A Market Full Of Gaps

Authored by Sven Henrich via NorthmanTrader.com,

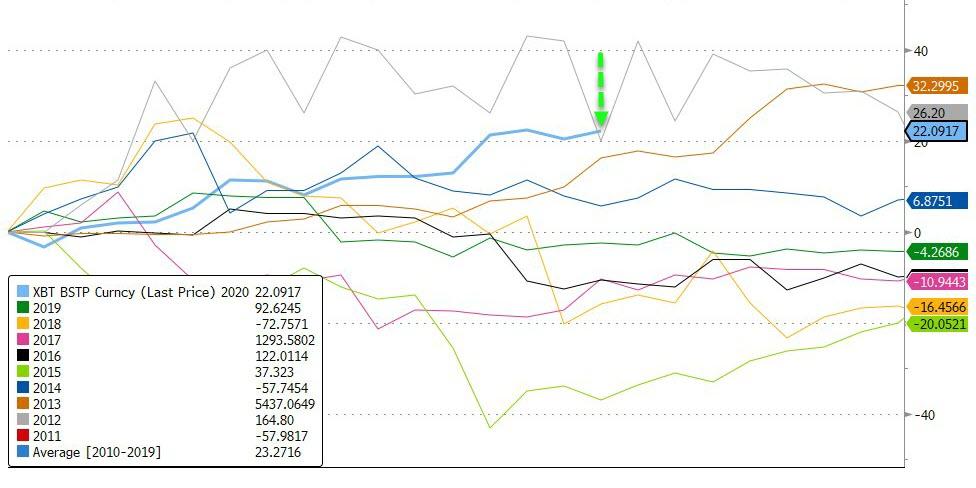

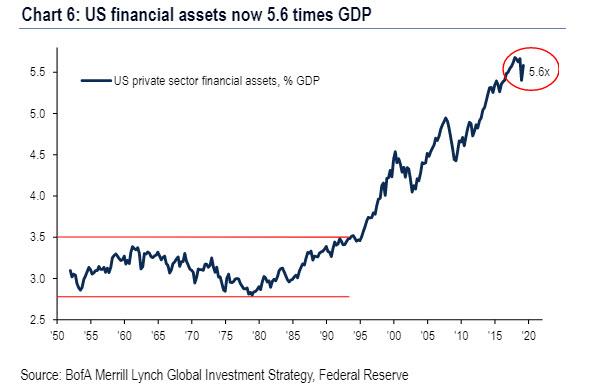

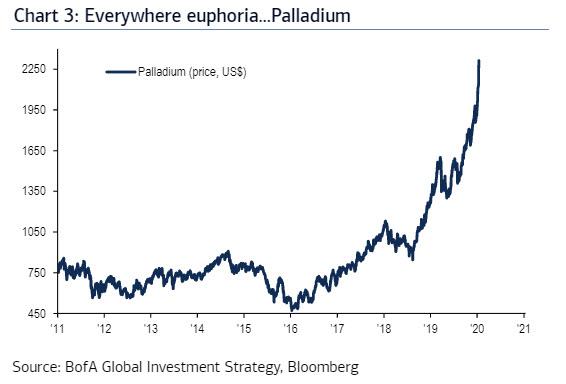

The bubble keeps on bubbling, the never ending rally keeps on rallying and the charts keep getting ever more dangerously stretched.

Intra-day price discovery is virtually absent as volatility remains woefully compressed and $SPX barely moves.

It’s become quite the scene to watch an index representing 500 stocks with a combined market cap of $27 trillion “trade” in a 0.1% price range for hours on end:

Now let’s make a new, even smaller price range. pic.twitter.com/wzogJo9sgd

— Sven Henrich (@NorthmanTrader) January 16, 2020

Worse, the price advance action is mostly driven by up gaps that rarely if ever fill and market open ramps that settle into tight price ranges during the day.

