‘Helicopter Money’ Sparks Bond Backlash, Stocks Bounce On Fed Bailout, But Bank Liquidity Worsens

US futures traded limit up overnight, plunge back to the lows of the day, soared back above overnight highs, dumped again, ripped again, then slumped… 1000s of Dow points in the swings on the back of various political and monetary headlines of ever-increasing bailouts (and warnings)… that is malarkey!

So, some (brief, perhaps) exuberance in stocks.

BUT…

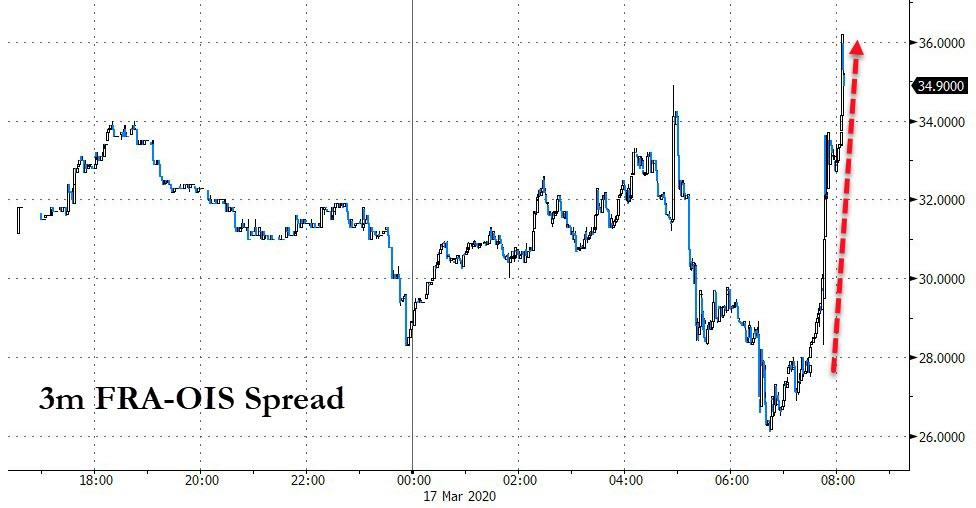

Despite The Fed’s CPFF, banking system liquidity worsened…

Source: Bloomberg

AND…

‘Helicopter Money’ sent the the 10Y Yield soaring back above 1.00% today as yields exploded 30bps higher…

Source: Bloomberg

AND…

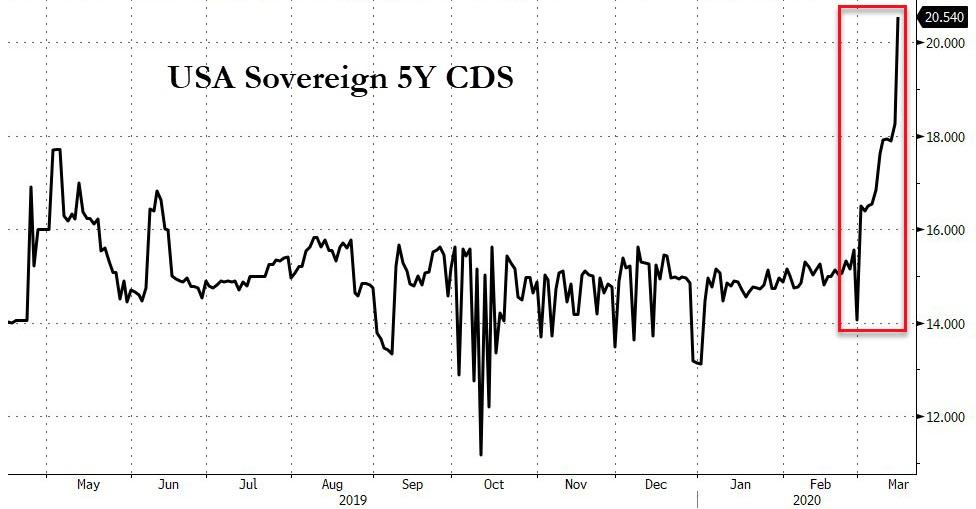

All this chatter of helicopter money has sent USA Sovereign risk is spiking…

Source: Bloomberg

Simply put, it appears the bond market is starting to panic about MMT becoming an imminent reality – not a good sign for The Fed, The Treasury, and all Americans. And while this may lead to dollar-weakness in the endgame, for now, liquidity is all that matters and the dollar soared higher again as the financial system’s liquidity crisis showed now signs of abating. The Dollar is up 6 days in a row…

Source: Bloomberg

Today was the dollar’s biggest daily gain since the flight-to-quality after the UK’s Brexit vote in June 2016 (and the biggest 6-day gain since Lehman).

