillion dollar coin to avoid Congressional gridlock surrounding the increase of the debt ceiling.

To be blunt, this claim is horse puckey and pseudo-legal in nature.

Below I explain why…

The statute doesn’t authorize a trillion dollar coin

Congress grants authority to the Executive Branch all the time to do certain acts and promulgate certain regulations. It does this through Acts of Congress which delegate that authority to the Executive Branch.

Understanding what authority is granted, and its extent, requires us to read carefully the terms – the text – of the legal rules which govern the conduct of the Executive Branch. For example, in 2020-2021 the U.S. Centers for Disease Control and Prevention, or CDC, instituted an eviction moratorium which barred landlords of property subject to federally insured mortgages from evicting their tenants. It did so in reliance of a grant of authority from Congress.

As statutory authority for the moratorium, the CDC relied exclusively on Section 361 of the Public Health Service Act. See id. at 55,297. Enacted in 1944, this provision delegates to the Secretary of Health and Human Services the authority to “make and enforce such regulations as in his judgment are necessary to prevent the introduction, transmission, or spread of communicable diseases” across States or from foreign lands, 42 U.S.C. § 264(a), who in turn has delegated this power to the CDC, 42 C.F.R. § 70.2.

Section 361 reads in relevant part:

The Surgeon General, with the approval of the Secretary, is authorized to make and enforce such regulations as in his judgment are necessary to prevent the introduction, transmission, or spread of communicable diseases from foreign countries into the States or possessions, or from one State or possession into any other State or possession. For purposes of carrying out and enforcing such regulations, the Surgeon General may provide for such inspection, fumigation, disinfection, sanitation, pest extermination, destruction of animals or articles found to be so infected or contaminated as to be sources of dangerous infection to human beings, and other measures, as in his judgment may be necessary.

In a similar way, Congress also delegates authority to the Secretary of the Treasury to mint coins. The relevant provision for the “Mint the Coin” movement is sub-section (k) of 31 U.S. Code § 5112, which states in relevant part:

The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.

A number of adherents of an expansionary monetary ideology called “Modern Monetary Theory,” or “MMT,” and some of their friends in the media, including a pet legal academic of the movement who wrote a 75-page paper on the subject, appear to think that this statute authorizes the Treasury to mint a $1 trillion coin.

On a very cursory reading it certainly seems possible that this statute could authorize minting a $1 trillion coin, as long as the coin were a platinum proof coin. If this were the case, the Treasury could then sell to a prospective buyer and book the profits as general revenue, as indeed the Treasury does for all manner of proof coins and bullion that it issues and sells directly to the public on a regular basis.

Words have meaning, though, and I suspect the MMT crowd reading 5112(k) simply isn’t reading it carefully enough. This means that if someone “Minted the Coin” and that act were challenged, I don’t think a court would agree with them.

Let’s bounce back to Alabama Ass’n of Realtors (the CDC case) government claims of sweeping authority. In that case the CDC sought to argue that the language authorizing the Surgeon General to “make and enforce such regulations” as were necessary for the prevention of disease to authorize a nationwide eviction moratorium.

The District Court (with which the Supreme Court eventually agreed) found for the plaintiffs. Applying Chevron deference, the court first asked whether Congress had “spoken directly to the precise question at issue” – i.e., does the law in dispute do what the government says it does.

The Court found that it did not. The use of a list which governed the scope of the regulation the statute permitted – “inspection, fumigation, disinfection, destruction… and other measures” – limited the “other measures” that were allowable: such measures were “controlled and defined by reference to the enumerated categories before it,” an application of the so-called ejusdem generis canon of textual construction. The court therefore held that “[t]hese ‘other measures’ must therefore be similar in nature to those listed’”.

Put another way, the court looked to the actual text of the law and found that “[t]he national moratorium satsifies none of these textual limitations. Plainly, imposing a moratorium on evictions is different in nature” than inspections, fumigations, disinfections, etc.; and “[m]oreover, interpreting the term ‘articles’ to include eviction would stretch the term beyond its plain meaning.”

The second Chevron step is for the court to decide whether the agency’s interpretation of the statute is permissible. The CDC argued – as the “Mint the Coiners” do – that

“the grant of rulemaking authority…. is not limited in any way by the specific measures… Congress granted the Secretary the ‘broad authority to make and enforce’ any regulations that ‘in his judgment are necessary to prevent the spread of disease.’”