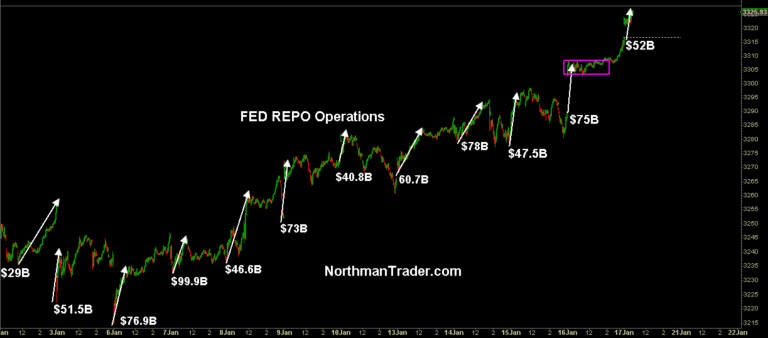

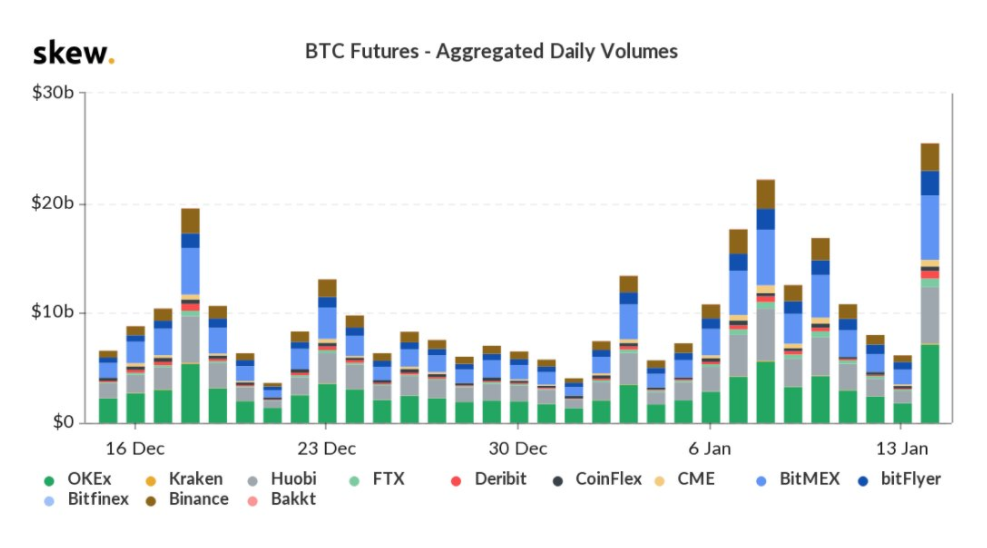

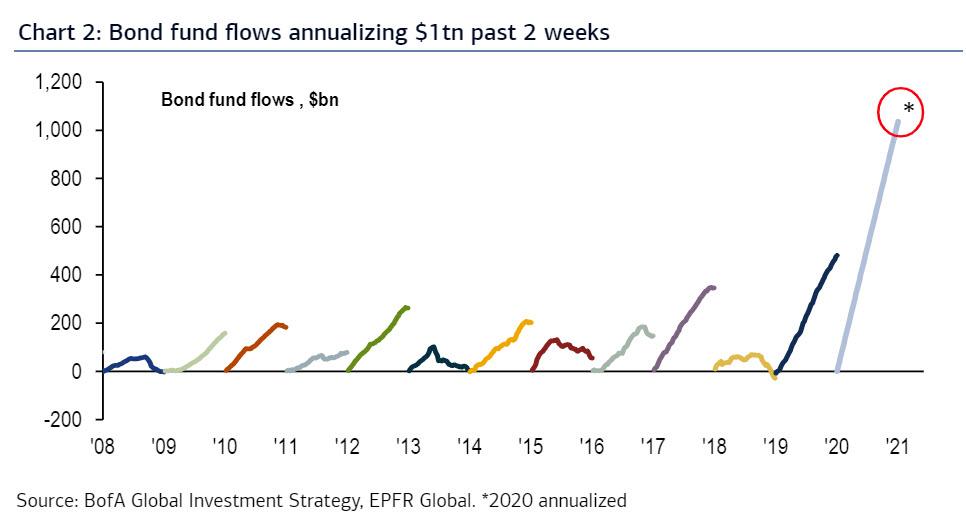

While Fed critics are dismissed as QE conspiracists, we can either choose to be believe the Fed or our own lying eyes as the repo machine continues to execute relentlessly:

Open gaps in markets are not unusual, some stay open for weeks, months, even years. Some may never fill.

But it is when you get gap after gap after gap that the action becomes incredulous and challenges conventional market wisdom. I’ve seen 3 or 4 unfilled gaps in a short time frame, I’ve even seen 5, but I can’t recall seeing anything like this:

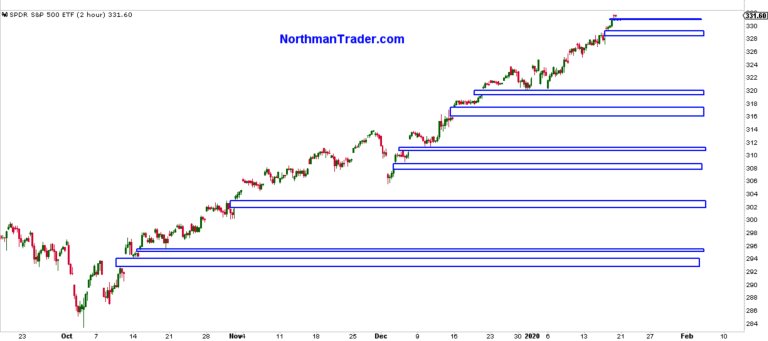

That’s the $SPY since not QE which is now widely acknowledged to be quasi QE. Count the unfilled gaps.

