“We Are Not Going To Launch” – NASA Scrubs SpaceX Launch At Last Minute “Due To Bad Weather”

Tyler Durden

Wed, 05/27/2020 – 16:26

Update (16:46 ET): President Trump canceled the rest of his trip “due to the scrubbing,” and will return to DC. He will not be “delivering scheduled remarks.”

Due to scrubbing of launch, Pres Trump cancelling the rest of his visit to @NASAKennedy and will be returning to DC. He won’t be delivering scheduled remarks to @NASA personnel. Remains to be seen if Pres will return for rescheduled launch on Saturday. pic.twitter.com/Bjb3PBFeg7

— Mark Knoller (@markknoller) May 27, 2020

* * *

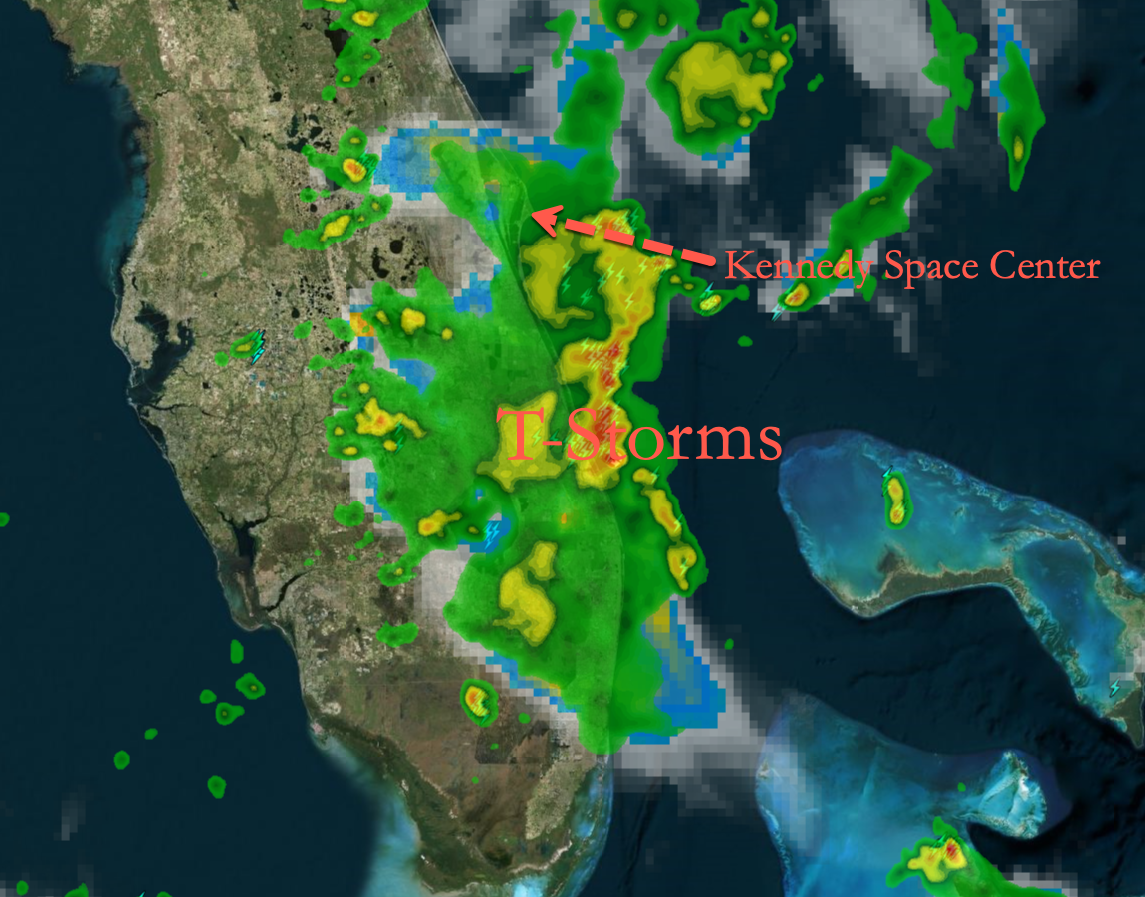

Update (16:25 ET): Via NASA TV, it appears the SpaceX launch has been scrubbed due to bad weather.

