By Michael Every of Rabobank

Infections, retentions, creations, and tensions. In that order.

Here comes the first October surprise. US President Trump and the First Lady have both tested positive for Covid-19 after one his advisors, Hope Hicks, tested positive for Covid-19 and has also started showing symptoms. She travelled on Air Force One with him to Minnesota last week, and was additionally seen maskless near another presidential advisor. He tweeted:

“Tonight, @FLOTUS and I tested positive for COVID-19. We will begin our quarantine and recovery process immediately. We will get through this TOGETHER!”

To say this could potentially be a *big* deal is an understatement. Not much more can be said here at this stage, other than to do what one always does when **anyone** catches Covid – wish them a rapid and full recovery. However, one cannot help but note that Trump is very much in the age and weight category that place him in the higher risk groups, health-wise, and the market and public talk will now be of little else.

Up goes the USD as risk off? It seems that the kneejerk reaction was first to sell USD a little instead, at least until markets can work out exactly how this potentially plays out. Stock futures are certainly going down at time of writing, however. Risk is off there.

Obviously now eclipsed, but in the UK a Scottish Nationalist MP –a political party who have made a name for themselves as good stewards of public health– also started to show virus symptoms….and so decided to get on the train all the way to London; go to the House of Commons and mix with members of Parliament; and then, after a positive test result, to go all the way back to Scotland by train again. As we all know, PM Johnson has already had Covid-19 and ended up on a ventilator after boasting he had been shaking the hands of virus patients. Hopefully there won’t be any repeat for other MPs (or train passengers) now.

Apart from infections, the focus today is going to be very much on employment: both job retentions and job creations.

In the UK as one benchmark there was a report yesterday that 1 in 3 firms are preparing to fire workers imminently. Today we see the Telegraph saying unemployment is expected to reach as high as 4 million in a labour force of around 34 million. That is an entire army of people –actually the equivalent of the US and Russian and Chinese and Indian armies– all needing to be retrained as builders at once. Yet there are also reports the UK was recently looking into copying a Trump policy and building a wall around itself – on the water. This fantastical feat of engineering was apparently being considered as a way to keep the number of illegal asylum seekers arriving by boat over The Channel down. (“Welcome to day one of your builder training course everyone. Please pick up the scuba gear to your left and follow me into the pool.”) There were already some high fevers running in Westminster even before Covid re-entered the building. Does GBP float?