* * *

Legendary investor Jim Rogers warned that “the next time we are going to have a financial problem it’s going to be the worst…” and right now it appears we are headed toward “the worst financial crisis of our lifetimes” and “we will know in a few months.” However, Rogers noted, the reason behind such market mayhem is “not just the virus, it is certainly much more” than that.

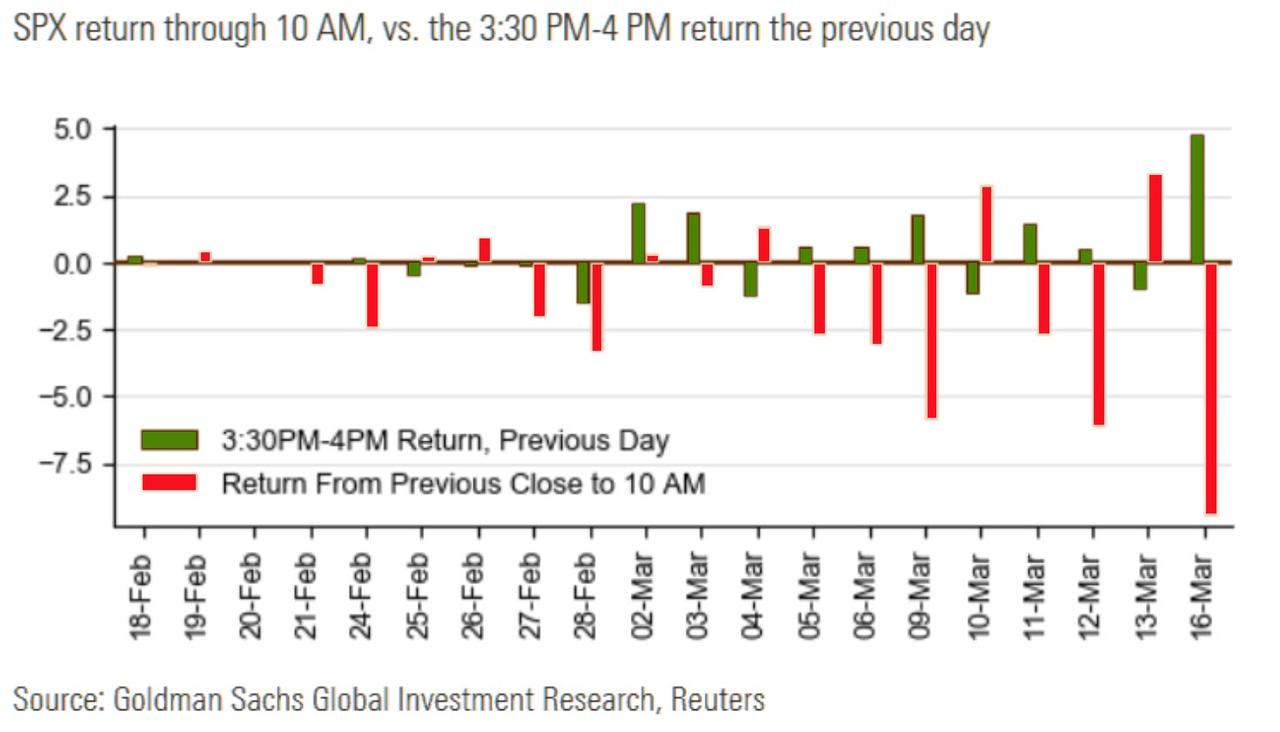

Rather notably, the US equity market has started each day moving in the opposite direction from the previous day’s late-day move every day for two weeks…

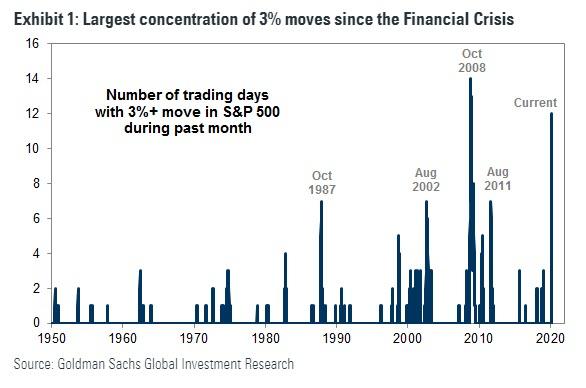

There have been 3%+ moves in the S&P 500 during 13 of the past 22 trading days, approaching the October 2008 experience.

