Why Are We Limit Up? Here’s A List Of All The Interventions Unveiled Overnight

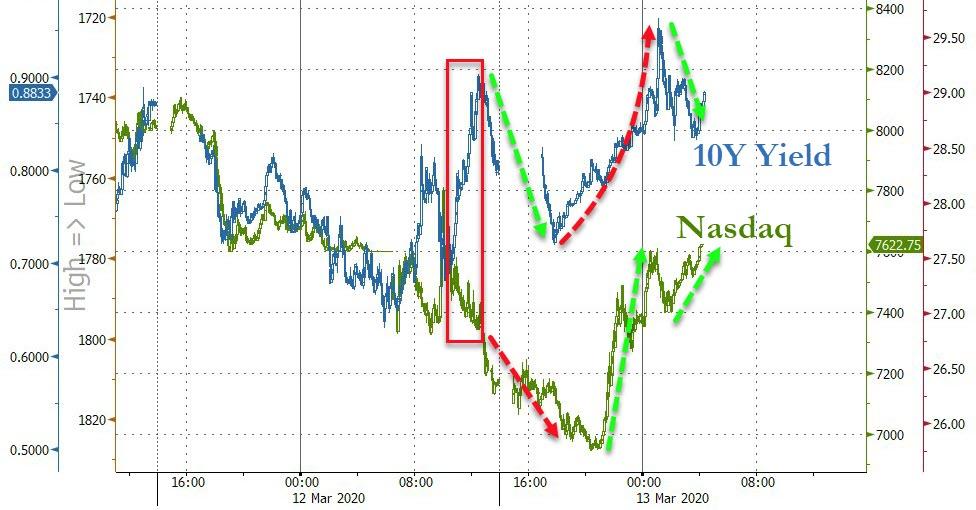

US equity futures are limit up this morning after an impressive rally from ugly depths during Asian trading overnight.

So, what, or who, is responsible for this massive comeback?

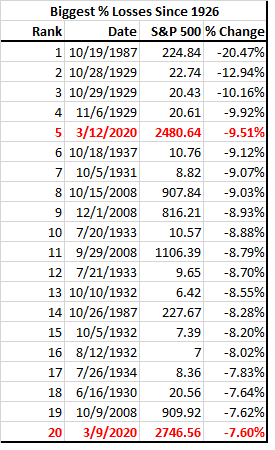

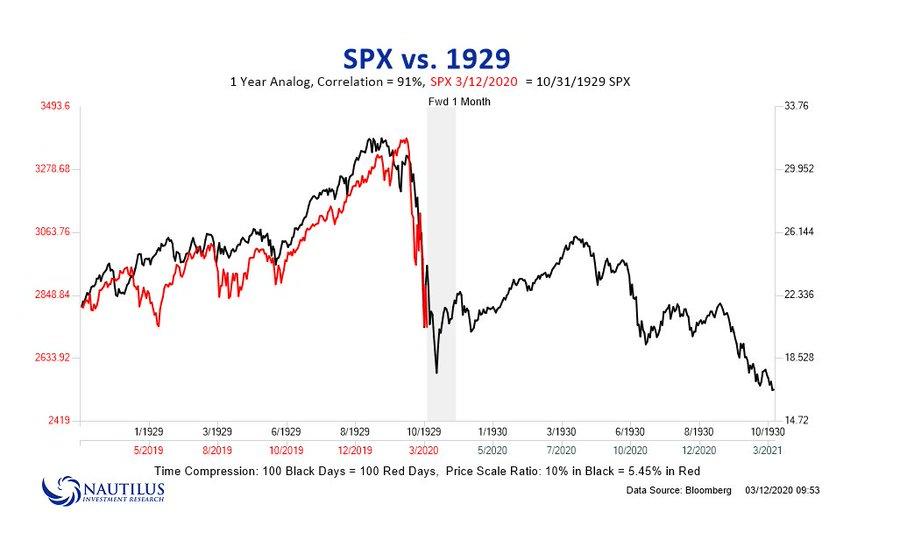

Admittedly – after the 5th worst daily drop in history of the S&P 500 – one might have expected a bounce…

But, as Nomura’s Charlie McElligott details below, there was an armada of stimulus plans suggested overnight to rescue the world (markets)…

As we have continued repeating, “The worse it gets, the larger the ultimate policy response” – and away we go, highlighted by German’s shock “fiscal” capitulation announcements happening real-time:

German FinMin Scholz unleashes the REAL bazooka today though, in a shocking FISCAL “whatever it takes” moment: *SCHOLZ SAYS POSSIBLE GERMANY WILL NEED TO TAKE ON ADDED DEBT*; GERMANY WILL HAVE NO LIMIT ON CREDIT PROGRAM FOR COMPANIES; SCHOLZ SAYS GERMANY WILL SPEND BILLIONS TO CUSHION ECONOMY; *GERMANY PLANS TO SET UP SAFETY NET FOR VIRUS-HIT COMPANIES; ALTMAIER: RESOURCES FOR GERMANY’S STATE BANK TO RISE TO 500BN

