“What The F**k Are These Guys Smoking…?”

Authored by Bill Blain via MorningPorridge.com,

“Well, it has to happen. Because if it doesn’t happen, we hit the wall next week. We’re already in breach.”

Happy St Patricks day. Extra points for identifying the moment in Irish history in this morning’s quote…

Meanwhile… back in Today

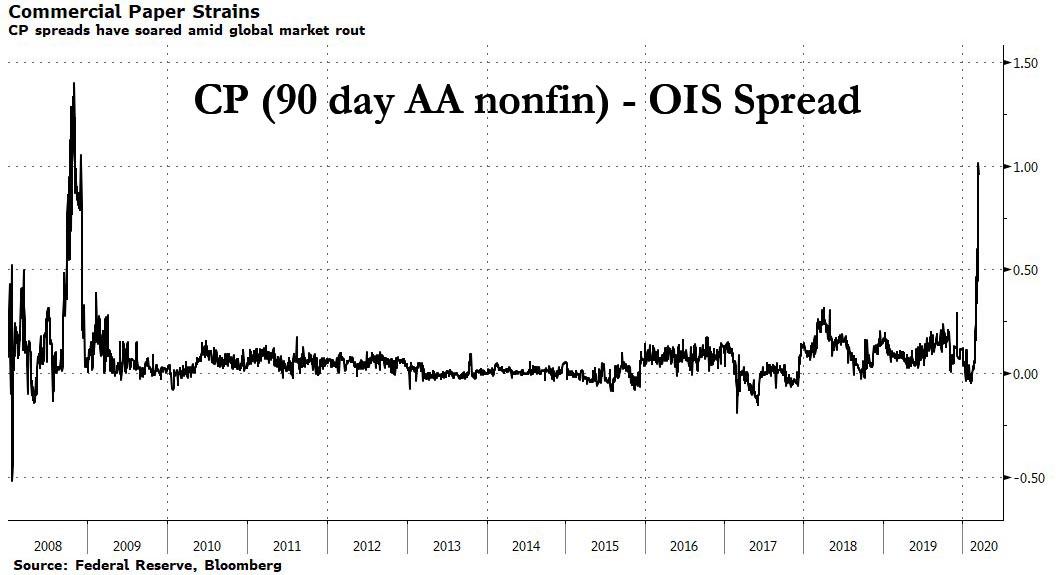

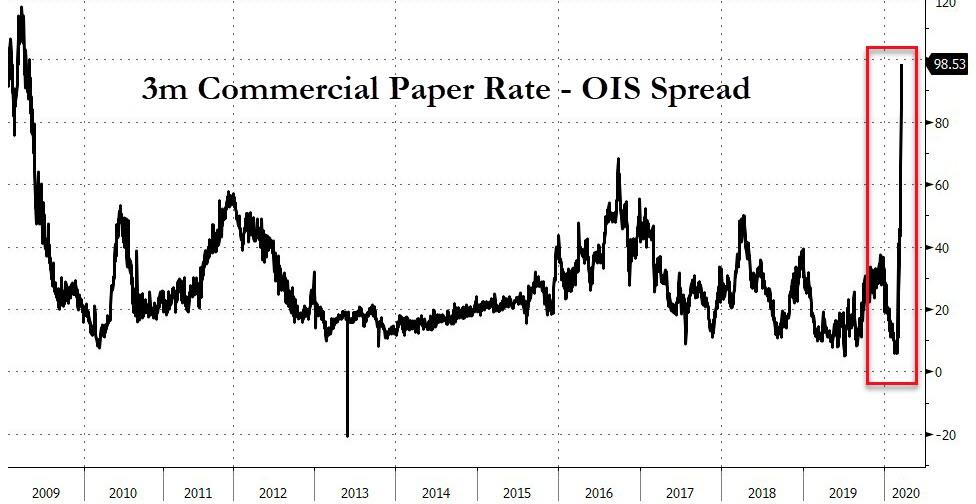

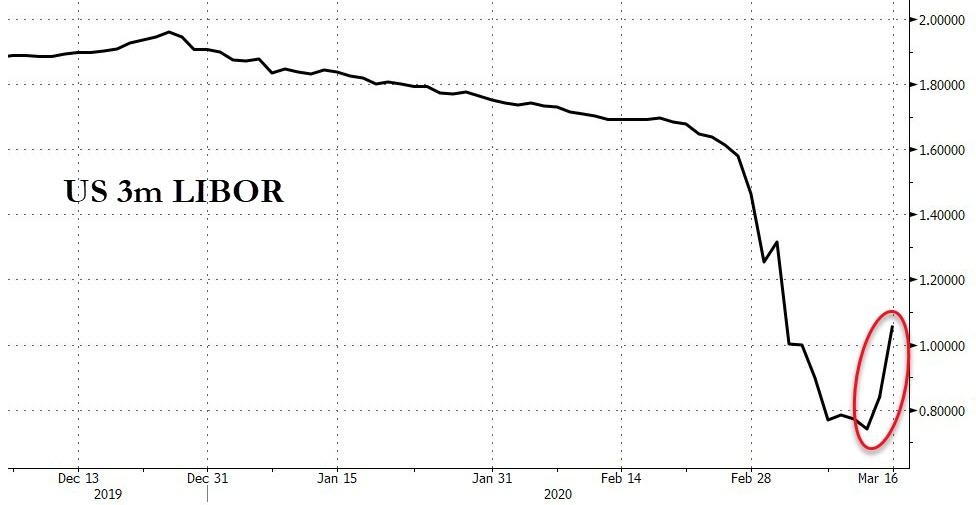

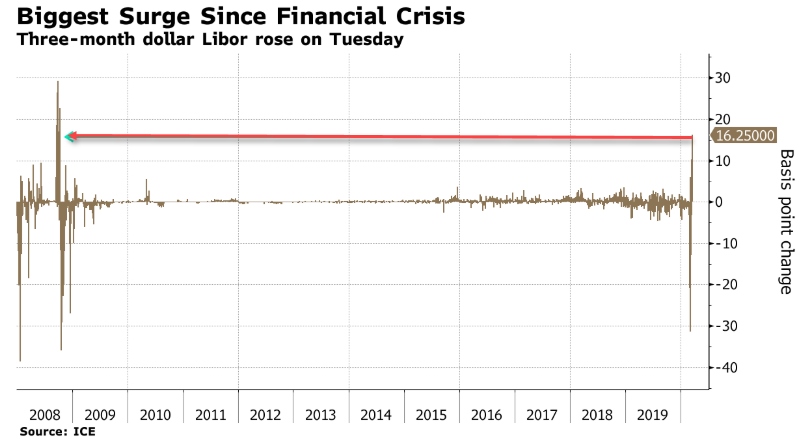

Yesterday was another nasty day – uncertainty, panic and fear fuelling the worst fears for the market. The scale of capitulation was massive – Treasuries heading for zero percent, stocks biggest down day for 33 years, and gold sliding because investors literally have nothing else to sell to meet margin calls. If you aren’t out yet, you are stuck. Forget liquidity – it’s almost impossible to exit even liquid index ETFs.

Stop. Breathe deep. And relax.

Today looks like it might be an up day. The market is swinging madly because of uncertainty and we just don’t knows. After yesterday’s Fed all-in-rates to zero and essentially unlimited QE, Lagarde at the ECB effectively apologising for throwing Italy under the bus, and the G7 giving us a Mario Draghi “do whatever it takes” moment to address the virus – its entirely possible we’re headed higher today on hopes of a relief rally. In other words investors might find a plank of wood to cling to in this raging market maelstrom.

Hope is never a good strategy. Don’t be fooled. It will get worse before it gets better.

At this stage in the Coronavirus No-See-Em shocker, It’s all about uncertainty. We just don’t know how critical the virus will go, the scale of the dislocation to come, and how deep the economic damage will go.