The court disagreed because, among other things,”[a]n overly expansive reading…that extends a nearly unlimited grant of legislative power to the Secretary would raise serious constitutional concerns,” and further that “courts ‘expect Congress to speak clearly if it wishes to assign to an agency decisions of vast ‘economic and political significance[.]”

Put another way, the doctrine that “Congress does not hide elephants in mouseholes.”

The Court concluded:

Accepting the Department’s expansive interpretation of the Act would mean that Congress delegated to the Secretary the authority to resolve not only this important question, but endless others that are also subject to “earnest and profound debate across the country.” Gonzales, 546 U.S. at 267 (internal quotation marks omitted). Under its reading, so long as the Secretary can make a determination that a given measure is “necessary” to combat the interstate or international spread of disease, there is no limit to the reach of his authority.

“Congress could not have intended to delegate” such extraordinary power “to an agency in so cryptic a fashion.” Brown & Williamson Tobacco Corp., 529 U.S. at 159. To be sure, COVID-19 is a novel disease that poses unique and substantial public health challenges, see Def.’s Cross-Mot. at 14, but the Court is “confident that the enacting Congress did not intend to grow such a large elephant in such a small mousehole.”

So as we we can see, even where the plain language of a law would appear to authorize the nearly unlimited exercise of power, the claim of unlimited power invites us to take – as the courts would take – a closer look.

This brings us to the question of what might happen if the Secretary of the Treasury decided to read Section 5112(k), the Platinum Coin rule, as granting a similarly broad authority to mint a $1 trillion coin, as the “Mint the Coin” crowd claims it does.

How that would end is anybody’s guess, but we can have some idea about how it would play out. First, a radical Treasury Secretary, likely with the support of a radical President, would decide that it’s no longer worth his or her time to deal with an uncooperative Congress on a debt ceiling increase. Then, the Secretary, listening to some MMT-schooled special advisers in the new administration, would mint the coin and dare someone with standing – whomever that might be – to sue.

Pleadings would follow, in which the government would get cute like the CDC did in Alabama Association of Realtors. In the meantime, the challenger would argue:

-

5112(k) is a law which enables the Mint to mint and sell two types, and two types only, of platinum curios: “platinum bullion” and “proof platinum” coins.

-

Trillion dollar coiners’ legal argument is that they believe 5112(k) allows them to mint, and circulate, proof coins to redeem U.S. outstanding debt.

-

The statute does not define “proof platinum” so we have to go with the term’s plain and ordinary meaning. The dictionary definition of “proof coin” in Merriam-Webster and the OED – means a collectible, a decorative thing, means a “coin not intended for circulation but struck from a new, highly-polished die on a polished planchet and sometimes in a metal different from a coin of identical denomination struck for circulation.” In the OED it means “special coins struck from highly polished dies mainly for collectors“, with one definition dating to 1949 pointing out that “Proof coins were never struck for circulation… Proofs were first used as presentation pieces.”

-

There is a definition of “proof coin” in 31 CFR § 92.3, but it isn’t expressed to govern the interpretation of Section 5112(k).

-

Applying the plain and ordinary meaning of “proof coin” to the statute, 5112(k) does not authorize the issuance of proof coins for circulation, even if it such coins are made of 100% pure platinum (although if valued by weight they could be sold as “bullion” – more on that below). The use of the term “Proof Coin” requires for proof coins to be sold with the intent of being curios or collectibles, not circulating currency.

-

“Circulation” means, in relation to currency, “the passing of something, such as money or news, from place to place or person to person.”

-

The Trillion Dollar Coin is clearly made with the intent of being placed into circulation, even if that circulation is initially very limited (to the Fed). It, or its series, is also not made with the intent of being produced mainly for collectors, if we want to use the English dictionary instead of the American one. There is nothing preventing the Fed from selling it to someone else for $1 trillion, and so on, in the same manner as any other coinage. This is especially the case if the money bears the inscription “this money is legal tender for all debts public and private,” as some prominent MMT promoters claim it should. To describe the “Trillion Dollar Coin” as a proof coin, to borrow from Alabama Ass’n of Realtors, would be to “stretch the meaning” of “proof coin” beyond recognition.

-

Using two of the most authoritative plain language definitions of “proof coin,” the Trillion Dollar Coin cannot be described as a “proof coin.” Therefore its production as a proof coin is not authorized by 5112(k).