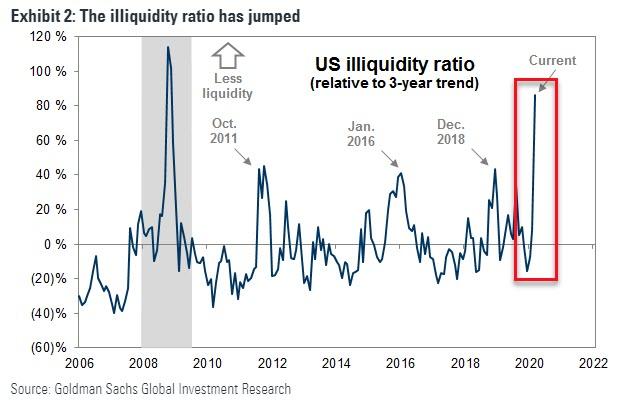

Goldman’s illiquidity ratio, which measures the price impact of trading volumes, shows that liquidity has evaporated within US equities…

Bid-ask spreads have widened to 8-year highs…

Early in the day, stocks tumbled back into the red but ever-escalating helicopter money headlines and The Fed’s CPFF and extended Repo helped lift the market to a big day, led by Small Caps…(NOTE – the drop around 12ET came after the White House Virus Task Force stated that “we are losing the fight to contain the virus.”

Defensive and Cyclicals rallied today, but cyclicals are dominating the week…

Source: Bloomberg

For some context, this drop in stocks dwarfs the Y2K-post-Fed-liquidity plunge…

Source: Bloomberg

VIX dipped today back below 75, but remains extremely elevated…

There was a bloodbath in bondland today with yields exploding higher across the curve – long-end smashed hardest – 30Y spiked 35bps, 2Y +9bps…

Source: Bloomberg

The ETF liquidity crisis is abating as rates soar…

Source: Bloomberg

US yield curve steepened as chatter increased of the helicopter money-drop in the US…

Source: Bloomberg

This is the biggest steepening since the US downgrade in 2011…

Source: Bloomberg

In the past week, junk-bond investors have suffered through two of the worst days since the collapse of Lehman Brothers. The struggle reflects the spike in economic uncertainty and how many high-yield borrowers will have problems with bank lines. However, junk CDS spreads are pricing in a 43% five-year default probability. That’s high, but in 2009 CDS was pricing a more than 60% default probability, so it can go higher.

Source: Bloomberg

IG credit is even worse, with CDS pricing in a 9.9% default probability, which is extremely high…

Source: Bloomberg

And European sovereign credit spreads are blowing out…

Source: Bloomberg

Cryptos extended their gains today with Bitcoin almost back to even on the week…

Source: Bloomberg

Commodities were mixed today with Gold managing gains as crude and copper were crushed…

Source: Bloomberg

Silver’s continued weakness, and gold’s gains today, sent the gold/silver ratio to another new all-time record high…