What If We Knew?

What if we had a much clearer idea of what and when it’s going to happen? There is the brainpower, analytical and modelling experience out there in the marketplace to clearly model the multiple transmission, infection, and treatment scenarios plus the economic implications in terms of jobs, production, supply and demand, to give us a very clear idea of how this goes.

Here in the Shard Offices (actually, today I’m a home), we’ve been working out our own scenarios of when to put our buying boots on. We reckon the buy signal will be a slowing infection/transmission rate. That is when the market will start to anticipate recovery and we’ll see prices start to strengthen.

What if we knew, with a high degree of certainty when moment is going to come? What if we had a high degree of confidence in the implications for the economy?

I’ve now spent some time looking at a superb virus model with clear potential to crack the numbers, handle multiple scenarios, and can process all that data to provide some very clear signals. IT provides answers to the critical questions. I’m looking to introduce institutions to the team behind the model. Its operational now.

If you want to know more email me, or call me direct.

Recovery?

A number of firms have clearly been doing their own modelling of the crisis. Yesterday the Goldman Sachs crisis call suggested “Stock Markets should fully recover in the 2nd half of the year”. This morning Credit Suisse is on the wires saying something similar and positing a strong V-Shaped recovery, with markets swiftly undoing the damage this year.

What TF are these guys smoking? I want some…

It’s not going to be that simple. More than “psycological” damage has been done. It’s not about volatile market sentiment. This has been an economic shock and a correction.

Let’s be brutally honest about what’s happened in recent weeks (and I shall be posting a note on Virus Timeline later today):