-

Additionally, even if the Trillion Dollar Coin could be described as a “proof coin” (and, to be clear, it cannot, at least if two of the leading English-language dictionaries are to be relied upon), the fact that Trillion Dollar Coiners seem to think that the power is infinite – quadrillion, quintillion, whatever-illion are all in play, they claim – is problematic. Congress does not hide elephants in mouseholes, much as was the case with the CDC and the Public Health Act. If we look at the fullness of 5112(k) (enacted in 1996) and go through the Chevron two-step, it’s clear that Congress was authorizing the Mint to produce collectibles, and not authorizing the Treasury Secretary to assume wholesale control of U.S. fiscal and monetary policy, or create unlimited money for the government’s use in such a way as to arrogate to itself the power to singlehandedly resolve “earnest and profound debate across the country” over the statutory debt limit.

A reader asks:

On the subject of bullion: as I mentioned above, 5112(k) authorizes the manufacture and sale of two types of collectible – “platinum bullion” and “platinum proof.” Because the statute does not give us a definition of “platinum bullion,” we have to take the term at its plain and ordinary meaning. As a result, the “platinum bullion” language in 5112(k) isn’t readily cooperative with MMT funny business, which is why the MMT crowd’s argument is that the trillion dollar coin they want to strike is to be a platinum proof.

There are alternative price-setting regulations for gold bullion. MMT people think that these other regulations permit platinum bullion to be given a face value higher than the price of the metal used in the coin.

They are wrong.

The issue is that the regulations governing the sale of gold bullion aren’t expressed to apply to platinum bullion under 5112(k). They do not provide a definition of “bullion” for the purposes of 5112(k). .Indeed, they don’t define “bullion” at all – they just regulate its manner of sale, if it’s gold.

We are not entitled to read these provisions as saying things that they do not say. Absent a statutory definition of “platinum bullion” we must fall back to plain language. Bullion’s dictionary definition is “[precious metals] in bulk before coining, or valued by weight [after coining].” If the Mint could rustle up $1 trillion in platinum 5112(k) authorizes it to issue a (very large) $1 trillion coin, or more likely lots of smaller-denomination platinum coins. If it’s not valued by weight, and not substantially made up of platinum, I submit that it cannot be platinum “bullion” and would not be authorized by the “platinum bullion” language in Section 5112(k).

Moving away from “platinum bullion,” and before wrapping up the discussion of “platinum proof”I note, before MMT fanbois chime in that Rohan Grey’s paper on this subject refers to a “circulation critique,” that this critique does not apply to this conclusion as his argument pertains to Section 5136 whereas my objection says that the Trillion Dollar Coiners are simply misreading Section 5112(k) without regard to any other statutory provision.

MMT proponents contend the platinum coin statute’s grant of authority is essentially unlimited:

This view is incorrect and, in any case, logically inconsistent. If we want to put 5112(k) in its wider cultural context, the so-called intentionalist approach, then we get to talk about what Congress meant when they drafted Section 5112(k) – and it’s clear Congress didn’t intend to grant the Treasury a power to mint a trillion-dollar-coin.

This is why folks like the MMTers point to, and rely upon, the plain language of the text, a literal reading which yields (in my view an absurd) result. That invites us, as it would invite a court going through the Chevron two-step, to ask whether the plain language grants the power claimed.

Lib law profs like Larry Tribe have cut corners on this analysis and reached the same conclusion as the MMT crowd:

Using the statute this way doesn’t entail exploiting a loophole; it entails just reading the plain language that Congress used. The statute clearly does authorize the issuance of trillion-dollar coins.

As we know, this view is wrong. The statute does not authorize the Treasury Secretary to have the Mint strike any or all coins. It authorizes the Treasury Secretary to strike bullion coins and proof coins, a necessarily narrower definition which, per the inclusio unius canon of statutory construction, necessarily excludes any coin which is not bullion or a proof coin from its scope.

Conclusion: the Trillion Dollar Coin, being neither “bullion” nor a “proof,” cannot be lawfully made

In order for a trillion dollar coin to be lawfully struck under the power granted in 5112(k), it must either be bullion (i.e., contain $1 trillion of platinum) or it must be a proof coin. MMT shitcoiners’ proposal requires a “proof coin” in order to work (and if they had $1 trillion in platinum to spare they would have long since sold it to pay for state expenditures).