Here’s the moment when NASA determined the launch was “scrubbed.”

“We are not going to launch today.”

Due to the weather conditions, the launch is scrubbing. Our next opportunity will be Saturday, May 30 at 3:22pm ET. Live #LaunchAmerica coverage will begin at 11am ET. pic.twitter.com/c7R1AmLLYh

— NASA (@NASA) May 27, 2020

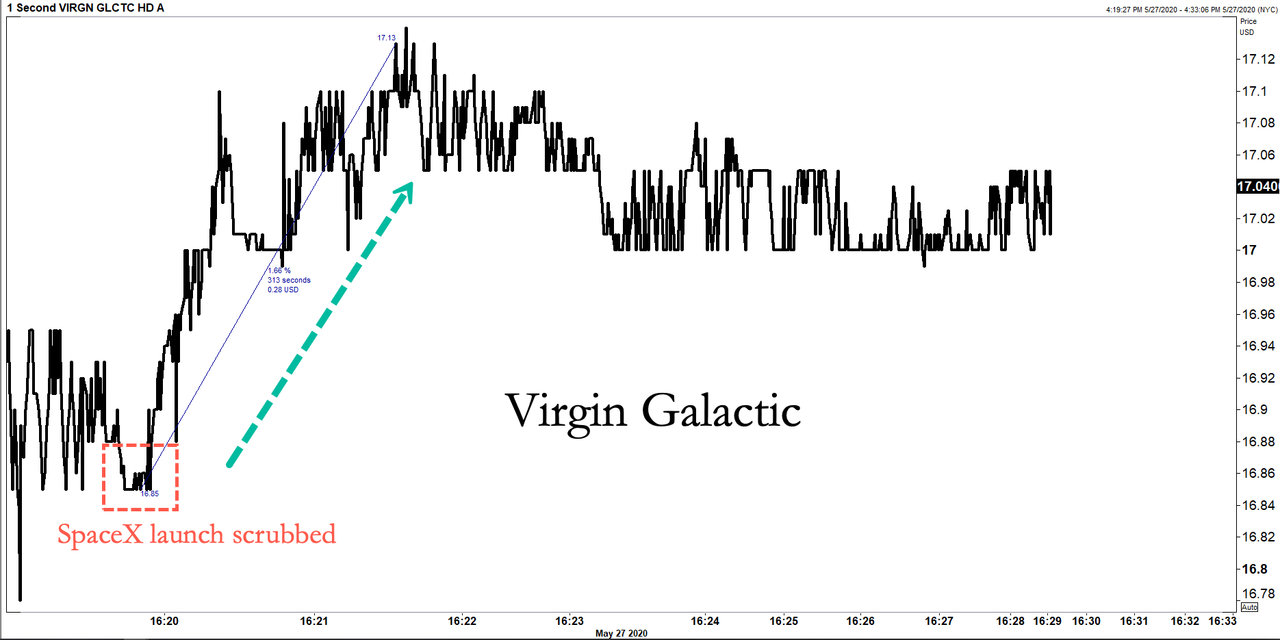

Virgin Galactic shares moved higher on the postponement news.

It appears the next launch attempt will be on Saturday at 3:22pm ET (19:22 UTC).

* * *

On Wednesday afternoon, NASA is preparing to send two of its astronauts, Bob Behnken and Doug Hurley, to orbit aboard a spacecraft built by Elon Musk’s SpaceX.

The launch will mark the first time a private US company has catapulted astronauts into space. It has also been about a decade since NASA retired its space shuttles in July 2011.

“For the first time since 2011, we are sending American astronauts back to space, on an American rocket, from American soil. And we would like you to join us for launch – at a safe virtual distance, of course,” NASA said in an announcement.

NASA’s live broadcast of the launch begins 12:15 p.m. EST with liftoff scheduled for 4:33 p.m. EST. It will be held at the Kennedy Space Center in Florida. If the weather holds up, SpaceX’s Crew Dragon will launch on a Falcon 9 rocket to the International Space Station (ISS).

Falcon 9 rocket and Crew Dragon spacecraft this morning

Scheduled events for today:

-

12 p.m. – Live Views of the SpaceX Falcon 9 Rocket on Launch Pad 39-A at the Kennedy Space Center for NASA’s SpaceX Demo-2 launch to the International Space Station.