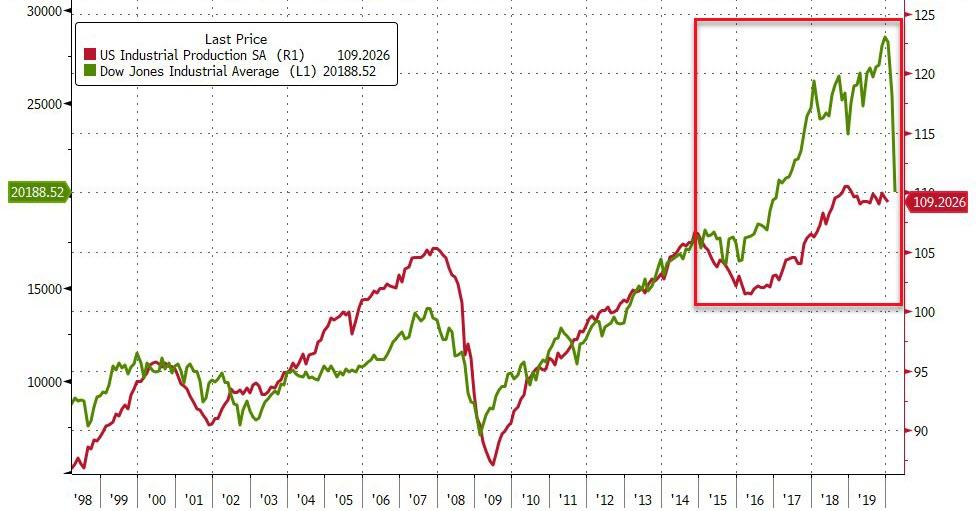

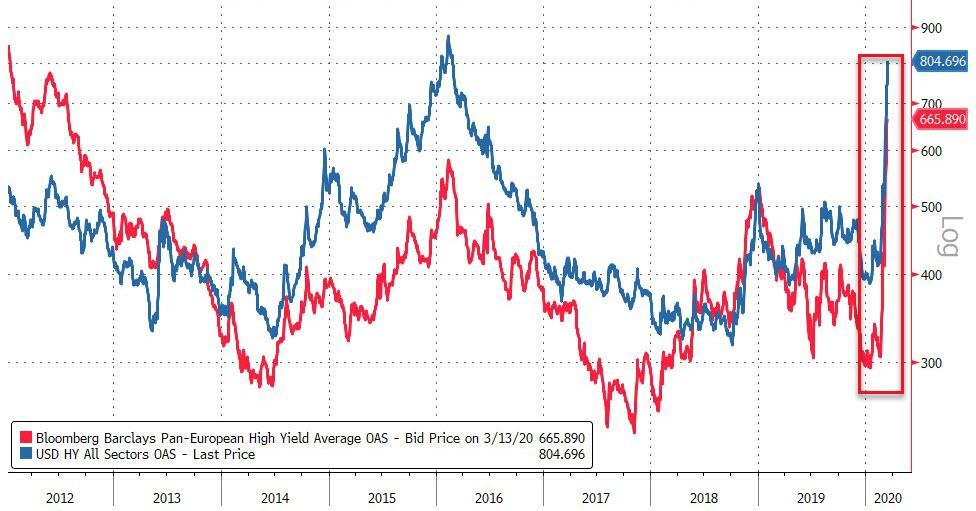

Markets hit all-time record highs just a few weeks ago. Stocks hit record levels. Corporate bond spreads had never been tighter. Most of the globes sovereign debt was trading at sub-zero or barely positive yields. The bull market was unstoppable – no matter how bad the news about virus, trade wars, and rising debt seemed.

Everything was perfectly priced – mispriced.

The market’s final euphoric top wasn’t driven by economic reality, phenomenal growth expectations, accelerating corporate profitability or rising consumer incomes and discretionary spending. Nope. The only real driver was the continuing expectation/belief Central Banking Authorities would continue to juice the market and distort prices the way they’ve been doing since they stumbled on monetary experimentation, QE and NIRP since the last crisis.

Now we know they were not a cure. They were hits of monetary addiction.

Just how dangerous we will shortly find out – just how damaging the unintended consequences the last eight years of market distortion have been. I suspect unravelling the damage will be long-term and extremely destabilising.

For instance; the obvious one is corporate debt. $14 trillion of new corporate debt in the last 7 years needs to be repaid. Was it spent on building new productive assets? Nope. Most of it was spent on stock buybacks which created wealth for owners, but has simply leveraged companies to the hilt. There is enormous balance sheet damage to be corrected – and that is not stock positive in the next few months.

The wealth effect of stock buybacks juicing stock markets has fuelled property, art, and luxury businesses around the globe. Remove the multiplier and these wealth effect markets all look vulnerable.