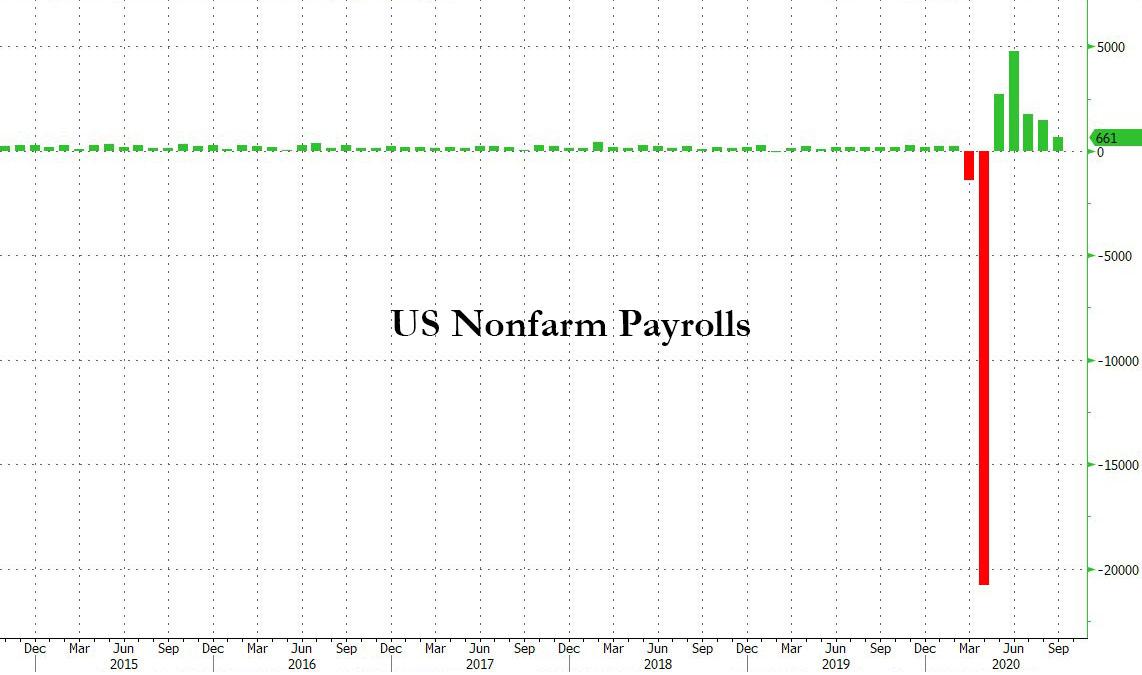

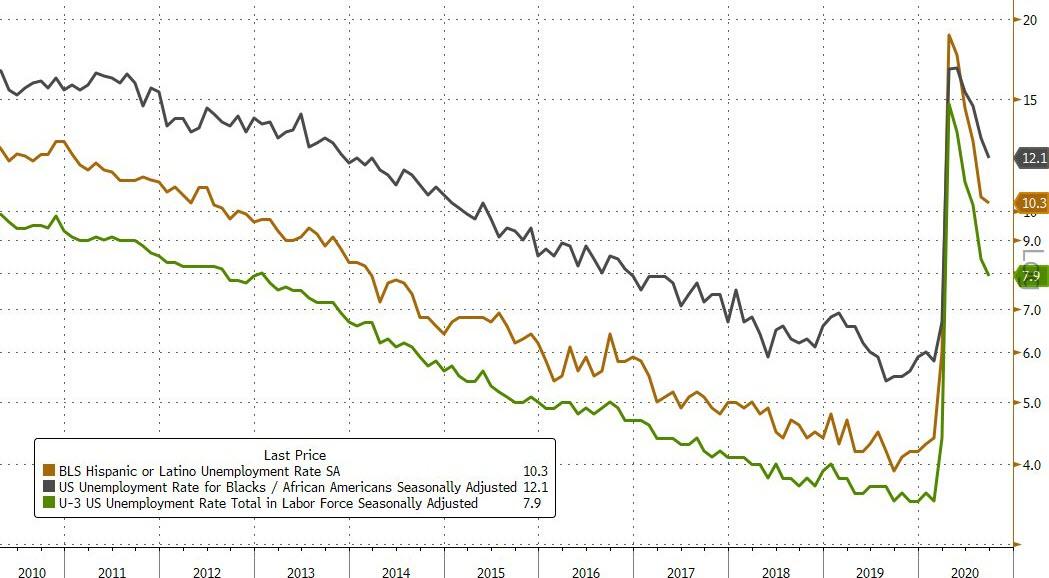

In the US, it will be the last monthly payrolls report before the election, if you can believe it. This will naturally be the figure that Trump will be still be able to Tweet about today, one hopes. The consensus is 875K, which would help close the gap of jobs lost to the Covid shutdown. Risks may be slightly the upside based on the ADP report this week. However, initial claims yesterday made clear yet again that we are far from back to normal. Will it move markets? Maybe not that much given the focus is now more on infection and stimulus.

Indeed, we are also not likely to get back to normal if we don’t see less tension in Washington. Markets have gyrated recently on headlines saying Mnuchin and Pelosi were close, then far, then close to a compromise stimulus deal. Well, the House Democrats just passed their own USD2.2 trillion package, which will of course be rejected by the Republican-held US Senate, so the same old games continue as everyone from the NFIB small business survey to the FOMC cries out for more stimulus, and now. The public reaction at some point may well start to echo that after the recent presidential debate: everyone loses in the most important respects even if a technical win can be claimed by both sides in others. Up went the USD – until that Trump news, which again potentially changes everything.

Meanwhile, there will be tensions in DC on another front. That is on the back of a claim from the head of a House antitrust panel that certain household-name Big Tech firms –who basically are the US economy as far as some markets are concerned– abuse their power as gatekeepers of the internet. There is apparently going to be a recommendation that legislation be passed to rein these giants in. You thought Big Tech was already involved in this election, even if they are not a topic of conversation? Well now they are trillions-of-USD deep involved.

And on another kind of tensions, the EU actually managed to agree something on joint foreign policy, which could be a headline in itself given how rare this achievement is. Targeted sanctions are now going to be put in place on Belarus, and apparently part of the quid-pro-quo of that is that the door remains open to sanctions on Turkey too if it continues to ruffle the feathers of Greece and Cyprus – which will not soothe tensions with Ankara.

Anyway, everything now takes a backseat to the latest incredible twist in this US election campaign.