Treas Sec Mnuchin and House Dems reached an agreement last night to move forward with legislation that would shore up the US public health response to COVID-19, while also blunting some of the economic impact (h/t Rob Dent)

-

Free COVID-19 testing, including for the uninsured

-

Paid emergency leave for workers (14 days paid sick leave, up to three months paid family/medical leave)

-

Enhanced unemployment insurance (increased access, waived requirements)

-

Increased food assistance

-

Increased federal funds for Medicaid

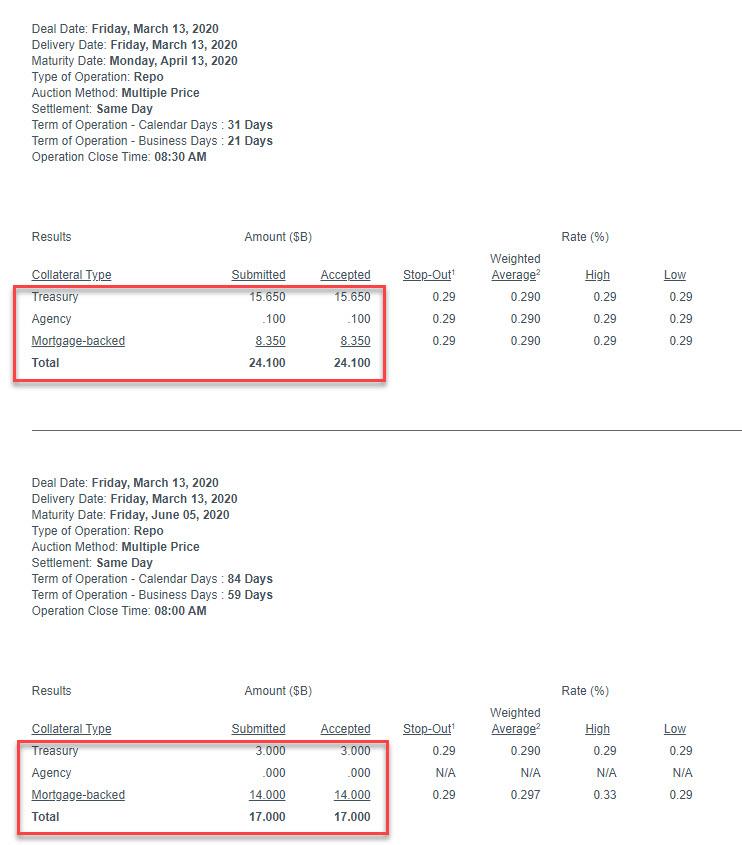

Yesterday’s Fed liquidity actions with the expansion of repo ops (beginning immed) and transition to “outright” QE (as previous “bill only” purchases expanded out across a range of maturities—thus, they are now explicitly buying Duration across nominal coupons, TIPS, FRNs and Bills) were introduced in an attempt to offset the obviously liquidity strains in the “frozen” Rates space, as evidenced by the moves in basis / off-the-runs this week

Further, given the deterioration of market conditions within Rates, I expect them to announce next week that they will effectively double the current monthly $notional purchases in an effort to soak-up some of this liquidity strain as OTR’s remain largely ‘bid-less’ and a large problem for both dealers and the leverage RV community alike

Lew’s new house-view is that the Fed will cut 100bps next wk, plus the aforementioned additional $50B of purchases on top of the current $60B plus the $20B from the MBS runoff reinvestments means a potential aggregate purchase of $130B / month from the Fed

-

PBoC cuts RRR for some banks this morning, releasing $79B of liquidity

-

ECB’s Villeroy—“We can distance ourselves from the capital key to purchase more of some countries debt if required”; ECB obviously too grew their QE yesterday as well

-

EU President Von Der Leyen unveiling emergency measures to tackle the economic fallout, including flexibility on budgetary and state aid rules; 37B Euro fund for coronavirus support

-

Italy may spend up to E16B on first stimulus

-

BoJ ups bond buying overnight in unannounced move (offering to buy $1.9B), while sources story says that QE interventions will grow (e.g. Commercial Paper, ETFs, Corp Bonds)

-

RBA added $5.5B of liquidity through daily repo ops, largest since at least ‘13

-

South Korea banning short-selling for 6m; Italian CONSOB bans short selling; Spain’s CNMV banned short sales on 69 stocks which fell over certain amounts yesterday; UK’s FCA temporarily prohibits short selling in certain instruments; French watchdog also investigating short selling ban;

-

Norges Bank cuts rates 50bps to 1%, is prepared to ease further; cuts countercyclical buffer to 1% from 2.5% with immediate effect

-

Riksbank lends 0.5T crowns to safeguard supply of credit while Ingves states can buy local, govt and corp bonds, can do currency intervention & cut rates if we think it’s needed

-

BoC injecting billions of cash with repo ops and is set to expand the scope of bond buybacks to add mkt liquidity

Finally, McElligott quotes Lenin:

“There are decades where nothing happens; and there are weeks where decades happen”

That seemed to sum things up extremely well.

Tyler Durden

Fri, 03/13/2020 – 09:50

via ZeroHedge News https://ift.tt/38NkvHF Tyler Durden