But as we have seen, just as not all that glitters is gold, not every coin is a proof coin. MMT types are not free to supply “proof coin” with whatever meaning they want. That is the mistake the MMT crowd has made for seven years on the trot in (mis)reading 5112(k), and which they continue to make today.

Since 5112(k) doesn’t supply a definition of “proof coin,” we have to look to the plain and ordinary meaning of “proof coin” – as found in a dictionary – to provide that limiting definition, the thing that tells us what makes a proof coin different from any other coin used as money. The definition we find there – “never struck for circulation” and made for collectors in the OED, “not intended for circulation” in Merriam-Webster – tells us that Section 5112(k) authorizes the creation of a collectible which will not enter into circulation. This expressly contradicts the “Mint the Coin” plan, which requires, and therefore intends, circulation, and is not made to pass into the hands of collectors but is made as a fiscal policy trump card.

Long story short: a shiny object made with the intent of being a Trillion Dollar Coin is, definitionally, not a “proof coin.” If it’s not a proof coin (as it needs to be for the MMT crowd’s legal argument to work), 5112(k) doesn’t give the Treasury Secretary legal authority to mint it as a proof coin in platinum and sell it for $1, let alone $1 trillion.

The doctrine of absurdity

There is also a canon of statutory construction which in England we call the Golden Rule and in America they call the “Doctrine of Absurdity.” Generally stated, the Doctrine of Absurdity holds that when interpreting a statute, it is to be given its plain and ordinary meaning unless the meaning of the statute would be absurd.

The American formulation of that rule takes the following form:

The principle sought to be applied is that followed by this court in Holy Trinity Church v. United States, 143 U. S. 457, 12 S. Ct. 511, 36 L. Ed. 226; but a consideration of what is there said will disclose that the principle is to be applied to override the literal terms of a statute only under rare and exceptional circumstances. The illustrative cases cited in the opinion demonstrate that, to justify a departure from the letter of the law upon that ground, the absurdity must be so gross as to shock the general moral or common sense.

To that end, I asked the MintTheCoiners what limits, if any, they placed on the power of the Treasury Secretary here – could he or she mint a quadrillion dollar coin, quintillion dollar coin, sextillion dollar coin under 5112(k)?

Not realizing I was teeing their responses up for this blog post, they responded. Rohan Grey, a first year contracts lecturer at Willamette Law, said he thought they could:

The absurdity doctrine is generally disfavored by U.S. courts. It takes a fairly extreme example to trip it and the Supreme Court has only dealt with the matter a handful of times. Quite apart from the textual analysis we saw in the Alabama Ass’n of Realtors to one outrageous example of government overreach, which gives us some hints as to how a well-informed district judge might approach the MintTheCoiners’ textual arguments and claims of sweeping authority, I submit that claiming “proof coins” – keeping in mind this term means they are not for circulation – to justify the implementation of an MMT policy with seemingly no limitation, infinite money, which expressly places new money into circulation (a) fails for textual grounds, (b) shocks the conscience and (c) is, in every conceivable way, thus an absurd interpretation of a statute designed to authorize the manufacture and sale of numismatic curios.

At the end of the day, “MINT THE COIN!” strikes me as bad, pseudo-legal analysis of a law which very clearly does not authorize “minting the coin” – at least, if we don’t stretch the meaning of “proof coin” beyond recognition. Fortunately the matter also appears to be moot, as it seems Congress will be raising the debt limit and we can safely ignore “minting the coin” – at least for now. The danger behind this idea, however, is that one day we will be faced with an administration more stacked with Marxist radicals than the current one, who will have few qualms at sweeping Congress aside to carry out their own policy agendas.

The danger there is not loss in the courts, but rather what will happen between the time that the coin is minted and a final judgment is entered in a challenger’s favor. When trillions of dollars and the full faith and credit of the United States are on the line, a Mint-the-Coiner could simply mint $trillions to fund its operations or redeem Treasuries and then dare the courts to unwind the transaction – forcing a default – after the fact. Even if the Executive Branch should lose, it could put the courts in an impossible dilemma where restoring constitutional order would force a default.

That – the act of norm- and constitution-breaking unilateral executive action – must be forestalled as a matter of urgency. As soon as Republicans reclaim power they must introduce legislation to amend Section 5112(k) to ensure that no administration can misconstrue its meaning ever again.

[ZH: On a side note, Twitter CEO Jack Dorsey appeared to suggest that if the coin was minted, America could see Civil War…]