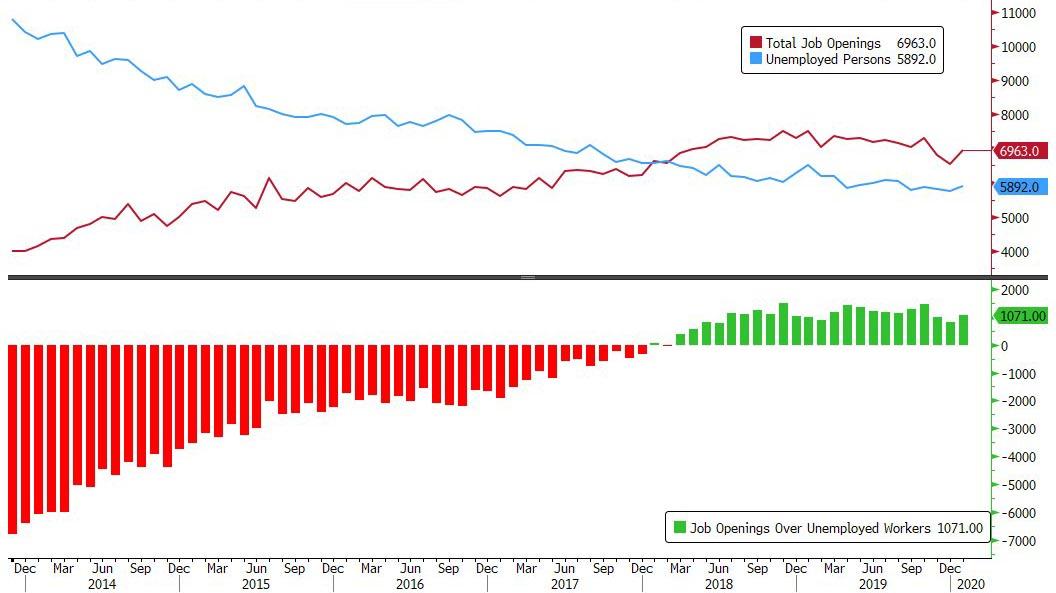

And what about the consumers that have already lost jobs, spent their savings and are scrabbling to stay afloat today? I’m reading estimates saying 10 million US catering and entertainment jobs will be shuttered, furloughed or gone in next few weeks. They aren’t going to start consuming any time soon to drive recovery.

The consensus on Government debt is that nations can simply make QE debt effectively disappear. Maybe… but there will be a credibility gap at some point. The big one will be Yoorp – where the implausibility of agreeing de facto debt mutualisation (ie: persuading German car workers to fund French farmers pensions), ain’t going to happen unless its forced through in crisis.

They are so many reasons the market is not simply going to bounce back after the virus crisis has past. Unravelling the supply and demand side damage to the economy is not going to happen overnight. Mass tourism is not going to switch back on in a heart-beat. There will be millions of consumers who have seen their incomes collapse on the back of lay-offs. They will need time and opportunity to rebuild savings. Fear is going to be the primary driver.

In the long-run the global economy will recover – but it won’t be overnight in a V shape undoing of what’s going on now in terms of contraction. In the short-medium terms we face at least months, if not years of rebuild. Stock markets are not going back to February’s levels anytime soon. THat doesn’t mean we won’t new highs as a new bull market takes hold – but it could be years.

Asset Price recovery will be more nuanced. There will certainly be opportunities.

This morning I’m thinking of buying aviation bonds on the basis: “if all airlines will be bankrupt by May”, then its highly likely we will see governments step into support them. Which means they will keep paying the leases on their aircraft, and we’ll see medium term recovery in tourism and business travel – the clock is not going to roll back to the 1930s!

Is it time to buy Asian banks on the expectation Asia is going to recover faster than Europe? Or what about wide-spread Italian and Spain bonds on the basis the ECB will bail them out? What about European banks on the basis the ECB, and nations, can’t afford national champions (ha! Are there such things in Yoorp) going to the wall?

What about corporate bonds on the basis it’s a buyer’s market and easy to buy bonds…

However, the really, really interesting thing is the opportunity for Governments to do the right thing.

Spend Money on Health

This crisis is not really about economics or market levels. It’s all about the ability of Health Services to cope with an unexpected shock and catastrophe levels of demand. Yet, anyone who uses the NHS regularly – as my dicky ticker requires – will know Health Services are financially stretched, in permanent semi-crisis, chaotic and understaffed. They are full of dedicated doctors and nurses, but inefficient managed by inflated bureaucracies.

In 2008 the UK government bailed out failing banks to the tune of some £500 bln. In 2019 we spent some £125 bln on the NHS. We are now at a stage where credible governments can borrow/create (via a QE trick) unlimited sums at essentially zero interest cost. We are now used to Boris describing this crisis in terms of a war we can win. We can – imagine using this opportunity to rebuild and refocus the NHS into something modern, ready and prepared for this happening again, paying nurses properly, introducing proper AI and management. The opportunities are legion.

Same thing in the US where the crisis will likely bite deepest. The US wins wars because it can outspend any enemy. In 2008 it spent $700 bln bailing the banks – and got the money back. Imagine if the US was to spend similar amounts on a proper free health service? That might truly make America Great Again.

Just thinking out loud..

Tyler Durden

Tue, 03/17/2020 – 10:30

via ZeroHedge News https://ift.tt/2wZCD3Y Tyler Durden