-

12:15 p.m. – Coverage of NASA’s SpaceX Demo-2 launch to the International Space Station (Launch scheduled at 4:33 p.m. EDT).

-

7:30 p.m. – NASA/SpaceX Demo-2 post-launch news conference with Administrator Jim Bridenstine

NASA will stream the launch event live on YouTube

This is a big day for Musk, considering last night his electric car company, Tesla, cut prices across the entire US lineup, as it appears a demand problem is forming.

President Donald Trump will be in attendance today to witness the launch of the first manned space mission for the US in a decade. Vice President Mike Pence will attend as well.

The president has bragged about the public/private program for space travel, by allowing “rich guys” to bankroll the missions.

“We are letting those rich guys [Elon Musk] that like rockets, go ahead, use our property, pay us some rent,” Trump said at a rally in Tupelo, Mississippi, in Nov. 2018. “Go ahead. You can use Cape Canaveral. You just pay us rent and spend that money.”

Peter Diamandis, founder of the X Prize, the first private company to launch a rocket to the edge of space, told Financial Times if Musk is successful today, it will mark a period where space flight has become ‘reliable and cheap.’

“It’s the first, fully commercially built, entrepreneurial capability,” Diamandis said. “What Elon Musk has done is nothing short of extraordinary, outpacing the US government-backed industries, Russia and China.”

Ahead of the launch, SpaceX raised $346 million, which was $100 million more than it originally disclosed in March. In the company’s existence, it has raised $3.5 billion, according to Crunchbase data.

Greg Autry, a former White House liaison to Nasa, said the commercialization of space flight is equivalent to when the internet was first created by the US Defense Department. He called today’s flight a “tipping point we’ve been waiting for in the commercial space industry for a number of years.”

Financial Times describes the SpaceX and Boeing competition over the last decade to drive commercialization of space.

“Nasa, which commissioned both SpaceX and Boeing seven years ago to build human launch systems, is counting on commercial incentives and market competition to drive down the price of getting into space. It has estimated that the $400m SpaceX spent to develop its Falcon 9 rocket, which has become the workhorse for lifting cargo to the ISS, was only a tenth what it would have cost Nasa itself to build a similar rocket.

“Since the Space Shuttle was retired in 2011 and the US was forced to buy seats on Russian rockets to propel its astronauts to the ISS, the cost of getting into space has risen sharply. Dennis Tito, the first space tourist, paid $20m in 2001 for a ride to the ISS on a Russian rocket. The price of a seat has now ballooned to more than $90m.

” A competitive commercial market could quickly push that price back below $50m, said Mr Autry. Boeing’s rival space capsule suffered a setback earlier this year because of software glitches but is expected to make its first manned test launch next year. Other companies, including Jeff Bezos’s Blue Origin and Sierra Nevada, a Californian company that has built a space vehicle with wings, also hope to cash in.

“As competition increases and the process for mounting human flights becomes more streamlined, the price for a trip into orbit could fall below $10m over the next decade, Mr Autry predicted.”

Targeting 4:33 p.m. EDT today for Falcon 9’s launch of Crew Dragon with @NASA astronauts on board. Teams are closely monitoring launch and downrange weather → https://t.co/bJFjLCilmc pic.twitter.com/XyyT9YgESB

— SpaceX (@SpaceX) May 27, 2020

A boom in commercial space travel could be ahead if Musk is able to pull off today’s launch. It could signify affordable space flight is here. This could also unleash new industries such as space tourism, something that, Laura Forczyk at Astralytical, a US space consultancy, said could see exceptional growth in the 2020s.

The next big step in commercializing space will need to be the retirement of ISS with private companies launching a new space station. That could be possible by the midpoint of the decade.

Ahead of the launch, Musk said: “I’m Chief Engineer of the thing. If it goes right, it’s credit to the SpaceX/NASA team. Goes wrong, it’s my fault.”

“I’m Chief Engineer of the thing. If it goes right, it’s credit to the SpaceX/NASA team. Goes wrong, it’s my fault.” — @elonmusk

💯 leadership. pic.twitter.com/tKPIpq0CRH

— Viv 🐉 (@flcnhvy) May 27, 2020

via ZeroHedge News https://ift.tt/2XBIm9v Tyler Durden