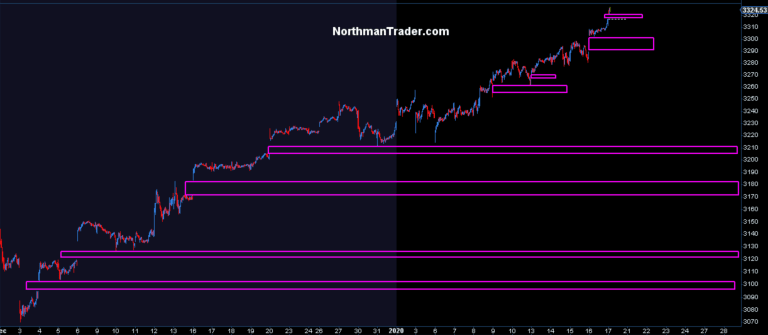

And here, for granularity, here’s the $SPX since just December:

Resistance is futile if you can just gap above it and never actually have any price discovery in between. It is impressive to say that this market finds support on top of each gap each time, but I suppose extraordinary liquidity measures produce extraordinary results.

But don’t take my criticisms seriously. I’m just a “swashbuckling pirate QE conspiracist” according to Neel Kaskari president of the Federal Reserve Bank of Minneapolis:

1 thing I’ve learned abt twitter is the louder the critic, generally the thinner the skin. I confess finding amusement in needling critics calling them conspiracists or goldbugs. Its fun to watch swashbuckling pirates of free market capitalism get easily upset. I mean no offense. https://t.co/dMgSsk2pBR

— Neel Kashkari (@neelkashkari) January 17, 2020

My skin is plenty thick, thank you very much, but evading answers and accountability by those in power is pet peeve and when they think it’s all worth a giggle on twitter I find myself unimpressed by the institutional arrogance on display.

Fun and giggles over substance apparently:

Glad you find amusement in needling critics Neel.

If you engaged the “swashbuckling pirates” on substance you may find that there are well founded concerns that deserve much deeper attention.

The Fed is not beyond criticism & fault even if it acts like it. https://t.co/HivnNTsabZ— Sven Henrich (@NorthmanTrader) January 17, 2020

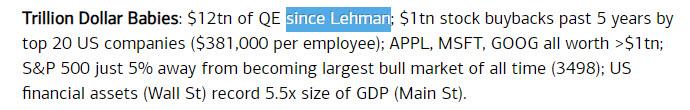

It’s a shame and a sham really. The Fed deserves to be criticized. If it wants to claim the banner of transparency it needs to earn it, and denying reality while labeling critics as “conspiracy theorists” is just not credibility building:

QE conspiracists can say this is all about balance sheet growth. Someone explain how swapping one short term risk free instrument (reserves) for another short term risk free instrument (t-bills) leads to equity repricing. I don’t see it. /end

— Neel Kashkari (@neelkashkari) January 17, 2020

Especially as parts of the Fed have already admitted it:

They all know:

“My own view is [buying bills] is having some effect on risk assets. It is a derivative of QE in that when we buy bills and we inject more liquidity, it affects all risk assets,” Kaplan said.https://t.co/l5WAviQkV1— Sven Henrich (@NorthmanTrader) January 16, 2020

And the bubble blowing recognition has also now extended to the Financial Times:

“The Federal Reserve is the cause of the bubble in everything.

QE is here to stay. We should expect QE5, QE6, QE7 and beyond.

Enjoy the party, yes. But dance near the door.”h/t @jennablan https://t.co/RhFpmNsHjq

— Sven Henrich (@NorthmanTrader) January 16, 2020

Maybe they too are now pirates sailing the stormy sea of QE conspiracies. Looks like the number of pirates is increasing outside the sound proof walls of cushy Fed offices.

No, keep denying the bubble and claiming to not to see the relationships in policy and price action as you wish. But the gaps are there. And they demand filling. Not only the gaps in the charts, but also the gaps in credibility.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Fri, 01/17/2020 – 15:17

via ZeroHedge News https://ift.tt/3ahnI4a Tyler Durden