Source: Bloomberg

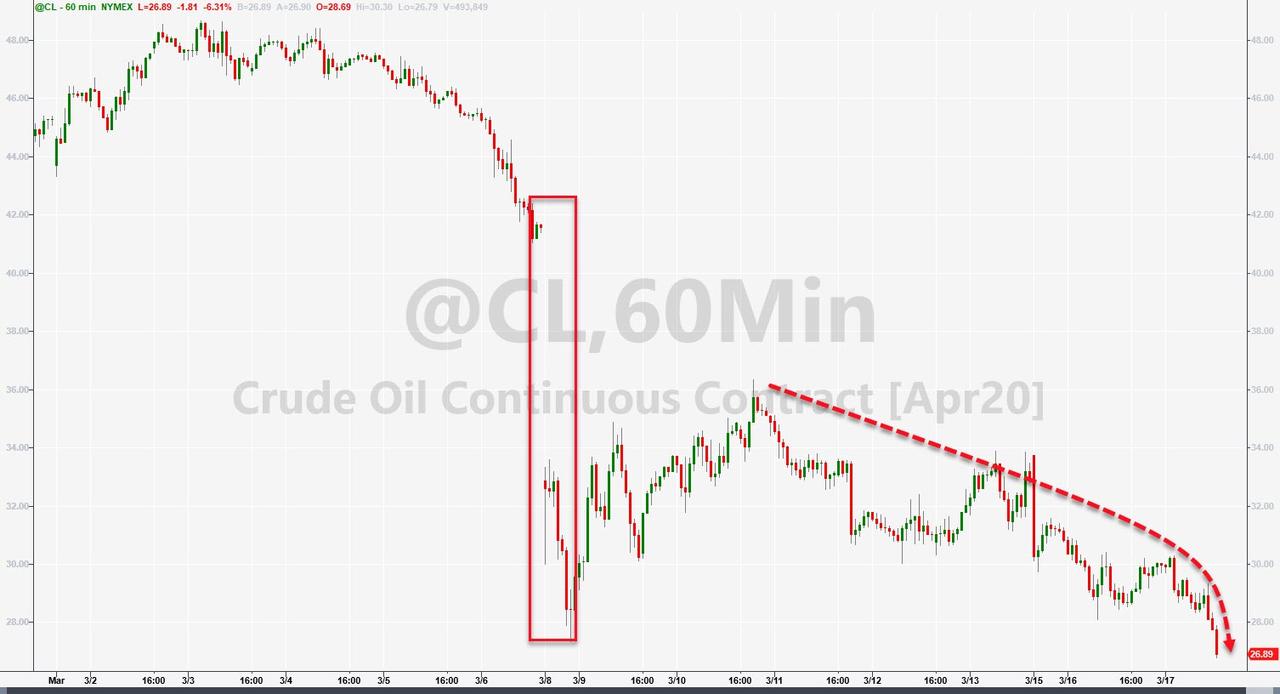

WTI puked to a $26 handle!!

After some serious ugliness yesterday, precious metals rebounded aggressively today as helicopter money chatter hit, BUT that was quickly slapped down by the powers that be… gold and palladium higher on the day (palladium’s jump was biggest since 2001 at its highs), silver and platinum lower…

Source: Bloomberg

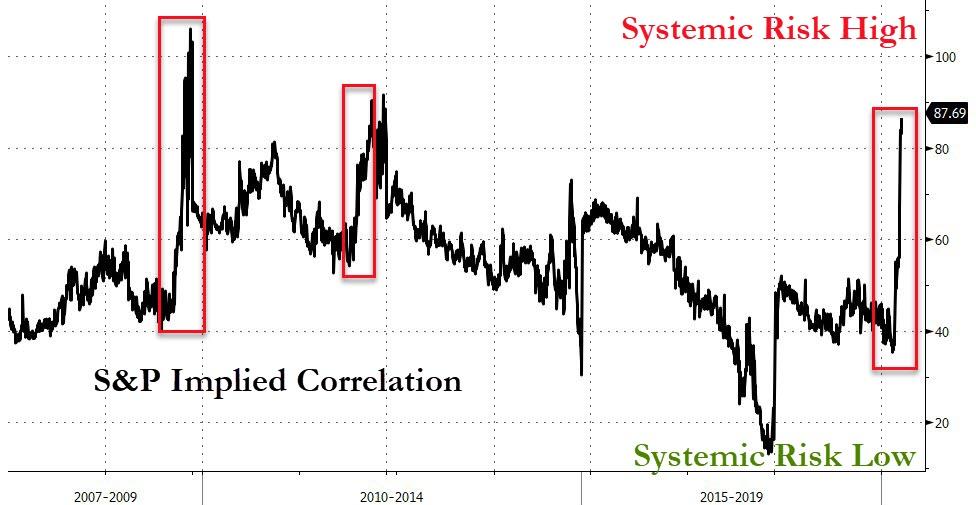

Finally, systemic risk continues to soar in deep, dark corners of the financial markets… Implied Correlation is at Lehman/EU Crisis levels…

Source: Bloomberg

But, we suspect this reracking has a lot further to go…

Source: Bloomberg

Tyler Durden

Tue, 03/17/2020 – 16:00

via ZeroHedge News https://ift.tt/3dahg06 Tyler Durden